Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 27 August 2015

[font size=3]STOCK MARKET WATCH, Thursday, 27 August 2015[font color=black][/font]

SMW for 26 August 2015

AT THE CLOSING BELL ON 26 August 2015

[center][font color=green]

Dow Jones 16,285.51 +619.07 (3.95%)

S&P 500 1,940.51 +72.90 (3.90%)

Nasdaq 4,697.54 +191.05 (4.24%)

[font color=red]2.18% +0.04 (1.87%)

30 Year 2.93% +0.06 (2.09%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Demeter

(85,373 posts)mother earth

(6,002 posts)straightforward and enlightening. This is a must see, imo.

Demeter

(85,373 posts)The youth of Germany have reportedly created the new and unflattering verb “merkeln”. It is derived from the name of Angela Merkel, the country’s chancellor, and its inventors say it means “to display extreme passivity and indecisiveness”. Perhaps the name of Alexis Tsipras, her counterpart in Athens, might also be used to invent a new Greek infinitive. It means “to call a highly-charged poll at short notice”. Following his snap referendum last month, Mr Tsipras this week resigned to force a general election on September 20. His move came after Ms Merkel managed to pass the third rescue loan for Greece in five years through a grumbling Bundestag. Politically both leaders are far apart but a common error has brought the mercurial Mr Tsipras and the passive Ms Merkel to this point. Both have failed to confront the mistaken beliefs within their electorates about the causes of, and solutions to, the Greek crisis.

Mr Tsipras’s decision to call an election may well make sense. A revolt on the far left of his shaky coalition has deprived him of a working majority. If the poll gives him a fresh mandate to push through the latest rescue package, it is all to the good. But calling an election in September to support a bailout that is almost identical to the one rejected in a referendum only shows how detached from reality Mr Tsipras and his Syriza party have become. Syriza came to office in January falsely promising voters that they could reject the demands of the troika and yet remain in the euro with the European Central Bank underpinning the Greek banking system. That pledge has expensively and painfully been exposed as a fraud.

Meanwhile, Ms Merkel has allowed the entire euro crisis to be portrayed within Germany as a fiscal mess caused by profligate peripheral countries. This analysis ignores the role of the financial bubble fuelled by banks - including Germany’s - which has hampered sensible discussion of debt restructuring. It has also, under the influence of Wolfgang Schauble, her misguided finance minister, worsened instability by raising discussion about the desirability of Greece leaving the currency union.

Although the Greek bailout passed through the Bundestag, Ms Merkel endured the biggest revolt yet in her Christian Democratic Union and its sister party. But she retains a huge grand coalition majority with a supine coalition partner and a fragmented opposition. If ever there was a time to spend her vast political capital, this is it.

The result of these twin deceptions is that Greece has signed up for policy packages it is substantially unable or unwilling to implement. For their part, the eurozone (and the International Monetary Fund) needlessly opposed early debt restructuring and have operated with hugely optimistic growth assumptions undermined by the very fiscal stringency they themselves have demanded. Little wonder voters in both creditor and debtor countries grow more disillusioned with each iteration of the bailout.

Bad economics often becomes bad politics. The rescue - while worth continuing - has become politically toxic to its signatories. They have themselves to blame and can do little but press on with the least worst option, which is to try to make the agreement work. Whether it does or not, more honesty with voters of both debtor and creditor countries would be in order.

Mr Tsipras took a gamble this week to put not just the finances but also the political economy of his country back on track. It was a courageous move. But the fact he did so only highlights the primrose path to oblivion down which Greece had previously been heading.

Demeter

(85,373 posts)China is the world’s second-largest economy and, in recent years, the main contributor to global growth. But that role is starting to change — and wildly. China is now acting more as a risk than a savior, and contagion within its own stock market has spread over the past week through Asia, Europe and America.

All at once, seemingly, investors have determined that China’s long-held investment-and-infrastructure growth strategy is hitting its expiration point — even though official numbers show an economy that is merely decelerating, and gradually at that. Meantime, erratic efforts of Chinese leadership to stabilize the plunging stock market have set off new questions about the wisdom of the Communist Party. Put that together — slowing growth and doubts about suits pulling the strings — and you have the makings of global chaos. Here are a few basic questions and answers about how to understand these events:

We’ve known for years that China would slow down. So why the panic?

It’s worth starting by emphasizing just how essential China has become to the global economy. It is the world’s largest manufacturer, largest merchandise trader and largest holder of foreign reserves. Over 2½ decades, China’s economy averaged nearly 10 percent annual growth — and it continued to surge in recent years, as other developed economies stagnated. On a heavy diet of oil, coal and steel, China consumed more and more of the global pie.

But, of course, the Chinese economy has always been an experiment — a market that is not-quite-free and is dominated by state-owned enterprises. That economy, too, is also guided by a party that views growth as an essential political tool: Nobody will get too frustrated with the leaders, the thinking goes, when the growth rate is the best in the world.

Only now, there are questions about whether China’s growth has been underpinned by a lot of unhealthy — and ultimately corrosive — practices. China’s rise was powered by heavy construction carried out by companies that operated free of competition. As my colleague Simon Denyer has pointed out, a lot of that construction — particularly as it pushed out into newer cities, on the promise of ever-expanding riches — now looks unwise...

MORE

Demeter

(85,373 posts)The King Is Dead

In the first half of this year, at least six domestic coal companies filed for bankruptcy. In February, West Virginia’s Covington Coal fell, followed by Xinergy and Grass Creek Coal in April, Patriot and Birmingham Coal & Coke in May, and A&M Coal in June. In August came the biggest announcement of all: the $10-billion coal giant Alpha Natural Resources had entered the bankruptcy sweepstakes, too.

Only four years earlier, Alpha had secured its position as one of the world’s largest coal outfits by purchasing the Appalachian company Massey Energy for $7 billion and expanding its operations to 60 mines, many in Appalachia. But its reign would prove short-lived. The price of coal has been plummeting as utility companies shift to significantly cheaper shale gas, extracted through the drilling process known as hydraulic fracturing, or fracking, to produce power. This April, for the first time since the U.S. Energy Information Administration began collecting data in 1973, gas surpassed coal as the nation’s number one producer of energy.

By late July, the New York Stock Exchange announced that it had suspended trading of Alpha Natural Resources’ stock because it was worth next to nothing.

In August, the inevitable occurred. Alpha submitted a bankruptcy filing which read in part: “The unprecedented changes facing the coal industry run deep and are occurring at a frenetic and unpredictable pace…The U.S. coal industry as currently structured is unsustainable.”

MORE

Demeter

(85,373 posts)By Roy Poses, MD, Clinical Associate Professor of Medicine at Brown University, and the President of FIRM – the Foundation for Integrity and Responsibility in Medicine.

...Readers of Health Care Renewal know that we often discuss systemic problems in health care, often involving the leadership of large health care organizations, that may produce real harms to patients’ and the public’s health, but for which no good policing mechanisms seem to exist. Worse, these problems seem to be a taboo topic in health care policy discussions, and in medical journals, like the Annals of Internal Medicine...

Example: the Anechoic AllTrials US Launch

Very recently we discussed how the launch of new US AllTrials initiative got almost no notice. Specifically, even though a sponsor of the initiative is the American College of Physicians, that organization’s publication, the Annals of Internal Medicine, did not comment on it. (A search of the journal using the term AllTrials produced no results.)

However, the AllTrials initiative means to tackle the problem of suppressed clinical research. We have long discussed how research may be systematically suppressed when its results do not please its commercial sponsors. Particularly, trials of drugs or devices that do not produce favorable results may be suppressed by their sponsors, usually the companies that make the drugs or devices. Such suppression breaks trust with and therefore hugely disrespects the patients who volunteered to participate in the trials, who believed they were contributing to science and public health. Suppressing data that drugs and devices may be ineffective and harmful may endanger patients by letting them be treated by such drugs and devices in the illusory belief that they are safe. Yet where is the outrage about such dishonest behavior by large and powerful health care organizations that disrespects, and more importantly, endangers patients?

Health Care Corruption

When a pharmaceutical, biotechnology, or device company withholds results of a clinical trial to makes its product look better and enhance its revenue, that is an example of health care corruption.

Transparency International defines corruption as

Abuse of entrusted power for private gain

When health care corporations run clinical trials, we entrust them to do honest research and be worthy of the trust of their research subjects. Withholding the results to enhance revenue is therefore abuse of that entrusted power for private gain.

Health Care Corruption as a Taboo Topic

This blog focuses on the US, and we now have in our archives some amazing stories that document various forms of health care corruption in the US, including numerous allegations of misbehavior by large health care organizations ending in legal settlements, and examples of outright fraud, bribery, kickbacks and other crimes. Some large and profitable health care corporations have made numerous such settlements over recent years. (For example, see the track record to date of Pfizer Inc and that of Johnson and Johnson...LINKS AT OP)

Much of this bad behavior was meant to sell drugs, devices, or clinical services, often in situations in which their benefits did not outweigh their harms. For example, we just discussed the latest settlement by Amgen of allegations that it promoted an epoetin (Aranesp) “off-label” for cancer patients not on chemotherapy. Such “misbranding” was not merely a technical violation, since it has been shown that use of the drug in this situation increases mortality. Such bad behavior thus likely harmed numerous patients.

Furthermore, efforts to police these kinds of corruption have been weak and scattered. Most cases have ended with legal settlements that at most involve fines to corporations, yet the fines are rarely big enough to significantly affect their overall revenues. While the corporations themselves may be thus punished, the people who actually authorized, directed or implemented the bad behavior are usually unscathed. So as we have discussed frequently, such attempts at justice are unlikely to deter future bad behavior.

In fact, people more distinguished than yours truly have been warning about health care corruption for years. In particular, in 2006, the Transparency International Global Corruption Report focused on health care corruption, and asserted in its executive summary, ” the scale of corruption is vast in both rich and poor countries.” It also noted how diverse is health care corruption:

It further stated how serious the consequences of corruption may be for patients and public health:

The poor are disproportionately affected by corruption in the health sector, as they are less able to afford small bribes for health services that are supposed to be free, or to pay for private alternatives where corruption has depleted public health services.

Corruption affects health policy and spending priorities.

Occasionally, something is published about health care corruption in the US in the medical literature.

– In 2009, qualitative interviews by Pololi et al in the Journal of General Internal Medicine produced many striking anecdotes suggesting corruption in US academic medicine. Four of the interviews were with faculty whose leaders allegedly used deception for personal and professional gain (i.e., “a situation of major unethical use of funding,” “fraudulently creating data for a research project,” “we’re lying to the people who are doing our school evaluations, we’re putting things on paper that we do that we don’t do,” “that’s what I think he felt he had to do—hide money, lie about money, or at least cook the books a little bit.”)(4) These results produced few echoes, particularly not any strident editorials about the need to address corruption.

– In 2011, an article in the Lancet suggested that “there is more corruption in the G8 countries than in the whole of Africa,” but for any health care professional to acknowledge that would be “professional suicide” (see this post).(3)

– Finally, in 2013, a Transparency International survey showed that 43% of Americans believe their health care system is corrupt. Yet this received no media attention, and to my knowledge has never been mentioned in a major US medical journal. (Look here.)

So health care corruption remains a largely taboo topic. (On Health Care Renewal, we call corruption “anechoic,” since evidence of health care corruption produces few echoes.)

The Annals of Internal Medicine, like most major medical journals, has long avoided discussion of health care corruption, and how systemic corruption harms patients’ and the public’s health.

Of course, the unwillingness to discuss global health care corruption, health care corruption in the US, and the relationship of health care corruption in the US to corruption in other sectors may arise from the fear, as stated by one person interviewed in Charles Ferguson’s documentary Inside Job, that discussion could lead to investigation, and investigation could “find the culprits”.

MORE

Demeter

(85,373 posts)Today(MONDAY) the S&P500 dropped about 4 percent. A pretty big move, yes, but hardly a catastrophe. But to follow the financial media and Twitter, you’d think it was market Armageddon. It’s Monday, so of course everybody was screeching “Black Monday,” and (of course)^2, #blackmonday trended on Twitter.

Not even close.

I worked at an FCM in Chicago on Black Monday. Well I guess I still worked there. After a falling out with my boss, I submitted my resignation at 7AM on the October 19, 1987: so now you know the real cause of the Crash. But I was in the office, and had a ringside seat to an honest-to-God crash. People, please. Today wasn’t even close. Today’s move was about a 3 sigma move. Black Monday, 1987, was a 20 sigma move. If the world was normal-which it ain’t, of course-a 20 sigma move should occur every several billion lives of the universe. Three sigma moves occur about once every five years. So in fact, we’re a little bit overdue. In brief, there is no comparison.

Despite the decline in stock prices, there is still one raging bull market. In stupidity. Today’s market move triggered Pavlovian responses from both idiots and people who should know better. Leading the idiot parade were Bernie Sanders and Donald Trump. (You’re shocked, I’m sure.) Both took to the express lane of stupidity, Twitter, to share with us their deep thoughts. Sanders reflexively blamed trade:

Trump blamed China, and (apparently) US policy makers dancing to China’s tune:

Yes, China has something to do with it, but (a) as noted above, today’s “crash” is small beer indeed, and (b) the sort of autarky that Trump fantasizes about would have made us far less wealthy than we are, resulting in stock prices (and other asset prices) far below than the level to which they “crashed” today. And then there’s Zero Hedge, which wet itself repeatedly in excitement, all the while declaring that the era of DOOM! is upon us. Too bad for ZH that if there’s anybody who’s effed by recent developments, it’s ZH’s BFF Putin and Russia. (Ruble above 71, and Brent at a 42 handle today. Good times, Vlad!)

As for people who should know better, consider Mark Cuban:

“No one else that trades can move the market [by] hundreds of points in hundreds of seconds in either way,” Cuban said.

“What we saw today was like a three stooges market… that doesn’t happen from normal traders, that doesn’t happen from large funds taking positions or selling positions, that happens because algorithms watch everything that’s happening and everything that’s correlated to what’s happening in equities and they take action.

Cuban has an obsession with HFT, and today gave him an opportunity to spout off on it again, revealing his ignorance, and unreasoning hatred, of it. Days like today, and market movements like today (with big gaps) have occurred before anyone even thought of algos, before markets were computerized, and before Mark Cuban was born. Days like today occurred when prices were recorded on blackboards in chalk. Days like today occurred when the closest thing to HFT was the telegraph and the stock ticker. Regardless of the technology, markets do things like they did today.

Everybody should just give it a rest. Days like today happen with some regularity. No reason to panic. Indeed, it should be a source of some comfort that the impetus for the selloff was events in China, rather than (as in 2008) the impending implosion of the US banking sector. And do yourself a favor. Turn off the TV, and just look at Twitter so that you can mock the likes of Trump and Sanders. The signal-to-noise ratio is asymptotically approaching zero. When you really need to panic, you’ll know.

SOMETIME NEXT WEEK, PROBABLY, HE'LL GET WHAT HE'S WAITING FOR....

Demeter

(85,373 posts)It looks like HFT was responsible for Monday's market plunge (Investment News)

Paul Schatz, president of Heritage Capital, says Monday's stock market plunge looked a lot like the May 2010 flash crash. In an article for Investment News Schatz wrote, "I believe that high-frequency trading was responsible, not for the whole stock market decline, but for the quick acceleration and pricing dislocations or anomalies." He continued, "Remember, HFT thrives when markets are volatile and liquid. Not so much in quiet and less volatile markets." Schatz points to the big declines in the value of healthcare and biotech ETFs despite their largest holdings being some of the most liquid names in their respective industries as evidence of a HFT-driven flash crash.

Ray Dalio says the Fed's next move is QE4 (Business Insider)

Ray Dalio, the founder of Bridgewater Associates, the world's largest hedge fund, thinks the Fed's next policy move won't be to raise interest rates. Instead, Dalio believes the central bank will embark on a new quantitative easing program. Dalio thinks "it should now be apparent that the risks of deflationary contractions are increasing relative to the risks of inflationary expansion because of these secular forces." He continued, "Our risk is that they could be so committed to their highly advertised tightening path that it will be difficult for them to change to a significantly easier path if that should be required."

Demeter

(85,373 posts)Remember the 4th Amendment? We hear it's making a comeback. Back in May, we had a story about another court explaining to the government that, contrary to popular belief within Homeland Security, the 4th Amendment does still apply at the border, and thus Border Patrol can't just take someone's laptop without a warrant.

The case involved a guy named Jae Shik Kim, who the government suspected was shipping items to China that were then being forwarded to Iran. Because of that, DHS grabbed his laptop as he was leaving the US (on a flight to Korea). The DOJ argued that the laptop was a "container" subject to search at the border. The court disabused the DOJ of this notion:

After considering all of the facts and authorities set forth above, then, the Court finds, under the totality of the unique circumstances of this case, that the imaging and search of the entire contents of Kim’s laptop, aided by specialized forensic software, for a period of unlimited duration and an examination of unlimited scope, for the purpose of gathering evidence in a pre-existing investigation, was supported by so little suspicion of ongoing or imminent criminal activity, and was so invasive of Kim’s privacy and so disconnected from not only the considerations underlying the breadth of the government’s authority to search at the border, but also the border itself, that it was unreasonable.

Given an opportunity to respond, the DOJ has dropped the entire case.

The United States, by and through its attorney, the Acting United States Attorney for the District of Columbia, respectfully moves this Court to dismiss the Indictment against the defendants. As grounds for this motion, the government states the following: in a Memorandum Opinion and Order, filed on May 8, 2015, the Court granted the defendants’ motion to suppress evidence, and the government has decided not to pursue an appeal of that decision. Accordingly, the government is unable to continue prosecuting this matter, and we therefore move the Court to dismiss the Indictment pending against the defendants.

Yup. Next time, maybe don't violate the 4th Amendment.

IT'S A NICE DREAM...BUT WHEN I WAKE UP, IT'S STILL 1984 AND COUNTING.

Demeter

(85,373 posts)THE ONION, OF COURSE. HOW THEY CAN HOPE FOR ANYTHING IS BEYOND ME.

http://www.theonion.com/article/nation-just-hoping-next-president-can-prevent-coun-38512

Over 90 percent of registered voters say the next administration’s top priority should be minimizing the country’s collective embarrassment as the U.S. backslides into mediocrity...

WASHINGTON—As momentum builds toward the 2016 election, citizens across the nation told reporters this week they simply hope the next president of the United States can prevent the country’s decline from being an utterly humiliating experience for the American public.

Rather than discussing policy issues they feel strongly about, U.S. voters spoke instead of their desire to just put someone in the White House capable of getting America through the next four years of increased income inequality, environmental degradation, and catastrophic international entanglements with some shred of its dignity intact.

“This time around, I’m really only asking for a president who can keep us from embarrassing ourselves any more than we already have as our country continues sliding backward,” said 36-year-old Cleveland resident Michael Shapiro, adding that he will throw his full support behind any candidate who demonstrates a clear vision for navigating the country through its unavoidable downfall with as much self-respect as can be mustered. “We need a leader who will help us bow out as gracefully as possible, so we can just transfer the reins to China or whoever without making a huge deal about it.”

“We’re already kind of a global laughingstock when it comes to things like health care, education, and our middle class,” he continued. “So if whoever’s in charge could just make sure we hold on to, say, our basic housing infrastructure and relatively clean water supply during our tailspin, that’d be great.”

According to a Quinnipiac University poll conducted last month, 64 percent of Americans said their vote will hinge entirely on whichever candidate, regardless of party, can help the nation preserve some semblance of integrity while its moral standing in the world continues to plummet. Meanwhile, 58 percent reported they were desperate for a leader who can assume the responsibilities of commander-in-chief without making the country look completely helpless and ineffective in every single international dispute.

“That’s seriously all I want from my president going forward. Just the faintest of silver linings that I can hold on to while everything else goes down the drain.”

In addition, 87 percent of citizens confirmed that during the next presidential term, they merely hope to occasionally read something about their country in the news that doesn’t leave them feeling ashamed, angry, depressed, or completely mortified.

“It’s pretty simple, really: Just lay out a clear-cut, straightforward plan for a future in which we don’t totally go down in flames on a grand stage, and you’ve got my vote,” said Allison Joyce, a 47-year-old middle school teacher from Bethesda, MD. “Look, I don’t need to be inspired; I don’t need to be assured our future is bright; I don’t need to be told I’m strong and resilient in the face of hardship. Just convince me we can get through the next decade in the least demeaning way possible given all our problems with childhood poverty, gun violence, and people dying because they can’t afford medical treatment. That’s it.”

“That’s seriously all I want from my president going forward,” she added. “Just the faintest of silver linings that I can hold on to while everything else goes down the drain.”

Though they admitted to reporters that no one in the current field of presidential hopefuls seems likely to spare the country much humiliation while its infrastructure crumbles and its reputation is reduced to tatters, most voters expressed optimism that such a candidate will eventually emerge.

“We know what’s in store for America, so if we could elect someone who’s committed to keeping things somewhat tolerable while the whole place goes to hell, that’d be great,” said Seattle-based tax attorney Greg Hudson, 57. “It’s really our best hope at this point. The British Empire kind of just gradually fell by the wayside without too much embarrassment. Maybe we can, too. Who knows, we might still be able to go out with a little bit of class.”

“Then again,” Hudson added, “maybe at this point the best option is to put someone in the White House who will just bite the bullet and get this whole thing over with as quickly as possible.”

Demeter

(85,373 posts)America’s largest bank, JPMorgan Chase, has lost 10.87 percent of its market capitalization in the past three trading sessions. That’s $27.18 billion in three days, raising serious questions about the Federal Reserve’s theory that beefed up equity capital would buffer the mega banks in a market downturn.

While the Dow Jones Industrial Average lost 3.57 percent yesterday (MONDAY), JPMorgan lost 5.27 percent, despite its rich dividend yield of 2.92 percent. The indefatigable Eric Hunsader, owner of the market data firm Nanex, was Tweeting the abominations occurring in the stock market yesterday as the opening bell set off a bungee dive to a loss of 1,089 points in the Dow Jones Industrial Average (DJIA). The Dow ended the day down 588 points to close at 15,871.35, a three day loss of 1,477 points. One of Hunsader’s Tweets remarked on the bizarre price action in the stock of JPMorgan Chase, a member of the 30 stocks in the DJIA. The chart posted by Hunsader showed that JPMorgan’s stock was flash crashing by $5 a pop, only to regain the loss seconds later. The price action shown on the chart above occurred between 9:33 and 9:34 a.m., within moments of the market open. So who was this miracle worker helping to boost JPMorgan’s sagging share price? According to the SEC’s amended Rule 10b-18, JPMorgan Chase could have had its own agent buying back its stock after just one “independent” trade had occurred at the opening. The SEC’s amended rule notes:

“…because the opening transaction continues to set the tone for that day’s trading session, the safe harbor will continue to preclude an issuer from being the opening (regular way) purchase reported in the consolidated system.”

But after the first opening trade, the SEC explains:

“We are adopting the proposed amendment to apply a uniform price condition that limits all issuers to purchasing their securities at a price that does not exceed the highest independent bid or the last independent transaction price, whichever is higher, quoted or reported in the consolidated system…”

In addition to not being allowed to be the first buyer at the open, corporations with highly liquid float are barred from conducting buybacks during the last ten minutes of trading before the market closes. Issuers of illiquid stocks are barred for the last 30 minutes under the SEC’s Rule 10b-18.

Another Wall Street mega bank, Citigroup, recipient of the largest taxpayer bailout in history during the 2008 crash, has also been pummeled in the past three trading sessions. Citigroup closed last Wednesday at $57 per share. In the intervening three trading days, its stock has lost an eyebrow-raising 11.68 percent or a total of $20.05 billion in market capitalization.

We have few delusions that the market panic will galvanize our Congress to take meaningful steps to deal with the fragile nature of our financial system, tethered to Wall Street gambling casinos in drag as insured, deposit-taking banks. But it should if Congress genuinely cared about the future of America...On November 24, 2008, we wrote the following about how Citigroup was unraveling before our very eyes in the midst of the last panic:

“Citigroup’s five-day death spiral last week was surreal. I know 20-something newlyweds who have better financial backup plans than this global banking giant. On Monday came the Town Hall meeting with employees to announce the sacking of 52,000 workers. (Aren’t Town Hall meetings supposed to instill confidence?) On Tuesday came the announcement of Citigroup losing 53 per cent of an internal hedge fund’s money in a month and bringing $17 billion of assets that had been hiding out in the Cayman Islands back onto its balance sheet. Wednesday brought the cheery news that a law firm was alleging that Citigroup peddled something called the MAT Five Fund as ‘safe’ and ‘secure’ only to watch it lose 80 per cent of its value. On Thursday, Saudi Prince Walid bin Talal, from that visionary country that won’t let women drive cars, stepped forward to reassure us that Citigroup is ‘undervalued’ and he was buying more shares. Not having any Princes of our own, we tend to associate them with fairytales. The next day the stock dropped another 20 percent with 1.02 billion shares changing hands. It closed at $3.77.

“Altogether, the stock lost 60 per cent last week and 87 percent this year. The company’s market value has now fallen from more than $250 billion in 2006 to $20.5 billion on Friday, November 21, 2008. That’s $4.5 billion less than Citigroup owes taxpayers from the U.S. Treasury’s bailout program.”

In February, the Treasury’s Office of Financial Research released a study finding that JPMorgan Chase and Citigroup scored the highest among U.S. banks for systemic importance, meaning the “threat to global financial stability that a large bank would pose if it were to fail.” The study noted:

“…the default of a bank with a higher connectivity index would have a greater impact on the rest of the banking system because its shortfall would spill over onto other financial institutions, creating a cascade that could lead to further defaults. High leverage, measured as the ratio of total assets to Tier 1 capital, tends to be associated with high financial connectivity and many of the largest institutions are high on both dimensions…The larger the bank, the greater the potential spillover if it defaults; the higher its leverage, the more prone it is to default under stress; and the greater its connectivity index, the greater is the share of the default that cascades onto the banking system. The product of these three factors provides an overall measure of the contagion risk that the bank poses for the financial system.”

Don’t count on the U.S. Congress, or the Federal Reserve, or any other bank regulator to take any meaningful action to deal with the systemic dangers in our financial system before the next crash. When it comes to Wall Street, you’re on your own.

Demeter

(85,373 posts)A White House spokesman on Monday sought to soothe public fears amid dramatic volatility in U.S. stock markets, while delivering a warning to Congress to avoid a "self-inflicted wound." Press secretary Josh Earnest stressed the “ongoing strength and resilience of the U.S. economy" during a briefing with reporters, citing the falling unemployment rate and growing investments.

THE PRESS SECRETARY'S NAME IS "JOSH EARNEST??!!" IS THAT SOME KIND OF NON DE PLUME? OR A VERY BAD JOKE IN POOR TASTE?

He said those indicators point to “how durable the U.S. economy continues to be even as we see increased volatility overseas.” Earnest blamed the current market volatility in large part on weakness in the Chinese economy, adding that Treasury Department officials are closely monitoring overseas markets and President Obama has been briefed on developments.

Earnest also encouraged China to adopt economic reforms, including tying its currency rate to market forces. Earnest warned, however, that “this would be a particularly bad time for a self-inflicted wound.”

The Obama administration spokesman called on Congress to avoid a government shutdown and pass spending bills that reverse the sequester, reauthorize the Export-Import Bank and pass a long-term highway spending bill.

"We would like to see Congress take the kind of common-sense steps that builds on momentum that the economy continues to enjoy," he said.

Demeter

(85,373 posts)in August. (I was getting desperate). She's sounding and feeling better....the weather is cool and cloudy but summer's coming back, that is the forecast. We'll see.

Joe Chi Minh

(15,229 posts)I was familiar with the first one but not the second:

“Since I entered politics, I have chiefly had men’s views confided to me privately. Some of the biggest men in the United States, in the field of commerce and manufacture, are afraid of somebody, are afraid of something. They know that there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they had better not speak above their breath when they speak in condemnation of it.” (President Woodrow Wilson, The New Freedom, 1913.)

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated governments in the civilized world. No longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and duress of a small group of dominant men.” (President Woodrow Wilson, a few years before his death in reference to the Federal Reserve act of 1913, which he signed into law. The American Mercury?, p. 56. 1919.)

'The more it changes....

mother earth

(6,002 posts)a parasite, as Michael Hudson would call it, killing off the host...

Joe Chi Minh

(15,229 posts)more than vindicated. Indeed, he took the blame for it, sorely lamenting his responsibility for it.

Demeter

(85,373 posts)The European Central Bank is becoming more aggressive in trying to procure asset-backed debt after its purchase program drew criticism from investors and traders disappointed by its reach. Instead of just buying notes directly from banks, the ECB is now targeting investor holdings, according to four people familiar with the matter, who asked not to be identified because they’re not authorized to speak about it. Fund managers hired by the central bank started sending unsolicited requests for securities in June, the people said. The ECB is seeking to inject new energy into its purchase plan for asset-backed debt, which it started last year to help boost lending in the euro-area. The program has been hindered by lack of new issuance and an approval process for acquisitions that takes as long as five days.

“The ABS program has been heavily criticized in some circles, and certainly the purchases have been slower than many people thought,” said Rob Ford, a London-based money manager at TwentyFour Asset Management, which manages 4.9 billion pounds ($7.7 billion) of assets. “It makes sense for the ECB’s agents to ask the dealers to go out and seek offers directly from investors.”

Since the program started in November, the ECB has bought 11.2 billion euros ($12.8 billion) of notes, about a 10 percent of purchases made under a similar covered bond program that’s managed directly by the central bank and less than 3 percent of its total bond-buying program...The ECB said it wants to revive the asset-backed debt market, which shrank almost 50 percent since 2010, because the notes allow banks to transfer risk to investors and offer more credit to companies. Sales of the debt at 55 billion euros this year, while more than the 47 billion euros in the same period a year earlier, remain short of the 255 billion euros raised in the same period of 2006, the busiest year for sales, according to data compiled by JPMorgan Chase & Co.

“I was hoping to see the ECB’s program spur more prime issuance but it hasn’t dramatically improved this part of the market and is turning out to be something of a damp squib,” said Gordon Kerr, head of European structured finance research at credit ratings firm DBRS in London. “Urgency is needed to help spur on the prime markets.”

While the central bank has acquired covered bonds under two previous buying programs, it has never previously bought asset-backed bonds. Lacking expertise and knowledge of securitized debt, the ECB sought advice from a unit of BlackRock Inc. and hired NN Investment Partners, Deutsche Asset & Wealth Management International, State Street Global Advisors and Amundi to carry out the transactions on its behalf.

The third-party money managers have to prepare lengthy documents detailing the investment case for each bond and await sign off from the central bank. By sending lists of desired securities, known as offers-wanted-in-competition or OWICs, the ECB can increase its holdings of transactions it has already approved for purchase, said Dalibor Jarnevic, an ABS trader at DZ Bank AG in Frankfurt.

“With such a lengthy approval process this change can help the ECB to leverage its holdings of approved deals,” said Jarnevic. “Bringing in real money investors through OWICs is a good way to find more bonds to buy.”

SOUNDS PRETTY RISKY TO ME.

Demeter

(85,373 posts)Major U.S. stock exchanges and Barclays Plc on Wednesday won the dismissal of nationwide litigation in which pension funds and other investors accused them of rigging markets to benefit high-frequency traders.

U.S. District Judge Jesse Furman in Manhattan said federal law affords exchanges "absolute immunity" from the plaintiffs' key claims, including over the creation of "complex order types" and proprietary data feeds that can benefit rapid traders, because of their status as self-regulatory organizations. In a 51-page decision, Furman also said the plaintiffs did not show they reasonably relied on Barclays' misrepresentations about the safety of its Barclays LX "dark pool," including that they were not at risk of being exploited by fast traders.

The lawsuit accused Barclays and seven exchanges including Nasdaq, Intercontinental Exchange Inc's New York Stock Exchange, BATS Global Markets and CHX Holdings Inc's Chicago Stock Exchange of giving high-frequency traders favoured treatment, costing less-favoured investors billions of dollars. Several regulators are also investigating dark pools, and New York Attorney General Eric Schneiderman has sued Barclays.

High-frequency traders use computer algorithms to gain split-second trading advantages, and were accused of rigging markets in Michael Lewis' 2014 best-seller "Flash Boys." Furman alluded to Lewis in saying it is for Congress and U.S. authorities such as the Department of Justice and Securities and Exchange Commission to level the playing field for investors, rather than let private plaintiffs do their work. "Lewis and the critics of HFT may be right in arguing that it serves no productive purpose and merely allows certain traders to exploit technological inefficiencies in the markets at the expense of other traders," he wrote. "They may also be right that there is a need for regulatory or other action from the SEC or entities such as the exchanges and Barclays. Those, however, are debates and tasks for others."

Patrick Coughlin, a lawyer representing several pension fund plaintiffs, said: "We're disappointed that the judge thought the exchanges deserved immunity as to complex order types. The way they were implemented disadvantaged our clients. We will review the opinion and determine whether to appeal."

WELL, LET THAT BE A LESSON TO YOU! FORGET GOVT. REGULATION, IT WILL NEVER HAPPEN. THE HFT-VULNERABLE FINANCIAL PRODUCTS WILL JUST GO OUT OF FASHION AND BUSINESS.

Demeter

(85,373 posts)BNY Mellon Corp was scrambling to fix a computer glitch on Wednesday that has delayed how billions of dollars of assets are valued, throwing the U.S. funds industry into disarray and damaging the reputation of the world's largest custody bank. BNY Mellon said an accounting system it relies on to calculate the prices of clients' mutual funds and exchange traded funds (ETFs) broke down over the weekend just as investors headed into a global market meltdown sparked by fears over the Chinese economy. The system, run by financial software provider SunGard, resumed with limited capacity on Tuesday but was still not fully operational on Wednesday, leaving BNY Mellon with a backlog of funds to price. SunGard, which is being bought by rival software provider Fidelity National Information Services, did not return messages seeking comment.

BNY Mellon raised the alarm with regulators and held emergency calls with customers to try and resolve the problem. "No one here can understand why it's not up and running yet," said one executive at a firm that was affected. The glitch occurred on a SunGard system called InvestOne, which is used by financial institutions managing more than $28 trillion in assets. BNY Mellon said it outsources some of its net asset value (NAV) calculations to SunGard.

*********************

New York-based BNY Mellon has been under fire from some hedge fund investors for having too many employees and not reining in expenses. The bank has nearly $30 trillion in assets under custody and administration. Smooth fund accounting is something its clients rely on.

Its arch-rival, State Street Corp is considered the No. 1 provider of mutual fund accounting services.

BNY Mellon spokesman Kevin Heine said he did not know how many funds had been affected. In addition to Federated Investors, Guggenheim Investments and First Trust Advisors both had ETFs affected by the glitch, the firms said.

...BNY Mellon said it was able to construct Monday net asset values (NAVs) for all affected funds. But there remains a backlog of Tuesday NAVs that still need to be generated.

First Trust, which manages several exchange-traded funds, said on Wednesday in a statement that the net asset value of some of its funds contained errors greater than 1 percent.

"The errors resulted from a technical malfunction at our third party administrator, the Bank of New York Mellon," First Trust said.

HOW EMBARRASSING---LET THE LAWSUITS BEGIN!

Demeter

(85,373 posts)Outgoing Prime Minister Alexis Tsipras signalled on Wednesday he would accept an easing of Greece's huge debt burden if he wins elections expected next month without any of the write-offs he has long demanded. Tsipras, who hopes to return to power with an absolute majority, told Alpha TV that he favoured longer repayment periods and lower interest rates on the debt, now that Greece has secured a new 86 billion euro ($98 billion) bailout. But in the interview, he made no mention of writing off any debt - a campaign promise when he was elected in January that Germany, the biggest contributor to Greece's three bailouts since 2010, opposes.

With his radical left Syriza party split over the latest bailout, Tsipras heaped praise on his finance minister, Euclid Tsakalotos, and rejected the possibility that his ally may not even run in the election. President Prokopis Pavlopoulos is expected to call the election on Friday, probably for Sept. 20, an official at the presidency told Reuters. This follows Tsipras's resignation last week when he lost his parliamentary majority due to a rebellion in Syriza ranks over the bailout's demands.

With Greece facing financial collapse and an exit from the euro zone, Tsipras caved in to the zone and IMF earlier this month by accepting their demands for yet more austerity and painful economic reforms - the very policies he had promised to reverse when he won power. Tsipras has long argued Greece cannot repay all its debt and needs part of it cancelled to return to long-term economic growth after a depression, a view shared by many mainstream economists and possibly even the International Monetary Fund. But on Wednesday he appeared to change tack on debt write-offs, raising only the scenario of "an elongation of maturities and a lowering of the interest rates".

"We will have what economists call fiscal space to repay the debt. This would be the first step for us to return to the markets and regain their trust, if of course simultaneously we have managed to return to positive rates of growth," he said.

While Syriza wants an outright majority - something it narrowly missed in January - the strength of its support is unclear due to a lack of surveys by leading pollsters in the past month when much has changed. Last week, 25 out of Syriza's 149 lawmakers walked out to form a new anti-bailout party. The defection has done nothing to heal the rift in Syriza. Many of the 43 lawmakers who refused to back the bailout in parliament remain in the party, at least for the time being. But more seriously, there are also misgivings among members of Syriza's mainstream "53+" faction, including lawmakers who reluctantly backed the bailout for the sake of the party and the nation. These include Tsakalotos, the British-educated economist who clinched the deal, and former government spokesman Gabriel Sakellaridis, members of the faction said. "Neither Tsakalotos nor Sakellaridis have yet made clear whether they will run in the upcoming election," a member of the faction told Reuters.

Tsipras signalled he had won them over, saying both would run for Syriza. "Euclid Tsakalotos has done a marvellous job and it's true that if he wasn't for him, we wouldn't have achieved a deal," he said. This warmth contrasted to the scorn he poured on his previous finance minister, Yanis Varoufakis, who became a cult figure among anti-austerity campaigners across Europe for attacking the euro zone establishment. Tsipras recalled one session of particularly tough negotiations in June - just before he closed Greek banks for three weeks to save them from collapse - with IMF chief Christine Lagarde, European Central Bank head Mario Draghi and European Commission President Jean-Claude Juncker.

"Varoufakis was talking but nobody paid any attention to him. They had switched off, they didn't listen to what he was saying," said Tsipras. "He had lost his credibility."

Tsakalotos has won the trust of his fellow euro zone finance ministers despite his left-wing views. But he has yet to confirm his candidacy in the election. Under the Greek political system, Tsakalotos could still serve in a future government even if he is not a member of parliament. But if he failed to run for Syriza, this would be a blow to Tsipras who needs the "53+" faction if he is to hold the party together, win the election and implement the bailout programme.

President Pavlopoulos has asked a conservative and the leader of the new anti-bailout party to try to form a new government but the former has already failed and the latter is due to give up formally on Thursday. The official at the presidency stressed that the timetable could still change, but Pavlopoulos intended to appoint a caretaker premier, Supreme Court judge Vassiliki Thanou, on Friday and call the election. Thanou would become Greece's first female prime minister, but only until a new government is formed.

WATCHING GREECE IS MORE PAINFUL THAN WATCHING THE GOP....WOULD WOULD HAVE GUESSED?

AND AS FOR LOSING CREDIBILITY...WELL, THAT'S WHAT ELECTIONS DECIDE.

Demeter

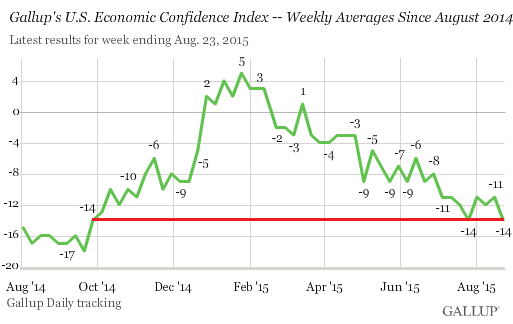

(85,373 posts)The rout in Chinese stocks, the deteriorating Chinese economy, the subsequent rout in US stocks, and nagging questions about the US economy – they all got blamed for the unceremonious collapse of the confidence Americans have in our rosy scenario. It’s sinking in. Even NPR has been talking about it. Whatever you do, “don’t sell,” was their admonition today. Those kind of shows first thing in the morning don’t fit into our rosy scenario. That scenario looked a lot rosier in early January, when after a long hard climb the economic confidence of Americans reached the highest level in the Index since Gallup started collecting the data on a weekly basis in 2008. At the time, Gallup credited lower gas prices for the miracle. At +5 in January, the index wasn’t exactly wallowing in exuberance, given its theoretical range of +100 to -100 (it hit -65 during the Financial Crisis). But these folks don’t live in the Wall-Street economy. They struggle with their daily challenges in the real economy. And it’s tough out there. Yet, even at that level in January, lousy as it was, it was practically exuberant compared to what it is today.

In February, the economic confidence began to zigzag south. At first, it looked like statistical noise, the normal volatility of weekly data. But month after month it got worse. And for the week ending August 23, which Gallup released today, the index dropped to -14. The culprit, according to Gallup:

Growing concerns about China, which devalued its currency and saw major losses in its stock market, led to a global stock sell-off, including in the U.S., where the Dow Jones declined by more than 500 points by market close on Friday.

However, the mayhem in these departments that has happened since Friday hasn’t made it into the index yet. So the index has dropped back to where it had been in the week ending July 14, which had been the worst level since September:

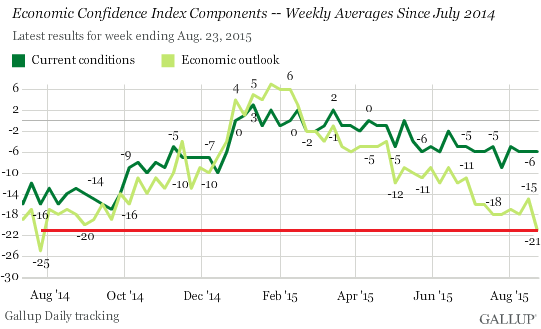

But the most troubling part is simmering underneath the overall index. The index is a composite of two sub-indices: one tracks how Americans perceive current economic conditions; the other tracks how Americans see future economic conditions. The current economic conditions index has been trending down gradually, and today’s reading remains stuck at the dreary -6, where it had been more or less since late May, with 24% of Americans saying the current economy is “excellent” or “good,” while 30% said it’s “poor.” An interesting way of shedding light on the Fed’s designer economy: for 30% of Americans, it sucks. But the real issue is outlook on what’s coming down the pike, the index for future economic conditions. And this time, the score plunged 6 points from an already very crummy -15 last week to -21 now, the lowest since July 2014, with only 37% of Americans saying the economy is “getting better,” and a whopping 58% saying it’s “getting worse”:

The chart is not exactly a propitious sign. It speaks of a process by which people, who’re working in the real economy and are struggling with everyday things, are looking around and are seeing increasingly ominous signs, and their economic outlook is getting hit. The chart speaks of an unraveling. Gallup points at the source of this unraveling:

This hasn’t yet “greatly shaken” – as Gallup put it – Americans’ overall economic confidence, based on the slowly degrading current conditions index. But it has slammed into Americans’ economic outlook. And it’s likely to get worse:

But there may be more to it than just Chinese and US stocks. Many Americans don’t own stocks and don’t pay attention to stocks even if they do own them in their retirement accounts. They care about job prospects, promotions, and incomes, which aren’t really going anywhere; and health care expenses, college expenses, housing costs, and the like, which are soaring. For many Americans, this economy is tough. And it has nothing to do with the collapse of stock market bubbles in China or in Germany or in the US or the devaluations of one or the other currency. Their deteriorating outlook is a reflection of their end of the real economy in the US.

Demeter

(85,373 posts)By Steve Roth, a serial entrepreneur whose businesses have ranged from book and magazine publishing to high-tech professional conferences to corporate services. His publications include “Capital in the American Economy Since 1930: Kuznets Revisited,” an appendix to James Livingston’s Against Thrift: Why Consumer Culture is Good for the Economy, the Environment, and Your Soul.

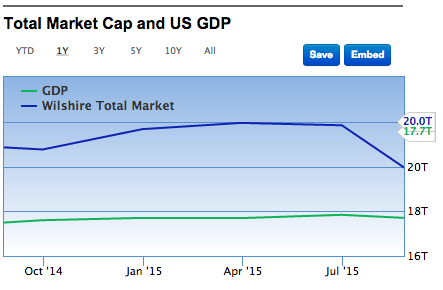

In my last post I pointed out that over the last half century, every time the year-over-year change in Real Household Net Worth went negative (real household wealth decreased), a recession had either started, or was about to. (One bare exception: a tiny decline in Q4 2011, which looks rather like turbulence following The Big Whatever. The problem: we don’t see this quarterly number until three+ months after the end of a quarter, when the Fed releases its Z.1 report for the the preceding quarter. The Q2 2015 report is due September 18. But right now we might be able to roughly predict what we’re going to see four+ months from now, in the report on our current quarter, Q3, which ends September 30. We’re a bit over a month from the end the quarter, and we have some numbers to hand.

The U.S. equity markets are down roughly 7% year-over-year (click for source):

Total U.S. equities market cap one year ago was about $20 trillion:

So a 7% equity decline translates to a $1.4-trillion hit to total market cap, which goes straight to the lefthand (asset) side of household balance sheets, because households ultimately own all corporate equity — firms issue equity, and households own it (at one or more removes); people don’t issue equity in themselves, and firms don’t own people (at least not yet). It’s an asymmetrical, one-way ownership relationship. (Note: yes, the Fed accounts for household net worth on a mark-to-market basis.) Total household net worth a year ago was $82 trillion. The $1.4 trillion equity decline translates to a 1.7% decline in household net worth. Meanwhile household liabilities over the last four quarters have been growing at a fairly steady rate just above 0.2% per year. There’s no reason to expect a big difference in Q3.

This suggests a 1.9% decline in household net worth over the last year, based on the equity markets alone. (My gentle readers are encouraged to add numbers for real estate and fixed-income assets.) Add (subtract) 1.5% in inflation over that period, and you’re looking at something like 3.4% decline in real household net worth, year over year. Unless the stock market rallies by 10% or 15% before the end of September ($2–3 trillion, or 2.5–3.5% of $80 trillion net worth), it’s likely we’ll see a negative print for year-over-year change in real household net worth when the Fed releases its Z.1 in early December of this year. And we know what that means — or at least we know what it’s meant over the last half century.

You heard it here first…

Demeter

(85,373 posts)BECAUSE IN A RACE TO THE BOTTOM, THE US IS STILL LOSING....BEING THE RESERVE CURRENCY MEANS NOT BEING ABLE TO EFFECTIVELY COMPETE IN CURRENCY DEBASEMENT. BUT THERE'S NOTHING LIKE BEING BROKE TO SHUT DOWN ONE'S ABILITY TO BE THE MARKET OF LAST RESORT. WE CAN'T AFFORD TO IMPORT LIKE WE USED TO.

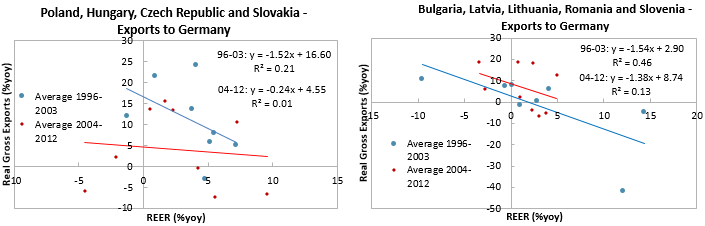

http://www.voxeu.org/article/depreciations-without-exports

The export-less depreciation of the yen has opened a debate on the power of exchange rates to boost exports. This column presents new evidence on how the exchange rate elasticity of exports has changed over time and across countries, and how global value chains have affected it. The upshot is that greater integration in global value chains makes exports substantially less responsive to exchange rate depreciations. Competitively valued exchange rates are often seen as crucial to promote exports (e.g. Freund and Pierola 2012, Eichengreen and Gupta 2013). However, in the aftermath of the Global Crisis, some episodes of large depreciations appeared to have had little impact on exports, the depreciation of the yen being the main example. This has led some observers to question the effectiveness of lower exchange rates (Financial Times 2015).

Figure 1 focuses on a sample of Central Eastern European countries and provides some suggestive preliminary evidence. The figure shows that those countries that are more tightly integrated in German supply chains (Poland, Hungary, Czech Republic and Slovakia) saw a much stronger flattening of the relationship between real effective exchange rate (REER) growth and export growth to Germany than those that are more loosely integrated in German supply chains (Bulgaria, Latvia, Lithuania, Romania, and Slovenia). While other factors were certainly at play, this evidence suggests that cross-border production linkages may contribute to reducing the effectiveness of depreciations to boost exports.

Figure 1. REER growth vs. exports to Germany

Declining REER Elasticity

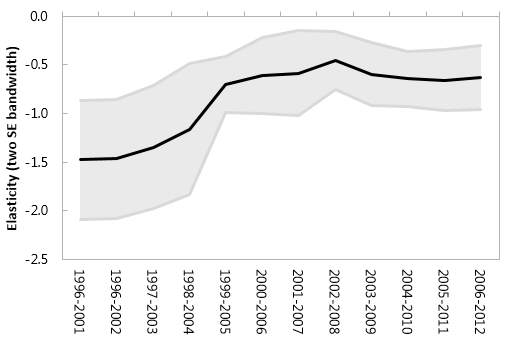

In a recent paper (Ahmed et al. 2015), we use a panel framework covering 46 countries over the period 1996-2012 to formally investigate the questions above. The period of analysis and sample size is determined by the availability of value-added trade data from the OECD-WTO Trade in Value Added (TiVA) database used to assess the role of global value chain integration. We focus on manufacturing exports because of the importance of cross-border linkages in this sector. We find evidence that the REER elasticity of manufacturing exports has decreased over time. Specifically, the REER elasticity of gross real exports fell in absolute value from an average close to 1.3 in the first half of the period to slightly above 0.6 in the second half. Figure 2 presents estimates of the REER elasticity using 7-year rolling regressions and shows that the decline preceded the Global Crisis, suggesting that it is only in part driven by cyclical factors such as weak global demand.

Figure 2. REER elasticity of manufacturing exports

Note: These are the slopes on Real Effective Exchange Rate Change elasticity of manufacturing exports estimated for the different samples in the horizontal axis.

The Role of Global Value Chains

What affects the ability of currency depreciations to boost exports? There are a number of possible explanations including the global trade slowdown (Constantinescu et al. 2015), low pass-through (Berman et al. 2012), and trade policy retaliation (Bown and Crowley 2012). The common theme of these explanations is that they temper the international demand-switching mechanism that underlies the competitive impact of a depreciation. Global value chains introduce a supply-side mechanism (Bems and Johnson 2015). In the presence of backward linkages (i.e. foreign value added embodied in gross exports), a depreciation increases the cost of imported intermediate inputs used in final-good production, thus lowering the competitive gain. With forward linkages (i.e. domestic value added exported in intermediates re-exported to third countries), a depreciation also increases the competitiveness of downstream producers, which stimulates demand for their goods.

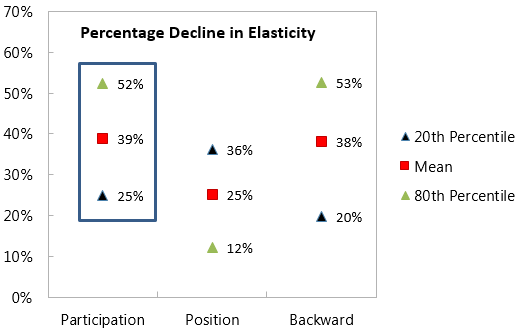

Our results suggest that the rise in global value chains (backward plus forward linkages) explains on average 40% of the fall of the REER elasticity of exports. For countries with highest participation in supply chains (i.e. in the first 20th percentile in our dataset), this channel explains more than half of the reduction of the exchange rate elasticity over the period of analysis (Figure 3). We also find evidence suggesting that the role of global value chains in dampening the responsiveness of exports to a real depreciation is mainly due to backward linkages, relative to other metrics (i.e. forward linkages and position). These results confirm in a cross section the findings by Amiti et al. (2014) using firm-level data for Belgian firms.

Figure 3. REER elasticity across global value chains

REER, An Optical Illusion?

The decline of the REER elasticity of manufacturing exports can be in part explained by the fact that REERs do not properly capture changes in price competitiveness in a world with global value chains. Indeed, using measures of REER that correct for global value chains developed in the literature (Bems and Johnson 2013, Bayoumi et al. 2013, IMF 2013):

• We do not find the same decreasing pattern of elasticity over time. This suggests that the decrease in the REER elasticity is, at least in part, an optical illusion that results from the fact that REER and exports are measured in gross rather than value-added terms.

• We also find that the estimates of the elasticity of value-added exports to both standard REER and value-added REER are smaller than our estimates in gross terms. This is an important point for policymakers since value-added exports matter more for GDP growth than gross exports.

While more work is needed in this area, these findings may indicate that the role of exchange rates in promoting export growth (and, more broadly, export-led growth) and in the macroeconomic adjustment process needs to be carefully re-evaluated in a world where global value chains are increasingly important.

Authors’ note: The views expressed in this paper are those of the authors and do not necessarily represent the views of the IMF or the World Bank, their Executive Boards, or management.

See original post for references