Economy

Related: About this forumSTOCK MARKET WATCH - Friday, 27 January 2012

[font size=3]STOCK MARKET WATCH, Friday, 27 January 2012[/font]

SMW for 26 January 2012

AT THE CLOSING BELL ON 26 January 2012

[center][font color=red]

Dow Jones 12,734.63 -22.33 (-0.18%)

S&P 500 1,318.43 -7.62 (-0.57%)

Nasdaq 2,805.28 -13.03 (-0.46%)

[font color=red]10 Year 1.93% -0.04 (-2.03%)

30 Year 3.09% -0.04 (-1.28%)

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

[HR width=95%]

[center]

[/center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red]

Demeter

(85,373 posts)But I demand equal time for the opposition.

Tansy_Gold

(17,847 posts)Until I found the Davos "social responsibility" one.

Today, on the other hand, had several good ones.

Demeter

(85,373 posts)But it isn't any more.

Tansy_Gold

(17,847 posts)There's still no party for the poor, and now there isn't one for the middle class either. THEY'RE BOTH FOR THE FILTHY FUCKING RICH.

bread_and_roses

(6,335 posts)DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Morgan Stanley (MS) Chairman and Chief Executive Officer James Gorman said employees understand why the investment bank had to cut pay, and those who don’t grasp the reasoning need to adjust their attitude.

“You’re naive, read the newspaper, No. 1,” Gorman said he would tell miffed employees, speaking in an interview on Bloomberg Television. “No. 2, if you put your compensation in a one-year context to define your overall level of happiness, you have a problem which is much bigger than the job. And No. 3, if you’re really unhappy, just leave. I mean, life’s too short.”

Morgan Stanley is reducing pay for senior investment bankers and traders by an average of 20 percent to 30 percent, people with knowledge of the decision said last week. The New York-based firm is also capping immediate cash bonuses at $125,000 as it defers a greater share of awards, a person briefed on the plan said.

“The world has changed and the banking industry has gone through a fundamental change, and we have to readjust,” Gorman said from Davos, Switzerland, where he’s attending the World Economic Forum’s annual meeting. “When we come out of this and we start re-performing, obviously compensation will reflect that. Until then, we have to respect the fact that shareholders have to get paid, too.”

WHAT IS THIS WORLD COMING TO? NEXT THING YOU KNOW, HE'LL BE TELLING THE WHIZ KIDS THAT THERE'S NO SANTA CLAUS, EASTER BUNNY, OR TOOTH FAIRY....MORE BAD NEWS AT LINK

Demeter

(85,373 posts)What seems fairly obvious is that the law calls for MF Global to file a Chapter 7 bankruptcy in which customers are given seniority to creditors, rather than a Chapter 11 non-broker bankruptcy in which the customer interests are not upheld. The rationale for Chapter 11 has always seems to be contrived to favor a particular creditor bank. Prior CFTC rulings and 'Rule 190' seems to have dealt with this in the past. Statements by various CFTC commissioners of late also seem to suggest that customers absolutely have a senior claim to any assets.

Why then did the SEC, with Gary Gensler's purported assent, seem to ignore the precedent and their own rules and cut a deal in a secret meeting to favor the Banks, specifically JP Morgan? The personal involvement of Gary Gensler seems a little ambiguous based on the facts at hand, but it is obvious that the bankruptcy filing is being mishandled, and the SEC and CFTC are doing too little to represent the interests of the customers.

Obviously this should be more explicitly addressed and the customers need to be relieved of this travesty of justice. President Obama may speak brave words in his speeches, but the actions of his Administration show that there is little teeth in their supposed championing of the public interest over the powerful interests of Wall Street. Actions speak louder than words.

MFGFacts

Last week we witnessed lawyers dueling in the bankruptcy court on the details of exactly what code of law supports customer priority in liquidation of the parts of MF Global Holdings, and gosh!….is the Holdings is even a broker ? Why are lawyers debating these questions at this late date?

First we’ll cover what started the fight and then move onto the genesis of why it has come to this so far into the proceedings. Do stick with the story as it might sound like legal minutiae, but does have everything to do with recovery of customer funds.

It started with the Sapere Wealth Management, LLC assertions (among others) that the MF Global estate must be administered under 17 C.F.R paragraph 190. Remember paragraph 190 as you will hear more about this in the next weeks. Applying this clause of the bankruptcy code to the liquidation of MF Global Holdings would assure customer priority in the liquidation of MFGH, which is also claimed to have taken customer assets out of MFGI, the commodity brokerage unit of the Holdings company, MFGH — before and after the bankruptcy.

That all customer property as defined in paragraph 190 of the code, must be returned to commodity customers free and clear of other claims is also supported by others parties, including the CFTC. The CFTC, however, also asserts that existing principles of law are available to ensure this, but first the court needs to make “antecedent determinations.” In other words, the CFTC legal team is playing the adult and indicating that we already have the laws on the books to deal with this once the court figures out what laws it wants to use.

So why is the question if MFGH is even a broker so important? Again, the key paragraph 190, which legally secures customer priority and distributions can only be applied to a brokerage Chapter 7 bankruptcy, which is used for brokerage bankruptcies, but was not used for MFGH, which is the holding company of MFGI. MFGH was filed as a Chapter 11 bankruptcy. This Bankruptcy Code is used for non-broker entities, seeking re-organization.

Also, and to use the words of the Sapere plea to the court, “A decision by the court that 17 C.F.R §190 applied to MFGH’s estate can, among other things, obviate the need for titan law firms representing MFGH and MFGI, respectively, to engage in battles with one another funded by “other people’s money,” i.e., at substantial costs to the estates of MFGH and MFGI.”

The ability to use many millions of customer funds locked in the estate to pay trustees and their “titan” law firms representing MFGH and MFGI is possible because the bankruptcy was filed as a Chapter 11 for the Holdings and Chapter 11 SIPC filing for MFGI, the commodity brokerage, and not under Chapter 7 for both.

As regular readers know, from the start of this sorry saga, MFGFacts.com has focused on the questions around why a Chapter 11 SIPC bankruptcy with almost non-existent securities accounts when neither SIPC nor Chapter 11 address brokerage liquidations. Additionally, Chapter 11 is the choice when a restructuring is planed, which is not so with MFGH.

A Breaking Investigative Report

Fortunately, these question are now receiving greater scrutiny in the industry press as we read in this investigation published last week by Mark Melin of Opalesque Futures Intelligence who contacted MFGFacts.com while conducting his investigation, Sold Out: How A Private Meeting Between Regulators Gave Away MF Global Investor Protections. In short, as Melin reports, “Deciding upon a Securities industry SIPA liquidation process for an FCM over the Commodity Exchange Act (CEA) liquidation and section 7 of the US Bankruptcy Code was a legal maneuver with far reaching consequences for customers with segregated funds and property with custodial banks. The selected SIPA liquidation does not recognize fund segregation or futures industry account regulations. The process considerably favors creditors.”

In other words, when the SEC threw the liquidation process to SIPC under for a Chapter 11 securities liquidation, and with the CFTC’s immediate agreement (under the conflicted Chairman Gensler who had not yet to recuse himself from MF Global issues), a framework of law was chosen where customers were — for the very first time ever — made creditors and their assets thrown into the entire MF Global estate. Many say what! And the industry is now asking how?

According to the report, the speculation is this: Robert Cook, SEC Director of Division and Trading and Markets is said to have been the lead regulator at the key meeting, the details of which are still not public. “Before joining the SEC, Mr. Cook was a partner at the powerful Washington D.C. law firm of Cleary Gottlieb Steen & Hamilton LLP, which represents JP Morgan, among other clients,” Melin reported. We all know that JP Morgan is the largest creditor to MF Global Holdings. Readers may reach their own conclusions about that. Yet, making the liquidation of MF Global Holdings and its parts a Chapter 11 and SIPC bankruptcy, set the stage for expensive dueling among lawyers over the fact if MF Global is even a broker or not. This also and — most importantly — tremendously enhanced the recovery position for non-customer creditors over all customers.

The CFTC Warned in the 1980s of Potential for Abuse and Problems when Bankruptcy Codes Conflict with a Duel Registered Entity

As Melin shares, that the CFTC – to the agency’s great credit — recognized and dealt with this problem: Citing the exemplary record in the futures industry in the event of bankruptcies, former CFTC Director of the CFTC Division of Trading, Andrea Corcoran writes in a January 1993 issue of Futures International Law Letter “As early as 1980, however, concerns were expressed about the ability to retain this record in the event of the bankruptcy of a dually-licensed firm – that is, a firm registered as both a futures commission merchant (FCM) and a securities broker-dealer.”

To rectify this, the CFTC then drafted rules we find under then now famous Part 190 where Corcoran writes, “In the final rules, the Commission noted that Section 7(b) of SIPA (read Securities Investors Protection Act) …proved that a trustee in a SIPA liquidation shall be subject to the same duties as a trustee in a commodity broker bankruptcy under Subchapter IV of Chapter 7 of the Code.”

The CFTC was well prepared for a MF Global-like event. Against this background, and as Melin also reports, the choice of a Chapter 11 SIPC bankruptcy code for the liquidation of a futures broker, makes Chairman’s Genslers “give away” even more baffling. We’d call it a throw away and ask if Chairman Gensler invited a single CFTC attorney into that early hour meeting before agreeing to file MFGI under MFGH as a Chapter 11 SIPC bankruptcy? Regardless, with that decision the fate was sealed. And not only were customers and the industry severely damaged, but there was a complete disregard of the decades of work, preparation and public service by the many professionals in the CFTC to which Chairman Gensler was entrusted.

And now we have the spectacle of “titanic” lawyers in one of the largest bankruptcies ever arguing if an entity is a broker or not.

AnneD

(15,774 posts)These people cannot see past their own dicks. These are selfish little brats that need to go to their corners and adults need to step in.

By filing it the way they have...which is illegal, they are activating the golden rule-he who has the gold rules. They are killing their own market. What investor in their right mind would open a brokerage account if their money could be stolen from them so easily.

The more I read about this the more I am looking to heat up some tar and by a few feather pillows. No wonder the presstitutes are keeping their pie holes closed on this one.

I have had some dealings with some financial folks of late. I ask them if they have been following the MFGlobal events. The answer has been disheartening, but when you think that you have to dig to get any info...it is really not suprising. I tell them to look it up.

My broker's young assistant came back to me. He was rightly appalled and thanked me for telling him to follow up. Now, he has all the brokers licenses' so he has more knowledge than I. Even he goes green when we talk about it now. He is worried about the future of his career if this continues. I tell him to just keep his eyes wide open.

Demeter

(85,373 posts)We are educating the country, one person at a time...

Demeter

(85,373 posts)Petition Calling on Federal Reserve and Financial Stability Oversight Committee to Break Up Bank of America

January 25, 2012 — Bank of America, the second-largest bank holding company in the U.S., should be broken up and reformed, Public Citizen said in a petition sent today to the Federal Reserve and the Financial Stability Oversight Council. Regulators should to use authority granted by section 121 of the Dodd-Frank Wall Street Reform and Consumer Protection Act to reform Bank of America into a set of smaller, simpler and safer institutions. Bank of America, which holds assets equal to roughly one-seventh of the country’s gross domestic product, is too large and complex to manage or regulate properly, the petition said. Moreover, its financial condition is poor and could deteriorate rapidly.

Demeter

(85,373 posts)... a considerable portion of the value of a deal lies in releases (waivers of liability) or other provisions that might not seem all that important to the party signing away its rights. Bloomberg reports that the state of Arizona has told the court that Bank of American is undermining the state’s investigation of its loan modification practices. The probe comes out of a 2010 lawsuit which alleged that Countrywide misled customers about its loan modification policies. So what did Bank of America do? It apparently gave mortgage mods to some (many?) of the people who had complained to state officials and had them sign an agreement not to say anything about the deal or disparage Bank of America. Per Bloomberg:

The borrower “will remove and delete any online statements regarding this dispute, including, without limitation, postings on Facebook, Twitter and similar websites,” and not make any statements “that defame, disparage or in any way criticize” the bank’s reputation, practices or conduct, according to documents filed in state court in Phoenix….

“These agreements have completely silenced even the most communicative consumers,” Matthews said in the filing. “The settlement agreement purposefully makes it impossible, legally and practically, for a consumer signing it to come forward, voluntarily and promptly, to provide evidence in this case.”

She asked a state judge to order Bank of America to notify borrowers who signed the agreements that they don’t have to adhere to the confidentiality and non-disparagement provisions.

This is all very entertaining. Remember, first, that it is not uncommon for parties to put provisions in contracts that are not enforceable in the hope they can snooker the unsophisticated into thinking they have to respect them. For instance, some landlords will try putting a “no roommates” clause in their rental contracts when New York city rent regulations allow tenants to take roommates. In addition, many confidentiality agreements contemplate that the parties might be compelled by judicial order to break the agreement; they contain clauses requiring the party subpoenaed to inform the other party to give them the chance to try to block the order. But there was apparently no language like that in these provisions that would clue presumably unsophisticated borrowers into the idea that these agreements could be superceded by court action.

Bank of America has amusingly adopted contradictory responses to being caught out. On the one hand, its formal response argues that these gag orders are “plain vanilla” that it uses “on an every day basis to resolve disputes”. In other words, this sort of language is perfectly routine and BofA use it all the time. Yet it ALSO said it uses it on a “limited” basis to settle disagreements and forestall costly lawsuits. Similarly, Bloomberg reports:

“We look at each situation on a case-by-case basis and decide what to do based on the specific situation,” Shirley Norton, a Bank of America spokeswoman, said in an e-mail.

Huh? First, they can’t have it both ways. Either they use this provision normally in mortgage mods or not. They seem to be muddying the water by bringing in ALL disputes the bank enters into. Yes, in a bank as big as Bank of America, I’d suspect they are just about never creating new legal language for a customer disagreement, so by definition any language could be characterized as “routine”. But the germane question is not how often it is used across the bank, but whether this is standard practice in mortgage mods. If not, it would confirm the Arizona AG’s allegations regarding intent. In addition, how would this sort of gag order help BofA avoid costly lawsuits? Only if borrowers broadcast the info: “Heh, BofA told me incorrectly I had to default to get a HAMP mod, and they started to foreclose when they didn’t get a permanent mod, and I was talking to the AG’s office and they were super interested. And funny, BofA changed their tune and gave me really nice mod like X.” And that still isn’t a lawsuit (readers are welcome to tell me what scenario IN THIS CASE they think I’ve missed).

The point here is the AG has a point: despite BofA’s pleading, it looks like it was doing what it could (which may not have been all that much, given how badly organized most servicers are) to make its little bad servicing problem go away before the AG got to unhappy borrowers. If I were the judge, I’d have a lot of trouble with BofA’s wounded tone. Most of them are smart enough to see through pretenses of wounded innocence.

Demeter

(85,373 posts)http://www.nakedcapitalism.com/2012/01/yes-virginia-servicers-lie-to-investors-too-175-billion-in-loan-losses-not-allocated-to-mortgage-backed-securities-and-another-300-billion-on-the-way.html

The structured credit analytics/research firm R&R Consulting released a bombshell today, and it strongly suggests that prevailing prices on non-GSE (non Freddie and Fannie) residential mortgage backed securities, which are typically referred to as “private label” are considerably overvalued. R&R Consulting described how the reports presented to RMBS investors show losses at the loan level (which is super eye-numbing detail in the investor reports) that have NOT been allocated to the bonds:

In addition, R&R estimates that approximately $175 billion of losses already incurred on the loans have not yet been allocated to the bonds in the related transactions. Failure to allocate realized loan losses could distort the valuation of related RMBS tranches.

In the course of conducting valuations on RMBS, the R&R analytics team discovered widespread, serious, repeated data discrepancies. Ann Rutledge, a founding principal, asked the team to measure the magnitude of the discrepancy on the RMBS universe. To do this, R&R subtracted cumulative losses allocated to the tranches from unallocated, expected losses, calculated as the sum of defaults, bankruptcies, foreclosures and REOs minus recoveries. “The results were very disturbing: $175 billion of unallocated current losses and $300 billion of imminent losses,” Rutledge said.

Now you might say, how can investors NOT know this is happening? Have you ever looked at an investor report on MBS? They are really really nerdy. Summary stuff up front, tons of pages of detail. Now bond fund managers are presumably paid to care about nerdy stuff like this, but I have spoken to some MBS lifers who have gone to the buy side, and they tell me that the level of expertise among MBS investors is not high....But, but, but….some of you are protesting….surely these errors are just innocent mistakes? That’s a nice theory, but the numbers are huge, and the “mistakes” happen to line up with more profit for servicers:

Translation: when the servicers don’t write down the bonds in a securitization to allow for ACTUAL and pretty certain losses, the effect is that junior tranches show artificially high balances (remember, as losses occur, the effect is to wipe out tranches from the bottom of the securitization up. The riskiest tranche fails first, then the next riskiest, and so on). Servicers ALSO advance principal and interest to bondholders when borrowers quit paying, in theory up to the mortgage balance (we’ve seen cases where advances exceeded the mortgage balance). Then when they foreclose and liquidate the loan, the servicer reimburses himself for the advances and his fees and foreclosure costs first. So, if they report artificially high balances in junior tranches, they are paying interest to investors who don’t deserve it. The result, when the foreclosure occurs and the real estate is sold, is that the interest overpayment to the junior bondholders reduces the monies that should have gone to the senior bondholders. Oh, and those junior bondholders are more likely to be hedgies, and those senior bondholders are more likely to be pension funds, bond fund (the sort that you might hold in your 401 (k) and insurers. The costs to the insurance industry alone means that this is not a fat cat investor issue but affects all of us (losses to insurers eventually lead to higher insurance premiums to compensate for the shortfall in investment income).

Demeter

(85,373 posts)http://www.commondreams.org/view/2012/01/26-3

While many of us are working to ensure that the Occupy movement will have a lasting impact, it’s worthwhile to consider other countries where masses of people succeeded in nonviolently bringing about a high degree of democracy and economic justice. Sweden and Norway, for example, both experienced a major power shift in the 1930s after prolonged nonviolent struggle. They “fired” the top 1 percent of people who set the direction for society and created the basis for something different.

A march in Ådalen, Sweden, in 1931.

Both countries had a history of horrendous poverty. When the 1 percent was in charge, hundreds of thousands of people emigrated to avoid starvation. Under the leadership of the working class, however, both countries built robust and successful economies that nearly eliminated poverty, expanded free university education, abolished slums, provided excellent health care available to all as a matter of right and created a system of full employment. Unlike the Norwegians, the Swedes didn’t find oil, but that didn’t stop them from building what the latest CIA World Factbook calls “an enviable standard of living.”

Neither country is a utopia, as readers of the crime novels by Stieg Larsson, Kurt Wallender and Jo Nesbro will know. Critical left-wing authors such as these try to push Sweden and Norway to continue on the path toward more fully just societies. However, as an American activist who first encountered Norway as a student in 1959 and learned some of its language and culture, the achievements I found amazed me. I remember, for example, bicycling for hours through a small industrial city, looking in vain for substandard housing. Sometimes resisting the evidence of my eyes, I made up stories that “accounted for” the differences I saw: “small country,” “homogeneous,” “a value consensus.” I finally gave up imposing my frameworks on these countries and learned the real reason: their own histories.

Then I began to learn that the Swedes and Norwegians paid a price for their standards of living through nonviolent struggle. There was a time when Scandinavian workers didn’t expect that the electoral arena could deliver the change they believed in. They realized that, with the 1 percent in charge, electoral “democracy” was stacked against them, so nonviolent direct action was needed to exert the power for change.

In both countries, the troops were called out to defend the 1 percent; people died. Award-winning Swedish filmmaker Bo Widerberg told the Swedish story vividly in Ådalen 31, which depicts the strikers killed in 1931 and the sparking of a nationwide general strike. (You can read more about this case in an entry by Max Rennebohm in the Global Nonviolent Action Database.)

The Norwegians had a harder time organizing a cohesive people’s movement because Norway’s small population—about three million—was spread out over a territory the size of Britain. People were divided by mountains and fjords, and they spoke regional dialects in isolated valleys. In the nineteenth century, Norway was ruled by Denmark and then by Sweden; in the context of Europe Norwegians were the “country rubes,” of little consequence. Not until 1905 did Norway finally become independent.

When workers formed unions in the early 1900s, they generally turned to Marxism, organizing for revolution as well as immediate gains. They were overjoyed by the overthrow of the czar in Russia, and the Norwegian Labor Party joined the Communist International organized by Lenin. Labor didn’t stay long, however. One way in which most Norwegians parted ways with Leninist strategy was on the role of violence: Norwegians wanted to win their revolution through collective nonviolent struggle, along with establishing co-ops and using the electoral arena.

In the 1920s strikes increased in intensity. The town of Hammerfest formed a commune in 1921, led by workers councils; the army intervened to crush it. The workers’ response verged toward a national general strike. The employers, backed by the state, beat back that strike, but workers erupted again in the ironworkers’ strike of 1923–24.

The Norwegian 1 percent decided not to rely simply on the army; in 1926 they formed a social movement called the Patriotic League, recruiting mainly from the middle class. By the 1930s, the League included as many as 100,000 people for armed protection of strike breakers—this in a country of only 3 million!

The Labor Party, in the meantime, opened its membership to anyone, whether or not in a unionized workplace. Middle-class Marxists and some reformers joined the party. Many rural farm workers joined the Labor Party, as well as some small landholders. Labor leadership understood that in a protracted struggle, constant outreach and organizing was needed to a nonviolent campaign. In the midst of the growing polarization, Norway’s workers launched another wave of strikes and boycotts in 1928.

The Depression hit bottom in 1931. More people were jobless there than in any other Nordic country. Unlike in the U.S., the Norwegian union movement kept the people thrown out of work as members, even though they couldn’t pay dues. This decision paid off in mass mobilizations. When the employers’ federation locked employees out of the factories to try to force a reduction of wages, the workers fought back with massive demonstrations.

Many people then found that their mortgages were in jeopardy. (Sound familiar?) The Depression continued, and farmers were unable to keep up payment on their debts. As turbulence hit the rural sector, crowds gathered nonviolently to prevent the eviction of families from their farms. The Agrarian Party, which included larger farmers and had previously been allied with the Conservative Party, began to distance itself from the 1 percent; some could see that the ability of the few to rule the many was in doubt.

By 1935, Norway was on the brink. The Conservative-led government was losing legitimacy daily; the 1 percent became increasingly desperate as militancy grew among workers and farmers. A complete overthrow might be just a couple years away, radical workers thought. However, the misery of the poor became more urgent daily, and the Labor Party felt increasing pressure from its members to alleviate their suffering, which it could do only if it took charge of the government in a compromise agreement with the other side.

This it did. In a compromise that allowed owners to retain the right to own and manage their firms, Labor in 1935 took the reins of government in coalition with the Agrarian Party. They expanded the economy and started public works projects to head toward a policy of full employment that became the keystone of Norwegian economic policy. Labor’s success and the continued militancy of workers enabled steady inroads against the privileges of the 1 percent, to the point that majority ownership of all large firms was taken by the public interest. (There is an entry on this case as well at the Global Nonviolent Action Database.)

The 1 percent thereby lost its historic power to dominate the economy and society. Not until three decades later could the Conservatives return to a governing coalition, having by then accepted the new rules of the game, including a high degree of public ownership of the means of production, extremely progressive taxation, strong business regulation for the public good and the virtual abolition of poverty. When Conservatives eventually tried a fling with neoliberal policies, the economy generated a bubble and headed for disaster. (Sound familiar?)

Labor stepped in, seized the three largest banks, fired the top management, left the stockholders without a dime and refused to bail out any of the smaller banks. The well-purged Norwegian financial sector was not one of those countries that lurched into crisis in 2008; carefully regulated and much of it publicly owned, the sector was solid.

Although Norwegians may not tell you about this the first time you meet them, the fact remains that their society’s high level of freedom and broadly-shared prosperity began when workers and farmers, along with middle class allies, waged a nonviolent struggle that empowered the people to govern for the common good.

************************************************************************************

This work is licensed under a Creative Commons Attribution-Share Alike 3.0 United States License

************************************************************************************

George Lakey is Visiting Professor at Swarthmore College and a Quaker. He has led 1,500 workshops on five continents and led activist projects on local, national, and international levels. Among many other books and articles, he is author of “Strategizing for a Living Revolution” in David Solnit’s book Globalize Liberation (City Lights, 2004). His first arrest was for a civil rights sit-in and most recent was with Earth Quaker Action Team while protesting mountain top removal coal mining. E-mail: [email protected]

Demeter

(85,373 posts)http://www.nakedcapitalism.com/2012/01/philip-pilkington-%E2%80%98does-capitalism-have-a-future%E2%80%99-%E2%80%93-why-the-financial-times-asks-all-the-wrong-questions-to-avoid-the-real-issues.html

...During the Great Depression – indeed, even after WWI – there was a serious alternative to capitalism. During the depression years the Soviet economy, under Stalin’s iron fist, was moving briskly, if brutally toward development and increased growth. Should social forces have begun to move in this direction in the West the elites had a ‘panic button’ that they could push. They could, if they were so inclined, move toward instituting a fascist system. Hitlerite economic policies – a peacetime Keynesianism never before or since matched in the Western world – were remarkably successfully and had largely warded off the German depression by 1936. Unpalatable as it may have been to many it was certainly looming in the background in the 1930s – and should the spectre of Communism have truly risen the elite would probably have reluctantly moved in this direction rather than see themselves expropriated (and perhaps not so reluctantly, since Hitler had quite a few fans in the British upper class prior to 1939). Figures such as Henry Ford in the US were keenly aware of what might have to be done to maintain the order of things in the event of large-scale social unrest.

Yes, this was a very different time; real and seemingly viable challenges to capitalism existed. No such challenges exist today...Various commentators run pieces that are… well… largely irrelevant. They assure us that capitalism will survive because there are no alternatives...realistically where is the Western capitalist system headed? Because this is a question that is as important as it is answerable.

...There’s a myth that goes around Keynesian and progressive circles that runs something like this: In November 1932, after three years of failed austerity policies by President Herbert Hoover, Franklin Delano Roosevelt was elected. FDR increased government spending, ushered in the New Deal era of Big Government and created America’s welfare state. These developments gave rise to a new sort of mixed economy that was to prove immune from depressions until it came under stress in the 1970s thanks to Vietnam-induced deficit spending and was taken apart by Reagan and the nefarious financial industry starting in 1980s.

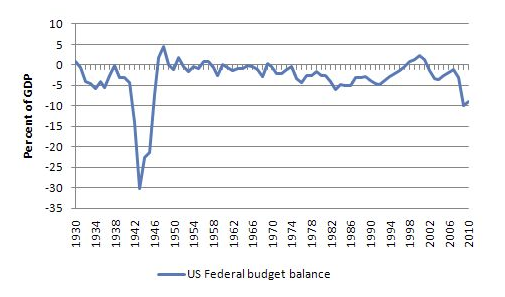

Nice story. Pity it’s not remotely true. If one looks at the actual history one finds that FDR’s anti-depression policies were a palliative at best. Roosevelt was terrified of unbalancing the budget too much and hostile to Keynes’ actual ideas. Indeed, after meeting FDR Keynes commented that he hoped the man would be better versed in economics. In 1937 FDR became scared of the unbalanced budget and withdrew spending – leading, predictably, to a massive recession. FDR’s public works programs were excellent, far beyond anything a US president seems capable of today. And he took a lot of flak from the business community for initiating them. But they did not open the deficits nearly enough to pull the economy out of recession. Just look at the actual deficits run by the FDR administration in the 1930s – they were smaller than the today’s deficits! In truth – and as the shrewd reader will already have seen clearly in the above graph – it was WWII that ended the depression. WWII gave politicians and policymakers the gall to unbalance the budget sufficiently to restore the economy. It also gave them the space to rejig the taxation system in a way that made it far more sustainable. If anyone objected, well, they were moving against the war effort, anti-patriotic and hence excluded from the debate.

MORE HISTORY AND ANALYSIS AT LINK...GOOD READ AND RESOURCE

Demeter

(85,373 posts)Some of the world's biggest companies are in the running for an award that none of them actually wants. This Friday, two will be singled out as the biggest offenders of the year for "contempt for the environment and human rights". Six have made the shortlist – one voted for by the public, the other by the organisers of the Public Eye awards, Greenpeace and the Swiss economic justice group the Berne Declaration.

- Barclays Capital is described as "arguably the fastest-growing food speculator worldwide" and "contributing to sharp rises and falls that cause hunger and poverty." And Samsung is cited for allegedly failing to protect factory workers from banned and highly toxic substances.

- Another nominee is the Japanese energy company Tepco, which runs the Fukushima nuclear plant – it is accused of "wilful negligence" in compromising safety to reduce costs.

- The Swiss agrochemical giant Syngenta is shortlisted for selling Paraquat, banned in Europe, in the developing world.

- And the US mining corporation Freeport McMoran makes the list for allegedly running the world's largest gold and copper mine, in West Papua, "without regard for nature or people".

- Another contender is the Brazilian conglomerate Vale, involved in a major dam project that could have "devastating consequences" for the Amazon.

Perhaps, unsurprisingly, only half the nominees responded to requests for comment. Samsung said it takes its workers' wellbeing "very seriously"....And at Barclays Capital, a spokeswoman said: "We act as an intermediary for our clients globally. A considerable number of studies have demonstrated that financial flows have little or no impact on commodities prices. The factors influencing food prices are complex and multiple." Whatever the outcome, it is unlikely any of the firms will show up to claim their award.

Demeter

(85,373 posts)Political scientist Tom Ferguson agreed with our dim take of the news reports last night on the formation of a “new” financial fraud commission on mortgage abuses (which is actually just part of an existing fraud commission that has done squat). He also saw the apparent co-optoins of New York’s Eric Schneiderman as an effort to rein in the attorneys general that oppose the mortgage settlement.

If you are concerned and skeptical as I am, PLEASE write or call Schneiderman’s office. While it is unlikely to derail this particular train, it does not hurt Schneiderman know that you recognize this as a likely Faustian bargain.

Reader DS sent this note as an example:

Having admired the integrity with which you have supported the rule of law

related to Wall St shenanigans and the mortgage crisis, I find it deeply distressing to read the following:

http://www.nakedcapitalism.com/2012/01/is-schneiderman-selling-out-signs-up-to-co-chair-committee-designed-to-undermine-defectors-to-mortgage-settlement-deal.html

I hope/trust that you will not ‘sell out’.

You can call Schneiderman’s office at 800-771-7755

Demeter

(85,373 posts)Jury watches video of Allen Stanford where he blamed Wall Street “greed” and the “stupidity” of underwriting standards on the sharp stock market fall in 2008

Read more >>

http://link.ft.com/r/XYEWFF/IIT8KN/IEP5S/IIFQVB/KQB9DQ/RF/t?a1=2012&a2=1&a3=27

Demeter

(85,373 posts)The Global Financial Markets Association plans to reinvent itself to give the world’s biggest lenders a new voice on the regulatory stage

Read more >>

http://link.ft.com/r/XYEWFF/IIT8KN/IEP5S/IIFQVB/AMR5VR/RF/t?a1=2012&a2=1&a3=27

Demeter

(85,373 posts)Delegates seem to be taking the prospect of war seriously amid rising concern over Tehran’s intentions and the response of Israel and Arab states

Read more >>

http://link.ft.com/r/UXDMSS/KQBOCY/9MEOW/SPGPQ9/KQBSI9/B7/t?a1=2012&a2=1&a3=27

Demeter

(85,373 posts)Officials once spoke in riddles and did not announce their actions. A transparent Fed is likely to be Mr Bernanke’s most enduring legacy, but he may be the last of the almighty Fed chairmen

Read more >>

http://link.ft.com/r/UXDMSS/KQBOCY/9MEOW/SPGPQ9/7A97VQ/B7/t?a1=2012&a2=1&a3=27

I DISBELIEVE EVERY PREMISE AND CONCLUSION IN THIS RIDICULOUS POLICY AND THE INTERPRETATIONS LAID UPON IT

Demeter

(85,373 posts)The Federal Reserve has moved closer to embarking on a new round of its controversial money-pumping after the central bank and its chairman Ben Bernanke highlighted a grim outlook for the U.S. economy. Bernanke on Wednesday opened the door a bit wider for the Fed to return to buying securities in the months ahead to buttress a weak recovery and keep inflation from slipping too far below its newly adopted 2-percent target.

"It sounds like the finger is on the trigger," said Thomas Simons, a money market economist at Jefferies & Co.

The Fed's announcement that it was unlikely to raise interest rates until at least late 2014, more than a year beyond its previous guidance, immediately pushed down Treasury bond yields and Bernanke's comments to the media raised expectations of a further round of so-called quantitative easing, or QE3.

It remains to be seen if the potential political backlash proves too daunting...The prospect of the Fed pumping yet more money into the U.S. economy was seized upon by Republican hopeful Newt Gingrich to slam President Barack Obama's record. That highlighted the political pitfalls for the Fed in an election year.

Demeter

(85,373 posts)Warren Mosler recently ran a very succinct account of why the Fed/Bank of England’s easy monetary policies – that is, the combination of Quantitative Easing and their Zero Interest Rate Programs – might actually be killing demand in the economy. Mosler’s argument runs something like this: when interest rates hit the floor they suck interest income payments that might flow to rentiers and savers. And no, we’re not just talking about Johnny Moneybags refusing to buy his daughter a new Prada handbag (which, say what you will, creates job opportunities). We’re also talking about regular savers and, as the Fed recently noted, pension funds seeing their income fall – not to mention certain industries, like insurance, finding their profits lowered (and hence their premiums raised?).

Mosler sums it up well:

Lowering rates in general in the first instance merely shifts interest income from ‘savers’ to borrowers. And with the federal government a net payer of interest to the economy, lowering rates reduces interest income for the economy.

He then goes on to make the point that we’d have to see borrowers spending more than savers to see any real stimulative effect on the real economy. But alas, such is probably not the case.

In her seminal book The Accumulation of Capital – truly a forgotten classic of 20th century economics, right up there with Keynes’ General Theory – Joan Robinson trashes out the implications of falling interest rates. Of the investor she writes:

Demeter

(85,373 posts)German Chancellor Angela Merkel appealed to business leaders at the World Economic Forum to give policy makers the space they need to tackle the debt crisis, pledging that Europe will pull together and restore confidence.

“I would like to ask all of you who are here as the representatives of the business community” to recognize how democratic governments work and to “please take the long-drawn- out processes with a degree of acceptance,” Merkel said in a question-and-answer session after opening the forum yesterday in Davos, Switzerland.

Merkel’s comments underscore her shift in approach to taming the debt crisis now in its third year, having ditched rhetoric about conducting a “battle” between markets and politicians. At the same time, Merkel rejected adding any new money to fight the crisis and reiterated the need to curb debt and deficits while boosting competitiveness as the main thrust of her strategy to keep the 17-nation euro area together.

“Europe will become more attractive once we have conquered this crisis, and I’m absolutely convinced that we will be able to master this crisis,” she said. European leaders will discuss measures to raise competitiveness and create growth and jobs at their Jan. 30 summit and again in March, she said...

POOR ANGELA! FACTS ARE SUCH NASTY, INTRACTABLE THINGS

Demeter

(85,373 posts)NEW DELHI: A reputed Israeli intelligence website has claimed that India is opting for gold to repay crude oil supplies from Iran. Given the US and EU embargo on Iran, payment in hard currency, such as the US dollar or euro, is very difficult; hence, this barter...

xchrom

(108,903 posts)Demeter

(85,373 posts)and it's cold, damp and gloomy. They promised us sun for today! Liars.

xchrom

(108,903 posts)in the winter -- even mild winters -- i treasure having some sun.

xchrom

(108,903 posts)he Pentagon revealed a bit more of its defense budget today, and, really, the proposed cuts in spending amount to no big deal. It would be hard to justify not making these cuts. If Congress winds up wanting to cut deeper, there’s plenty of room for more hacking.

First, a word of caution: There are many ways to calculate a “cut,” and some will no doubt invoke a few to claim that the Obama administration’s cuts are severe. Let’s go to the numbers.

In his press conference today, Secretary of Defense Leon Panetta said that he will request $525 billion for fiscal year 2013—plus $88 billion for “overseas contingency operations” (aka the wars in Afghanistan and elsewhere, the costs for which have generally been considered separately from the baseline budget).

Some hawks will no doubt scream that this constitutes a cut of $45 billion, or 8 percent—a substantial rip for a single year. But this claim is at best misleading. It’s true that, a year ago, the Pentagon projected that the budget for FY 2013 (at the time, two years out) would be $571 billion.

xchrom

(108,903 posts)There is a lot to digest in a recent series of events on the Prosecuting Wall Street front – the two biggest being Barack Obama’s decision to make New York Attorney General Eric Schneiderman the co-chair of a committee to investigate mortgage and securitization fraud, and the numerous rumors and leaks about an impending close to the foreclosure settlement saga.

There is already a great debate afoot about the meaning of these two news stories, which surely are related in some form or another. Some observers worry that Schneiderman, who over the summer was building a rep as the Eliot Ness of the Wall Street fraud era, has sold out and is abandoning his hard-line stance on foreclosure in return for a splashy federal posting.

Others looked at his appointment in conjunction with other recent developments – like the news that Tim Geithner won’t be kept on and Obama’s comments about a millionaire’s tax – and concluded that Barack Obama had finally gotten religion and decided to go after our corruption problem in earnest.

At the very least, Obama’s recent acts were interpreted as a public move toward economic populism: if the president was looking to associate himself with that word, he did a good job, since there were literally hundreds of headlines about Obama’s "populism" the day after his State of the Union speech.

Read more: http://www.rollingstone.com/politics/blogs/taibblog/is-obamas-economic-populism-for-real-20120126#ixzz1key9ZLLt

Demeter

(85,373 posts)And it's a little late to be changing minds.

As for Schneiderman, I think he's a big boy, and can take care of himself. I'm sure he's a quick learner....which is more than I can say for some people.

Demeter

(85,373 posts)I was crossing the overpass over 94, and the State troopers are blinking all over, and the exits are blocked...make way for the Presidential motorcade....Obama preaching to the U of M student body.

xchrom

(108,903 posts)The final decision is planned for the next European Union summit on Monday. There leaders from 26 of the 27 member states plan to finalize the new fiscal pact, the agreement pushed hard by Chancellor Angela Merkel requiring signatories to adhere to strict fiscal policy guidelines.

They are, by all accounts, rules that are long overdue. After all, the original common currency agreement, the Maastricht treaty, was signed 20 years ago. Now, it is to be given teeth. Or is it?

Because Chancellor Angela Merkel pushed the reform through almost entirely on her own, the new accord reflects a number of German suggestions. Each country that signs must introduce legal limits on budget deficits -- a so-called debt brake. If they exceed the structural debt limit of 0.5 percent of gross domestic product (GDP), the debt brake mechanism will automatically go into effect, and they will face fines from the European Court of Justice.

But the high expectations awakened by Merkel are unlikely to be fulfilled. Several elements in the agreement are of questionable legality. It can't be written as an EU treaty because Great Britain won't sign it, which means it will only be an "inter-governmental agreement" between the 17 euro-zone countries and a handful of other countries participating voluntarily.

xchrom

(108,903 posts)n his State of the Union address, many heard echoes of the Barack Obama of old, the presidential aspirant of 2007 and 2008. Among the populist pledges rolled out in the speech was tough talk against the too-big-to-fail banks that have funded his campaigns and for whom many of his key advisers have worked: “The rest of us are not bailing you out ever again,” he promised.

President Obama also made a striking announcement, one that could have been written by the Occupy Wall Street General Assembly: “I’m asking my attorney general to create a special unit of federal prosecutors and leading state attorneys general to expand our investigations into the abusive lending and packaging of risky mortgages that led to the housing crisis. This new unit will hold accountable those who broke the law, speed assistance to homeowners and help turn the page on an era of recklessness that hurt so many Americans.”

Remarkably, President Obama named New York Attorney General Eric Schneiderman as co-chairperson of the Unit on Mortgage Origination and Securitization Abuses. Schneiderman was on a team of state attorneys general negotiating a settlement with the nation’s five largest banks. He opposed the settlement as being too limited and offering overly generous immunity from future prosecution for financial fraud. For his outspoken consumer advocacy, he was kicked off the negotiating team. He withdrew his support of the settlement talks, along with several other key attorneys general, including California’s Kamala Harris, an Obama supporter, and Delaware’s Beau Biden, the vice president’s son.

In an op-ed penned last November, Schneiderman and Biden wrote, “We recognized early this year that, though many public officials—including state attorneys general, members of Congress and the Obama administration—have delved into aspects of the bubble and crash, we needed a more comprehensive investigation before the financial institutions at the heart of the crisis are granted broad releases from liability.”

xchrom

(108,903 posts)Recent headlines of a brighter economic picture have given many people hope that the economy is not in another free fall. GDP growth did tick upward in the last quarter. But for many communities the picture is enduringly dark, because unemployment rates have lagged far behind the national average for years and will likely continue to do so.

While the President is putting forth a plan to help students pay off their student loans, more and more educated students are unable to find employment. Contrary to popular belief, an educated workforce doesn't really make a difference (areas with many college grads are actually doing worse than areas with fewer) and a diversified economy does not always mean a more thriving economy.

A Place Near You?

There are 216 defined metropolitan (metro) and micropolitan (micro) areas—with populations ranging from 10,000 to 4 million—that have had unemployment rates at least two percentage points higher than the national average for either 20, 10, or 5 years (see tables 1, 2, 3 at the end of this article). These are America’s dead zones. Here employment growth is stagnant or non-existent and high levels of joblessness dominate. Some areas were once prosperous while others have recently experienced economic distress. In these communities paid work is hard to find for those who have not given up looking, and widespread involuntary idleness is the norm.

Poor employment prospects are not related to periods of recession or prosperity; these communities have not had substantial and sustainable increases in employment for lengthy stretches. America’s dead zones can not be described as containing “weak labor markets” because many have had long term unemployment problems that are more than weak and not temporary. Even in zones with only 5 years of high unemployment, the prior years were hardly marked by robust job growth.

Demeter

(85,373 posts)I don't think so.

Ghost Dog

(16,881 posts)

Ghost Dog

(16,881 posts)BERLIN (dpa-AFX) - Germany's import price inflation eased sharply and for a third consecutive month in December, data from the Federal Statistical Office showed Friday. Inflation eased to 3.9 percent in December from 6 percent in November and 6.8 percent in October. Economists expected the rate to be 3.8 percent. On a monthly basis, the index rose 0.3 percent compared to 0.4 percent increase in the previous month. This was in line with economists' forecasts. The index of import prices rose 8 percent on an annual average in 2011 compared with 2010. This was the highest price increase since 2000, the statistical office said. The index of import prices, excluding crude oil and mineral oil products, was on an annual average 5.1 percent above the level of 2010.

/... http://www.finanznachrichten.de/nachrichten-2012-01/22547926-german-import-price-inflation-eases-sharply-in-december-020.htm

Ghost Dog

(16,881 posts)MADRID (dpa-AFX) - Retail sales in Spain continued fall in December, as stringent austerity measures across the country dampened consumer spending. Data from the statistical office Ine showed Friday that sales at retail outlets declined 6.2 percent year-on-year at constant prices in December, faster than the expected 5.5 percent decline. This followed a 7.3 percent fall in the previous month.

/... http://www.finanznachrichten.de/nachrichten-2012-01/22548533-spanish-retail-sales-continue-to-decline-020.htm

xchrom

(108,903 posts)Spain’s unemployment rate rose to 22.9 percent, the highest in 15 years, increasing pressure on Prime Minister Mariano Rajoy to deliver on his election pledge to create jobs in a shrinking economy.

The unemployment rate rose in the fourth quarter from 21.5 percent in the previous three months, the National Statistics Institute in Madrid said today. That’s more than twice the euro- region average and exceeds the median estimate of 22.2 percent in a Bloomberg survey of seven analysts.

Unemployment “is the main source of vulnerability of the Spanish economy and this is something that we hope to start to fix in the short term,” Economy Minister Luis de Guindos said today on Bloomberg Television in Davos, Switzerland. “We have to take a lot of decisions because there are some things that don’t work properly in the labor market in Spain.”

Spain is home to a third of the euro region’s unemployed, according to the European Union’s statistics office, which estimates that half of young Spaniards are out of work. The People’s Party government, which won the Nov. 20 election after a campaign focused on jobs, has promised to overhaul labor and wage rules in the next two weeks to prompt companies to hire.

xchrom

(108,903 posts)German Chancellor Angela Merkel praised Spanish Prime Minister Mariano Rajoy's austerity drive Thursday, saying after meeting with him in Berlin that she has "great respect" for his government's efforts to cut the country's budget deficit and tackle sky-high unemployment.

Rajoy traveled to the German capital ahead of the European Union summit on Monday to convince Merkel that he was able to deal with Spain's economic problems. "We have great respect for \[Spain's drive\]," Merkel said. "Sometimes these are steps that are not easy to take, and we wish him a lot of luck."

Rajoy was expected to press the German chancellor into giving Spain some breathing room in bringing down the country's deficit, which was at eight percent of GDP at the end of 2011, to the official target of 4.4 percent by the end of the year, implicating about 40 billion euros in public spending cuts in the middle of a recession.

"The government of Spain is committed to reducing its deficit," Rajoy said. "I am absolutely convinced that one cannot spend more than what one needs." The Popular Party prime minister has pledged to cut the country's deficit to meet the target.

xchrom

(108,903 posts)There have been large demonstrations in the three provincial capitals

Marches were held in the three provincial capitals in the Valencia region on Thursday night, called to demonstrate against the cuts from the regional administration, but attracting many calls against Francisco Camps, the ex President of the region who was found not guilty in the Gürtel suits case on Wednesday night.

A popular chant was ‘Eo, Eo , Eo, Camps al talego’, ‘Guilty, Guilty’ and ‘How much did the jury cost?’. The march in Valencia passed by the door of Francisco Camps’ home.

The protests were called by the five unions, CCOO, CSIF, FSES, Intersindical and UGT, and all the protests ended at the headquarters and sub headquarters of the Valencia Government.

The Valencia march, of some 100,000 people according to the unions, caused long delays to traffic in the evening rush hour and restricted access was seen to the V35, A3, V21 and V31.

Read more: http://www.typicallyspanish.com/news/publish/article_33518.shtml#ixzz1kfqsIxPu

Roland99

(53,342 posts)2011 U.S. GDP rises 1.7% vs. 3.0% in 2010

Personal savings rate drops to 3.7% from 3.9%

Business inventories increase by $56 billion

Business investment rises 1.7% in fourth quarter

Fourth-quarter U.S. GDP climbs 2.8%

Personal spending rose 2.0% last quarter

PCE price index increases 0.7%, or 1.1% core

Real disposable income up 0.8% in quarter

U.S. exports climb 4.7%, imports rise 4.4%

Government spending declines at all levels

Ghost Dog

(16,881 posts)Q4 GDP Misses Estimates, Inventory Stockpiling Accounts For 1.9% Of 2.8% Q4 US Economic Growth

The US economy grew at a 2.8% annualized pace in the supposedly blistering fourth quarter, yet the number was a disappointment not only in that it missed estimates of 3.0% (and far higher whisper numbers) but when one looks at the components, where a whopping 1.94% of the upside was attributable to a rise in inventories as restocking took place. And as everyone knows in this day and age a spike in inventories only leads to sub-cost dumping a few months later. In other words, the economy grew at a 0.8% pace ex inventories. Yet for all intents and purposes, this is considered "growth." Personal consumption was also weaker than expected coming in at 2.0% on estimates of 2.4%. Perhaps the only silver lining was Core PCE which came at 1.1% on expectations of 0.9%, however as discussed extensively before, this was driven by an unsustainable surge in credit-binge spending, primarily for iStore trinkets, and is hardly sustainable especially as the US Savings Rate fell to 3.7% in the fourth quarter, the lowest since Q4 2007...

/... http://www.zerohedge.com/news/q4-gdp-misses-estimates-inventory-stockpiling-accounts-19-28-q4-us-economic-growth

Roland99

(53,342 posts)Ghost Dog

(16,881 posts)CANBERA (dpa-AFX) - Asian stocks swung between gains and losses before ending mostly higher on Friday as the Fed's decision to provide some policy certainty outweighed concerns surrounding Greece's debt talks. The markets in China and Taiwan remain closed for the Lunar New Year holidays. Former U.S. Federal Reserve Governor Kevin Warsh said the dovish stance of the central bank and recent policy activism may adversely affect the U.S. economic expansion in the long run. The Fed's latest pledge to keep interest rates near zero through 2014 isn't seen as a 'guarantee' that 'reacquaints consumers with bad habits, ' Warsh reportedly said in a speech in Stanford, California. Tokyo stocks erased initial gains as weak earnings results clouded the earnings outlook for Japanese companies. The benchmark Nikkei eased 0.1 percent while the broader Topix index shed half a percent...

... Commodity-related stocks advanced, with Inpex, Itochu and Marubeni gaining around 3 percent each after commodities rallied overnight in the wake of Fed's pledge to keep interest rates near zero at least until the middle of 2013. Australian shares posted modest gains, as traders returning from a holiday the day before lapped up miners, encouraged by strong gains in commodity prices overnight. The benchmark S&P/ASX 200 closed 0.4 percent higher while the broader All Ordinaries index advanced half a percent...

... South Korea's Kospi averaged finished 0.4 percent higher, with caution ahead of a busy earnings season limiting further upside. Foreign funds extended their buying streak for the 12th consecutive session despite downbeat data which showed the South Korean economy grew at its slowest pace in two years in the fourth quarter of 2011, as Europe's lingering debt problems damped demand for exports from the region...

... Elsewhere, India's Sensex was last trading up a percent, Hong Kong's Hang Seng rose 0.3 percent, Indonesia's Jakarta Composite edged up marginally and Singapore's Straits Tims was up 0.8 percent...

/... http://www.finanznachrichten.de/nachrichten-2012-01/22549330-asian-stocks-post-modest-gains-on-fed-stance-020.htm

Ghost Dog

(16,881 posts)LONDON | Fri Jan 27, 2012 12:54pm GMT (Reuters) - World stocks hovered near a 5-1/2 month high on Friday as investors anticipated an imminent conclusion to Greek debt talks while lower Spanish bond yields and a fall in Italy's six-month borrowing costs also supported the euro.

Sentiment was also buoyed by expectations that upcoming U.S. data would show the world's largest economy grew at its fastest pace in nearly two years at the end of 2011. . Stock futures pointed to a steady market open on Wall Street...

... The MSCI world equity index .MIWD00000PUS, which has gained more than 5 percent in January, erased earlier losses to stand unchanged on the day.... European stocks .FTEU3 inched up to also hover at five-month highs while emerging stocks .MSCIEF rose further to new three-month peaks. U.S. stock futures S&P 500 inched up 0.01 percent, while Dow Jones futures rose 0.1 percent and Nasdaq 100 futures were up 0.4 percent at.

Brent crude oil rose 0.3 percent to $111.65 a barrel. Bund futures were little changed after hefty gains on Thursday...

/... http://uk.reuters.com/article/2012/01/27/uk-markets-global-idUKTRE80M23K20120127

xchrom

(108,903 posts)International Monetary Fund Managing Director Christine Lagarde maintained pressure on Greece’s private creditors to produce a better offer to reduce the nation’s debt burden in a bond swap being negotiated.

“Until now it was not appropriate to accept the creditors’ offer, so I’m pleased to see they’re back to the drawing board,” Lagarde told Bloomberg Television today in Davos, Switzerland.

Creditors, led by the Institute of International Finance’s Charles Dallara, are pursuing talks with the Greek government on a debt swap to lower Greece’s borrowings and avert a collapse of the economy. Greek Prime Minister Lucas Papademos will meet Dallara today at 6:30 p.m. in Athens.

European Union Economic and Monetary Affairs Commissioner Olli Rehn said separately in Davos that authorities are “very close” to reaching an agreement on a private-sector involvement in Greece this month. An agreement may come “if not today, then over the weekend,” he said.

xchrom

(108,903 posts)Leaders of the world’s biggest banks touted the virtues of austerity at the World Economic Forum in Davos -- for themselves, not just for over-indebted governments.

Many arrived in the Swiss Alps following a year marked by weak revenue, declining stock prices and cuts in jobs and compensation. The finance and banking industries remain the “least trusted” for the second consecutive year, according to a 20-country survey released earlier this week by public relations firm Edelman.

“Last year every bank thought they could grow their way out of trouble,” Huw van Steenis, who oversees European bank research for Morgan Stanley (MS) in London, said between meetings with investors and policy makers in Davos. “Now they realize they have to shrink their way out of trouble.”

Financial companies, mainly in Western Europe and the U.S., have announced more than 238,000 job cuts since last year’s meeting in Davos, according to data compiled by Bloomberg. Bank of America Corp. (BAC), Deutsche Bank AG (DBK), and HSBC Holdings Plc (HSBA) are among banks selling businesses and slimming down as they adapt to capital requirements approved by the Basel Committee on Banking Supervision, new national regulations and a slowdown in economic growth in Europe.

***

Ghost Dog

(16,881 posts)Loge23

(3,922 posts)Don't want to catch whatever they have.

Then again, we haven't quite shook off the last bout of the green flu.

xchrom

(108,903 posts)In the wake of austerity measures, on 20 January, Mario Monti’s government launched a vast plan for deregulation which aims to generate new jobs and open protected sectors of the economy to competition. However, the professions concerned, led by taxi drivers and truckers, have responded with mass protests.

Make way for deregulation. Business opening hours have already been extended [since 1 January shops can stay open 24 hours a day]. Administrative obstacles that blocked entry into a wide range of highly regulated sectors have been removed: pharmacies, taxis, newsagents, self-employed professions etc. In short, a wave of competition is about to break over the Italian peninsula.

To understand the scope of these measures, you have to bear in mind the dichotomy that has emerged over the years between the protected sectors of the Italian economy and those that are exposed to international competition, in particular competition from developing countries.

More competition implies advantages for customers

Sectors open to competition, that is to say almost all of the manufacturing sector and certain segments of the tertiary sector (market services) have seen major upheavals over the last 20 years: enormous price pressure, increased competition on foreign and domestic markets, the ongoing need to innovate etc.

Demeter

(85,373 posts)The US economy grew 2.8 per cent in the final three months of 2011 as consumers ramped up spending and businesses boosted production.

The commerce department’s initial reading of gross domestic product growth in the fourth quarter missed economists’ expectations of a 3 per cent annualised pace, following the third quarter’s tepid 1.8 per cent increase.

Read more >>

http://link.ft.com/r/6NPSBB/QNCME7/B49CK/TU8LDJ/JEHFFX/SN/t?a1=2012&a2=1&a3=27

xchrom

(108,903 posts)If the sorry parade of European poodles - or what analyst Chris Floyd delightfully dubbed Europuppies - had any understanding of Persian culture, they would have known that blowback for their declaration of economic war in the form of an Iranian oil embargo would be nothing short of heavy metal.

Better yet; death metal. The Majlis (Iranian parliament) will discuss this Sunday, in an open section, whether to cancel right away all oil exports to any European country that approved the embargo - according to Emad Hosseini, the rapporteur of the Majlis Energy Committee. And that comes with the requisite apocalyptic warning, relayed via the Fars news agency, courtesy of member of Parliament Nasser Soudani: "Europe will burn in the fire of Iran's oil wells."

Soudani expresses the views of the whole Tehran establishment

when he says that "the structure of their [Europe's] refineries is compatible with Iran's oil", and so Europeans have no alternative as replacement; the embargo "will cause an increase in oil prices, and the Europeans will be compelled to buy oil at higher prices"; that is, Europe "will be compelled to buy Iran's oil indirectly and through intermediaries".

According to the EU sanctions package, all existing contracts will be respected only until July 1 - and no new contracts are allowed. Now imagine if this pre-emptive Iranian legislation is voted within the next few days. Crisis-hit Club Med countries such as Spain and especially Italy and Greece will be dealt a deathblow, having no time to find a possible alternative to Iran's light, high-quality crude.

Ghost Dog

(16,881 posts)... The world needs a digital Herodotus to decode how these European poodles who claim to represent "civilization" were able, in a single stroke, to inflict simultaneous pain on Greece - the cradle of Western civilization itself - and Persia - one of the most sophisticated civilizations in history. In an astonishing historical replay of tragedy as farce, it's as if Greeks and Persians were bonded together at the Thermopylae facing the onslaught of North Atlantic Treaty Organization armies.

Hit the Eurasian groove

Now compare it with the action all across Eurasia. Russian Foreign Minister Sergey Lavrov said, "Unilateral sanctions don't help matters". The Ministry of Foreign Affairs in Beijing, exercising immense tact, nevertheless was unmistakable; "To blindly pressure and impose sanctions on Iran are not constructive approaches."

Turkey's Foreign Minister Ahmet Davutoglu said, "We have very good relations with Iran, and we are putting much effort into renewing Iran's talks with the 5+1 [Iran Six - the United Nations Security Council permanent members plus Germany] mediators' group. Turkey will continue looking for a peaceful solution to the issue.”

BRICS member India - alongside Russia and China - also dismissed sanctions. India will keep buying Iranian oil and paying in rupees or gold. South Korea and Japan will inevitably extract exemptions from the Barack Obama administration.

All across Eurasia trade is fast moving away from the US dollar. The Asian Dollar Exclusion Zone, crucially, also means that Asia is slowly disengaging itself from Western banks...

/... http://www.atimes.com/atimes/Middle_East/NA28Ak05.html

Demeter

(85,373 posts)This is one time where I'm glad to be supported by "experts".

xchrom

(108,903 posts)Even as the economy slowly picks up, finding a job is harder than ever for teenagers, according to a national study released on Tuesday. That’s likely because the jobs that are being "created" in recent months are being snapped up by adults—often people over age 50 who were laid off from other positions or forced out of retirement during the economic crisis. Meanwhile, funding for youth jobs has suffered because of state and local budget crises, and significant "stimulus" funding for youth jobs and training under the American Recovery and Reinvestment Act has now expired.

The study, by researcher Andrew Sum at the Center for Labor Market Studies at Northeastern University in Boston, looks at teen employment over time through "jobless" numbers rather than "unemployment" numbers, since unemployment figures don’t include youth who are not actively looking for work. As with adults, since it has become harder and harder to get a job many youth have given up and hence dropped from the unemployment figures.

A press release for the report says:

The teen employment rate declined by 19 percentage points, or more than 40%, nationally from 1999-2000 to 2011, falling to 26, the lowest rate since World War II… The figures are bleakest for African-American teens in the city of Chicago, of whom 90 percent are jobless, including 93 of every 100 teens from families with incomes under $40,000; upper-middle-income whites were nearly four times as likely to hold a job, the data show.

Demeter

(85,373 posts)The US economy grew 2.8 per cent in the final three months of 2011 as consumers ramped up spending and businesses boosted production.

The commerce department’s initial reading of gross domestic product growth in the fourth quarter missed economists’ expectations of a 3 per cent annualised pace, following the third quarter’s tepid 1.8 per cent increase.

Read more >>

http://link.ft.com/r/6NPSBB/QNCME7/B49CK/TU8LDJ/JEHFFX/SN/t?a1=2012&a2=1&a3=27

wobblie

(61 posts)xchrom

(108,903 posts)#

America power polarization affected world geopolitics and global economy; what will be the future? @saxby08 @senBobCorker @NitaLowey #davos

by wef via twitter 1/27/2012 5:18:25 PM 12:18 PM

#

Now Live #WEF: The Future of American Power with @Saxby08, @SenBobCorker and @NitaLowey wef.ch ^ml

by wef via twitter 1/27/2012 5:15:01 PM 12:15 PM

#

Future of American Power in the 21st Century: #wef #davos wef.ch Watch it live bit.ly

by wef via twitter 1/27/2012 5:12:51 PM 12:12 PM

#

More on the Greek deal. Finance Minister Evangelos Venizelos says there is just one step left to complete the debt swap deal.

by Reuters_RossChainey1/27/2012 5:12:03 PM 12:12 PM

Demeter

(85,373 posts)Last week Thomas Edsall had a column in the New York Times where he directly stated that the difference between conservatives and liberals is the extent over which they are willing to reverse market outcomes to redistribute money from winners to losers:

“...the two sides are fighting over what the role of government in redistributing resources from the affluent to the needy should and shouldn’t be."

This was annoying not only because it is so seriously wrong, but also because this statement came from one of the more astute observers of American politics alive today. Anyone trying to understand the role of the government in the economy should know that whatever it does or does not do by way of redistribution is trivial compared with the actions it takes to determine the initial distribution. Rich people don’t get rich exclusively by virtue of their talents and hard work; they get rich because the government made rules to allow them to get rich.

To take an obvious example, according to the Centers for Medicare and Medicaid Services we spend close to $300 billion a year on prescription drugs. If drugs were sold in a free market, without government-granted patent monopolies, we would spend around $30 billion a year. The difference of $270 billion a year is more than five times as much money as is at stake with extending the Bush tax cuts to the wealthy. By making us pay far more for drugs, the government’s patent policy is redistributing a huge amount of money from ordinary people to the shareholders and top executives of the drug companies. We need a way to finance drug research, but there are far more efficient mechanisms than patent monopolies that don’t redistribute income upwards in the same way.

In a similar vein our policy on labor unions is incredibly one-sided in management’s favor. If a company illegally fires a worker for trying to organize a union, the complaint would go to the National Labor Relations Board (NLRB). It is likely to take months and possibly years before the complaint is settled. Even if the worker can prove their case (employers rarely admit that they fired someone because they were organizing a union) the fine to the company is trivial. As a result, breaking the law and getting rid of agitators can be very profitable for the company....On the other hand, if workers stage a strike that violates the law, for example a wildcat strike at a time when a contract is in force or a secondary strike in support of other workers, a company can typically get an injunction immediately. If the workers continue their strike, their assets will be seized and their leaders thrown in jail....Needless to say, this incredible asymmetry tilts the field in management’s favor. It is difficult for workers to organize unions and it is often difficult for organized workers to push for better wages and working conditions. That is not just a market outcome; this is the result of deliberate government policy.

The downturn we are currently suffering through is also the result of government policy. This is for two reasons. First, we got here because of the ineptitude of top policymakers in failing to recognize the housing bubble and the risks that it posed to the economy. The Federal Reserve Board just stood back and let the housing bubble grow to a size where its collapse would inevitably wreck the economy. Furthermore, once the bubble burst, the Fed, Congress, and the White House have opted not to take the actions needed to restore full employment. While the Fed has taken steps to boost the economy, it certainly could have done more. Similarly, Congress did not approve a large enough stimulus package to offset the hit from the collapse of the housing bubble. And, President Obama and the Fed have not tried to push down the value of the dollar to make U.S. goods more competitive in world markets. A lower-valued dollar could create millions of new jobs, most of which would be in manufacturing. However, because an over-valued dollar benefits powerful interest groups, like the financial sector, policy makers have been willing to allow the dollar to remain over-valued at the cost of millions of jobs for ordinary workers.