Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 1 September 2015

Last edited Tue Sep 1, 2015, 12:38 AM - Edit history (1)

[font size=3]STOCK MARKET WATCH, Tuesday, 1 September 2015[font color=black][/font]

SMW for 31 August 2015

AT THE CLOSING BELL ON 31 August 2015

[center][font color=red]

Dow Jones 16,528.03 -114.98 (-0.69%)

S&P 500 1,972.18 -16.69 (-0.84%)

Nasdaq 4,776.51 -51.82 (-1.07%)

[font color=red]10 Year 2.22% +0.07 (3.26%)

30 Year 2.96% +0.09 (3.14%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Hugin

(33,059 posts)I wish. ![]()

pscot

(21,024 posts)Demeter

(85,373 posts)Tansy_Gold

(17,847 posts)today felt like Monday, Tuesday, and Wednesday.

Hugin

(33,059 posts)However, I was delighted to skip forward on this week with your encouragement. ![]()

Demeter

(85,373 posts)So I made two pies....and when I was done, there were 3 more fallen.

I'd pick them all off the tree, if they were riper. They are still pretty hard and a little green in spots. Mother Nature is trying to tell me something, but what? Pick them anyway?

Two years ago, I had a total of 10 peaches, and I picked them all when the first one fell, because they were soft and red and gold.

This year, I will have 4 times that? It's exciting!

mother earth

(6,002 posts)thing...I think that's called conditioning, lol.

Then I realized, maybe you've got a good peach pie recipe...![]()

Fuddnik

(8,846 posts)tclambert

(11,085 posts)and 3 more left New York at 60 miles per hour, what is the speed of light inside a vacuum cleaner?

mother earth

(6,002 posts)Hotler

(11,396 posts)tclambert

(11,085 posts)You're not saying the tree dropped to the ground are you? that would be sad. Though it would make the peaches easier to pick.

In my youth, I knew a guy who liked to graft branches from different kinds of trees onto others. He had seven different kinds of fruit from one tree. Apparently, trees don't reject grafts as ferociously as people do.

Demeter

(85,373 posts)It's only the fruit (and an occasional leaf) that's falling...the tree still stands. I was rather loopy from exhaustion while writing that. I'm all better now...(sure she is, they say knowingly)

The fruit doesn't look buggy, so it's not that. I think perhaps the branches aren't strong enough for the fruit yet. The peaches are 4 times as many, and at least twice as big, as they were two years ago (there was no fruit last year due to a cold snap during blossom time). All the fruit trees are putting out tremendous amounts of fruit this year, to make up for the total lack last year.

Since this is only its 3rd year in the spot, the tree is still growing. Needs more vitamins or something. Definitely needs pruning. I was hoping to prune while picking, so I knew not to cut off the fruit-bearing branches, but the tree is defeating my plan...

bread_and_roses

(6,335 posts)Real, picked ripe or just a hair's short of ripe so that by the time you get them home they're almost ready to eat. Fuzzy skins, so juicy you have to eat them kind of bending over or they're all over your chin.

My sister wishes for NY apples in fall; I long for the PA peaches this time of year (we used to get them by the bushel when I was growing up - they were so cheap - one of the few memories of any sort of treat food abundance I have). I am luckier than she - she only gets NY apples if I visit at that time.

Demeter

(85,373 posts)I PREFER THIS KIND OF POLITICAL SPEECH, MYSELF:

http://failedevolution.blogspot.gr/2015/08/schauble-to-tsipras-they-will-skin-you.html

How the German Finance Minister was threatening Tsipras, and through him the Spanish Left movement, even before the Greek politician take the power...

The strategy of Wolfgang Schäuble, already from September 2014, to force Alexis Tsipras - who already seemed to be the next prime minister -to surrender to Berlin's logic, is described by the newspaper Vima of Sunday. But alongside this strategy that unfolded last year, Schäuble made sure to send to Alexis Tsipras the appropriate warnings of what to expect when he would undertake tasks.

It all started in September 2014 when the then prime minister, Antonis Samaras, requested from Angela Merkel a 'moderate' fifth assessment that would help the country to get out from the Memorandum and therefore, New Democracy to remain in power. The German chancellor did not commit, but didn't also exclude such a possibility. In practice, however, as mentioned in the report, the final word was again Schäuble's. A few days later, there was a secret meeting of the German Finance Minister with Poul Thomsen of the IMF, for which the BoG governor, Yannis Stournaras, was reportedly informed, and, on what has been discussed.

Both were fully informed and clearly saw the victory of the Left Opposition. They felt that the days of Samaras-Venizelos coalition were numbered, and did not believe, not for a moment, the argument of the then Greek Prime Minister that any concessions in the economic field would change the course of the political situation, according to the report.

Schäuble didn't want to help Samaras, because he didn't want to risk, by no means, to establish in the center of the eurozone a Leftist politician, who that time was declaring that his purpose was to alter the priorities of the economic policy in Europe, abolish austerity, and change the course the Old Continent towards a Keynesian direction.

Therefore, a lenient treatment during the fifth assessment, a repayment of war reparations to Greece, and, a solution for the Greek national debt, would make Tsipras, according to Schäuble-Thomsen, almost unbeatable, and would allow him to run 'like a bull in a china shop' in the centers of the European politics. Mr. Schäuble seemed to prefer to test, as highlighted in the report, the strength of the Greek system, and mostly, to force Tsipras to move within the framework of European rules, and more particularly, the economic policy authorities that he had imposed himself in the Eurogroup. He didn't want in any case a Greek precedent that would encourage similar moves in Spain, Italy and elsewhere.

Of course, Schäuble didn't just wait for Tsipras to form a government. He was already sending various messages to the Leftist politician, like a threat through the phrase 'they will skin you like hares and wave your skins to Podemos'! , according to the report.

Source:

http://www.huffingtonpost.gr/2015/08/29/strathgiki-soible-tsipra-apeiles_n_8059292.html

The article, however, does not define who Schäuble meant by saying "they". It's easy: he meant the oligarchs, his bosses:

The mobilization by the global financial mafia this time will be more intense, as its representatives know that a potential Leftist government in Greece who may strongly resist against the austerity policies, could trigger an "uncontrolled" domino rise of the Leftist powers in Europe, who will fight against the neoliberal agenda. Make no mistake, the war will be hard. But there is no alternative. Either the European people will choose to fight determined and united, or, will be surrendered to the plutocrats who will bring the new Dark Ages. The "Battle of Greece" will be decisive ...

http://failedevolution.blogspot.gr/2014/12/europe-get-ready-for-war.html

Demeter

(85,373 posts)The prospect of President Bernie Sanders still seems like a heck of a long shot. For whatever it is worth there is polling that indicates that Bernie Sanders would win against Donald Trump. The best summary I’ve seen as to why a Sanders win is impossible is that this is a center-right country. When you travel in certain circles that is difficult to grasp. (Remember the joke about the college professor who could not figure out how Nixon won by a landslide, since everybody he knew voted for McGovern?) Still. Do we really think that the country was as far as left as it would ever be forty years ago and that there is no possibility of a crazy pendulum swing? Anyway, I think there is enough to the contingency of the coming Sanders administration to think about what kind of a tax plan you might want to have in place in the event that that on January 20, 2017 Senator Sanders is sworn in as President. (See Note)

What Is The Tax Program?

I had a little trouble finding Bernie Sanders’s tax program in one convenient place so I wrote to the campaign. I heard back from Policy Director Warren Gunnels who indicated that the campaign is still working on a comprehensive tax reform plan, but he gave me a summary of what Senator Sanders has called for to date. The paper is titled “Real Tax Reform Means Making the Wealthy and Large Corporations Pay their Fair Share”. My main focus in looking at this is to see if there are any moves that high income/high net worth individuals should consider teeing up, so I will touch only lightly on some of the proposals. The funniest thing about the tax proposals is that this candidate who is as far left as you can go without getting into Green Party territory is promoting a tax package that would pretty much bring us to the second half of the Reagan administration when it comes to income and estate tax.

Corporate Proposals

Senator Sanders would end rules that allow US corporations to defer paying federal income tax on profits of offshore subsidiaries. He would enact rules to prevent companies that are managed and controlled in the US from establishing themselves as foreign companies and would eliminate the tax benefit of inversion. He also wants to eliminate tax breaks for oil, gas and coal companies. He would also limit the way the foreign tax credits can be gamed...None of the above has me coming up with a to-do list. I’ll leave that for corporate tax geeks.

Estate Tax

They lead off with a quote from a Republican President to give you a sense of where they are coming from:

I wish I could offer a prize to the first commentator to correctly identify that Republican President, but I’ll just let you all compete for the glory. Sanders proposes that the estate tax kick in at $3.5 million with a rate of 40%, got to 50% over $10 million, 55% over $50 million with a 10% billionaire surtax. The document also talks about “closing loopholes”, but does not get real specific. I think that this might be a good time to dust off the notion of forming a family limited partnership. If it is well executed it is an excellent method for separating management of wealth from its transfer. You could tee up a mega gift to make sure you use up the current exemption of $5.43 million in December 2016 while Sanders is still President-elect. There are a host of other techniques likes GRATS and QPRTs that you may have thought about doing someday. If it is something that you think was sound but have been procrastinating, you might take the Sanders surge as a prod to finally get it done.

Financial Transactions Tax

Whenever I have written about proposals like this in the past, I have gotten comments that any such move would have dire consequences for the economy. The funny thing about that is I know a lot of pretty conservative people who think that high volume trading is not good for the real economy. Personally, I tend to be agnostic on the issue. Regardless, I don’t see any planning opportunities here.

Social Security

This proposal is huge in my mind. They would apply the social security tax on incomes over $250,000 The current limit is $118,500. So it seems like there would be a tax-free bubble between $118,500 and $250,000. It’s hard to see the policy justification for the bubble, but that is neither here nor there. This change would cost Sanders main opponent Hillary Clinton well over $1,000,000 in self-employment tax on her self-employment income, mainly from speeches, of over $13,390,499. The current solution, not open to Hillary probably for political reasons, is to do what Newt Gingrich did and run your income through an S Corporation. If you have thought about converting your business to an S Corporation and passed it by, you should probably think again. There is an immediate savings on the medicare tax, as long as you are not piggy about it and it would pay off big time if this change went through. Certainly if you are running a professional practice as a C corporation and bonusing everything out, you should really take another look. You probably should do that anyway, but here is an extra incentive.

Dividends And Capital Gains

The change with dividends is big, but not applicable to that many people. My practical take-away from this is that if you have been putting off and putting off dealing with a C corporation that has greatly appreciated property, now might be the time to stop putting it off. Actually 1987 was the time, but no use crying about spilled milk. If the corporation does not have a lot of active income you need to blow out the earnings and profits in order to continue as an S corporation long enough to avoid double taxation on an asset sale. It may be cheaper to do that in 2015 or 2016 than it will ever be again. Taxing capital gains as ordinary income is, of course huge. Is it premature to start thinking about not being so excited about deferring gains? I would go this far – If you have a transaction where deferral is elective – an installment sale or an involuntary conversion for example – plan on extending your 2015 return. If when the leaves are turning and the October 15th deadline is approaching, it seems like the country is “Feeling the Bern”, recognizing the gain in 2015 might seem like a bargain. More aggressive moves can probably wait till December of 2016.

Nothing On Marginal Rates

I have seen things here and there where Sanders calls for much higher individual income tax rates. So when I started this project I was coming up with a lot of schemes to accelerate income and defer deductions but the summary from the campaign seems to just call for rolling the rate table back to what it was in 2000, which kicks in the top 39.6% rate at a lower level. If this is really shaping up to be a redo of the Tax Reform Act of 1986, maybe the top marginal rate will get scaled back a bit in exchange for eliminating the capital gains preference. So I’ll save my crazy schemes for another day.

No More Details Yet

I listened to the Sanders speech at the DNC on August 28 and did not note anything new. So if you are, like it or not, starting to feel the Bern, the things to look closely at right now are closely held C corporations and transfer taxes. In the mean-time, it looks to be an interesting election season coming up.

Note

In an earlier version I noted that Senator Sanders would be our first Jewish President. This is something that I thought of as a milestone worth remarking. When I was in the second grade we got our first Catholic President and it was a really big deal, particularly in parochial grammar schools. I also noted the composition of the Supreme Court.

I clearly pushed some buttons with what I thought of as an historical observation.

Demeter

(85,373 posts)A federal judge has ordered the IRS to reveal all requests the White House made for private taxpayer data. It is a potentially explosive line of inquiry, and the IRS fought the court ruling hard. But now, the IRS must hand them over. It could mean another bombshell in the long simmering IRS scandal that has dogged the Obama administration for over two years.

Recently, the IRS revealed–two years late–that firebrand Lois Lerner had a secret email account under her dog’s name for IRS business. There have been multiple federal investigations for several years, and Ms. Lerner has refused to cooperate or testify. So, one might assume that American taxpayers would know about all of her emails by now. Indeed, IRS documents previously revealed a Lois Lerner email that warned IRS staffers about revealing too much information to Congress.

You might assume that the information would be handed over willingly from the IRS and other agencies. Yet prying each tidbit of information out of a notoriously opaque Obama administration has not been easy. Now, federal Judge Amy Berman Jackson issued her opinion requiring the IRS to reveal whatever the White House requested.

Amazingly, the chief IRS defense in this case—which presumably the White House would support—is that the IRS cannot hand over White House requests and any private taxpayer data the IRS gave the White House in response, because those records are private taxpayer data. We have to protect that taxpayer data, said the IRS! We can’t reveal that is was revealed in violation of the law, because we must protect it!

MORE INSANITY AT LINK

THE SYSTEM IS BEYOND REPAIR

Demeter

(85,373 posts)The numbers are compelling: an estimated 20 million men were active members of affair-seeking site Ashley Madison. I crunched the numbers (see bottom of post for details), and estimate that about one in six married men in the United States were on the site. You know six married men. I know at least six married men. At least one in six of them was on Ashley Madison. Of course, there are a zillion other ways to find sex or romantic companionship with someone who is not your wife. I don’t need to spell them out, because you are an adult, and you live in the real world where everyone knows that people cheat, all the time. And yet, when we hear figures like half of men cheat, or 15 percent of married women cheat, as New York Times bestselling therapist M. Gary Neuman told me for this article about Ashley Madison and the impending divorce boom, we all exhibit shock and awe and skepticism at these very high numbers.

We can mark that all up to quaint American Puritanism (which has always barely veiled our very naughty ways), but there is real financial fallout from women choosing to ignore the facts about how fragile their marriages really are. Despite the fact that divorce rates have remained relatively steady at about 50 percent for decades (though researchers debate whether the figures are ticking up or down at the moment), women continuously fail to safeguard the financial futures (and therefore that of their children, since the two are statistically intertwined) by abandoning their careers, failing to maintain financial autonomy, and banking on lifetime alimony.

As devastating as infidelity is to the individuals involved, and nearly always ends the marriage, and according to Neuman, the sheer vastness of the Ashley Madison hack should be a powerful wake-up call for women who tell themselves that their marriage is fail-proof, and they don’t have to take responsibility for their own financial wellbeing . They’re wrong. Here’s how to turn that around:

- Never, ever abandon your career. Sure, you might want to scale back or slow down when you have your kids. But technology and the nature of the economy means it is more critical than ever to maintain your hard-earned skills, network and certifications. Plus, when you put 100% of your entire family’s financial eggs in their husband’s basket, you increase risk of financial woes two-fold. Critical to note: couples that depend on a single income are twice as likely to divorce, according to one study, and couples in which both partners are happy at work are more likely to be happy in their marriages. Further, opting out of the workforce puts you at very high financial risk in the very likely chance that you do divorce. Cheating and divorce are extremely likely. You buy life insurance in the teeny tiny likelihood that you should die before you kids graduate college. What are you doing to safeguard your financial future in the very real chance your husband will cheat, or you will otherwise find reason to want out of the marriage?

- Never assume alimony will support you in the event of divorce. Increasingly, judges limit alimony payments in term of time and amounts paid, and expect women to work for their livelihoods, as I wrote about here. Remember: more and more judges are women — women who worked while their kids were growing up and have little sympathy for women who expect men to support them indefinitely. Plus, if your husband looses his job or becomes disabled, no more alimony. Sorry.

- Be actively involved in the family finances. One financial planner specializing in divorce told me: “It amazes me how often women have no idea what is going on with the family accounts.” You should have bank and investment accounts in your own name, and together with your husband keep a close eye on household finances. That way you know if hundreds of dollars (or more) each month are flying out the window on clandestine dinners, hotels and dating sites via secrete credit cards, or joint accounts you choose to ignore. Plus, in the event of a split, you will be in a better position to support yourself and your kids while the finances are sorted out, and have a lower chance of your ex blowing through joint funds or ruining your credit.

Demeter

(85,373 posts)Wall Street ended lower on Monday and wrapped up its worst month since 2012 after comments from a senior Federal Reserve official heightened fears among investors of a potential U.S. interest hike in September.

Fed Vice Chairman Stanley Fischer on Saturday said U.S. inflation would likely rebound as pressure from the dollar fades, allowing the Fed to raise interest rates gradually. Many analysts took Fischer's comments as a sign the Fed would raise rates in September, instead of December. That shook investors who were already jumpy after weeks of turbulence caused by concerns about a stumbling Chinese economy.

"What you see in the market today is caused by Fischer's comments over the weekend. If they move in September, it's going to cast a lot of doubt about where they will stop," said Stephen Massocca, chief investment officer at Wedbush Equity Management LLC in San Francisco.

Fischer's remarks at the global central banking conference in Jackson Hole, Wyoming suggested the Fed does not see the recent stock market drop and concerns about China as reasons that would keep it from raising rates. A decade of near-zero interest rates has helped the U.S. stock market stage a spectacular bull run since the financial crisis and investors are worried those gains many end once rates start to climb.

The CBOE Volatility index .VIX, known as Wall Street's "fear gauge," rose about 9.14 percent to 28.43, above its long-term average of 20. It spiked to as high as 53.29 last week.

Investors will keep a sharp eye on the Labor Department's monthly jobs report on Friday, which will be the last one before the Fed meets on Sept. 16-17.

"We can still expect to see some significant drops in the market until we get some direction from the Fed regarding a rate increase," said John DeClue, chief investment officer of U.S. Bank Wealth Management.

*************************************

Crude oil prices jumped after data indicated surprise cuts to U.S. oil production and as OPEC said it was ready to talk to other producers about the recent drop in prices.

In August, the S&P lost 6.3 percent, the Dow fell 6.6 percent and the Nasdaq declined 6.9 percent. Declining issues outnumbered advancers on the NYSE by 1,724 to 1,339. On the Nasdaq, 1,432 issues fell and 1,380 advanced. The S&P 500 index showed one new 52-week high and two new lows, while the Nasdaq recorded 24 new highs and 22 new lows.

Volume was lighter than in recent days. About 7.8 billion shares traded on U.S. exchanges, compared to an average of 10.7 billion in the past five sessions, according to BATS Global Markets.

Demeter

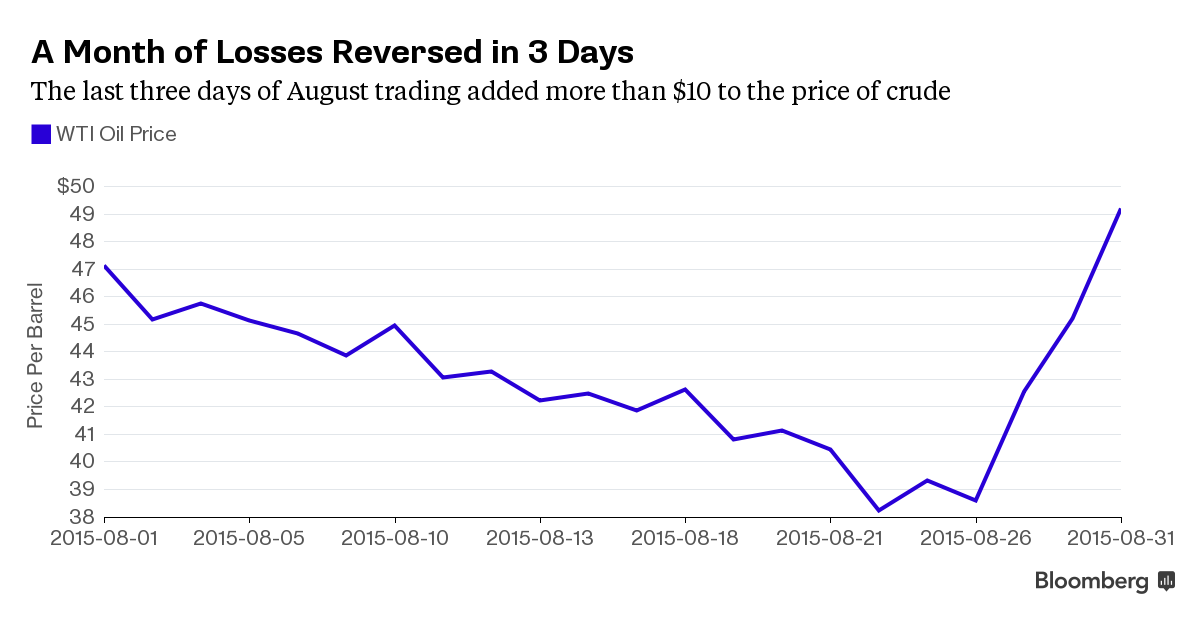

(85,373 posts)Oil futures soared on Monday for a third consecutive day, rising more than 8 percent, as a downward revision of U.S. crude production data and OPEC's readiness to talk with other producers helped extend the biggest three-day price surge in 25 years.

U.S. crude oil prices have skyrocketed more than $10 a barrel in three days, erasing the month's declines as a series of relatively small-scale supply disruptions and output risks prompted bearish traders to take profits on short positions, which had been near a record a week ago.

On Monday, prices fell initially but reversed course mid-morning. The three-day gains were more than the 20 percent mark that often signals a bull market. Even so, few were prepared to call a definitive end to the slump.

"Sharp gains over the past three trading sessions were driven by a combination of short covering and chart-readers again looking to call a bottom falsely," Citi said in a report, saying that prices may yet test new lows before year's end...

MORE

Demeter

(85,373 posts)Oil prices have rocketed more than 25 per cent in three trading sessions, with the latest boost coming from data on US production and vague hints of a change of thinking inside the Opec producers’ cartel.

The rise has been brutal for bearish traders, who just a week ago had pushed crude to the lowest levels in six and a half years.

MORE

Demeter

(85,373 posts)And it could make the old glut even bigger...As crude oil continues to rip higher—it's currently in the midst of its best three-day performance since January 2009—analysts at Barclays highlight one reason why this rally could prove to be short-lived. Resilience in U.S. shale production and supply increases from members of OPEC have left global oil markets in a prolonged state of surplus.

Earlier in the year, this oil surplus was relatively easy to spot in the form of rising U.S. inventories. But with U.S. crude stockpiles trending downward since late April, a new glut has emerged, according to Barclays.

"The surplus in the petroleum market is increasingly evident in refined products," says the team led by commodities analyst Miswin Mahesh. "Global refinery throughput touched a record high of 80.6 million barrels per day in July, with utilization rates at the highest in eight years."

This product glut is less intense than the crude surplus and took a little longer to materialize, as elevated crack spreads and heavy demand for gasoline prompted refiners to run on full blast.

Elevated refinery margins and a steep contango structure in the oil futures curve that created incentivizes for traders to lock in profits by engaging in storage arbitrage were two key sources of demand for crude that helped pull WTI crude off its March lows. The gap between the spot price and the 12-month futures contract has proceeded to narrow since then, effectively eroding the profitability of the storage trade.

And with refiners heading into the traditional fall period of scheduled maintenance, this global source of demand for crude is poised to wane by 2 million barrels per day in September and by 2.7 million barrels per day in October, according to Mahesh. This development could cause worries about U.S. storage tanks getting filled to the brim to reemerge unless crude output is suitably curtailed as refineries go offline.

"If supply does not adjust swiftly by then, crude stocks could swell faster again," writes Mahesh. "To a certain extent, as the market trades the shoulder month contracts, these expectations are getting priced in."

Barclays is sticking with its call that oil prices will rise by year's end as the supply-demand imbalance eases, while cautioning that higher than anticipated refinery maintenance, a slowdown in China, continued strength in the U.S. shale industry, increased supply from Iran, and a U.S.-dollar rally together constitute a long list of notable risks to its forecast.

IN OTHER WORDS, ANYBODY'S GUESS

Demeter

(85,373 posts)Nearly a third of the roughly 50 million elderly Americans who depend on Medicare for their physician care and other health services could see their premiums jump by 52 percent or more next year. That’s because of a quirk in the law that punishes wealthier beneficiaries and others any time the Social Security Administration fails to boost the annual cost of living adjustment.

While Congress is largely focused on addressing looming shortfalls in the Social Security Disability Insurance program, a financial time-bomb of sorts may go off in 2016 because of the festering premium problem in Medicare Part B – the premium-based government health insurance program that covers seniors’ visits to doctors and other health care providers, out-patient care and durable medical equipment. Unless Congress or Health and Human Services Secretary Sylvia Mathews Burwell intervenes, an estimated 15 million seniors, first-time beneficiaries or those currently claiming dual Medicare and Medicaid coverage will see their premiums jump from $104.90 per month to $159.30 for individuals, according to an analysis by the Center for Retirement Research at Boston College. Higher-income couples would pay multiples of that increase. A spokesperson for the Centers on Medicare and Medicaid Services on Friday confirmed that the premium hike is in the works, although a final decision won’t be made until later this year. While approximately 70 percent of Medicare beneficiaries “are expected not to see a premium increase in 2016,” he stressed, “the remaining 30 percent of beneficiaries would pay a higher premium based on this projection.” CMS is exploring its options for finding a way to blunt the effect of the major premium increase next year, although officials say the federal agency does not have authority to extend beyond what the law calls for.

The likely rate hike has received relatively little public attention until now. According to the Center for Retirement Research study, it illustrates the broader “complicated interaction” between Medicare premiums, which are typically automatically deducted from Social Security benefits, and the rest of Social Security funds that are used for retirement and other non-health care related expenditures. For just the third time since automatic cost of living adjustments started in 1975, Social Security will not increase the cost of living benefit next year, simply because the Consumer Price Index used by the government has remained relatively flat. Since Social Security COLAs do not “fully reflect the increase in health care costs faced by the elderly,” the study notes, any missed annual cost of living adjustment can trigger a crisis in the Medicare Part B program.

Because the law for various reasons “holds harmless” about 70 percent of Medicare beneficiaries from premium hikes to compensate for diminished resources caused by a missed cost of living adjustment, the remaining 30 percent of Medicare Part B beneficiaries get clobbered by premium increases. “Because the COLA for Social Security benefits is expected to be zero for 2016, premiums would not increase for the 70 percent protected by the hold harmless provision,” according to the study. “Under current law, Part B premiums for other beneficiaries must be raised enough to offset premiums foregone due to the hold-harmless provision.” Unless the administration figures out some “work-around,” the study states, the base Part B premium would rise from $104.90 to $159.30 – a 52 percent increase. The study goes on to say that participants with higher incomes would then have to “pay multiples” of $159.30 depending on their income levels. As an example, each member of a married couple with household income ranging from $170,000 to $214,000 a year would pay a Part B premium in 2016 of $223.00. “Premiums would top out at $509.80 per person for couples with income of more than $428,000,” the study states. Juliette Cubanski, a Medicare expert with the Kaiser Family Foundation, said on Friday that the premium increases “could sting” millions of older Americans, but cautioned that the projected 52 percent average increase in premiums is based on 2015 Medicare Trustees’ projections that may be altered before the new rates take effect.

“The Secretary of HHS has some authority and discretion about what level the Part B premium will be set at,” she said. “So we may not see as steep an increase as the trustees are projecting.”

But seniors would be wise to brace for a hefty increase in any case.

yodermon

(6,143 posts)s&p emini at 1940, hold on tight!

Demeter

(85,373 posts)Fuddnik

(8,846 posts)Oil is down over $3.00.

Everything is wonderful!

Demeter

(85,373 posts)...It is important to note that the model does not reflect results if an election were held today, but relies on Moody's Analytics economic forecasts to determine what the world will look like in November 2016. Should gasoline prices rebound above the current baseline forecast by election time, the results of the model will move more in favor of the challenging Republicans. The forecast for house prices also accelerated moderately.

The election model's other main drivers saw little to no change from the previous month. No new historical data were available for real personal income per household, though September's quarterly update from the Bureau of Economic Analysis has potential to swing the model back toward the challengers if data come in weaker than forecast. The president's approval rating was unchanged from the previous forecast update; however, given the recent volatility in equity markets and what is expected to prove an extremely contentious debate surrounding the Iranian nuclear deal, this factor also has the potential to swing the forecast by next month.

The Moody's Analytics Presidential Election model forecasts whether or not the incumbent party will maintain control over the White House using a mixture of economic, demographic and political data. The model successfully predicts every election back to 1980, including a perfect electoral vote prediction in the 2012 election. Read More: Moody's on Volatility.

Demeter

(85,373 posts)ALWAYS A BAD SIGN, WHEN BANKSTERS MOVE INTO GOVT.

http://www.reuters.com/article/2014/08/26/us-france-politics-government-idUSKBN0GP0GN20140826?

President Francois Hollande replaced his maverick leftist economy minister with a former Rothschild partner on Tuesday, in a reshuffle intended to reconcile his efforts to revive the stagnant French economy with deficit-cutting orthodoxy.

The shake-up is the latest episode in the wrangling across Europe about how much budgetary rigor the region's economies can bear as they recover from financial crises. For Hollande, who is revamping his government for a second time in two years, it could be his last chance to make a success of his presidency.

Arnaud Montebourg, ejected from the key economy ministry post on Monday after his latest tirade against German-enforced "austerity" in the euro zone, was replaced by Emmanuel Macron.

Macron, a 36-year-old former merchant banker, acted as Hollande's top economic adviser until June. He was widely known in French business circles as their "ear" at Hollande's presidential palace, otherwise largely packed with technocrats...

MORE

Demeter

(85,373 posts)A press release issued by the United Nations Development Program (UNDP) confirmed that more than 56 million people have been lifted out of poverty in Latin America and the Caribbean in recent years.

The findings based on a new report from the UNDP found that poverty levels during the period from 2000-2012 fell from 41.7 percent to 25.3 percent of the population.

Despite positive progress in the area of poverty reduction, many people have been unable to enter into the middle-class, which the study claims could force as many as 200 million people into poverty.

In the event of a major crisis, the report found that 38 percent of the Latin American population faces severe economic vulnerability. This group is primarily composed of those earning between US$4 and US$10 a day, who are neither living in poverty, or on less than US$4 a day (25 percent), nor have entered into the middle class, earning between US$10 to 50 a day (34 percent).

This content was originally published by teleSUR at the following address:

"http://www.telesurtv.net/english/news/UNDP-Poverty-Declines-in-Latin-America-and-the-Caribbean-20140827-0064.html". If you intend to use it, please cite the source and provide a link to the original article. www.teleSURtv.net/english

Demeter

(85,373 posts)

Europe hasn't recovered, because it hasn't let itself. Too much fiscal austerity and too little monetary stimulus have, instead, put it more than halfway to a lost decade that's already worse than the 1930s.

It's a greater depression.

And as the latest GDP numbers show, it's not getting any less so. Indeed, the eurozone as a whole didn't grow at all in the second quarter. Neither did France, whose economy has actually been flat for a year now. Germany's economy fell 0.2 percent from the previous quarter—and that after revisions revealed it had quietly gone through a double-dip recession in early 2013. Though that's still much better than Italy: Its GDP also fell 0.2 percent, but its triple-dip recession has now wiped out all growth since 2000. The closest thing approximating good news was that Spain's dead-cat bounce recovery continued with 0.6 percent growth. But it still has 24.5 percent unemployment.

Here's a bit of perspective: it's been six-and-a-half years, and eurozone GDP is still 1.9 percent lower than it was before the Great Recession began. It "only" took the U.S. economy seven years to get back to where it'd been before the Great Depression hit.

But it's a little misleading to just call this a depression. It's worse than that. Europe is turning Japanese. The combination of zombie banks, a rapidly aging population and, most importantly, too-tight money have pushed it into a "lowflationary" trap that makes it hard to grow, and is even harder to escape from. That's what happened to Japan in the 1990s, and now, 20 years later, its nominal GDP is actually smaller than it was then. Now, Europe isn't that far gone, but it's getting there. Inflation is already a meager 0.4 percent. And you can tell that investors don't think it's going to pick up anytime soon, because they're willing to lend to governments for almost nothing. Indeed, for the first time in its history going back to the Napoleonic era, Germany (or one of its predecessor states) can borrow for 10 years for less than 1 percent. Japan, of course, has been able to borrow this cheaply for a decade now....

MORE, AND IT HASN'T CHANGED SINCE 2014

Demeter

(85,373 posts)Wall Street banks are scaling back their role in supporting debt sales that have helped online lending companies double their originations every year since 2010.

Investment banks earn fat fees by helping lenders pool and store their loans until enough are aggregated for sale to investors. But Goldman Sachs Group Inc., Credit Suisse Group AG and JPMorgan Chase & Co. are among the Wall Street firms considering limits to their financing for companies that lend to certain higher-risk borrowers, people with knowledge of the policies said.

The caution comes in response to a May ruling by the U.S. Appeals Court in Manhattan, which threatens to remove a protection that non-bank lenders have relied on to make high-interest loans. The issue boils down to whether these lenders can pay a bank in an unregulated state to make loans to borrowers in other jurisdictions, where the interest rates could be considered usurious...

Demeter

(85,373 posts)ANOTHER CASE OF RIGGING AND COLLUSION?

http://www.bloomberg.com/news/articles/2015-08-31/oil-s-three-big-days-wipe-out-a-month-of-losses

OPEC signaled that it might cut production in the future and the U.S. lowered output estimates, propelling oil back into a bull market less than a week after hitting a six-year low.

Prices surged 8.8 percent Monday in New York, capping the biggest three-day gain in 25 years.

The Energy Information Administration changed the way it calculates how much oil comes out of the ground, using a survey of producers in key states instead of relying on data from state agencies and computer models. As a result, 13.2 million barrels of oil production vanished with a government blog post.

YUP, ALL THE EARMARKS OF A CON GAME...

MORE AT LINK

Demeter

(85,373 posts)Argentina's central bank on Monday won the reversal of a U.S. court ruling that had allowed bondholders to try to hold it responsible for the country's obligations on debt that has been in default since 2002. The 2nd U.S. Circuit Court of Appeals in New York overturned a 2013 ruling denying a bid by Banco Central de la República Argentina (BCRA) to dismiss claims by U.S. investment firms holding $2.4 billion in judgments against the South American country.

U.S. District Judge Thomas Griesa had previously held that the central bank had waived its sovereign immunity, and that as a result, the hedge funds could move forward with a lawsuit targeting the bank's assets.

Argentina is lobbying internationally for tighter controls on the activities of junk debt specialists, which President Cristina Fernandez's leftist government brands "vultures."

The ruling "sets an international precedent and guarantees that vulture funds will not be allowed to seize the reserves of the central bank," bank President Alejandro Vanoli said in a statement.

"Once again, as Argentina has often expressed, Judge Griesa's absurd decisions are without judicial grounds," the economy ministry said in a separate statement.

Demeter

(85,373 posts)U.S. prosecutors have expanded their probe of currency-market manipulation by some of the world’s largest banks to include the Russian ruble and Brazilian real, according to two people familiar with the matter.

The Justice Department is using cooperation agreements it reached with banks in May to gather information and interview traders about suspected market rigging, said the people, who asked not to be named because the investigation is confidential. Trading of the Argentine peso has also attracted the attention of U.S. prosecutors, one of the people said.

The escalating investigation is scrutinizing trading practices at banks that didn’t previously settle currency-rigging claims. Prosecutors are examining a handful of institutions, including Deutsche Bank AG, the two people said. The bank has already disclosed it’s under a half-dozen criminal and regulatory investigations, including for possible currency manipulation.

Prosecutors are also stepping up efforts to charge individuals at major banks, including those that previously settled. The Justice Department has faced criticism from public-interest advocates and lawmakers for resolving Wall Street misconduct with billion-dollar deals that haven’t led to the arrest of traders. Traders at several banks in Moscow and other locations are being investigated for colluding to influence benchmark rates for emerging market currencies to boost profit for their firms, the people say...

HMM, WINDOW DRESSING, OR REAL POLICY CHANGE? TOO LITTLE TOO LATE?

Demeter

(85,373 posts)Activity in China's factory sector shrank at its fastest rate in at least three years in August as domestic and export orders tumbled, increasing investors' fears that the world's second-largest economy may be lurching toward a hard landing.

Even more worrying, China's services sector, which has been one of the lone bright spots in the sputtering economy, also showed signs of cooling, a similar business survey said.

Hurt by soft demand, overcapacity and falling investment, the economy has also been buffeted by plunging shares and a shock yuan devaluation, in what some have called a "perfect storm" of factors that is rattling global markets and could strain relations with China's major trading partners...

Demeter

(85,373 posts)The United States is considering sanctions against both Russian and Chinese individuals and companies for cyber attacks against U.S. commercial targets, several U.S. officials said on Monday.

The officials, who spoke on condition of anonymity, said no final decision had been made on imposing sanctions, which could strain relations with Russia further and, if they came soon, cast a pall over a state visit by Chinese President Xi Jinping in September.

The Washington Post first reported the Obama administration was considering sanctioning Chinese targets, possibly within the next few weeks, and said that individuals and firms from other nations could also be targeted. It did not mention Russia.

A move against Chinese entities or individuals before Xi's trip, the officials said, is possible but unlikely because of the strain it could put on the top-level diplomatic visit, which will include a black-tie state dinner at the White House hosted by President Barack Obama...

Demeter

(85,373 posts)Brazil’s government forecasts a further deterioration of its fiscal accounts as the combined effects of a deepening recession and political crisis have fueled opposition to austerity measures.

The government foresees a budget deficit next year excluding interest payments of 30.5 billion reais ($8.4 billion), or about 0.5 percent of gross domestic product, Budget Minister Nelson Barbosa said in Brasilia on Monday. That contrasts to a targeted surplus of 2 percent at the beginning of the year and a revised objective of 0.7 percent announced in July.

Finance Minister Joaquim Levy’s pledge to avert a credit downgrade to junk is proving increasingly ambitious as he faces the challenge of a deeper-than-expected recession and congressional resistance to spending cuts and tax increases. In the latest of a string of setbacks to its economic plan, the government over the weekend scrapped efforts to revive a tax on financial transactions following opposition by congressional leaders.

"Politics are making Levy’s life very difficult," Italo Lombardi, senior Latin America economist at Standard Chartered Bank, said by telephone. "Rating agencies would need to show a lot of patience to not downgrade Brazil."

The real on Monday slumped to more than a 12-year low and swap rates on the January 2021 contract surged 41 basis points to 14.12 percent on concerns that easing fiscal discipline will delay a reduction in interest rates. The Ibovespa extended the worst monthly slide since September...

IF YOU RECALL FROM THE WEEKEND, LEVY IS THE BANKSTER IN CHARGE....

Demeter

(85,373 posts)When something sounds too good to be true, it usually is, as investors in nontraditional bond funds are finding out.

These so-called go-anywhere funds, which typically give managers free rein and have racked up about $150 billion under management, promised safety amid turmoil but have mostly failed to deliver, prompting investors to pull their money out.

The funds, which exploded in the face of growing fears of rising interest rates in 2013, have lost 0.7 percent in the past month and 1.4 percent in the past year, according to Morningstar Inc. data. As for plain-vanilla U.S. government bonds? They eked out a 0.2 percent gain during this rocky August, while stocks globally plunged 5.9 percent.

Call it the curse of complexity. As central bankers from China to the U.S. wield unprecedented influence over all markets, balancing investments perfectly across asset classes is becoming exceedingly difficult.

Perhaps it’s also evidence that investors need to identify their single biggest fear and then hedge against it.

“These funds were more designed to protect people against interest-rate risk,” said Sarah Bush, a fixed-income fund analyst at Morningstar. To do that, she said, “A lot of these have taken a fair amount of credit and emerging-markets risk.”

MORE

Demeter

(85,373 posts)Mario Draghi may have skipped the Federal Reserve’s Jackson Hole symposium this year, but he can’t dodge its conclusion: central banks can’t steer inflation as well as they thought.

Less than six months into a stimulus program that the European Central Bank president promised would revive consumer-price growth, the euro area is facing renewed disinflationary pressure as China’s economy slows and commodity prices slump. Inflation failed to pick up this month, data showed on Monday, and Draghi may have to downgrade the institution’s forecasts on Thursday.

The newest risk to prices highlights how in the 19-nation currency bloc -- as in the U.S., the U.K. and other industrialized nations -- headline inflation is still far below target even as the economy recovers. Whether that heightens calls for the ECB to step up its 1.1 trillion-euro ($1.2 trillion) quantitative-easing program will depend on how Draghi communicates the complex economic picture.

People think “central banks don’t have a handle on inflation any more and that’s not true,” Jon Faust, professor of economics at Johns Hopkins University, said in an interview at the Kansas City Fed’s annual meeting in Jackson Hole, Wyoming. “Inflation will come back, but the specific timing of that is much more difficult in the current environment.”

THE GREEK GODS ARE LAUGHING THEIR HEADS OFF--HUBRIS, YOU KNOW

Demeter

(85,373 posts)Five years ago this month, GMAC became the first mortgage servicer to announce that they would suspend foreclosure operations, due to irregularities in their document preparation. Within a few weeks every major mortgage servicer in America followed suit. This is usually called the robo-signing scandal, but to be more precise we gave it the name foreclosure fraud. It ended with the five leading servicers, including GMAC, signing the $25 billion National Mortgage Settlement.

Except it didn’t end, and this past week I was handed inconvertible proof of that fact. The scenario is so fantastical that if I didn’t have a working knowledge of foreclosure fraud I wouldn’t have believed it. But it appears to be very real.

Bill Paatalo is a former cop who worked in the mortgage industry as a loan officer and, from 2002-2008, the President of Wissota Mortgage in the Midwest. Since 2009, after experiencing his own mortgage trouble through a loan with Washington Mutual, he became a licensed private investigator specializing in securitization and chain of title analysis. He testifies as an expert witness, working with foreclosure defense attorneys and pro se litigants.

On May 15, Bill got an email out of the blue from Jamie Gerber, “team lead” for a company called Security Connections. Here’s that email:

SEE LINK FOR DETAILS

Demeter

(85,373 posts)TO WHICH I REPLY: WHY NOT? ISN'T IT ABOUT TIME SOME OF THE .01% TOOK IT ON THE CHIN? ESPECIALLY THE MOST CRIMINAL?

http://wolfstreet.com/2015/08/30/four-richest-men-in-mexico-slimlandia-get-crushed-slim-velasco/

Tough times for Mexico’s very richest. A couple of weeks ago, I reportedthat Carlos Slim, once the world’s richest man and the undisputed Big Boss of Slimlandia, as Mexico has come to be called, lost $7 billion in the first seven months of 2015. But since then, his losses have exploded to $11.8 billion.

That’s close to one-fifth of Slim’s total fortune at the beginning of 2015, making him this year’s biggest loser, both in absolute and relative terms, on Bloomberg’s Billionaire index.

Most of Slim’s losses came on the back of continued financial hemorrhaging at his gold mining company Minera Frisco, whose stock has tumbled over 55% this year, as well as the recent drubbing in global stock markets.

Mexico’s second and third richest individuals, Germán Larrea Mota-Velasco and Alberto Baillères González, both of whom made their fortunes in mining, have fared little better this year, having also seen the dollar value of their wealth shrink by roughly 20%. But that is nothing compared to the wealth destruction, in relative terms, suffered by Ricardo Salinas Pliego, Mexico’s fourth richest man, whose personal fortune is now worth roughly half of the $8 billion it was worth at the beginning of the year...

MOST LIKELY, THIS IS THE START OF CANNIBALISM AMONG THE GREEDY AND OBSCENELY WEALTHY...

Taken together, Mexico’s four richest individuals have lost a staggering $21 billion so far this year – the equivalent of 20% of their total net worth and around 2% of Mexico’s GDP. Partly to blame for this wealth destruction is the Mexican peso. In the last eight months, the peso has shed 15% of its value against the US dollar. This is playing havoc with company margins and profits, especially for those with dollar-denominated debt but peso-denominated operating income. But it’s not just billionaires from Mexico who are struggling. On Monday, the last day of the latest stock market rout, $124 billion was wiped off the collective fortunes of the world’s 400 richest people. According to data compiled by the Bloomberg Billionaires Index, so far this year the world’s richest man Bill Gates has lost roughly $6.5 billion, while third-placed Warren Buffet’s fortune is down $9.5 billion.

Although global markets have made a recovery in the last few days, the recent rout has served as a stark reminder of just how exposed the world’s largest personal fortunes are to the everyday vagaries of the international equity markets. Thanks to years of unprecedented central bank intervention in financial markets, the paper value of the financial assets held by the world’s 0.0000(…)1% has been reinflated to the point where it bears not the slightest relation to economic reality or fundamentals. But reality cannot be forestalled indefinitely...Hence the rising panic of those at the very top of the global wealth pyramid.

MORE