Economy

Related: About this forumTrapped in a Bubble By Golem XIV

http://www.golemxiv.co.uk/2015/06/trapped-bubble/I think our ruling and wealthy elite are worried that they are stuck in their own ponzi scheme or bubble and are suffering from the general problem of all ponzis and bubbles – how to get out. You see, bubbles and Ponzi’s are fine as long as they keep going. As long as there are ever more suckers to recruit and as long as enough of those already in remain confident and choose to stay in, there is no real reason a ponzi cannot go on and on. A perfect example is Madoff’s scheme. The weakness of all bubbles, ponzi or otherwise, is that all it takes is a rumour that it might be time to get out, that it might soon get difficult to get out, or that someone ‘in the know’ wants out, and a ponzi scheme pops like a soap bubble. They are notoriously unstable.

So, if you are in one how do you get out?

I think this question is worrying our wealthy Over Class because stock markets around the world are over-valued and its their wealth which is most tied up in the markets. I think some of them are now rather worried that they have built themselves a luxury tower of paper wealth from which, when it catches fire, they will not all escape. I think they are right.

So, first, are the markets a bubble or ponzi?

Well if we look at the real economies of the West and then at the stock markets, the later have the look of a ponzi. I’m certainly not alone in thinking this. In Europe, the U.S. and Japan, over the last 6 years, in what we might call the ‘real economy’ of people making things, earning money and spending it to buy things other people have made, we have had either anaemic growth, no growth or outright contraction. And yet all the time the stock markets have roared ever higher.

On the ‘real’ side of things lets look at Caterpillar (CAT), the american heavy construction equipment manufacturer. It is often seen as a bellwether. CAT, as recently reported over at ZeroHedge, is now in its 28th consecutive month of declining sales.

And yet its share price is $86 not far off its record highs, up from a low of $23 to which it fell in March 2009. $86 or thereabouts ever since 2010 despite 28 months of declining sales.

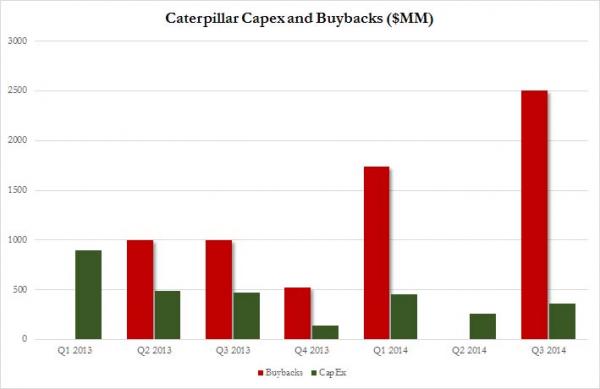

Is this supply and demand? I think not. Part of an explanation for this levitating share price is, as the ZeroHedge article points out, that the corporation has been buying back its own shares.

CAT had been using more and more of its cash (the red bar) to buy back its own shares inflating the apparent demand for them and therefore their price. It’s not illegal, but what does it do for the idea that share price indicates what a company is worth? And where was CAT getting the money with which to buy those shares? I doubt it was from profits given the long cumulative decline in sales. More likely it was from selling bonds i.e. using borrowed money. And indeed that seems to be the case. In May of 2014 CAT sold $2 billion of debt some of it dated as long as 50 years. So let’s take a look at what we have. In May of 2014, despite having already suffered a year of declining sales, CAT shares were the second best performing shares on the Dow Jones. Who was so keen to buy all their shares? Who knows. But CAT itself had just spent 175 million in buying their own shares in the first quarter (when it was the second best performing share on the DOW) and in the last quarter of the year went on to buy another 250 million dollars worth. In fact, and perhaps most critically, in January the CAT board had authorized $12 billion for buy-back. So the market knows that a lot of shares were going to be bought up…by CAT. And not at bargain basement price either. Take a look at the record of their share price above and you’ll see that the board had authorized using borrowed money to buy their shares at around the highest price they had ever been. Hmm. Did buying all those shares encourage others to do likewise, especially knowing that CAT had a war chest of $12 billion earmarked for buying shares? Any ‘investor’ would know there was a buyer in the market who would be ready and willing to buy them back from him. The upshot would be a guaranteed buoyant market in CAT shares at a time when without such a buoyant demand a year of declining sales might just possibly have led to a steep decline in share price....

...If you can’t get out and you are afraid there are not enough new buyers to keep your ponzi/bubble going what do you do? I think the answer is you and your friends do the buying yourself. If you and your friends are big enough players with enough to lose that defecting is really dangerous, then you actually have a workable incentive to keep playing. You buy the shares I sell and I buy yours (It doesn’t just have to be just buy-backs as per the CAT example). And I think this is what has been happening. Of course it only works of you are able, as a group, to have a really serious effect on the over all market. But if you think of the top 10% they certainly have that. I buy your shares and pay you your asking price. You do the same for me. Tomorrow we do it again and each time we ramp the price a little. The limiting factor, of course, is that we will not have enough money to buy all the shares as their price goes up and up. But that little problem can be easily solved if we have a friendly banker who will accept our shares as collateral for a loan. If our banker will extend us a loan and increase that loan periodically in line with the increase in value of the shares then all is good. Because the bank can just magic new money in to existence.

And if anyone get a creeping feeling that the banks are getting stretched a little thin or their margins – the interest they charge us for our loans above what they pay for borrowing – are too small for their comfort, then we all just tell the central bank that some new very low interest money is needed to juice the whole system. And since most of them are former us (bankers and financiers) they will understand. Plus they don’t want a systemic crash. It’s bad for their reputation and their personal wealth...The point, however, is that there is an air of conspiracy about it. The companies (which includes financial ones) are playing around on the border between creative accountancy and fraudulent misrepresentation and the analysts and auditors are not correcting them. Much as we saw in the figures for all the banks in the run up to the crash. All of the big 4 accountancy firms were signing off on the robust financial health of banks sometimes mere weeks before said bank then collapsed. All of the big 4 auditors subsequently found themselves in court. So to suggest that companies, analysts and auditors might be not just allowing and enabling dangerous misrepresentations but even endorsing them is not really conspiracy theory, more painful experience.

BUT WAIT! THERE'S MORE! AND IT'S WORSE! SEE LINK

Warpy

(111,249 posts)but this has just about run its course. The Dow has been flat for many weeks, 18,000 plus or minus 500. There is little funny money left to use to inflate the market above where it is.

All it's going to take is a handful of insiders who look at each other and realize the jig is up and the days of easy money are over. They will attempt to cash out and hide their money all over the planet, hoping most of it survives the crash they're the ones who actually start.

The only thing that will avert a huge crash is a massive redistribution of wealth from the top, where it is hoarded, to the bottom, where it starts to move around and accomplish things. Money only works when it's moving around, which is why any economy that funnels it all to the top is destined to fail catastrophically.

DemReadingDU

(16,000 posts)The few people at the top of this bubble hoarding all the wealth, do not appear to be letting it trickle down.

This is not going to end well.

Demeter

(85,373 posts)at least, I can't think of a single historical occasion that did.