Economy

Related: About this forumWeekend Economists Go for Broke October 17-19, 2014

I keep my promises (when the gods let me) so here it is, the WEE on time! Thank you, thank you very much!

Well, this was a week that was. Let's see what issues came into prominence:

1. Global Economic and Market Collapse

2. Ebola and at least 3 strains of influenza

3. Midterm Elections Too Close to Call...if we are lucky

4. Racism fades to back burner

5. Ukraine, Syria, Iraq, Russia, Venezuela, Brazil, fade out momentarily

6. The Ghost of Euros Past Rises Again

That's enough to begin with. Also, I have started medicating with a nice fruity Moscato, because the chocolate was in the freezer and will need to defrost, first. I defy anyone who isn't in a coma or brain dead to get through this weekend without aid of some kind.

So, the theme is healing...whatever that means. And I offer the first selection:

Demeter

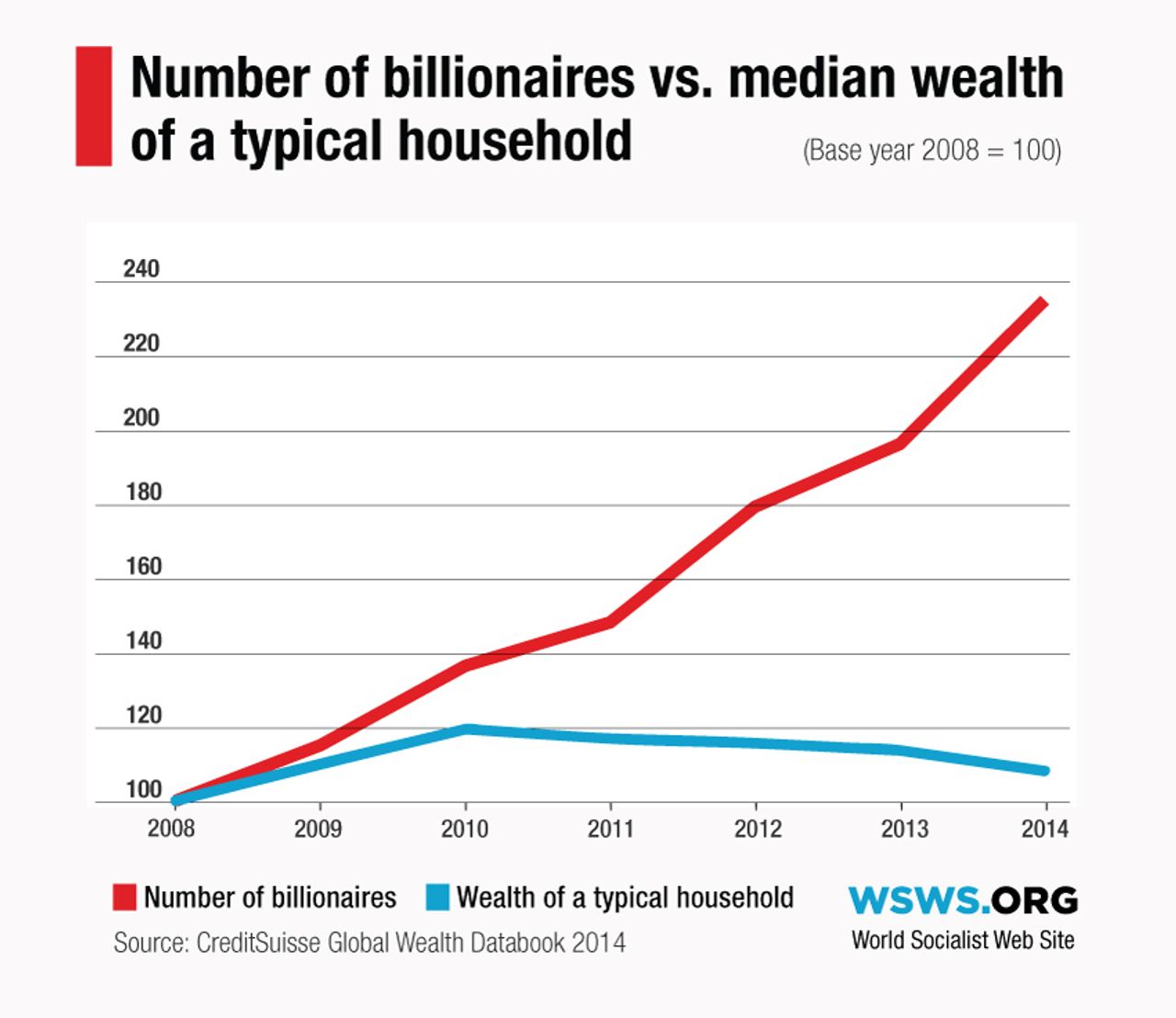

(85,373 posts)If it were thousands of points....it would be a correction. This is just rowdiness. DJIA is still 10,000 points above the close on March 6, 2009. Of course, the Federal reserve presses are on the verge of meltdown, but what do the Big Boys care?

It's a disease, I'm thinking. From yesterday's WSJ:

October 16, 2014: Markets opened lower on Thursday following a sharp drop in crude oil prices overnight and a better-than-expected report on new claims for jobless benefits. St. Louis Fed President James Bullard talked up a longer period of quantitative easing, and that put equities on a solid track to get back in the black. Shortly before the closing bell the DJIA traded down 0.10% for the day, the S&P 500 traded up 0.15%, and the Nasdaq Composite traded up 0.16%.

The Dow 30 stock posting the largest daily loss ahead of the close today was The Goldman Sachs Group Inc. (NYSE: GS) which traded down 2.54% at $172.71. The stock’s 52-week range is $151.65 to $189.50. The big bank reported third quarter results this morning that were better than expected, but that didn’t slow down investors wanting to get rid of shares. Goldman’s volume was more than double the daily average of around 2.7 million shares.

Wal-Mart Stores Inc. (NYSE: WMT) traded down 1.86% at $73.79 in a 52-week range of $71.69 to $81.37. Volume was more than double the daily average of around 5.6 million shares. The company cut its capex and sales growth forecasts yesterday and investors are not finished selling.

Pfizer Inc. (NYSE: PFE) traded down 1.63% at $27.73. The stock’s 52-week range is $27.51 (a new 52-week low) to $32.96. Trading volume was a third higher than the daily average of around 24 million shares. The company had no news today.

The Coca-Cola Co. (NYSE: KO) traded lower by 1.41% at $42.62. The stock’s 52-week range is $36.89 to $44.87. Volume was about 30% higher than the daily average of around 15 million shares. The soft drinks maker had no news today.

Of the Dow 30 stocks 20 are set to close lower today and 10 are on track to close higher.

Demeter

(85,373 posts)"It could never happen again... right?"

And if you think this time is different - just take a look at the 'tricks' they used 27 years ago to stop the fall - A Fed statement and borken/halted exchanges...

Of course Bill Griffeth asks should we buy this dip... Tudor Jones replies - so ironically -

"we should see massive Federal Reserve and Government intervention in the FX and debt markets to stem what has unquestionably been a panic."

But Tudor-Jones cautions:

"prudent investors should use any rally to scale back into short-term Treasuries."

The legendary trader goes on to explain he is trading fear as investors fear deflation and disinflation and warns

"every American needs to get their house in order, needs to be conservative in their investments, the next few years will be about capital preservation."

Wise words for record highs...

littlemissmartypants

(22,590 posts)Demeter

(85,373 posts)Well, we got an October Surprise--and it was self-inflicted. So, how does the Leader of the Free (or reasonably priced) World deal with the dreaded Ebola?

He hires a political operative/hedge fund manager/lawyer as the Ebola Czar.

They aren't calling it that. They say he's a top-notch manager with top notch government experience, and he's gonna coordinate EVERYTHING.

So, are we gonna sue Ebola out of existence? Leverage it into the ground? Catapult the propaganda?

The mind boggles. I've never tried, but maybe it's possible to have an out-of-body (or maybe, out of country) experience for two years.

Demeter

(85,373 posts)As you already know, there is a major outbreak of the Ebola virus in Africa which is starting to spread to other parts of the world. It is too soon to panic, but not too soon to be concerned and to start educating yourself as to the problem and taking some common-sense precautions.

Ebola basics

Ebola is a member of the filovirus family, closely related to the Marburg viruses. Their structure is very simple, consisting of a single RNA strand surrounded by simple proteins. By itself, it is very fragile, unable to survive in the air, and easily destroyed by short-wave ultra-violet light and disinfectants such as chlorine bleach. Bodies of Ebola victims cease being infective after 4-5 days due to the decomposition processes, which are toxic to Ebola. People who recover from Ebola are still infectious for seven weeks afterwards.

There are several strains of Ebola which vary in lethality. The worst known is the Mayinga strain (also called Ebola Zaire), named after a Zaire nurse, Mayinga N'Seka, who died of the disease in 1976. That strain has a better than 90% lethality rate, that is, nine out of every ten people who become infected will die. At the other end of the spectrum is Ebola Reston, names for an outbreak that hit an animal facility in Reston, Virginia in 1990. Although lethal to the monkeys in the facility, Ebola Reston does not infect humans. The current West African Ebola has a lethality rate of about 50%.

An illnesses' rate of infection is expressed as the "R-naught", or R-0. This is the measure of how many people a single infected person will themselves infect. An R-0 of 1 means each person with the illness will infect one more person. An R-0 less than one means an illness will die out as it is unable to infect new patients as fast as existing patients are cured or die. An R-0 larger than one means an illness means the illness will naturally spread. The current Ebola has an initial estimated R-0 of 2. To put that into perspective, Measles has an R-naught of 12-18. Smallpox and Polio are 6. Flu is between 2 and 3. So the current Ebola is slightly less infective than the season flu, although obviously the consequences of infection are more severe.

No natural source for Ebola has been identified. But it is known that Ebola does infect other species than humans, mostly apes and monkeys, and even dogs. There is no evidence that insects can transmit eBola, although mosquitoes are documented to carry other forms of haemorraghic fever.

Ebola has been researched by the US military for its potential as a biological weapon in the context of potential terrorism and is classed as a Category A bioterror weapon. Concern has been raised that the current Ebola outbreak erupted around a bioweapons research facility at Kenama, Sierra Leon, operated jointly by USAAMRID and Tulane University (since closed and under investigation by the Sierra Leon government) which was conducting trials of an experimental vaccine among the general population. This bears an eerie similarity to the 1918 pandemic of the "Spanish Flu", a misnomer as the illness erupted during vaccine trials at Camp Funston, now Fort Riley, then swept the world killing more people than had died in the war. The same illness again appeared at Fort Dix in 1976, again linked to trials of an experimental vaccine...

Demeter

(85,373 posts) ?3591

?3591

Following the death of the first person diagnosed with Ebola in the United States, concerns about the deadly hemorrhagic virus are running high throughout the country. Here is everything you need to know about Ebola:

What is Ebola?

Ebola is an infectious, often fatal virus. For more complete information, consult your own darkest paranoid nightmares.

How do you contract Ebola?

Ebola is contracted through contact with a health care system that vastly overestimates its preparedness for a global pandemic.

What are the symptoms of Ebola?

Severe flu-like symptoms that a CNN cameraman is filming.

How long does it take for symptoms to first appear?

Anywhere from two to 10 days after passing through U.S. customs.

How is Ebola treated?

The virus is eventually killed when the body begins naturally decomposing inside a coffin several feet underground.

Do I have Ebola?

Not yet.

How dangerous is Ebola?

Easily Africa’s fourth or fifth most pressing issue.

I come into frequent physical contact with Ebola-infected blood, urine, saliva, stool, and vomit. Am I at risk of contracting Ebola?

Yes.

Is there a risk of Ebola spreading further?

If Dallas authorities fail to properly contain the disease, it may spread as far as Plano and Fort Worth.

How are Ebola outbreaks contained?

Great question!

What are airports doing to screen passengers?

Questionnaire based on fundamental assumption that those in desperate need of medical attention would not lie to get out of western Africa and into the U.S.

How many people could die if Ebola begins spreading in the United States?

Projections are currently imprecise but range anywhere from 318.8 million to 319.0 million Americans.

When will all this Ebola hysteria end?

For you? At exactly 11:18 a.m. on Tuesday, Oct. 28.

Demeter

(85,373 posts)In my recent post on Ebola I mentioned that the turn off point for Africa being able to handle an epidemic was in the 70s and 80s. That’s worth a full post on its own. The first thing to understand is this: 3rd world GDP growth in the post-war liberal period (roughtly 46-68 or so), was good. It was above population growth in most cases. That changed around about the time OPEC grabbed the West by short and curlies, squeezed and wound up with tons of money they didn’t know what to do with. This is an act in three parts:

ACT 1: Banks Loan Money to Third World Countries

Lots and lots of it. The pitch is this: we know how to develop countries. You’ll borrow this money, invest in development and have more than enough money to pay off the loans. Except that they didn’t know how to develop countries and even those countries in which the leaders didn’t steal the money, the loans grew faster than the tax base, leaving governments less and less able to administer their own countries.

ACT II: Money, Money, Money and Cash Crops

So, you need $. Foreign dollars. How do you get them? You could do what Japan, Korea, the United States and Britain all did, and develop real industry behind trade barriers, of course, but that’s not what the experts are telling you to do. What they’re saying is “you have a competitive advantage in certain commodities: cash crops and maybe minerals. You should work on that.”

Most cash crops are best grown on plantations, so if you want to move your economy to cash crops, you have to move the subsistence farmers off their land. That means they will go to the cities and need food that you no longer grow (since you’re growing cash crops to sell to Westerners.) But hey, that’s ok, because with all the foreign currency you’ll be getting from bananas, coffee and so on, you’ll be able to buy that food from Europe and America and Canada. Right? Right!

Except that everyone is getting this advice, and everyone is growing more cash crops, and the price drops through the floor and you have a thirty year commodities depression. You can’t feed the people you’ve shoved off the land without taking more loans; there are no jobs for those people, so now instead of self-supporting peasants you’ve got a huge amount of people in slums. But, on the bright side, while not enough hard currency has been created to develop, or even stay ahead of your loans, enough exists so that the leaders can get rich; the West can sell grain to you; and you can buy overpriced military gear from the West. Win! For everyone except about 90% of your population.

ACT III: The IMF

The above was standard IMF and World Bank advice, of course. Don’t let anyone tell you that the World Bank or IMF want a country to develop; their actions say otherwise. What they do need to do is push neo-liberal doctrine. So, now that your country is vastly in debt and can’t feed itself without foreign food which must be bought in hard currency, the IMF says “well, we could give you more money, BUT”.

The but is that they want you to stop subsidies of food and let food prices float. That they want you to reduce tariffs on goods, even though tariffs a huge source of tax revenue for you, because your government is crippled and your people have tiny incomes, so you really don’t have the ability to tax them. Then they want you to open up your economy to foreigners buying it up, so foreigners can own every part of your economy worth having (anything that generates hard currency, basically.)

FINIS

After all this your country is a basket case, and when something like Ebola (or terrorism) happens, you do not have the administrative or fiscal capacity to deal with it.

Win, Win, Lose.

Demeter

(85,373 posts)At the moment, the Ebola virus is ravaging three countries—Liberia, Guinea and Sierra Leone—where it is doubling every few weeks, but singular cases and clusters of them are cropping up in dense population centers across the world. An entirely separate Ebola outbreak in the Congo appears to be contained, but illustrates an important point: even if the current outbreak (to which some are already referring as a pandemic) is brought under control, continuing deforestation and natural habitat destruction in the areas where the fruit bats that carry the virus live make future outbreaks quite likely.

Ebola's mortality rate can be as high as 70%, but seems closer to 50% for the current major outbreak. This is significantly worse than the Bubonic plague, which killed off a third of Europe's population. Previous Ebola outbreaks occurred in rural, isolated locales, where they quickly burned themselves out by infecting everyone within a certain radius, then running out of new victims. But the current outbreak has spread to large population centers with highly mobile populations, and the chances of such a spontaneous end to this outbreak seem to be pretty much nil.

Ebola has an incubation period of some three weeks during which patients remain asymptomatic and, specialists assure us, noninfectious. However, it is known that some patients remain asymptomatic throughout, in spite of having a strong inflammatory response, and can infect others. Nevertheless, we are told that those who do not present symptoms of Ebola—such as high fever, nausea, fatigue, bloody stool, bloody vomit, nose bleeds and other signs of hemorrhage—cannot infect others. We are also told that Ebola can only be spread through direct contact with the bodily fluids of an infected individual, but it is known that among pigs and monkeys Ebola can be spread through the air, and the possibility of catching it via a cough, a sneeze, a handrail or a toilet seat is impossible to discount entirely. It is notable that many of the medical staff who became infected did so in spite of wearing protective gear—face masks, gloves, goggles and body suits. In short, nothing will guarantee your survival short of donning a space suit or relocating to a space station.

There is a test that shows whether someone is infected with Ebola, but it is known to produce false negatives. Other methods do even worse. Current effort at “enhanced screening,” recently introduced at a handful of international airports, where passengers arriving from the affected countries are now being checked for fever, fatigue and nausea, are unlikely to stop infected, and infectious, individuals. They are akin to other “security theater” methods that are currently in vogue, such as making passengers take off their shoes and testing breast milk for its potential as an explosive. The fact that the thermometers, which agents point at people's heads, are made to look like guns is a nice little touch; whoever came up with that idea deserves Homeland Security's highest decoration—to be shaped like a bomb and worn rectally....MORE

Demeter

(85,373 posts)Demeter

(85,373 posts)InkAddict

(3,387 posts)Oo-ee-oo-ah-ah; ting-tang walla-walla bing-bang

Oo-ee-oo-ah-ah; ting-tang walla-walla bing-bang.

then came:

baweema-wack baweema-wack

baweema-wack baweema-wack

In the jungle, the mighty jungle, the lion sleeps tonight.

but do you remember "The Little Boy with the Very Long Name":

I learned it this way though it's not quite perfect as from this link: http://beingbettejo.blogspot.com/2008/09/sticky-sticky-stumbo-revisited.html

Icky-sticky stombo - oh so rombo - odie bodie bosco - ugga-naga-rambo tombo (who) fell in the well.

Demeter

(85,373 posts)SILLY UKRAINIAN ELITES! FREE MONEY IS FOR BANKSTERS!

http://www.washingtonpost.com/business/economy/ukraines-economy-choking-under-russian-pressure-but-western-help-is-scarce/2014/10/15/d983dbfc-4fc6-11e4-babe-e91da079cb8a_story.html

With its war-torn economy threatened by further Russian disruptions, Ukraine is in desperate need of a new international financial aid package, economists say, but none appears imminent.

The International Monetary Fund’s $17 billion package in May was not designed to compensate for the effects of months of fighting between Ukraine’s military and Russian-backed separatist forces. In addition to military costs, lost tax revenue and the dire need for infrastructure repair, Ukraine faces a crisis of confidence that is driving capital flight and a decline in its currency.

“I now fear systemic economic failure — unless there is a positive confidence shock,” said Timothy Ash, London-based head of emerging markets research at Standard Bank. He said Ukraine’s banks are fragile, the budget deficit is more than 10 percent of gross domestic product, and the economy could shrink by as much as 10 percent, greater than the current IMF estimates.

Ash said that there were “lots of warm words for Ukraine but not many greenbacks” from the United States or the European Union, which is mired in its own economic stagnation. Ash said in an e-mail that on an official visit to Washington recently, Ukrainian President Petro Poroshenko “gave the speech of his life and got $53 million, which is small change. That funds the cost of the war in the East for 9 days.”

That fighting has disrupted the entire eastern part of the country, crimping business and tax receipts. Mikhail Afendikov, chief executive of Cub Energy, an exploration company, said his firm is drilling only four gas wells in eastern Ukraine instead of 18 as planned. Two-thirds of Ukraine’s coal production comes from the strife-torn Donbas region, and output there has fallen by half. Bridges and railways have been damaged.

Key economic reforms still lie ahead, and Western officials are hoping to see the government take more steps after parliamentary elections Oct. 26. “The hope is that the new government .?.?. can provide that reform blueprint, and the West stumps up enough cash to give those reforms a real chance,” Ash said.

THEY STILL DON'T GET IT...MORE AT LINK

THERE ARE WORSE PLACES TO BE THAN DALLAS OR WEST AFRICA...PERHAPS

MattSh

(3,714 posts)Trying to sound all reasonable and everything, while skipping over, ignoring, or misstating key facts.

This is what the west (and the bankers) are interested in, and the more "reasonable" Russia is, the more profitable it is for the west.

Some overlooked facts:

The gas price being offered now is about 20% then the negotiated price from the last time Ukraine signed a contract. Mind you, that contract was signed by Yushchenko, Timoshenko, and the Orange Revolution folks, not Yanukovich. Negotiated price $485/1000cm3. Price being offered now (on a temporary basis) $385.

Ukraine last winter was paying as low as $268. Part of that price was a discount for the use of the military base in Sevestapol Crimea. And part of that discount was a "best friend of Russia" price. You don't want to be best friends any more? You don't get the best friends price.

The best price for Russian gas in Europe? Belarus, at $166. Yes, that's a best friend's price. The highest price? $524 for Poland.

Gas prices are negotiated by contract. Contracts negotiated in 2010 will be priced differently than contracts negotiated in 2015. What Germany pays is irrelevant. Contracts are negotiated with the goal of the buyer getting the best price now and hopefully locking in a good price for many years to come. Sometimes you guess right and get an amazing long-term deal. And sometimes you guess wrong and screw yourself royally. That's not the sellers fault. Besides, Germany has a record of paying for their gas on time and can negotiate a better deal because of that. If you habitually pay your bills late, it's a risk for the seller and the seller is likely to demand a premium because of the additional risk.

Oh, another interesting fun fact. Ukraine has just rejected the latest attempt at a deal, because they don't want to pay for gas in advance. In reality, that means they want to steal more gas.

InkAddict

(3,387 posts)Demeter

(85,373 posts)Markets are realising that the five-and-a-half year recovery since the financial crisis may already be over... Combined tightening by the United States and China has done its worst. Global liquidity is evaporating. What looked liked a gentle tap on the brakes by the two monetary superpowers has proved too much for a fragile world economy, still locked in "secular stagnation". The latest investor survey by Bank of America shows that fund managers no longer believe the European Central Bank will step into the breach with quantitative easing of its own, at least on a worthwhile scale.

Markets are suddenly prey to the disturbing thought that the five-and-a-half year expansion since the Lehman crisis may already be over, before Europe has regained its prior level of output. That is the chief reason why the price of Brent crude has crashed by 25pc since June. It is why yields on 10-year US Treasuries have fallen to 1.96pc, and why German Bunds are pricing in perma-slump at historic lows of 0.81pc this week.

We will find out soon whether or not this a replay of 1937 when the authorities drained stimulus too early, and set off the second leg of the Great Depression.

If this growth scare presages the end of the cycle, the consequences will be hideous for France, Italy, Spain, Holland, Portugal, Greece, Bulgaria, and others already in deflation, or close to it. The higher their debt ratios, the worse the damage...MORE

AMBROSE IS SUCH A CHEERFUL FELLOW

HE HAS A LAUNDRY LIST OF VERY GRIM PREDICTIONS/PROBABILITIES

I NEED A REFILL

Demeter

(85,373 posts)The president of CNN Worldwide, Jeff Zucker, attempted on Wednesday to defuse the brewing controversy over his decision to change the network’s official slogan from “The Most Trusted Name in News” to “Holy Crap, We’re All Gonna Die.”

“This exciting new slogan is just one piece of our over-all rebranding strategy,” Zucker said. “Going forward, we want CNN to be synonymous with the threat of imminent death.” He added that the network expected to see strong ratings growth as a result of having the words “Holy Crap, We’re All Gonna Die” on-screen twenty-four hours a day.

Part of Zucker’s new strategy was on display during Tuesday’s edition of the network’s signature program, “The Situation Room,” in which a visibly ill-at-ease Wolf Blitzer appeared dressed as The Grim Reaper.

“That’s a work in progress,” Zucker said about Blitzer’s makeover. “But once Wolf gets comfortable swinging that scythe, he’s going to be amazing.”

Demeter

(85,373 posts)Seventh Circuit Judge Richard A. Posner's courageous reversal of his Crawford v. Marion County Election Board opinion on photo ID voting laws in a recent dissent should convince the US Supreme Court that such laws are both unconstitutional and a violation of the Voting Rights Act.

Last year, both election integrity advocates and dissembling GOP proponents of photo ID voting laws were taken by surprise when Seventh Circuit Judge Richard A. Posner said, during an interview with HuffPo Live, that the landmark 2008 Supreme Court decision on the matter "would have been decided differently" had the court then known "about the abuse of voter identification laws."

That, in and of itself, was a remarkable turn of events. What was ultimately to come was even more so.

Crawford v. Marion County Election Board is the case which Republican proponents of strict photo ID voting laws now (incorrectly and often disingenuously) cite as giving them carte blanche to enact similar laws in other states, irrespective of the extent to which photo ID laws serve to disenfranchise demographic groups - people of color, students, the poor, women - that all tend to vote for Democrats.

Posner is not just any judge. He is a renowned legal scholar and Reagan appointee to the federal bench, who has served on the US Seventh Circuit Court of Appeals since 1981. More importantly here, Posner was the author of the Seventh Circuit's opinion in Crawford. In that case, Posner rejected an allegation that Indiana's polling place photo ID restriction was unconstitutional. That decision was affirmed by the US Supreme Court.

Posner, who is, as Yale law professor Fred Shapiro notes, the most cited jurist of the 20th century, was not alone in his view last year that Crawford "would have been decided differently" had the court then known what it knows now....

PROVING THAT THE MAN MUST BE IN HIS SECOND CHILDHOOD, OR CONGENITALLY INNOCENT, IF HE THOUGHT THIS WAS AN HONEST MISTAKE ON THE DANCING SUPREMES' PART...

Demeter

(85,373 posts)Demeter

(85,373 posts)http://www.cnbc.com/id/102094381

Corbin Fawley knew he stood out on his Frontier Airlines flight from Denver to Dallas.

But that was fine with him.

Fawley wore a surgical mask and rubber gloves to give himself what he considered an extra level of protection against the Ebola virus, even though it's not airborne. Instead, it's spread through contact with the bodily fluids of an infected person who is showing symptoms of the virus.

"I am not losing anything by putting on gloves and a mask. It is just an extra precaution," Fawley said from the baggage claim area.

"How can they {the federal government} significantly regulate something like this? I mean, that's why I was taking matters into my own hands to protect myself from it," he said.

http://www.cnbc.com/id/102090367

Three people had contact with the latest Ebola patient before she was isolated, said Dr. Tom Frieden, director of the Centers for Disease Control and Prevention in a phone briefing. They have not identified anyone else who has exhibited symptoms. However, this can change from "minute to minute, hour to hour," he said...

"We will provide new information as decisions are made," the hospital said in the release.

The second healthcare worker who has contracted Ebola should not have traveled and violated CDC guidelines, said Dr. Frieden. The fact that the worker had high exposure to the deceased patient Thomas Eric Duncan should have been another indication to prohibit travel, he said. From now on, people being monitored will not be allowed to board a commercial flight.

Sylvia Mathews Burwell, secretary of the Department of Health and Human Services, said that the CDC would send go-teams to hospitals that find new Ebola cases to ensure rapid response.

"We know how to stop this," said Burwell...

THERE THEY GO, TEMPTING FATE

Sick passengers removed from flight at Boston's Logan Airport - official

http://www.cnbc.com/id/102083884

Emergency crews in protective gear removed five passengers with flu-like symptoms from an airplane at Boston's Logan Airport on Monday, a spokesman for the Massachusetts Port Authority said.

The Emirates flight 237 was from Dubai, and none of the ill passengers had recently been to West Africa, said spokesman Matthew Brelis.

The region is in the midst of a deadly Ebola outbreak.

"Out of an abundance of caution, the people were wearing protective gear when they went on board the plane and removed the passengers," Brelis said.

He was not immediately able to provide further details.

MY SISTER IN MASS. HAS SWINE FLU...SHE CALLED THE DOCTOR...

"Would you hold, please?.......

"Have you been to West Africa lately? No? Would you hold, please?....

"Do you know anyone who has been in West Africa Lately?....Hold please...."

Demeter

(85,373 posts)No restaurants, grocery stores, movie theaters or other places where members of the public congregate. No travel by airplane, ship, long-distance bus, train or other modes of commercial transportation.

Such are the restrictions that dozens of health care workers who treated the Ebola victim Thomas Eric Duncan are being asked to follow for the 21-day maximum incubation period of the virus.

The documents were drawn up by the Texas state health agency and Dallas County officials after an infected nurse, Amber Joy Vinson, took two flights between Dallas and Cleveland in the days before she developed symptoms of Ebola and was diagnosed with the disease.

County Judge Clay Jenkins, Dallas County’s chief executive and its director of homeland security and emergency management, said he was confident that all of the workers would agree to sign the documents. “These are hometown health care heroes,” he said. “They want to do this. They’re going to follow these agreements.”

AND....IT'S RETROACTIVE!

I SWAN...

Demeter

(85,373 posts)When Did Ebola Arrive and Spread at a Dallas Hospital? Timelines of the three people in Dallas who have been diagnosed with Ebola.

Sept. 19--Thomas Eric Duncan leaves Liberia

20--Arrives in Dallas.

21

22

23

24--Develops symptoms.

25--Visits hospital.

26

27

28--Returns to hospital--Pham and Vinson treating Duncan 3 days without protections

29

30--Duncan's ebola diagnosis confirmed

Oct. 1

2

3

4

5

6

7

8--Duncan dies

9

10--Vinson flies to Cleveland

11--Pham Ebola test positive

12

13--Vinson flies back to Dallas

October 14--Vinson Ebola test confirmed.

...Ms. Vinson’s air travel has stirred fears across the country. Federal health officials said on Friday that they had made contact with all 132 passengers on Monday’s Frontier Airlines Flight 1143 to Dallas.

“The vast majority of those called us,” said Dr. Katrin Kohl, the Centers for Disease Control and Prevention official who is overseeing efforts to contact passengers aboard both flights. “We are really grateful that people pay attention.”

Adding another dimension to the search for Americans possibly exposed to the Ebola virus, the State Department said on Friday that a hospital employee who might have had contact with specimens of the disease had left the United States aboard a cruise ship.

The employee and a traveling partner, who were not identified by name, have agreed to remain isolated in a cabin aboard the vessel, the State Department said, and “out of an abundance of caution,” efforts were underway to repatriate them. A physician aboard the cruise ship told the authorities that the employee was in good health.

News reports quoting an official statement from the government of Belize said the ship was in that country’s waters, but the authorities there have refused to allow American officials to evacuate the passengers through their territory. It has been 19 days since the passenger may have processed samples of fluids from Mr. Duncan, said Jen Psaki, a State Department spokeswoman.

SO MUCH MORE DETAIL AT LINK--BEST SUMMARY I'VE SEEN

Demeter

(85,373 posts)There is no case for an American Ebola czar, least of all another political "fixer" who has no expertise in public health. This is just another case of the Obama administration putting politics before substance, and cowering at the idiocy and vileness of the Republicans in Congress.

We already have an enormously competent national Ebola leader: Tom Frieden at the Centers for Disease Control (CDC). We already have an enormously competent coordinator for U.S. Ebola aid overseas: Raj Shah, the Administrator of USAID. What we need now is a president who backs up his front-line team...

HE'S A BITTER MAN, THAT JEFFERY. HE HAS LOTS OF COMPANY, TOO.

AND THERE'S SOME DOUBT ABOUT THE COMPETENCE OF TOM FRIEDEN, TOO.

Demeter

(85,373 posts)President Barack Obama appointed a former White House adviser as U.S. Ebola "czar" on Friday as the global death toll from the disease that has ravaged three West African countries rose to more than 4,500.

Amid growing concerns about the spread of the virus in the United States, authorities said a Texas health worker, who was not ill but may have had contact with specimens from an Ebola patient, was quarantined on a cruise ship that departed last Sunday from the port of Galveston, Texas.

The Carnival Magic, operated by Carnival Corp unit Carnival Cruise Lines, skipped a planned stop in Cozumel, Mexico, because of delays getting permission to dock from Mexican authorities, the cruise line said. The ship was scheduled to return to Galveston on Sunday.

A Mexican port authority official said the ship was denied clearance to avoid any possible risk from Ebola. “It is the first time that this has happened, and it was decided the ship should not dock as a preventative measure against Ebola,” Erce Barron, port authority director in Quintana Roo, told Reuters.

Obama, facing criticism from some lawmakers over his administration's handling of efforts to contain the virus, appointed Ron Klain, a lawyer who previously served as chief of staff to Vice Presidents Joe Biden and Al Gore, to oversee the U.S. response to the virus.

Klain's appointment and the cruise ship incident highlighted anxiety over the threat from Ebola, even though there have been just three cases diagnosed in the country, all in Dallas. They were a Liberian, Thomas Eric Duncan, the first person diagnosed in the United States, and two nurses who were on the team of health workers caring for him up to his death last week.

The worst-hit countries have been Guinea, Liberia and Sierra Leone, where Ebola has killed 4,546 since the outbreak of the hemorrhagic fever began there in March, according to a report on Friday from the World Health Organization. ...

MUCH MORE DETAIL THERE, TOO

Demeter

(85,373 posts)Demeter

(85,373 posts)

Xenex's 'robot' looks like a cross between a Dalek and a fridge

http://www.mirror.co.uk/news/technology-science/technology/ebola-killing-robot-brought-hospitals-4405653

Xenex Disinfection Services has developed an Ebola-killing robot that's being drafted into US hospitals to disinfect rooms...As panic starts to spread about Ebola, there are some US hospitals taking precautionary measures to combat this new threat - by using an Ebola-killing robot. The robot - made by Xenex Disinfection Services - is being used in 250 hospitals, including the Dallas hospital where the first US Ebola victim died.

The $115,000 machine - which looks like a cross between a large kitchen appliance and a Dalek - uses ultraviolet light to decontaminate hospital rooms, a potentially risky job for humans. The robot can disinfect a room in 5-10 minutes. The UV light - emitted in pulses - destroys bacteria, viruses, bacterial spores and other nasty bugs on the surface the light lands on.

The Ebola virus - which is transmitted in blood, urine, faeces and vomit - can survive for up to six days on solid surfaces. Given that it can be a messy disease - with bleeding, vomiting and diarrhoea - it can require quite a lot of clean-up after an infected patient has been in a hospital room.

Although it seems to only be transmitted through direct human-to-human contact, the virus is so aggressive that it’s important to eliminate any sources of infection.

Demeter

(85,373 posts)In a draft document, the World Health Organization has acknowledged that it botched attempts to stop the now-spiraling Ebola outbreak in West Africa, blaming factors including incompetent staff and a lack of information.

In the document obtained by The Associated Press, the agency wrote that experts should have realized that traditional infectious disease containment methods wouldn't work in a region with porous borders and broken health systems.

"Nearly everyone involved in the outbreak response failed to see some fairly plain writing on the wall," WHO said in the document. "A perfect storm was brewing, ready to burst open in full force."

The U.N. health agency acknowledged that, at times, even its own bureaucracy was a problem. It noted that the heads of WHO country offices in Africa are "politically motivated appointments" made by the WHO regional director for Africa, Dr. Luis Sambo, who does not answer to the agency's chief in Geneva, Dr. Margaret Chan.

WHO is the U.N.'s specialized health agency, responsible for setting global health standards and coordinating the global response to disease outbreaks....MORE

Demeter

(85,373 posts)SUMMARY OF GLOBAL TRAVEL CONDITIONS/RULES/ADVICE

Demeter

(85,373 posts)Man has no symptoms of Ebola virus, but health officials are taking 'abundance of caution'...A man from Liberia who is visiting family in Oak Park is being asked by the Centers for Disease Control and Prevention to self-monitor himself.

He does not have any symptoms of the Ebola virus.

"Out of an abundance of caution, an Oakland County Health Division epidemiologist has been assigned to communicate with the man twice daily to monitor his health for at least 21 days," reads a statement from the Health Division.

According to the Oakland County Health Division, the Liberian man entered the U.S. through an airport in New York City. There, he was screened in accordance with CDC protocol before being permitted to enter the country. The man said he had had no contact with anyone known to have the Ebola virus and was observed to be symptom-free at the time of arrival. When he landed at Detroit Metro Airport, he was screened a second time by the CDC which showed he remained symptom free.

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Jerome R. Corsi, a Harvard Ph.D., is a WND senior staff reporter. He has authored many books, including No. 1 N.Y. Times best-sellers "The Obama Nation" and "Unfit for Command." Corsi's latest book is "Who Really Killed Kennedy?"

http://www.wnd.com/2014/10/u-s-army-warns-of-potential-airborne-ebola/#DkZPlkuZoEJbcmZY.99

NEW YORK – While Centers for Disease Control and World Health Organization officials continue to insist Ebola cannot be transmitted by air from one person to another, an Army manual clearly warns the virus could be an airborne threat in certain circumstances. The handbook published by the U.S. Army Medical Research Institute of Infectious Diseases, USAMRID, titled “USAMRID’s Medical Management of Biological Casualties Handbook,” is now in its seventh edition. The most recent edition was published in 2011, with more than 100,000 copies distributed to military and civilian health-care providers around the world.

On page 117 of the handbook, in a chapter discussing “Viral Hemorrhagic Fever” (VHF), a category of viruses that includes Ebola, USAMRID says: “In several instances, secondary infections among contacts and medical personnel without direct body fluid exposure have been documented. These instances have prompted concern of a rare phenomenon of aerosol transmission of infection.” Page 117 continues to specify: “Therefore, when VHF is suspected, additional infection control measures are indicated.”

USAMRID recommends the patient should be hospitalized in a private room with an adjoining anteroom to be used for donning and removing protective barriers, storage of supplies and decontamination of laboratory specimen containers.

WND recently reported the World Health Organization, in a largely overlooked media advisory email, admitted there are some circumstances in which the current strain of Ebola in West Africa can be transmitted through coughing or sneezing.

“Theoretically, wet and bigger droplets from a heavily infected individual, who has respiratory symptoms caused by other conditions or who vomits violently, could transmit the virus – over a short distance – to another nearby person,” the WHO Ebola situation assessment said.”

“This could happen when virus-laden heavy droplets are directly propelled, by coughing or sneezing (which does not mean airborne transmission) onto the mucus membranes or skin with cuts or abrasions of another person.

Air-purifying equipment

The USAMRID handbook recommends that for all VHF patients with significant cough, hemorrhaging or diarrhea, the hospital room should be a “negative-pressure isolation room” with six to 12 air exchanges, adequate to pump air out of the hospital room on a constant basis through bio-filters. To make the point about airborne transmission of VHF viruses, including Ebola, USAMRID says all persons entering the patient’s room should wear double gloves, impermeable gowns with leg and shoe coverings for contact isolation, eye protection and HEPA (N-95) masks or positive-pressure air-purifying respirators (PARRS). In the absence of a large, fixed medical-treatment facility, or in the event of an overwhelming number of casualties when isolation rooms may not be available for all patients, USAMRID recommends that at a minimum, VHF patients should stay together in “a ward with an air-handling system separate from the rest of the building when feasible.”

The manual notes that clinical laboratory personnel are “at significant risk for exposure” and should employ a bio-safety cabinet when available, with barrier and respiratory precautions when handling specimens.

‘We have to consider the possibility’

Dr. David Sanders, a top Ebola virologist and Purdue University professor of biological science appeared on Fox News on Monday to discuss his research suggesting Ebola can be an airborne virus.

“Our own research shows that Ebola Zaire enters human lung cells from the airway side. So it has the inherent capacity to enter the lung from the airway,” he said.

“I’m not saying that there’s any evidence that the current spread is due to anything but bodily fluid contact, but we have to consider the possibility that it can enter through an airway route.”

Demeter

(85,373 posts)BNY Mellon Corp, the world's largest custody bank, said on Friday it began earlier this month charging clients 0.20 percent on euro-denominated deposits that recently totaled about $33 billion. BNY Mellon initiated the charge on Oct. 1, reflecting a recent move by the European Central Bank to charge 20 basis points on deposits in hopes of persuading banks to lend more money to businesses and consumers.

"Many institutions started to charge for deposits," BNY Mellon Chief Financial Officer Todd Gibbons said. "We're kind of in the middle of the pack."

Since imposing the 0.20 percent charge, there has been some decline in euro-denominated deposits at the bank, he said. Matt Eagan, a portfolio manager at Loomis Sayles, said his bond funds have been repatriating cash back to the United States to avoid getting charged on bond interest payments that might otherwise be parked at a European bank.

"Our clients don't want to get charged for deposits in Europe," Eagan said.

BNY Mellon reported $221.7 billion in average deposits at the end of September. And the bank said 15 percent of that amount was in euro-denominated deposit liabilities. Banks typically pay customers for their deposits, but that amount has been paltry amid an environment of prolonged, rock-bottom interest rates. The ECB's charge on deposits is designed to spur economic activity. In June, the ECB took the extraordinary step of charging banks 0.10 percent to park their money at the central bank. And in September, that negative rate was increased to 0.20 percent in a move to jump start a flagging European economy.

As of Sept. 30, BNY Mellon had $92.3 billion in interest-bearing deposits with the U.S. Federal Reserve and other central banks. That is down from $106 billion at the end of June. Gibbons declined to say how much of the bank's deposits were with the ECB. In 2011, BNY Mellon told some of its biggest depositors, hedge funds and other asset managers, that it would charge them a nominal fee of 0.13 percentage points a year on deposits in excess of $50 million. The move came amid the Greek debt crisis and the U.S. debt ceiling debate. The financial turmoil spurred big bank clients to sell riskier assets and to shift the proceeds into the shelter of their bank accounts. And in 2012, the bank openly talked about charging clients on their euro deposits as jittery investors felt more comfortable parking their cash rather than buying stocks and bonds. But no decision was made at the time. In the recently ended third quarter, BNY Mellon's net interest margin - largely the difference between what the bank pays on deposits and what it earns on the money through investing - was 0.94 percent compared with 1.16 percent in the year-earlier quarter.

Demeter

(85,373 posts)Fuddnik

(8,846 posts)In a glass with ice, mix 2 parts ginger beer, 1 part vodka, and squeeze a wedge of lime in.

Several of those will brighten your outlook on life.

We're going on a vacation. Leaving for Jacksonville tomorrow for a week-end long tailgate party, and we all have tickets for the Browns-Jaguars game. Then on Monday we're headed up to Charleston SC for a few days. The only part of that state worth a shit. Have a hotel down in the historic district, and we can walk to all the sites we want to see...again.

Demeter

(85,373 posts)I can't drink distilled spirits...champagne is as far as I get. But that would mean something to celebrate.

Demeter

(85,373 posts)NBRS Financial, Rising Sun, Maryland, was closed today by the Maryland Office of the Commissioner of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Howard Bank, Ellicott City, Maryland, to assume all of the deposits of NBRS Financial.

The five branches of NBRS Financial will reopen as branches of Howard Bank during their normal business hours...As of June 30, 2014, NBRS Financial had approximately $188.2 million in total assets and $183.1 million in total deposits. Howard Bank will pay the FDIC a premium of 1.19 percent to assume all of the deposits of NBRS Financial. In addition to assuming all of the deposits of the failed bank, Howard Bank agreed to purchase essentially all of the assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24.3 million. Compared to other alternatives, Howard Bank's acquisition was the least costly resolution for the FDIC's DIF. NBRS Financial is the 15th FDIC-insured institution to fail in the nation this year, and the second in Maryland. The last FDIC-insured institution closed in the state was Slavie Federal Savings Bank, Bel Air, on May 30, 2014.

I HAD A FEELING THIS WAS IN THE AIR...

Demeter

(85,373 posts)Demeter

(85,373 posts)"There are only two mistakes one can make along the road to truth; not going all the way, and not starting." -- Buddha

"Search for the truth is the noblest occupation of man; its publication is a duty." - Anne Louise Germaine de Stael

"The world is a dangerous place, not because of those who do evil, but because of those who look on and do nothing." - Albert Einstein

"What the people want is very simple - they want an America as good as its promise." - Barbara Jordan

Demeter

(85,373 posts)...Little wonder ebola conspiracy theories are spreading faster than ebola. And as far as any of us know, the conspiracies could be true.

University of Illinois law professor Francis Boyle, an expert of the perfidies of the US government, reminds us that Sierra Leone and Liberia, the countries most affected by the ebola outbreak, are two West African countries that host US biological warfare laboratories. Professor Boyle asks how the disease, which is mainly associated with equatorial Congo reached West Africa thousands of kilometers away.

Washington’s response is itself peculiar. The Obama regime sent 4,000 US soldiers to West Africa to fight ebola. Soldiers don’t have training or equipment with which to combat ebola. Why expose 4,000 Americans to an epidemic? This seemingly pointless decision has raised suspicions that Washington is exposing troops to ebola so that vaccines or treatments can be tested on the troops.

Other commentators have noticed that West Africa is an area of Chinese investments. They wonder if Washington is using the cover of ebola to occupy the countries or even set the disease loose in order to drive out the Chinese. The new US Africa Command was formed to counteract Chinese economic penetration in Africa.

The incompetence of US public health authorities in responding to ebola gives legs to these theories. Real conspiracies abound. Those who say “it’s just a conspiracy theory” need to look up the meaning of conspiracy. As one commentator observed, the CDC’s response to ebola is too stupid for stupid. The CDC’s protocol is based on assumptions about ebola that do not seem to be true for the current strain. A nurse, who treated the ebola patient in Dallas who died, was given the green light to fly commercially even though she reported to CDC that she had symptoms. She exposed 132 passengers on the flight, and these passengers have since been in contact with thousands of other people. The Daily Mail has published photographs of an American with a clipboard and without protective suiting boarding the nurse on a private airplane on way to hospital quarantine.

http://www.dailymail.co.uk/news/article-2794854/what-thinking-mystery-man-without-hazmat-suit-seen-helping-2nd-ebola-nurse-board-plane-atlanta-joining-them.html

US public health authorities have imposed no quarantine on travel to the US from infected countries. US airlines continue to fly to and fro from the infected countries despite the risk of introducing new infections into the US.

African countries are doing a much better job than the hegemonic superpower. They have closed borders, prevented air travel, and tracked down infected persons and those exposed to them.

http://hosted.ap.org/dynamic/stories/A/AF_EBOLA_AFRICA_CONTAINMENT?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT&CTIME=2014-10-16-14-24-38

Instead of taking sensible precautions, the Obama regime appoints an Ebola Czar and sends 4,000 Americans into the areas where the disease rages.

Little wonder that Americans have no confidence in their government.

As the Republicans want to privatize and outsource everything, why not close down Washington and outsource our governance to a more competent country?

Note: And there is this view also: http://jonrappoport.wordpress.com/2014/10/17/ebola-hoax-hidden-purpose-of-the-operation/

UPDATE: http://www.globalresearch.ca/a-liberian-scientist-claims-the-u-s-is-responsible-for-the-ebola-outbreak-in-west-africa/5408459

Dr. Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. Roberts' latest books are The Failure of Laissez Faire Capitalism and Economic Dissolution of the West and How America Was Lost. http://www.paulcraigroberts.org/

magical thyme

(14,881 posts)Getting supplies to the facilities. That is all. They will not be dealing with patients at all. And they will be quarantined for 21 days prior to return to the U.S.

The first vaccines are in human safety trials right now. Hopefully they have something that will be safe and effective sooner, rather than later. There's a good chance vaccines will be in production by the middle of next year, possibly sooner.

I hope so. I'm a lab tech in a small hospital. We'd be sending suspect patients to our large hospital to our south, but I'd rather have antibodies in advance of any suspects.

Demeter

(85,373 posts)and then you have to milk them like cows...

magical thyme

(14,881 posts)and the company that manufactures it has redirected all of it's resources away from other projects and onto producing more.

But you produce your own antibodies with a vaccine as long as you are immunocompetent. And I'm still immunocompetent; my titers were high enough decades after having measles, mumps, etc. that I didn't need to get vaccinated for my clinical training.

As along as it's a safe vaccine, you don't get the disease. Of course, if somebody effs up and accidentally injects you with intact virus instead of attenuated virus, then you get the disease. Presumably there won't be that level of mislabeling of tubes when the first vaccines come out next year, although in a panic rush I suppose anything is possible.

I'm torn between quitting the p/t healthcare job and sticking to the p/t customer service job. Or doing the reverse and being 1st in line when a vaccine is ready. Even the 1%ers know they need enough healthcare staff around to take care of them after everybody else has died off, and both the hospital and the urgent care centers where I work serve 1%er coastal communities.

Demeter

(85,373 posts)Demeter

(85,373 posts)

magical thyme

(14,881 posts)because of all the lawsuits that will potentially be headed their way. Not just wrongful death, either. Small businesses ruined because a nurse was allowed to travel (she helped her bridesmaids get fitted -- who's going into that shop and trying on dresses there now?), airlines contacting people who rode in their possibly contaminated planes, and so on.

It also dawned on me that in a panic, we turn to people we are comfortable with and innately trust. So a lawyer would turn to a lawyer. That's where their thinking is.

So far, all their attempts to quell panic have done nothing but incite panic because they lied and then lied some more. Now nobody believes them -- recipe for disaster.

Lawyers are smart in one way. But scientists are smart in a very different way. I really question the ability of a lawyer to be able to get up to speed on the science and epidemiology needed to be able to direct a good response. And nothing we, or anything anybody else for that matter, does at this point is going to stop it. By the time we build the couple thousand beds we've promised, they will need multiple times that number to get to the 70% isolation WHO projects is needed to stop the spread. That's why I think underneath it all, there is panic.

And as the numbers increase in W. Africa, the likelihood of it popping up in the US increases.

The WHO and UN effed up when they failed to raise the alarm early on, while MSF was begging for help. And Frieden really, really effed up on this. It's not rocket science. Anybody can look at the pictures of the biohazard gear used in Africa, in our research labs and in the BSL-4 hospitals and see the difference between that and the droplet precautions he recommended for regular hospitals. Those poor young, naive and trusting nurses were guinea pigs in an experiment -- how cheaply can we do this -- that blew up in their faces.

I saw an interview with Dr. Sanjay Gupta on Thursday evening. All day he wondered why they were shipping the nurses out to other facilities. He got the answer from an unnamed source by that evening -- staffing issues at Texas Presbyterian. He stated straight out that they are afraid of the nurses walking out.

Demeter

(85,373 posts)and if there's one thing this country doesn't need, it's getting screwed by another "fix".

magical thyme

(14,881 posts)antigop

(12,778 posts)antigop

(12,778 posts)antigop

(12,778 posts)antigop

(12,778 posts)From "The Best Little Whorehouse in Texas"

MattSh

(3,714 posts)Despite the reassuring narrative from The West that Russia faces "costs" and is increasingly "isolated" due to sanctions for its actions in Ukraine, the most recent data suggests reality is quite different. First, capital outflows slowed dramatically in Q3 (from $23.7 billion in Q2 to $13 billion in Q3) with September seeing capital inflows for the first time since Sept 2013. Second, Russia's current account surplus was significantly stronger than expected ($11.4 billion vs $8.8 billion expected) driven by increased trade. Third, and perhaps most crucially, Russia paid down a massive $52.8 billion in foreign debt as Putin "de-dollarizes" at near record pace, reducing external debt to the lowest since 2012.

As Goldman explains, Trade and income improved notably...

The current account balance for Q3 came in at a surplus of US$11.4bn, above consensus expectations of US$8.8bn and up sharply from a small deficit of US$0.7bn in Q3 2013.

On our estimates, on a seasonally-adjusted basis, this now puts the current account at 3.8% of GDP, up from a low point of 1% in Q2 2013 and 1.6% for the full-year 2013.

The improvement in the current account came from both the trade balance, where imports have contracted (due to slowing domestic demand and the weaker Ruble), and from the income balance.

In our view, the latter could be due to either cyclical or structural factors, which are difficult for us to pinpoint, but risks to our current account balance forecasts nonetheless remain to the upside.

Complete story at - http://www.zerohedge.com/news/2014-10-10/de-dollarizing-russia-pays-down-near-record-53-billion-debt-third-quarter

Demeter

(85,373 posts)It's as if FDR, Churchill, Eisenhower and the best of the Supremes had all reincarnated in one.

Demeter

(85,373 posts)Moody's Investors Service cut Russia's sovereign debt rating to 'Baa2' from 'Baa1', becoming the second ratings agency to cut the country's ratings this year, after S&P initiated a downgrade in April.

Moody's said the prolonged crisis in Ukraine was weighing on Russia's medium-term growth prospects.

"The military confrontation in Ukraine and escalating sanctions against Russia are likely to have an increasingly negative macroeconomic impact on Russia's investment climate," the ratings agency said on Friday. The agency maintained its negative outlook on Russia. Moody's cited the ongoing erosion of Russia's foreign exchange buffers due to low oil prices and Russian borrowers' restricted access to international markets as key drivers for the downgrade. Russia's high dependence on the hydrocarbon sector has not materially decreased despite its government's diversification strategies and is likely to limit the economy's potential for growth, Moody's said.

The agency expects real growth to start declining by the end of the year and continue falling at least until mid-2015. Moody's also lowered Russia's long-term country ceilings for local and foreign currency debt and for local currency deposits to 'A3' from 'A2'.

JUST GOES TO PROVE THAT "GROWTH" ISN'T EVERYTHING, NOT THE WAY THE BANKSTERS DEFINE IT, ANYWAY.

MattSh

(3,714 posts)The internet is full with Cassandras, announcing the end of the world as we know it and the fall of the dollar in particular. Our favorite site for instance is:

[usawatchdog.com] – USA Watchdog, Greg Hunter (former CNN)

But there are others, like zerohedge, whatreallyhappened or LewRockwell, to mention just a few of the more well known.

Now however, we have our favorite CIA outlet, the German magazine #1 der Spiegel, chiming in with the doomsayers and admit: the financial system is unsustainable and a crash is inevitable. Nothing is done to reduce the global debt of $150 trillion. According to der Spiegel ‘growing out of debt’ no longer an option. The three biggest creditors: Japan ($3.2T), China ($2.1T) and Germany ($1.9T). Largest debtor: USA ($5.7T). Der Spiegel predicts that the crash of 2008 was merely a small sign of things to come; the next crisis will be bigger. Der Spiegel finishes its article by adding gloomily: “you can’t say you have not been warned”.

Editor: ‘the system’ is preparing us for what is inevitable, The Big Reset. Don’t assume that your pension is certain, it is not.

Complete story at - http://deepresource.wordpress.com/2014/10/05/der-spiegel-the-coming-financial-crash-is-inevitable/

Like this. Only much worse.

Demeter

(85,373 posts)This one's pretty good!

http://usawatchdog.com/wnw-162-ebola-gets-worse-airborne-putin-war-talk-and-harvey-organ-update/

MattSh

(3,714 posts)News from the Milan summit is still trickling through but it is clear that there has been no breakthrough and the Ukrainian crisis remains deadlocked. Poroshenko said that the “parameters” of a gas agreement have been agreed but it seems that nothing of the sort has happened.

The most fatuous comment of the day has come from van Rompuy, who called it “progress” because Putin is supposed to have said that he does not want a frozen conflict in Ukraine or for eastern Ukraine to become another Transdniestria. To see the absurdity of that comment just try to imagine Putin solemnly telling the Europeans the opposite: that he does want a frozen conflict in Ukraine and that he does want eastern Ukraine to become another Transdniestria!

Not for the first time Putin comes over as a man surrounded by dwarfs.

As I understand it the idea of a breakfast meeting between Putin and European leaders came from Merkel. With the German and European economies tanking in part because of the very sanctions policy she has imposed, Merkel needs this crisis to end. At the same time she remains utterly unwilling to take on the US and its European allies or the Atlanticists within Germany. She therefore looks to Putin to extricate her from the mess she has got herself into. However because she is not prepared to face up to the US and its allies or the Atlanticists she wants Putin to get her out of trouble by capitulating to all their demands. She tries to do this by applying “pressure” on Putin (that was what today’s breakfast meeting was all about) and then looks sullenly angry and baffled when it doesn’t work.

http://www.thesaker.net/russia/alexander-mercouris-deadlock-and-gas-talks-in-milan/

Demeter

(85,373 posts)I used to admire Merkel....I suppose, next to W, almost anyone looks wise and competent.

I'm willing to make an exception for his successor, though.

MattSh

(3,714 posts)Never expected to see you here this early!

Demeter

(85,373 posts)When I have a "normal" life, I am a morning person.

One more week to go!

xchrom

(108,903 posts)WASHINGTON (AP) -- Construction firms broke ground on more apartment complexes in September, pushing up the pace of U.S. homebuilding.

Housing starts rose 6.3 percent to a seasonally adjusted annual rate of 1.017 million homes, the Commerce Department said Friday. Almost all of the gains came from apartment construction - a volatile category - which increased 18.5 percent after plunging in August.

The sluggish recovery and meager wage growth has left more Americans renting instead of owning homes. Apartment construction has surged 30.3 percent over the past 12 months.

Starts for single-family houses rose just 1.1 percent in September, contributing to an 11 percent gain during the past 12 months.

xchrom

(108,903 posts)FRANKFURT, Germany (AP) -- Europe's economy needs help - fast. Yet the two powers that could take action, the European Central Bank and Germany, don't see eye to eye about what to do.

That leaves Europe's currency union stuck in a dangerous policy limbo that has investors worried as it risks falling into recession for a third time in six years.

Concern that the 18-country currency union, which accounts for 17 percent of the world economy, has no clear path out of its economic trouble is among the key factors in this week's global market turmoil. The Stoxx 50 index of top eurozone stocks fell as much as 6.3 percent this week before recovering somewhat Friday. It is down 5.7 percent over the past three months.

The eurozone saw no growth at all in the second quarter after only four quarters of sluggish recovery. It also has dangerously low inflation, which can depress growth over years, if not decades, as happened in Japan. A sudden decline in exports and industrial activity in Germany, long the region's source of growth, heightened those concerns.

There are several big ideas about how to boost growth - for the long term. A free trade agreement with the United States, a Europe-wide investment fund to put 300 billion euros into infrastructure, looser employment rules in France and Italy. An ECB review of bank finances due this month could purge hidden losses from the financial system and get more credit flowing to companies.

xchrom

(108,903 posts)LAS VEGAS (AP) -- Caesars Entertainment said Friday it is prepared to start formal discussions with some of its bank lenders as it works to reduce its debt and stave off what some see as near certain bankruptcy.

In a filing to the Securities and Exchange Commission, the casino company announced that it has reached out to some of its creditors - namely bank lenders - to find ways to ease pressure on its $24.2 billion debt.

That came a day after the company promised its creditors who are first in line a claim on cash held by its debt-strapped subsidiary Caesars Entertainment Operating Co. in case it defaulted. It's been in formal talks with that group of creditors, too, for about a month.

In recent years the company has spun off multiple divisions in an attempt to shape up its finances, including Caesars Entertainment Resort Properties and Caesars Growth Properties, dividing its casinos, properties and businesses among the subsidiaries. The operating company has the largest debt load.

xchrom

(108,903 posts)- Resources Available for Children

For most families, "public funding plays an important role in providing resources to children that influence future levels of income and wealth," Yellen said. In particular, she expressed support for government-subsidized early childhood education, which has been shown to improve outcomes for lower-income children. But gains in enrollment and funding have stalled since 2010 due to budget cuts made in the wake of the Great Recession.

- Affordable Higher Education

Since 2001, college costs have risen far faster than income has in most U.S. families. That has resulted in a dramatic rise in student loan debt, which has quadrupled from $260 billion in 2004 to $1.1 trillion this year. "Higher education has been and remains a potent source of economic opportunity in America, but I fear the large and growing burden of paying for it may make it harder for many young people to take advantage of the opportunity higher education offers," Yellen said.

- Business Ownership

Building a business has "long been an important part of the American dream," Yellen said. Business ownership is a significant source of wealth and can be an important way for households to move up economically. But data show that it has become harder for many families to start businesses, and the pace of new business creation has fallen in recent decades. "One reason to be concerned about the apparent decline in new business formation is that it may serve to depress the pace of productivity, real wage growth and employment," she said.

- Inheritances

While large inheritances play a big role in the top 5 percent of households, they are also common among households below the top, Yellen said. "Considering the overall picture of limited resources for most families that I have described today, I think the effects of inheritances for the sizable minority below the top that receive one are likely a significant source of economic opportunity," Yellen said.

Demeter

(85,373 posts)and ending the public stupidity on the part of the top 20% would be a big help, too.

Demeter

(85,373 posts)...Consider, for example, the approach the last Fed chief took when he gave a speech on the same topic. Instead of raising the possibility that a widening gap between rich and poor could be contrary to American values, here’s what Ben Bernanke said in a 2007 speech to the Great Omaha Chamber of Commerce: “I will not draw any firm conclusions about the extent to which policy should attempt to offset inequality in economic outcomes; that determination inherently depends on values and social trade-offs and is thus properly left to the political process.” Ms. Yellen’s speech is a thorough airing of some of the latest research on how much inequality has widened in recent years and why. In the course of 4,300 words, she explores the role of rising debt loads poor students must incur to get a college education, a slowdown in small-business formation, and trends in inheritances, among other issues.

But in many ways the issues she leaves out are more instructive. In particular, she stays away from the aspects of the inequality puzzle that have a close tie-in to the policies of the Federal Reserve.

It would also have big implications for Fed policy. It would imply that, under the current economic arrangement, the nation’s potential economic growth is lower than it might otherwise be. Which implies that it would be dangerous for the Fed to try to seek growth much faster than that using monetary policy, as doing so might unleash inflation, financial bubbles or both.

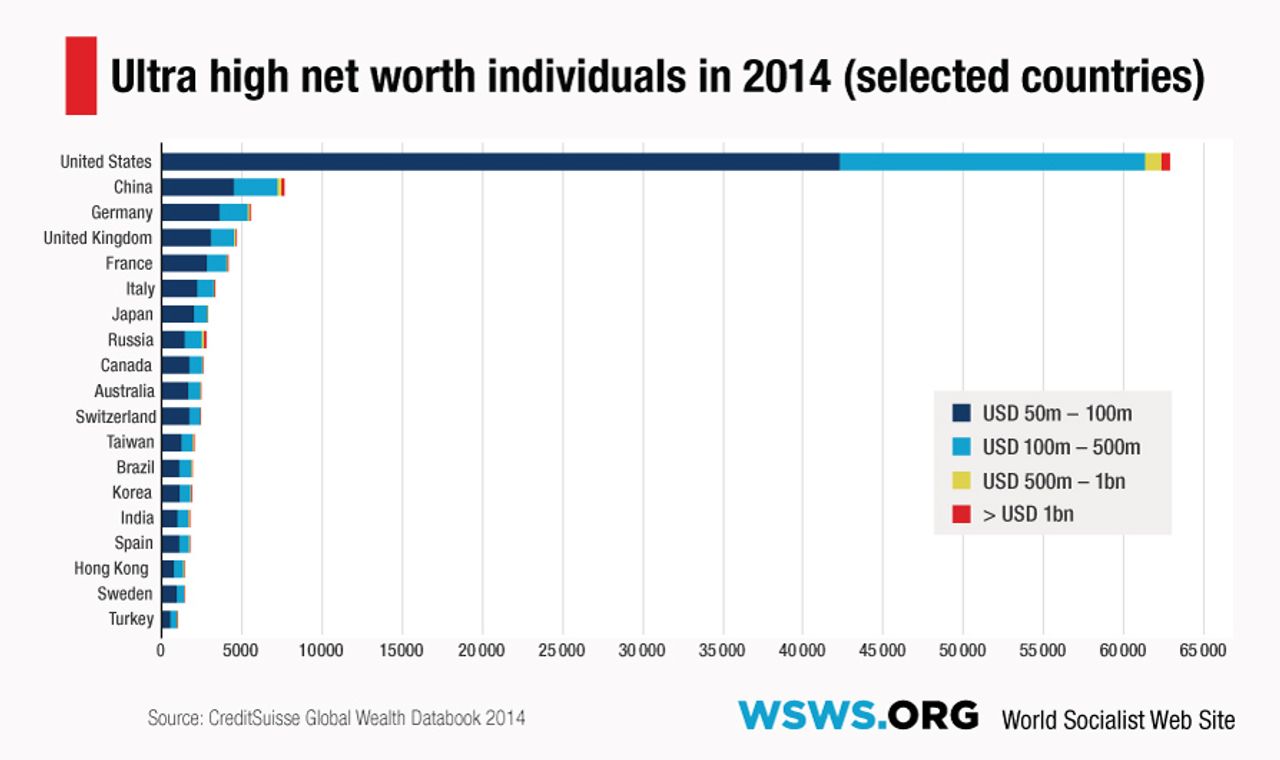

But this has contributed to an imbalanced form of growth in the United States. Many of the first-order effects of the Fed’s bond buying have been, for example, to drive up the stock market and to help lower mortgage rates. Because stocks are disproportionately owned by the wealthy and the upper middle class have been in best position to refinance their mortgages, the benefits of Fed policy for middle and low-income workers have been more indirect.

...Perhaps in future appearances, Ms. Yellen will give us a sense not just of what is wrong with inequality, but what it might mean for the policies over which she has some control.

BUT I DOUBT IT. THE SUBJECT WILL NEVER ARISE AGAIN.

Demeter

(85,373 posts)Few things matter more to the market than the policies of the Federal Reserve. And over the past week, the central bank sent the market mixed messages, at best. On Thursday, the head of the St. Louis Federal Reserve Bank said the Fed may want to keep up its bond buying stimulus for now given a drop in inflation expectations. However, one day later Boston Fed President Eric Rosengren told CNBC he doesn't expect the U.S. economy to need another round of quantitative easing, although he didn't rule out the option.

Top economist Maury Harris of UBS Investment Research thinks the Fed will surprise the market at its next meeting. He thinks the Janet Yellen and company could extend bond buying longer than expected. HE ALSO EXPECTS RAINBOWS AND UNICORNS

"Don't forget, they're still buying $15 billion a month," said Harris on CNBC's "Closing Bell." "I think they'll cut that to $5 billion instead of going straight to nothing, (as is widely expected)."

Harris added that the Fed is committed to moving gradually; and slowing the taper rather than ending it, would be, what he called, another example of its gradualism. If Harris is correct, economist Joe LaVorgna of Deutsche Bank said it wouldn't surprise him. "The Fed has made so many changes over the past year, they could, again, change their minds." However, both pros added that slowing the end of QE doesn't necessarily mean the Fed will kick a rate hike down the road. Both pros also said inflation data will likely compel the Fed to raise rates in June of next year. "And when that happens, it could be very disruptive," LaVorgna said.

bread_and_roses

(6,335 posts)Look, I am all for early childhood services and OF COURSE we should have professional day care and pre-school etc etc etc - but what about the children NOW in K-12, in poverty-stricken schools and families and communities? Do we throw them away - like, oh well, it's too late for them?

What about the kids going home to no food? In Detroit to NO WATER for goddess sake? What about the millions of children in families ravaged by life-long poverty and our utter abandonment of inner cities for the past - what? forty years - since the vanishing of the "war on poverty?" What about the kids now living in what amount to third-world war zones in our inner cities, their schools with no books and equipment, their homes with no food, books, computers, place to play? We throw them away?

What about the kids in towns like mine, where there is no "slum" but hidden families with Mom crying at the table because the cable or the phone or the electric will be shut off tomorrow and there is no way to pay it? Or the car has broken down and she can't get to her lousy four-hour a day job at McDonald's that keeps them half afloat if they eat macaroni and margarine every night for a week?

I know these families. Early childhood education "someday" ain't helping them.

DemReadingDU

(16,000 posts)In Iraq and Afghanistan, and now Africa

Why don't our leaders win the hearts and minds of its own citizens

Demeter

(85,373 posts)for so they consider us, a captive audience and labor force.

They keep forgetting about the "force" part of that equation, though. And someday, sooner than anyone thinks, that Force will be with us!

DemReadingDU

(16,000 posts)video at link

Since 2012, California has been suffering through a historically severe drought. For the farmers of the Central Valley, which is, as Dana Goodyear writes in this week’s issue, “the country’s fruit basket, salad bowl, and dairy case,” the future seems especially bleak. Wells have gone dry, orchards have been left to perish, and those who came to California to work the fields stand idle. Photographers Matt Black and Ed Kashi recently spent time with the farmers and shepherds of the Central Valley, documenting their ongoing struggles. Some of Black’s photographs are also featured in this week’s issue.

http://www.newyorker.com/culture/photo-booth/california-paradise-burning

xchrom

(108,903 posts)NEW YORK (AP) -- General Electric Co. posted strong third quarter results, issued an upbeat forecast for the fourth quarter and said U.S. industrial activity is at its highest level since the financial crisis.

CEO Jeff Immelt said there is uncertainty in the global economy, but that nations around the world are still going ahead with large infrastructure projects and companies are buying equipment.

"It's a slow growth pattern with volatility but not a lot different than what we've seen in the past," he said in a conference call with investors. He pointed to pockets of high activity in the developing world, slow growth in Europe and Japan, and strength in the U.S.

"The U.S. is probably the best we've seen it since the financial crisis," he said.

xchrom

(108,903 posts)BERLIN (AP) -- Train drivers at Germany's national railway have started a two-day strike after their union rejected a new pay offer in a bitter dispute complicated by rivalry between unions.

The GDL union called members out on strike from early Saturday morning until early Monday morning, its second walkout this week.

GDL wants a 5 percent pay increase and shorter working hours. A bigger sticking point is its demand to negotiate for other staff traditionally represented by a rival union.

National railway Deutsche Bahn says it offered a raise of 5 percent over 30 months on Friday for the drivers but won't accept rival pay deals for other employees. GDL rejected what it called a "sham offer."

Deutsche Bahn aimed to operate 30 percent of scheduled long-distance trains.

xchrom

(108,903 posts)BEIJING (AP) -- China and Vietnam agreed to resume military ties and better manage their maritime disputes in the first signs that tensions over territorial claims could be easing.

Despite fraternal ties between their ruling Communist parties, relations between the two countries grew tense this year after China deployed an oil rig near the Paracel Islands, which are also claimed by Hanoi. The vessels of the two sides rammed each other near the rig, and there were deadly anti-China riots in several industrial parks in Vietnam, leading to an exodus of thousands of Chinese workers.

During a visit to China this week, Vietnamese Defense Minister Phung Quang Thanh said it was "extremely necessary" to maintain a healthy and stable relationship to settle disputes, the Vietnamese People's Army newspaper said Saturday.

Thanh said the military forces should practice restraint, closely control activities at sea and avoid use of force or threats to use force, the newspaper said.

xchrom

(108,903 posts)Oct. 18 (Bloomberg) -- As rising seas threaten Florida, Thomas Steyer is floating an $8.6 million campaign to save the state, opening 21 offices, dispatching more than 500 staffers and volunteers and deploying a rolling ark.

The founder of hedge fund Farallon Capital Management LLC is pouring $36 million into seven states to show climate change can swing elections. That helps make him the largest individual U.S. political donor during the past two years, according to the Center for Responsive Politics.