Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 27 October 2015

[font size=3]STOCK MARKET WATCH, Tuesday, 27 October 2015[font color=black][/font]

SMW for 26 October 2015

AT THE CLOSING BELL ON 26 October 2015

[center][font color=red]

Dow Jones 17,623.05 -23.65 (-0.13%)

S&P 500 2,071.18 -3.97 (-0.19%)

[font color=green]Nasdaq 5,034.70 +2.84 (0.06%)

[font color=green]10 Year 2.06% -0.01 (-0.48%)

[font color=black]30 Year 2.87% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)The new issue of the Credit Suisse Global Wealth Report (2015) has been published. Below is the distribution of global wealth.

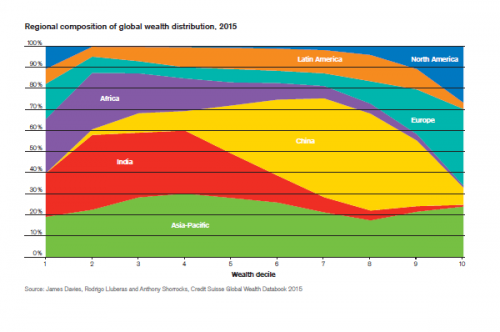

Nothing has changed much since we posted the previous version here. As I commented regarding the previous version, the poor are fundamentally in Africa, India, and Asia-Pacific (mainly Bangladesh, Indonesia, Pakistan, and Vietnam), while the wealthy are in the United States, Europe and Asia-Pacific (i.e. Japan). China has more people in the middle section of the wealth distribution than at the extremes.

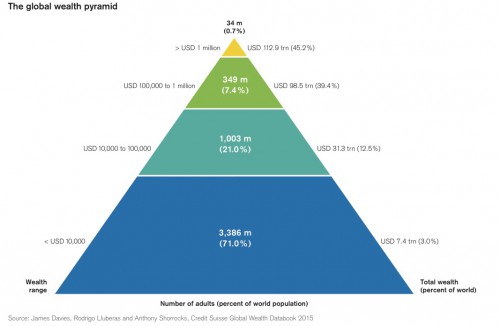

Below is the Global Wealth Pyramid.

Not much difference from the previous one, but a bit worse. Now 71% of the population holds 3% of the wealth (before it was the 67% at the bottom who held 3.3% approximately). And the top 0.7% of the population holds slightly more than 45% of total wealth.

By the way, the U.S. has added more people at the top, while Japan and Europe have lost a few. If you are interested on how many really wealthy people there are (not the 34 million people at the top of the figure above, who are the ones worth more than 1 million), here is what the report says:

UHNW means Ultra-High Net Worth (or what a decade ago Citigroup analysts called the plutonomy). So about 4,500 with a net worth above $500 million.

Read the full report here: https://publications.credit-suisse.com/tasks/render/file/?fileID=F2425415-DCA7-80B8-EAD989AF9341D47E

Demeter

(85,373 posts)Maybe Tuesday morning I'll have recovered enough to find some more news items...g'night, all!

Demeter

(85,373 posts)Some economists are suggesting that the best thing the Federal Reserve could do for the U.S. economy would be to raise interest rates for the first time in nearly a decade, mounting an argument that flies in the face of conventional economic wisdom.

Tightening, in light of the current circumstances, would actually be stimulative, on net, they argue.

"The reason [the Fed] should have raised rates in September and the reason, failing that, that it should do so this month isn’t that the economy can handle the pain but rather that it could do with the help," David Kelly, chief global strategist at JPMorgan Asset Management, wrote in a recent research note.

The consensus view, steeped in decades of economic thought, maintains that higher rates encourage saving instead of spending by households and raises the cost of capital for businesses, weakening current demand. Higher interest rates could also be a negative for asset values, as income generated would be subject to a higher discount rate. The ensuing negative wealth effect would be a drag on consumption. An increase in interest rates is also typically accompanied by a rise in the U.S. dollar, which crimps competitiveness and weighs on production in the tradable goods sectors.

But in practice, the effects of liftoff might well be different this time, some analysts contend.

For households and corporations, nonprice factors like credit ratings or a lender's regulatory requirements are the far bigger constraints on activity than the cost of carrying debt, and a pickup in interest rates would help alleviate some of these impediments...

http://www.bloomberg.com/news/articles/2015-10-26/how-a-fed-rate-hike-could-actually-stimulate-the-u-s-economy

SOUNDS LIKE TRICKLE-DOWN CLAP-TRAP TO ME, ESPECIALLY GIVEN THE ENORMOUS GLOBAL QE (FIAT PRINTING PRESSES FULL SPEED AHEAD!) GOING ON THIS WEEK

WHAT SHOULD (BUT WON'T) BE DONE IS RAISING TAXES ON THE RICH, TO SOAK UP THE OCEAN OF LIQUIDITY SO WE DON'T ALL DROWN IN IT, NOT INFLATING A NEW HOUSING BUBBLE, WHICH PEOPLE WON'T GO FOR, ANYWAY.

Demeter

(85,373 posts)I don't know how I missed that significant phrase. Total claptrap.

Demeter

(85,373 posts)Fifteen of the biggest players in the $14 trillion market for credit insurance are also the referees.

Firms such as JPMorgan Chase & Co. and Goldman Sachs Group Inc. wrote the rules, are the dominant buyers and sellers and, ultimately, help decide winners and losers.

Has a country such as Argentina paid what it owes? Has a company like Caesars Entertainment Corp. kept up with its bills? When the question comes up, the 15 firms meet on a conference call to decide whether a default has triggered a payout of the bond insurance, called a credit-default swap. Investors use CDS to protect themselves from missed debt payments or profit from them.

Once the 15 firms decide that a default has taken place, they effectively determine how much money will change hands.

And now, seven years after the financial crisis first brought CDS to widespread attention, pressure is growing inside and outside what’s called the determinations committee to tackle conflicts of interest, according to interviews with three dozen people with direct knowledge of the panel’s functioning who asked that their names not be used. Scandals that exposed how bank traders rigged key interest rates and fixed currency values have given ammunition to those who say CDS may also be susceptible to collusion or, worse, outright manipulation.

The trade group that oversees the process, the International Swaps & Derivatives Association, is now proposing rule changes that it says will reform the determinations committee. The proposals include limiting the people who can be involved in decision-making and prohibiting panel members from discussing decisions outside meetings, according to a document obtained by Bloomberg News.

For skeptics, the question is whether the changes would go far enough. Because only the biggest CDS traders are seated on the panel, conflicts are not only tolerated but unavoidable.

“You’ve got a self-regulatory body that has handed the authority over an entire market to those folks who have the greatest self-interest and have no prohibition for putting their interests ahead of the broader market,” said Joshua Rosner, managing director of the financial research firm Graham Fisher & Co., who wrote a report on the shortcomings of the determinations committee earlier this year....

SCANDALOUS! ANOTHER LIBOR IN THE MAKING

Demeter

(85,373 posts)About 22 blocks of vacant land in Detroit are destined for a future in agriculture.

The Detroit News reports that officials detailed a plan Monday that calls for 60 acres on the city’s east side to be used for greenhouses and hoop houses where specialty vegetables will be grown.

The project will be operated by RecoveryPark Farms and is expected to provide 128 jobs with 60 percent going to Detroit residents.

Mayor Mike Duggan says the project is taking “the hardest to employ” and “putting them to work on land that had been long abandoned and forgotten.”

The Detroit Land Bank Authority will lease 35 acres to RecoveryPark, a nonprofit that turns blighted areas into land that can be farmed.

The Detroit City Council has to OK the plan.

I SURE HOPE THEY ARE HYDROPONIC, OR BRING IN CLEAN SOIL, OR AT LEAST TEST FOR HEAVY METAL AND ORGANIC AND INORGANIC CHEMICAL POISONS. PARTS OF DETROIT ARE UNMITIGATED BROWNFIELDS.

Demeter

(85,373 posts)JPMorgan Chase & Co (JPM.N) said on Monday it will soon launch its own competitor to Apple Pay that will allow consumers to pay retailers using their smartphones in stores, and it has already won the endorsement of a major group of merchants.

The largest U.S. bank is the latest company to try to profit from the prevalence of smartphones, which many financial executives believe will one day be consumers' preferred way to pay for everything from milk and eggs at the supermarket to a rental car at an airport.

The companies that figure out how to convince consumers to stop pulling credit cards out of their wallets and start paying with their phones stand to earn vast sums by taking a percentage of the trillions of dollars that consumers spend annually.

No clear front-runner has emerged in the business yet. Chase believes its smart phone application, known as Chase Pay, has one key advantage: the caliber of retailers it has brought on board, Gordon Smith, chief executive of the bank's consumer business, told Reuters.

MORE

Demeter

(85,373 posts)JPMorgan Chase & Co (JPM.N) said on Monday its board will consider a bylaw amendment to make it easier for small groups of investors to run candidates for the New York bank's board of directors.

That move came just hours before fast-food leader McDonald's Corp (MCD.N) announced that its board amended company bylaws to provide shareholders with new rights of proxy access for director nominations.

In a securities filing, JPMorgan said its board told management to prepare an amendment to grant groups of up to 20 shareholders the right to nominate their own candidates, a change known as "proxy access" that has become a popular reform at many companies this year.

JPMorgan said the amendment would include a requirement that shareholders would need to have owned at least 3 percent of the company for three years, a common threshold and an approach the board requested.

In addition, JPMorgan said its board has adopted a policy under which it would disclose whether it has recouped any incentive compensation from senior executives.

Demeter

(85,373 posts)THAT REMAINS TO BE SEEN...

http://www.nytimes.com/2015/10/27/us/politics/budget-deal-isnt-boehners-grand-bargain-but-gets-job-done.html

It is no grand bargain, but it is a big deal.

As he prepares to vacate the House at the end of the week, Speaker John A. Boehner helped engineer an $80 billion bipartisan budget agreement with the Obama administration that may fall far short of earlier visions of budget grandeur but would still get Congress through a potentially dangerous period for both the economy and itself. The agreement, negotiated in secret by top congressional and White House aides, is a recognition by Mr. Boehner and Senator Mitch McConnell of Kentucky, the majority leader, that they were staring into a fiscal and political abyss.

With just days remaining before the Treasury Department estimated it would run short of cash to pay the federal government’s obligations, the two leaders of the House and Senate majorities had no clear path toward raising the federal debt limit. Many House Republicans and some in the Senate refuse to vote for any increase in federal borrowing power no matter the dire circumstances. Support for a debt-limit increase has become a sure ticket to a primary challenge from the right for many of them. But Mr. McConnell has repeatedly promised no default. And he and Mr. Boehner, with their ties to high-ranking allies in the business and financial worlds, knew that failure to head off a threat to the government’s creditworthiness could boomerang badly on Republicans just one year from Election Day. While fiscal turmoil might energize conservatives demanding that Republicans hold firm against the Obama administration, it probably would not sit well with many other American voters as they watched their retirement savings plummet, their mortgage rates soar, their car and student loan costs climb and unemployment tick back up.

Now the tentative budget agreement gives the Republican leadership the chance to persuade a sufficient number of Republicans to join Democrats in approving an increase in the debt limit that should take the government into the administration of the next president.

In fact, if approved, the deal does much more — both politically and substantively.

On the political side, it is a parting gift from Mr. Boehner to his presumed successor, Representative Paul D. Ryan of Wisconsin, who is expected to be chosen as the next speaker on Wednesday by his Republican colleagues and on Thursday by the full House. With passage of the deal, Mr. Boehner would make good on his promise to clean out the barn a bit for Mr. Ryan and allow him time to get his feet under him as the new leader without having to face the nearly impossible job of rounding up votes for the debt limit increase. It would give a little breathing room for more spending on politically popular domestic programs like health care research, federal law enforcement and the Coast Guard, while defusing tension between Republican hawks itching for more military spending and budget hawks demanding strict adherence to statutory spending limits. And it would avert premium increases of as much as 50 percent for millions of older people on Medicare, a potent political force.

The question remains, however, if the deal will weaken the conservative standing of Mr. Ryan — and upset his looming election — whether he had a hand in the negotiations or not. And those conservative activists who helped push Mr. Boehner to an early retirement were not looking kindly on the agreement as details began to trickle out Monday. The group Heritage Action for America labeled Mr. Boehner a “rogue agent” working for special interests in his final hours. “In Washington cleaning the barn is apparently synonymous with shoveling manure on the American people,” said Michael A. Needham, the head of the group, which is the political arm of the Heritage Foundation.

On the policy side, it potentially buys Republicans, congressional Democrats and the White House two years of relative budget peace by setting agreed-upon spending limits for this year and next, getting both parties through the election with a legislative truce that spares them tough political votes. It will then be up to the next Congress and president to renew the budget wars — or not. For Democrats and President Obama, it provides the added domestic spending they had demanded and resolves some of the pressing problems they had seen in the Social Security disability fund.

MORE

Hotler

(11,394 posts)"The agreement, negotiated in secret by top congressional and White House aides"

Pretty much says it all.

"On the policy side, it potentially buys Republicans, congressional Democrats and the White House two years of relative budget peace by setting agreed-upon spending limits for this year and next, getting both parties through the election with a legislative truce that spares them tough political votes."

It's all about them isn't it?

I hate them all.

Demeter

(85,373 posts)Demeter

(85,373 posts)Valeant Pharmaceuticals is a sleazy company.

Although it existed as a relatively small company before 2010, it did a deal that year that put it on the map. The deal was with Biovail, one of Canada’s largest drugmakers — and a company that had run afoul of the Securities and Exchange Commission.

In 2008, the S.E.C. sued Biovail for “repeatedly” overstating earnings and “actively” misleading investors. Biovail settled the case for $10 million.

As it happens, 2008 was the same year that a management consultant named J. Michael Pearson became Valeant’s chief executive. Pearson had an unusual idea about how to grow a modern pharmaceutical company. The pharma business model has long called for a hefty percentage of revenue to be spent on company scientists who try to develop new drugs. The failure rate is high — but a successful new drug can generate over $1 billion in annual revenue, which makes up for a lot of failures. Pearson didn’t have much patience for research and development. And while he certainly wanted moneymaking drugs, he didn’t really need blockbusters to make his business model work. His plan was to acquire pharmaceutical companies, fire most of their scientists and jack up the price of their drugs. Biovail gave him the heft to put his plan in action.

And so he has done, to the delight of Valeant’s shareholders, and the dismay of most everyone else....

WE'VE HEARD THIS SCHEME BEFORE

Demeter

(85,373 posts)The New York attorney general is probing whether three major Internet providers could be short-changing consumers by charging them for faster broadband speeds and failing to deliver the speeds being advertised, according to documents seen by Reuters. The letters, which were sent on Friday to executives at Verizon Communications Inc, Cablevision Systems Corp and Time Warner Cable Inc, ask each company to provide copies of all the disclosures they have made to customers, as well as copies of any testing they may have done to study their Internet speeds.

"New Yorkers deserve the Internet speeds they pay for. But, it turns out, many of us may be paying for one thing, and getting another," New York Attorney General Eric Schneiderman said in a statement.

Time Warner Cable spokesman Bobby Amirshahi said in a statement: “We’re confident that we provide our customers the speeds and services we promise them and look forward to working with the AG to resolve this matter.”

Cablevision spokesman Charlie Schueler said the company's Optimum Online service "consistently surpasses advertised broadband speeds, including in FCC and internal tests. We are happy to provide any necessary performance information to the Attorney General as we do to our customers.”

Verizon declined comment, saying it had not yet seen the letter.

The probe by the attorney general is particularly focused on so-called interconnection arrangements, or contractual deals that Internet service providers strike with other networks for the mutual exchange of data. In the letters, the office says it is concerned that customers paying a premium for higher speeds may be experiencing a disruption in their service thanks to technical problems and business disputes over the interconnection agreements...

MORE

Demeter

(85,373 posts)I had a good time Sunday...the story had the original unhappy ending, not the happy one they wrote for the film version... making it more of a Hallowe'en appropriate film than an uplifting one of Man against Vegetable (Alien). Made it more campy, too. The EMU students did a fine job of singing and dancing, set and costumes and lighting, too.

Eugene

(61,807 posts)Source: Reuters

Technology | Tue Oct 27, 2015 3:39pm EDT

IBM says SEC investigating company's accounts

International Business Machines Corp said the U.S. Securities and Exchange Commission was investigating the company's accounts.

The investigation relates to revenue recognition with respect to certain deals in the United States, Britain and Ireland, IBM said on Tuesday.

The company said it learned of the investigation in August and was cooperating with the SEC, but did not disclose what deals were being probed.

[font size=1]-snip-[/font]

IBM has been a subject of several SEC probes in the past, including an investigation in 2013 on how it reported revenue from cloud computing business. The regulators later decided not to recommend any action following the investigation.

[font size=1]-snip-[/font]

Read more: http://www.reuters.com/article/2015/10/27/us-ibm-probe-sec-idUSKCN0SL2L020151027