Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 10 July 2014

[font size=3]STOCK MARKET WATCH, Thursday, 10 July 2014[font color=black][/font]

SMW for 9 July 2014

AT THE CLOSING BELL ON 9 July 2014

[center][font color=green]

Dow Jones 16,985.61 +78.99 (0.47%)

S&P 500 1,972.83 +9.12 (0.46%)

Nasdaq 4,419.03 +27.57 (0.63%)

[font color=green]10 Year 2.55% -0.02 (-0.78%)

30 Year 3.37% -0.01 (-0.30%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I shouldn't have come back....at least, not so soon. That's what happens when your vacations (real vacations--not moving, court trials or funerals) are 25 years apart. My last vacation the baby was just learning to walk...

Demeter

(85,373 posts)even our own....

snot

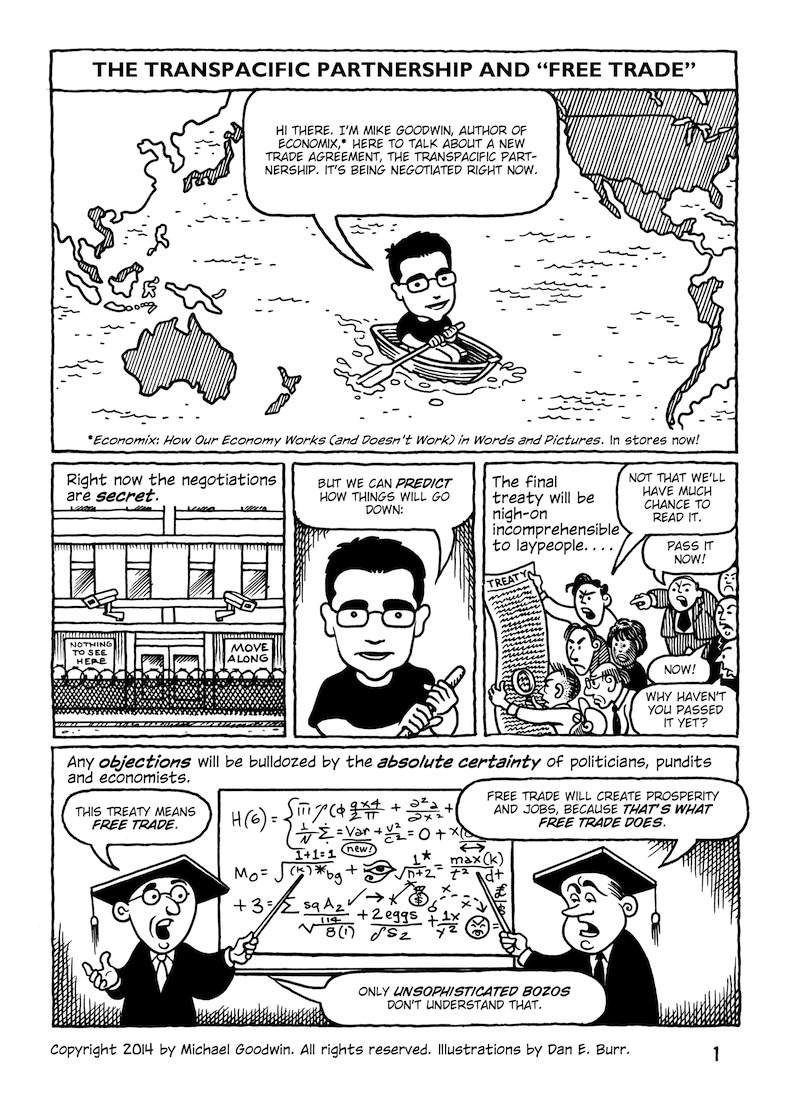

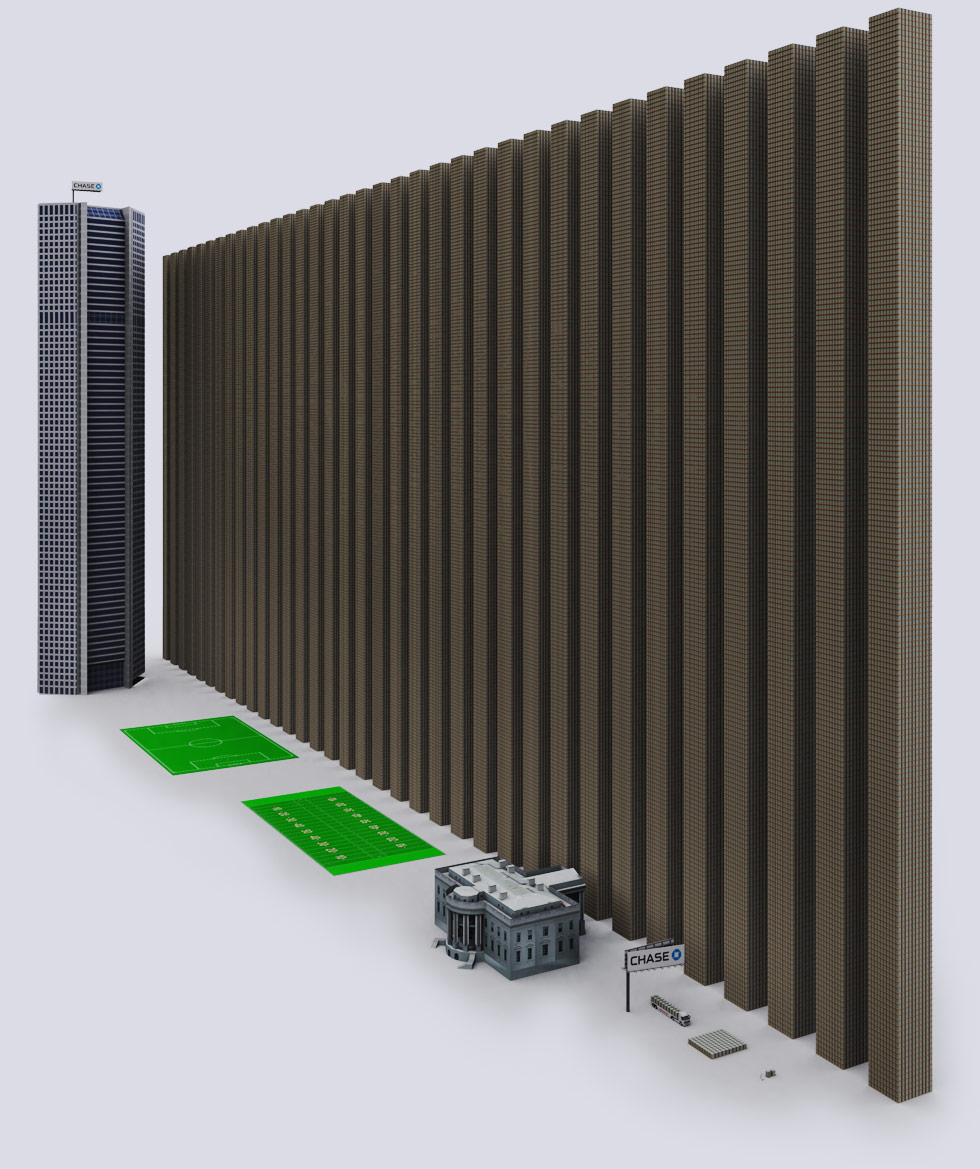

(10,502 posts)a great graphic, within the last few years (definitely since 2008), visualizing the amount of derivatives exposure of various major financial institutions? If I recall correctly, there was a separate image for each institution, with a little bank showing the size of the institution's capital reserves, and then behind it gargantuan stacks showing the relative size of the institution's exposure if the bets it was making tanked. It was extremely helpful in giving a sense of the magnitude of the risks, and I probably came across it thanks to some post here or elsewhere on DU . . .

Let me know if you recall anything that might help me find it again – thanks, and thanks to all of you for all you do!

Demeter

(85,373 posts)I would think it appeared in 2009...I did a google search; this is what I found:

https://www.google.com/search?q=IMAGE+DERIVATIVES+AND+BANK+CAPITAL&client=firefox-a&hs=qh5&rls=org.mozilla:en-US![]() fficial&channel=sb&source=lnms&tbm=isch&sa=X&ei=-fe9U8HHKcOwyATKlIDYBg&ved=0CAkQ_AUoAg&biw=939&bih=557

fficial&channel=sb&source=lnms&tbm=isch&sa=X&ei=-fe9U8HHKcOwyATKlIDYBg&ved=0CAkQ_AUoAg&biw=939&bih=557

http://www.usagold.com/publications/july2012newsletter.html

http://climateerinvest.blogspot.com/2008/08/us-bank-derivative-exposure-jpm.html

http://rortybomb.wordpress.com/2010/05/06/an-interview-about-the-end-user-exemption-with-stephen-lubben/

http://www.zealllc.com/2001/monster.htm

http://www.moneyandmarkets.com/jpmorgan-chase-goldman-sachs-citibank-wells-fargo-and-more-than-1800-other-institutions-believed-to-be-at-risk-of-failure-33058

snot

(10,502 posts)Here: http://demonocracy.info/infographics/usa/derivatives/bank_exposure.html

Esp. scrolling down to, e.g.,

DemReadingDU

(16,000 posts)Can you imagine the kaboom when that derivatives bubble pops!

![]()

DemReadingDU

(16,000 posts)From 2008

The Invisible One Quadrillion Dollar Equation -- Asymmetric Leverage and Systemic Risk

According to various distinguished sources including the Bank for International Settlements (BIS) in Basel, Switzerland -- the central bankers' bank -- the amount of outstanding derivatives worldwide as of December 2007 crossed USD 1.144 Quadrillion, ie, USD 1,144 Trillion. The main categories of the USD 1.144 Quadrillion derivatives market were the following:

1. Listed credit derivatives stood at USD 548 trillion;

2. The Over-The-Counter (OTC) derivatives stood in notional or face value at USD 596 trillion and included:

a. Interest Rate Derivatives at about USD 393+ trillion;

b. Credit Default Swaps at about USD 58+ trillion;

c. Foreign Exchange Derivatives at about USD 56+ trillion;

d. Commodity Derivatives at about USD 9 trillion;

e. Equity Linked Derivatives at about USD 8.5 trillion; and

f. Unallocated Derivatives at about USD 71+ trillion.

more...

http://www.siliconvalleywatcher.com/mt/archives/2008/10/the_size_of_der.php

Demeter

(85,373 posts)In yesterday’s roundup, we pointed out that the administration has left about 3.7 million Medicaid applicants or beneficiaries under ObamaCare in limbo with paperwork problems. That’s third world stuff. It’s unconscionable. There’s no excuse for it. And it’s all the more a saddening indicator of the general demoralization and crapification of American life that pointing such things out produces ennui or worse, excuse making, instead of burning outrage at the way a government that’s supposed to be of the people, by the people, for the people actually treats its citizens, especially when they are suffering or in need.

That said, I want to look at two emergent and continuing problems with ObamaCare. First, rates that vary randomly by jurisdiction; and second, narrow networks for both doctors and pharmaceutical formularies. (These problems have long been known to NC readers; see here, here, here, and here.)

ObamaCare and Random Rates

That insurance rates would vary wildly by jurisdiction was known before launch:

A Kaiser Health News analysis of the 1,923 plans being sold on federally run online marketplaces found wide variations of price and availability. For instance, Cigna is offering 50-year-olds one of its midlevel plans for $614 if they live in Flagstaff, Ariz. That same plan, contracting with different hospitals and doctors, will cost $428 in Phoenix and just $395 in Nashville.

(Here again, NC readers could see this one coming.) And the variations did indeed happen after launch. For example, in Michigan:

The least expensive basic plan for a 40-year-old couple with two children costs $761 in Delta County, compared with $462 a month for a comparable plan in Kent County, $560 in Washtenaw County and $566 in Ingham County. While Delta County offered just five insurance plans with one insurer, Kent County had four insurers and 33 plans, Ingham County five insurers and 39 plans and Washtenaw County five insurers and 40 plans.

Again, I think this is unconscionable. Where’s the justice in a citizen who lives on one side of the county line paying more for health insurance — and making life, or even life and death, decisions based on how much they have to pay — and a citizen on the other side paying less? None, that I can see. Well, to be fair, costs — and hence insurance company profit margins — may be different in the two counties. But all that says is that we need a single payer system to introduce a baseline of basic fairness. Social Security benefits don’t vary by the county, so why should health care costs?

MUCH MORE COOL REASON AT LINK

Demeter

(85,373 posts)Yesterday, we wrote about a major loss by the electronic mortgage registry, MERS, in a major Federal court case in Pennsylvania. MERS suffered an additional blow via an important adverse decision in the Maine Supreme Court, against Tom Cox, the attorney who first made robosigning a national issue.

Because mortgage abuses have faded from national headlines, some readers may not be familiar with MERS. MERS was created to replace the system of local recording of mortgages. While such an idea could have had merit (for instance, Australia has a national mortgage registry that by all accounts works well), MERS was designed for the convenience of banks and mortgage securitizers, with no review of how it would work with well-established real estate law in 50 states. MERS is a classic example of what Lambert calls “code as law” where computer systems are put in place and contracts and legal precedents are expected to conform to the dictates of often-not-well-enough-designed “innovations”. And even worse, in the case of MERS, the database protocols fall shockingly short of well-established norms for information integrity and security.

It is important to remember that with over 60 million mortgages in MERS, the records that show ownership and liens against many Americans’ biggest asset are in serious doubt. Yet astonishingly, MERS has been able to maintain a facade of legitimacy, mainly by settling cases that looked to pose a threat to its operations. However, a few important challenges have crept through. One was a case filed on behalf of all Pennsylvania county recorders. If it survives appeal, it will deal a fatal blow to the use of MERS in that state, will almost certainly result in large damages, and will have serious ramifications in other so-called “title theory” states.

The Maine victory by Thomas Cox is more decisive, in that MERS has no where to go in Maine after losing in the Supreme Court. Its full ramifications are not fully clear, however. We’ve embedded the ruling below...SEE LINK FOR MORE

Demeter

(85,373 posts)The System Worked: How the World Stopped Another Great Depression

Daniel W. Drezner

Oxford University Press, $29.95 (cloth)

The System Worked is a smart, thoughtful, and important book that I largely disagree with. Daniel Drezner, a professor of International Politics at Tufts University and notable public intellectual (he wrote a pioneering and widely admired blog for Foreign Policy and now writes for the Washington Post), has crafted a cogent, counterintuitive interpretation of the global financial crisis. The argument is neatly summed up by the book’s title, and on its first page: “The punch line of this book is that the conventional wisdom is wrong. In response to the 2008 financial crisis . . . global economic governance responded in an effective and nimble fashion. In short, the system worked.”

There is much to agree with in this claim: however bitter the experience of our lingering economic malaise—the “great recession”—the world did indeed avoid another Great Depression. Another such cataclysmic meltdown could have easily taken place in the wake of the financial crisis, as many analysts at the time feared. Drezner disarmingly notes that he was among the pessimists in those dark hours. He positions the book as his explanation of why he was wrong then and why, unlike many more conventional analysts, he is more sanguine now.

Drezner is right: the roof did not fall in, global economic performance stabilized, and, in many quarters, bounced back. But Drezner glances away from an elephant in the room: the system worked much better for some than for others. Speaking of elephants, one reason Drezner reaches conclusions different than those commonly found on the bookshelves sagging with crisis postmortems is that he is grasping firmly at the belly of the beast. There was “the system” before, during, and after the crisis, and it was in the heat of the moment that the system was at its best. But that same system arguably caused the financial crisis and, left largely in place, might yet contribute to another. As Peter Temin and David Vines argue in their book The Leaderless Economy: Why the World Economic System Fell Apart and How to Fix It (2013), while “the initial policy response to the crisis by world leaders” did the crucial job of preventing “a collapse of the world economy,” international cooperation is still wanting.

Nevertheless, to have avoided that meltdown was no small thing, and it was the result of good (or, at the very least, non-terrible) public policy. The System Worked attributes this outcome to the performance of international institutions. Drezner has in mind here the “set of formal and informal rules that regulate the global economy,” and he highlights the roles of the International Monetary Fund (IMF), World Trade Organization (WTO), The Bank for International Settlements, and the “G” country meeting groups (first the G7, now the G20). Drezner does not shy away from acknowledging the flaws and limitations of these institutions, and his central thesis, “the system worked better than is commonly believed,” cannot be dismissed as cheerleading.

MORE

Demeter

(85,373 posts)Until a few days ago, it looked like Detroit's chapter 9 plan confirmation would come and go untouched by appellate process. In February 2014, the U.S. Court of Appeals for the Sixth Circuit granted seven petitions for direct appeal of the bankruptcy court's eligibility decision, which included the finding that public pension claims could be impaired in chapter 9 bankruptcy. But the Sixth Circuit did not act on the request for expedited consideration. Somewhat remarkably, it agreed to do what the bankruptcy court had requested in its certification memo: consult with the bankruptcy court's lead mediator to consider the impact of the appeal's timing on negotiations. According to the bankruptcy court, "the interests of the City, its residents and its creditors are better served by adjusting the pace of the legal process, including the appeals, to meet the needs of the mediation process." (p. 14) Don't know for sure, but it seems plausible that the lead mediator preferred deferral of the appeal until after plan confirmation; doing otherwise might throw a wrench in implementation of plan settlements he oversaw - especially the Grand Bargain, for which he has pressed for many months. Because the eligibility decision included the finding that public pensions could be impaired in bankruptcy, the Sixth Circuit docket has swelled in the meantime to include many amici appearances and briefs, including from CalPERS, the Illinois Public Pension Fund Association, the American Federation of Teachers, and AARP.

A host of appeals from other bankruptcy court orders in Detroit's bankruptcy also are pending in the U.S. District Court for the Eastern District of Michigan. In at least several - and possibly all, as I haven't yet checked each and every one - the district judge sua sponte stayed the matter until the Sixth Circuit decided the eligibility appeal.

This week, the Sixth Circuit shattered the blockade on appeals from Detroit's bankruptcy.

First, acting on a writ of mandamus, the Sixth Circuit ordered a district judge to adjudicate an appeal, on a short deadline, of a bankruptcy court order regarding the City's casino revenues from late August 2013. Given that the district judge had stayed other appeals on the same grounds, it is possible that those will have to get moving as well.

Then, the Sixth Circuit scheduled oral argument for July 30 for appeals from the bankruptcy court's eligibility/pension impairment decision. Here's the notice; the time has since been changed to 1:30.

The Sixth Circuit's acts are important reminders that rights to appeal on major legal questions are not inherently second fiddle to expedience in restructuring. Yet, is this ever a fraught time for the oral argument announcement! The Sixth Circuit notice strongly discourages motions for deferrals. The identified standard is "exceptional circumstances." Detroit's counsel filed a motion anyway, asking for a time-out at least until the votes on the plan are counted. The voting deadline is July 11. The official tally is due to the bankruptcy court by July 21.

The eligibility appeals are intricately tied with key settlements on Detroit's plan of adjustment. The State of Michigan contribution to Detroit's plan is contingent on eligibility-challenging appellants giving up that fight. Most of those appellants - retiree and employee groups, unions, and the Detroit Retirement Systems - are part of the settlement and now advise a "yes" vote on class 10 and 11 claims, even though doing so is a vote to abandon the challenge to eligibility/pension impairment. Remember what Shirley Lightsey said: You Can't Eat Principles.

Claimants might have absorbed that message more readily when a Sixth Circuit oral argument was an abstract concept rather than the more tantalizing scheduled reality. Those who vote on Detroit's plan after the Sixth Circuit announcement may calculate the odds differently than those who voted before. Meanwhile, the settling organizations cannot say today that they are dropping the appeal because the votes are not yet in and tabulated.

Other twists: How many issues should the Sixth Circuit consider, depending on the votes and settlements? The bankruptcy court's certification memo listed eighteen questions, although the pension impairment question largely drove the challenges and appeals. Financial creditors sat out the eligibility fights. Although appeals of the eligibility decision were administratively consolidated in April, the Sixth Circuit instructed appellants to file individual briefs. Appellants have never raised fully identical issues or arguments. And is it conceivable that the Sixth Circuit could find a way to go forward with the appeal even if the last three employee/retiree associations settle with the City and the requisite majorities - but not 100% - of classes 10 and 11 vote in favor of a plan that impairs their pensions?

Complications indeed.

Demeter

(85,373 posts)THIS IS "PLAN B"...OR MORE LIKE THE NAZI "ULTIMATE SOLUTION"....

http://www.detroitnews.com/article/20140709/ENT01/307090069/1409/METRO

A New York art investment firm brought in to appraise the full collection at the Detroit Institute of Arts puts its total value between $1.1 billion and $4.6 billion. Artvest Partners principal Michael Plummer was hired by the DIA and the city to prepare an “expert report” on the museum’s value in response to claims by some creditors that an earlier Christie’s appraisal grossly undervalued the collection. The Artvest report was released by the city Wednesday.

In its appraisal, Christie’s examined only 2,800 works bought with city of Detroit funds — a practice that ended by 1955 — because they were thought to have the fewest legal restrictions on any potential sale. Christie’s estimated that selling those pieces would pull in no more than $866 million. The wide spread in valuation reflects the uncertainty of the art market, the report said, as well as the potential impact on prices were a great number of DIA artworks to hit the auction block at the same time. The report noted that prices for most categories of valuable art, with the exception of post-war and contemporary art, have plateaued and in some cases declined from highs set in 2011.

“This is the first comprehensive valuation of the entire DIA collection,” said Bill Nowling, spokesman for Emergency Manager Kevyn Orr. “The report makes it abundantly clear that selling art to settle debt will not generate the kind of revenue the city’s creditors claim it will.” He added that the $816 million that the “grand bargain” would deliver is still the best bet for both the museum and the city’s pensioners.

The Artvest report actually distinguished between estimates of the collection’s worth, and what it could actually bring in the real world were it all put up at once — the likely scenario were creditors like Syncora to succeed in their efforts to force a fire sale. So while the report pegged the low end of the collection’s fair-market worth at $2.8 billion, a quick sale of the museum’s holdings, it suggested, would only bring in $1.1 billion to $1.8 billion.

“An immediate liquidation of the art collection will result in selling the DIA collection at a fraction of its fair market value,” the report said, noting that it’s an art-world constant that works sold in a hurry pull only 50 percent of their fair-market valuation.

One New York art expert agreed with that assessment.

“The danger is flooding the market,” said Alan Fausel, vice-president and director of fine arts for Bonhams auction house. “There are only so many buyers for so many things.”

At the DIA, chief operating officer Annmarie Erickson said: “The report verifies the fact that it’s a lot easier to talk about selling art than it is to actually sell it,” noting that the $1.1 billion to $1.8 billion spread doesn’t take into account the possibility of legal action to block sales.

“There are many high-value objects that have restrictions on them, and would be litigated,” she added.

Artworks specifically cited by the report include Van Gogh’s “Portrait of Postman Roulin,” which it pegged at $120 million, while it suggested “Melancholy Woman,” one of the masterpieces of Picasso’s “blue period” would pull $80 million.

Artvest was paid $112,000 for the appraisal.

Demeter

(85,373 posts)xchrom

(108,903 posts)LONDON (AP) -- More "headline-grabbing" acquisitions are likely over the coming year as businesses take advantage of a period of improving economic growth and cheap financing.

That's the conclusion of a survey by business consulting firm EY, which says the value of takeover deals announced in the first half of 2014 struck its highest level since the end of the boom years in 2007.

In its half-yearly update of corporate activity, EY said Thursday that the value of deals rose by 50 percent from the same period the year before to $1.7 trillion. Not since the global financial crisis first erupted, prompting companies to batten down the hatches, has the value of deals been that high.

For years, big mergers and acquisitions have been notable for their absence as companies stocked up on cash reserves to weather the global economic storms. Pursuing M&A was very much a secondary consideration for boards round the world.

xchrom

(108,903 posts)WASHINGTON (AP) -- Federal Reserve officials are in broad agreement that they will likely announce an end to their monthly bond buying program in October, bringing to a close the third round of massive bond purchases the central bank has relied upon to boost economic growth following the Great Recession.

Minutes of the Fed's June 17-18 meeting released Wednesday showed officials were in basic agreement that the if the economy continues to improve, the final reduction in bond purchases would total a cut of $15 billion and would be announced at the Fed's Oct. 28-29 meeting.

With that final reduction, the Fed's balance sheet will be close to $4.5 trillion, more than four times the amount of the balance sheet when the financial crisis struck in the fall of 2008. The Fed has purchased Treasury bonds and mortgage-backed securities as a way to lower long-term interest rates to give the economy a boost.

Fed officials have said they will not immediately start selling off the holdings, a move that could send interest rates rising. But instead will reduce the holdings only gradually.

Demeter

(85,373 posts)That's the end of the fiscal year, too.

xchrom

(108,903 posts)SEOUL, South Korea (AP) -- Global markets were mixed Thursday with a slight pickup in China's exports failing to give a lift to European stocks after most Asian indexes closed up. Indonesian stocks surged despite a contested presidential election result.

European markets failed to extend the gains from the previous session when investor sentiment was boosted by strong corporate earnings. Britain's FTSE 100 was down 0.4 percent to 6,693.71. Germany's DAX slid 0.8 percent to 9,731.29 and France's CAC-40 sank 1.1 percent to 4,310.81.

Wall Street was also headed for a weak start. Dow Jones futures and S&P 500 futures were both down 0.6 percent.

Earlier in Asia, stocks closed mostly higher after China reported a small acceleration in export growth.

xchrom

(108,903 posts)Three of the biggest U.S. airlines are giving upbeat signals about their business as the peak summer travel season kicks into high gear.

American, United and Southwest indicated that a key revenue figure was higher than in the same period last year, and American also raised its forecast for profit margin in the second quarter.

Shares of airline stocks rose.

Since a series of big mergers that started in 2008, airlines have kept a lid on flights, which helps keeps fares high enough to overcome higher fuel prices. Of the four biggest U.S. airline companies, only United lost money in the first quarter, and analysts expect all of them to be in the black for the April-to-June quarter.

xchrom

(108,903 posts)MUMBAI, India (AP) -- India's new government introduced a reform-minded budget Thursday, vowing to lift economic growth to rates of 7-8 percent by promoting manufacturing and infrastructure and overhauling populist subsidies.

The budget for the fiscal year ending March 2015 is being closely watched as an indicator of whether Prime Minister Narendra Modi's government will act quickly to will deliver on promises to revive stalled economic growth.

Finance Minister Arun Jaitley outlined the broad strokes of the plan, which he said would be a departure from the "mere populism and wasteful expenditure" that has dragged down Asia's third-largest economy.

He said it would be daunting to keep the budget deficit for the year at 4.1 percent of gross domestic product, as targeted by the previous government, and it might end up at 4.5 percent. In the two subsequent years it is forecast to fall to 3.6 percent and 3 percent of GDP respectively.

xchrom

(108,903 posts)OAKLAND, Calif. (AP) -- A Northern California chemical engineer is facing more than 20 years in prison for a rare economic-espionage conviction for selling to China the technology that creates a white pigment.

A jury convicted Walter Liew, 56, of selling DuPont Co.'s secret recipe for making cars, paper and a long list of everyday items whiter to the Chinese government for $28 million.

Prosecutors are demanding a prison sentence of up to 22 years, arguing Liew's punishment needs to serve as a deterrent to others contemplating stealing trade secrets. Sentencing is set for Thursday.

"Defendant's conduct in this case represents a concrete threat to our nation's economic interests," prosecutor John Hemann wrote in court papers arguing for the lengthy prison sentence. Hemann argued that DuPont spent hundreds of millions of dollars and many years developing an efficient processing method for manufacturing the white pigment that enabled it to capture 20 percent of the $17 billion global market.

xchrom

(108,903 posts)BEIJING (AP) -- U.S. Secretary of State John Kerry said Thursday that the United States and China had a frank exchange on the issue of cyberhacking during this week's "Strategic and Economic Dialogue" in Beijing.

Kerry said the loss of intellectual property through hacking has had a "chilling effect on innovation and investment," and said such activity is hurting U.S. companies.

He made no mention of a New York Times report suggesting significant Chinese hacking of information about U.S. government personnel.

Chinese foreign policy chief Yang Jiechi described cybersecurity as a "common threat facing all countries."

xchrom

(108,903 posts)This comes as deflation risks rise. Earlier, we learned that the consumer prices increased by 0.5% in June, down from 0.7% in May, and worse than the 0.7% expected by economists.

"The decline in the French inflation rate may increase pressure on the European Central Bank to ease monetary policy of the euro area again in the months ahead," said Bloomberg's David Powell.

At its June policy meeting, the ECB pushed rates into negative territory in its efforts to stimulate growth and inflation.

Read more: http://www.businessinsider.com/france-inflation-industrial-production-miss-2014-7#ixzz373hoCqrW

xchrom

(108,903 posts)

The household mobility rate, or the percent of the population that moves into a new home in a year, has been in a long term decline. This trend has been unfavorable for the housing market, which in turn has been a drag on GDP.

According to Michelle Meyer at Bank of America Merril Lynch, the household mobility rate has been slowing since the mid-1980s,

A key driver of this trend has been the rise of homeownership in the 1990s. Homeowners are less like to move than renters. It's much more expensive for homeowners to move because of broker fees, transaction costs, mortgage fees, insurance and so on.

From 2000 on, aging population and changes in the labor market have also been negative for household mobility.

Read more: http://www.businessinsider.com/us-long-term-decline-in-household-mobility-2014-7#ixzz373ie75HV

xchrom

(108,903 posts)(Reuters) - Complaining they had worked without pay for months late last year, employees of the Serbian farming company Agroziv staged a short strike in January. Why should they work for no money, they said. The company, a poultry producer in the north of the country, was short of cash and pleaded for more time to pay wages, workers said.

"The management told us, 'Please be patient for another two weeks,’” said Vesna Srdic, a packaging worker with the firm. “We waited and nothing happened. Some workers grew so desperate they were buying bread on credit from local bakers. But after some months even bakers refused to give them bread for nothing."

Patience ran out on June 4. Using chains and padlocks, Agroziv employees locked every door and gate they could find on company property. Then they blocked a main road leading to the border with Romania for two hours.

"My salary is 29,000 dinars ($343) a month and I haven't received a penny since January. I'm drowning in debt," Milica Milkovic, 52, said last month. The mother of two, dressed in a faded red T-shirt was waving a banner that read, "We want answers." Agroziv did not respond to requests for comment.

Read more: http://www.businessinsider.com/r-special-report-all-work-and-no-pay-for-thousands-in-the-balkans-2014-10#ixzz373k0NmxP

xchrom

(108,903 posts)

Markets are getting walloped in Europe. And it looks like the U.S. is heading lower.

Dow futures are down 136 points.

S&P 500 futures are down 15 points.

Nasdaq futures are down 29 points.

There has been a decent amount of bad news since Wednesday's U.S. markets closed. Fresh data out of France and Italy have economists concerned that those economies could be in the midst of contraction.

Read more: http://www.businessinsider.com/us-futures-falling-2014-7#ixzz373kYic4H

xchrom

(108,903 posts)BEIJING (Reuters) - More than half of China's foreign aid of over $14 billion between 2010 and 2012 was directed to Africa, the government said on Thursday, underscoring Beijing's interest in the resource-rich continent to fuel its economy.

Some Chinese projects have attracted attention for China's support of governments with poor human rights records and lack of transparency, such as Zimbabwe, Sudan and Angola.

It provided no breakdown of aid recipients or any yearly figures. In 2011, China put its total foreign aid over the past six decades at 256.29 billion yuan ($41.32 billion).

While the number pales in comparison with the United States' foreign aid, which is about $46 billion for fiscal 2015, China says its aid has no political strings attached, unlike many Western countries.

Read more: http://www.businessinsider.com/r-china-says-more-than-half-of-foreign-aid-given-to-africa-2014-10#ixzz373l6YPoF

xchrom

(108,903 posts)Industrial production in Italy unexpectedly dropped by 1.2% month-over-month in May.

Economists were forecasting a modest 0.2% gain.

"The surprising decline in industrial production in May throws doubt on the expected Italian recovery in the second quarter," said Bloomberg's Maxime Sbaihi and David Powell.

This report follows disappointing industrial production and inflation data out of France earlier today.

Read more: http://www.businessinsider.com/italy-industrial-production-2014-7#ixzz373nxrdci

xchrom

(108,903 posts)The rate on Portugal's benchmark 10-year bond rose sharply on Wednesday amid concern over one of the country's biggest banking groups, an analyst said.

In afternoon trading on secondary government debt markets, the rate, or yield reached 3.778 percent, compared with 3.648 percent at the close of trade on Tuesday.

"Portuguese assets are under pressure in general, something that might stem from the banking sector," commented Cyril Regnat, a bond strategist at the French bank Natixis.

Earlier in the day, the financial news agency Bloomberg quoted Banco Espirito Santo (BES), the biggest Portuguese bank by capitalisation, as announcing delays in payments of short term debt by its parent holding company.

Read more: http://www.businessinsider.com/portugese-bank-espirito-santo-concerns-raises-interest-rates-2014-7#ixzz373s5cSDX

xchrom

(108,903 posts)NEW YORK (Reuters) - In one of the largest tests of a novel way to deliver and pay for healthcare, insurer CareFirst BlueCross BlueShield announced on Thursday that 1.1 million people receiving care through its "patient-centered medical homes" last year were hospitalized less often and stayed for fewer days compared to patients in traditional fee-for-service care.

Medical homes, a centerpiece of President Barack Obama's healthcare reform, have been heralded as one of the best hopes for reducing the cost of U.S. healthcare, the highest in the world, and improving its quality, which lags that of many other wealthy countries.

Medical homes are basically groups of primary-care providers who pledge to coordinate care, adhere to guidelines meant to improve patients' health, and avoid unnecessary tests, among other steps.

According to CareFirst, its medical home program, in its fourth year, also delivered high-quality care, measured by yardsticks such as whether doctors gave recommended cancer screenings and immunizations. The organization said it saved $130 million or 3.5 percent compared to projected spending under standard fee-for-service.

Read more: http://www.businessinsider.com/r-new-form-of-us-healthcare-saves-money-improves-quality-one-insurer-finds-2014-10#ixzz373splYsG

xchrom

(108,903 posts)NEW YORK (Reuters) - German lender Commerzbank AG is expected to pay between $600 million and $800 million to resolve investigations into its dealings with Iran and other countries under U.S. sanctions, sources familiar with the matter said.

The penalty, previously reported to be more than $500 million, includes a demand from New York's top banking regulator, Benjamin Lawsky, for more than $300 million from the bank, the sources said.

Other U.S. authorities, including the Department of Justice, the Treasury Department, the Federal Reserve and the Manhattan District Attorney, are also involved in the talks.

Among the violations being investigated are Commerzbank's transactions for the Islamic Republic of Iran Shipping Lines, one of the sources said.

Read more: http://www.businessinsider.com/r-exclusive-commerzbank-may-pay-600-million-800-million-to-settle-us-probe---sources-2014-09#ixzz373ubgkca

xchrom

(108,903 posts)Chinese exports climbed 7.2% year-over-year in June, missing expectations for a 10.4% rise. This compared to a 7% rise in May.

Meanwhile, Chinese imports were up 5.5%, missing expectations for a 6% rise. But this is up from a 1.6% contraction the previous month.

Chinese trade surplus widened to $36.95 billion, from $35.92 billion, but missed expectations for $26.95 billion.

Economists were looking for a much bigger rise in exports on the back of improving external demand and a lower base last year. Moreover, improving domestic demand was expected to boost imports.

Read more: http://www.businessinsider.com/june-china-exports-rise-72-2014-7#ixzz373zsK45c

xchrom

(108,903 posts)Crazy. Not sure what to make of this, but Japan just posted a nearly 20% drop in private sector machine tools.

According to Zerohedge, it was the biggest drop in history.

Expectations were for a gain of 1.1%.

Anyway, the Nikkei is barely moving, so the market isn't freaked out. Still, crazy number.

Read more: http://www.businessinsider.com/japan-machine-tools-2014-7#ixzz3740dr05Y