Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 28 September 2012

[font size=3]STOCK MARKET WATCH, Friday, 28 September 2012[font color=black][/font]

SMW for 27 September 2012

AT THE CLOSING BELL ON 27 September 2012

[center][font color=green]

Dow Jones 13,485.97 +72.46 (0.54%)

S&P 500 1,447.15 +13.83 (0.96%)

[font color=black]Nasdaq 3,136.60 0.00 (0.00%)

[font color=red]10 Year 1.65% +0.01 (0.61%)

30 Year 2.84% +0.03 (1.07%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,847 posts)Or something like that.

At any rate, I will be up in the air most of Friday, flying to the east coast to visit daughter and son-in-law and grandson, then spend a few days BY MYSELF at Cape May.

Never fear, however, I will have the trusty laptop with me and SMW shall continue uninterrupted! (I hope. . . . )

Fuddnik

(8,846 posts)And don't get bitten on the behind by any hungry sharks or Governors.

Demeter

(85,373 posts)You are the only person I know who would vacation in Joisey.

rfranklin

(13,200 posts)As in past decades, today’s visitors come to Cape May for surf and sun on the wide, white beaches. They come for the restaurants—from casual eateries like the Mad Batter and George’s Place to upscale classics like the Ebbitt Room and the Washington Inn. They come for Cape May’s two Equity theater companies: Cape May Stage and the East Lynne Theater Company. They come for the shopping, the Victorian architecture, the historic attractions and the natural beauty, including unparalleled bird-watching (read story here). Visitors even come year-round, thanks to Cape May’s steady diet of seasonal events.

These days visitors also come for the scene, whether it’s poolside cocktails at the Ocean Club Hotel or wine and tapas at Martini Beach—where last summer actress Anne Hathaway let loose karaoke-style to Journey’s “Don’t Stop Believin’” and K.T. Tunstall’s “Suddenly I See.” (Hathaway, who grew up in Millburn, is a longtime summer visitor.)

http://njmonthly.com/articles/jerseyshore/destination-cape-may.html

Tansy_Gold

(17,847 posts)Cape May is the country's oldest seaside resort and the entire town is a National Historic Landmark. The area is also well known for birding, and is lesser known as the birthplace of Paul Volcker.

Roland99

(53,342 posts)start training for my new job next week!

Last day on the job here, hard to leave but the new opportunity was too good to pass up.

Fuddnik

(8,846 posts)Pack snowshoes and good luck!

Demeter

(85,373 posts)More like Kracow....

Demeter

(85,373 posts)I thought you bought a house in Florida?

It's running in the 60's daily, 40's at night. For this week, at least.

DemReadingDU

(16,000 posts)Roland99

(53,342 posts)I'll be flying back to FL in exactly one from about right now.

So, what's the weather up there like right now? Do I need my bomber jacket? I'm assuming my flip flops won't be the best? ![]()

Ghost Dog

(16,881 posts)(Reuters) - The FTSE 100 looked to end a bullish third quarter on a high on Friday, with investors focusing on hopes that the euro zone's debt worries will ease further in the final months of 2012. At 9:40 a.m., the FTSE 100 index was up 17.66 points, or 0.3 percent, at 5,797.08, having closed 0.2 percent higher on Thursday after Spain unveiled a crisis budget mostly based on spending cuts.

The budget was welcomed by EU Economic and Monetary Affairs Commissioner Olli Rehn and many think it will have pre-empted any conditions Europe may put on an international bailout, making any application for such aid easier.

"It's the end of the week, the end of the month and the end of the quarter, so you're going to have a lot of portfolio adjustment ahead of that, but there's been a positive reaction to the Spanish budget," Michael Hewson, senior markets analyst at CMC Markets said.

/... http://uk.reuters.com/article/2012/09/28/uk-markets-britain-stocks-idUKBRE8710BE20120928

Euro-anxiety swells ahead of Spanish banks’ stress tests

FXstreet.com (Barcelona) - Euro sentiment has turned 180 degrees in the second half of the week, triggered by the rosy news coming from a well-received Spanish budget figures for 2013, pointing to 4.5% deficit of the GDP.

Ahead in the day, markets are eager to know the final results of the stress tests run by O.Wyman. Previous estimates expects the banks would need between €60 billion and €70 billion, in comparison with the results posted in June along with agency R.Berger, ranging from €51 billion and €62 billion. Other opinions believe that these figures would come absolutely short when takes into account the recent increase in non-performing loans to levels close to €170 billion...

... In the opinion of many analysts, the late upbeat news in the markets, plus better-than-expected results out of the stress tests would prepare the scenario for a full bailout, amidst increasing rumours of a ratings cut to the country by agency Moody’s.

/... http://www.fxstreet.com/news/forex-news/article.aspx?storyid=f0d738a9-1435-4c63-9ea0-47abc7fa2101

Spain's banks to hear extent of property crash damage

... The audit of the 14 banks that account for 90 per cent of Spain's banking sector will show capital needs of between 55 billion euros and 60 billion euros, a source with direct knowledge of the matter said...

... The Spanish big three - BBVA, Santander and Caixabank - are expected to emerge with no capital needs identified. Most of the European rescue money, 40 billion to 45 billion euros, will go to nationalized savings banks Bankia, NovaGalicia, Catalunya Caixa and Banco de Valencia. The biggest questions to be answered in the audit are around the capital needs of Popular and two other commercial banks, Sabadell and Bankinter, as well as four savings banks, Banco Mare Nostrum, Kutxabank, Ibercaja-Liberbank-Caja 3, Unicaja-CajaEspaña/Duero. Together the seven are set to take a total of 15 billion to 20 billion euros in the European aid, but some may not need any...

/... http://uk.reuters.com/article/2012/09/26/us-spain-banks-audit-idUKBRE88P14220120926

Germany's big worry: China, not Greece

Berlin, not Brussels, will decide the future of the ailing eurozone because Germany's economic power and its status as the European Union's main paymaster give it an effective veto over key decisions.

So it comes as a surprise to find that in Berlin's corridors of power, the main worry is not whether Greece sticks to its reform pledges or Spain demands an EU bailout.

As the world's third largest exporting nation, Germans are far more concerned about whether China loses its appetite for their machine tools and cars, or about what the famed Teutonic manufacturers should make in the year 2030...

... While other European countries still debate whether Greece should be allowed to stay in the eurozone after failing to meet targets to cut public spending, privatize state assets and open up its economy, officials in Berlin say Germany has already quietly decided to let Athens remain.

"Chancellor Merkel was much more interested in throwing Greece out six months ago, but not now, even though their credibility is close to zero", one official said. "If you want to know why, look at North Africa and the eastern Mediterranean. With all that's going on there, who wants a NATO member on the southeastern border of the EU to turn into a failed state ?"...

/... http://uk.reuters.com/article/2012/09/19/us-germany-nation-idUSBRE88I07W20120919

Demeter

(85,373 posts)but we have a continuing resolution to get us through till....March!

It's time to cut Congressional Pay. Their productivity drops with each pay increase.

Ghost Dog

(16,881 posts)(Reuters) - President Francois Hollande's Socialist government unveiled sharp tax hikes on business and the rich on Friday in a 2013 budget aimed at showing France has the fiscal rigour to remain at the core of the euro zone.

The package will recoup 30 billion euros (24 billion pounds) for the public purse with a goal of narrowing the deficit to 3.0 percent of national output next year from 4.5 percent this year - France's toughest single belt-tightening in 30 years...

... To the dismay of business leaders who fear an exodus of top talent, the government confirmed a temporary 75 percent super-tax rate for earnings over one million euros and a new 45 percent band for revenues over 150,000 euros.

Together, those two measures will bring in around half a billion euros. Higher tax rates on dividends and other investments, plus cuts to existing tax breaks will bring in several billion more.

Business will be hit with measures including a cut in amount of loan interest which is tax-deductible and the cutting of an existing tax break on capital gains from certain share sales - moves worth around four billion and two billion euros each...

/... http://uk.reuters.com/article/2012/09/28/uk-france-budget-idUKBRE88R0AI20120928

mother earth

(6,002 posts)Ghost Dog

(16,881 posts)WASHINGTON (dpa-AFX) - Optimism on Wall Street seems to have tempered, with the confidence engendered by austerity measures proposed by Greece and Spain yesterday waning. Now the focus shifts to when Spain will seek a bailout that could help it avert a fiscal crisis. Markets also keenly await the results of a stress results being conducted on the Spanish banking system to see how vulnerable these institutions are. Some first tier economic data on consumer confidence, consumer spending and the manufacturing sector may also set the tempo for today's movement.

As of 6:15 am ET, the Dow futures are receding 32 points, the S&P 500 futures are moving down 2.90 points and the Nasdaq 100 futures are declining 4.50 points...

... On the economic front, the Bureau of Economic Analysis is due to release its personal income & outlays report for September. Economists expect the report, which is due out at 8:30 am ET, to show that personal income rose 0.2 percent, while personal spending is expected to have increased by 0.5 percent. In July, personal spending rose 0.4 percent.

The results of the Institute of Supply Management-Chicago's business survey for September are scheduled to be released at 9:45 am ET. Economists expect the business barometer index based on the survey to remained unchanged at 53.

Reuters and the University of Michigan are due to release the final report on the consumer sentiment index for September is scheduled at 9:55 am ET. The consumer sentiment index is expected to be downwardly revised to 79.

/... http://www.finanznachrichten.de/nachrichten-2012-09/24726497-wall-street-nervous-as-eurozone-concerns-simmer-020.htm

Demeter

(85,373 posts)Sheila Bair’s new book Bull by the Horns is out and based on early reports, it looks like it skewers the bailouts in general and Tim Geithner in particular. But it also gets a lot into the weeds in what still needs to be fixed in bank-land, which is a part of these crisis post-mortems and retrospectives that too often get short shrift.

Rolfe Winkler at the Wall Street Journal has an informative chat with her about the book and her experience during the crisis. Despite her understated demeanor, she says some pretty eye-opening stuff, for instance, that Geithner was on the phone all the time during the worst of the crisis with Citigroup chief Pandit, with the aim of end running her. She similarly gets in an adept dig at Geithner’s lack of oversight while at the NY Fed and his relationship with his mentor Bob Rubin who was then on Citi’s board, [s]fiddling while the bank burned[/s] pulling down over $10 million a year during his time with the bank. As William Cohan noted:

She also says that Andrew Ross Sorkin didn’t speak to her at all in his research on his book Too Big to Fail, which tried to depict Bair as “not a team player” (a kiss of death in big government jobs) and a grandstander.

Oh, and her book has a nice shout out to NC readers! And this should also tell you that signing petitions can actually be productive (hat tip Moe Tkacik):

VIDEO INTERVIEW OF BAIR AT LINK, TOO

Demeter

(85,373 posts)WHEN YOU REFUSE TO SELL YOUR REO, THE SUPPLY GETS CUT...SIMPLE SUPPLY/DEMAND CURVE FIDDLING.

http://thehill.com/blogs/on-the-money/1091-housing/258685-rising-home-prices-offer-hope-for-obama-on-economy

A new report showing home prices rising in 20 U.S. cities gave a boost to President Obama’s reelection chances on Tuesday.

The data amplified other reports that suggest the long-awaited recovery in the housing market is emerging six weeks before Election Day, and arrived alongside other encouraging news about increased consumer confidence and spending. The signs of a turnaround in housing are coming at a fortuitous time for President Obama, who is running for reelection in a campaign dominated by concerns about his management of the economy.

“You probably have a somewhat more positive picture going into the election than people might have been thinking, say, two months ago,” Dean Baker, the co-founder of the liberal Center for Economic and Policy Research, said Tuesday.

MAKES ME RATHER ILL TO THINK THIS PASSES FOR RATIONAL DISCUSSION...

Demeter

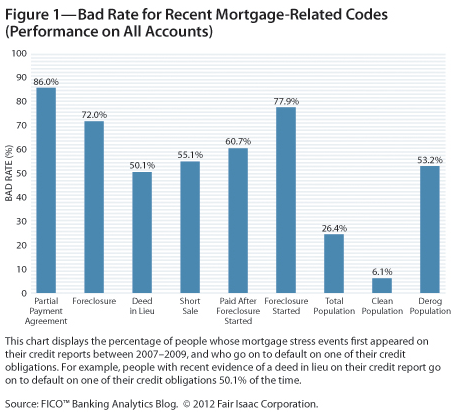

(85,373 posts)...a recent piece by FICO... warrants further discussion. The FICO article attempted to justify its position that someone who enters into a short sale gets his credit score dinged as badly as for a foreclosure. Yes, you read that correctly. One of the reasons many borrowers go to the effort to arrange a short sale, as opposed to the faster and easier process of “jingle mail” is that they assume that the damage to their credit score will be lower.

Here is the rationale, per FICO’s Banking Analytics blog (emphasis theirs):

…we conducted a study isolating more recent occurrences of mortgage stress events. By studying the subsequent performance of these borrowers on all accounts, we determined the credit risk associated with their mortgage events. Looking at data from October 2009 to October 2011, we were able to verify that short sales and other events of recent mortgage distress continue to represent a high degree of risk. These results closely match earlier studies of the risk associated with short sales and other events of mortgage stress.

As the graph below shows, short sales remain extremely risky. However, foreclosures have a bad rate of 72.0% while short sales have a better bad rate of 55.1%. Should that lead to less punitive treatment for short sales?

While it is true that short sales represent slightly better risk than foreclosures, they do not perform well enough to merit a more positive treatment in the FICO® Score. Here’s why. In the population we studied, one out of every two borrowers who experienced a short sale went on to default on another account within two years. That is exceptionally high risk. Additionally, the overwhelming majority of consumers with short sales have some other evidence of mortgage delinquency.

From a weighting perspective, all these mortgage events – short sale, foreclosure, deed in lieu – fall into the same heavyweight class, because they correlate with exceptional riskiness. They aren’t alone in that class either. Based on the data, consumers with short sales perform no better than consumers who have a severe delinquency (90+ days past due), a collection, or a derogatory public record (e.g., bankruptcy, tax lien, etc.) on file.

By comparison, only about one in every 50 borrowers with a score in the high 700s will default on one of their credit obligations. This strong separation of goods from bads is what makes FICO® Scores so useful.

Gee, even though there is a big difference between a 72% default rate and a 55.1% default rate (as in 30%), FICO says this doesn’t matter, 1 in 2 is so bad that they don’t care how much worse nearly 2 in 3 is relative to that.

But there is a pretty serious problem with their argument. Go look at the itty bitty print under that table. The people that are counted in this study first started looking wobbly in the 2007 to 2009 period. As readers may recall, that was during the big subprime reset period. Those folks were much less salvageable than the current wave of defaulters, who are being hit by traditional causes of default: job loss or wage reductions, divorce, medical emergency, with more than usual in the first category thanks to the lousy state of the economy.

A second reason that it’s dubious to apply conclusions from that period to now is servicers have changed their posture on short sales. Until very recently, they were uncooperative, to the point that in Los Angeles, homeowners would have state in their listings that they were not looking for a short sale because brokers would not even bother showing buyers those homes. They knew the banks would jerk them around and they didn’t want to waste their and their customers’ time. So anyone who got a short sale during this time period had to very persistent and/or very lucky (perhaps in a home with a mortgage on the bank’s balance sheet, where you’d see more willingness to reduce losses than on a serviced loan).

MORE AT LINK

otherone

(973 posts)I hope everyone has a great weekend

xchrom

(108,903 posts)

xchrom

(108,903 posts)

Assembly line worker Carrie Atwood moves a seat into position at the General Motors Hamtramck Assembly plant in Michigan Photograph: Paul Sancya/AP

The fragile state of the US's economic recovery was thrown into focus once more Thursday as the government announced growth was slowing and orders for long-lasting goods plunged in August, the latest sign of a weakening manufacturing sector.

US gross domestic product (GDP) – the broadest measure of the economy – grew at an annual rate of 1.3% between April and June, the commerce department said Thursday. The figure was revised down from a previously reported 1.7% gain.

Meanwhile the commerce department said durable goods orders fell 13.2% last month, the largest fall since January 2009. The measure of orders for goods designed to last three months or more is a key indicator of economic growth.

The decrease followed three consecutive monthly increases including a 3.3% rise in July. August's figure was a seasonally adjusted $198.49bn, the lowest dollar figure since February 2011, and far below most economists predictions.

xchrom

(108,903 posts)SINGAPORE (Reuters) - Moody's downgraded Vietnam to its lowest rating ever on Friday citing a weak banking sector likely in need of "extraordinary support", dealing another blow to a country once tipped as Southeast Asia's next emerging market star even as many of its neighbours prosper.

Analysts said the downgrade of Vietnam and eight of its banks - including two controlled by the state - did not signal a full-blown banking crisis and that the slowing economy should return to form if the government takes action.

Still, the cut compounded concerns about bad debts and the pace of so-called "doi moi" reforms begun in 1986 to build a socialist-oriented market economy.

It also put Vietnam on a different track to Indonesia, which was raised to investment grade last December, and the Philippines, which could soon win the coveted status that lowers borrowing costs and opens the door to more foreign funds.

xchrom

(108,903 posts)

Another anti-austerity protest in Spain. Photograph: Guillem Valle/Corbis

Austerity mania is sweeping Europe. François Hollande's socialist government in France will become the latest to tighten its belt when it announces €30bn (£25bn) of spending cuts and tax increases on Friday. This follows Spain's decision to take around €40bn out of its budget with the aim of hitting deficit reduction targets agreed with Brussels.

Meanwhile, negotiations continue in Athens between Greece and the so-called troika (the International Monetary Fund, the European Central Bank and the European Union) over a fresh package of spending cuts and tax increases now estimated at €13.5bn.

All this is happening at a time when the eurozone economy is already going backwards. France announced zero growth in the second quarter – extending its period of stagnation to nine months. Spain's central bank warned earlier this week that the economy was currently contracting sharply, while Greece is already in the midst of a 1930s-style depression.

The austerity programmes come with pledges of economic reforms. Put simply, the idea is that too many eurozone countries have been feather-bedded for too long and now need a chill blast of reality to wake them up. Budget retrenchment will ensure that countries live within their means while deregulation, privatisation and more flexible labour markets will make them leaner and fitter. Before too long a revitalised Europe will be punching above its weight in the global economy.

xchrom

(108,903 posts)

Ed Balls says a budget review would report within a year after the next election should Labour find itself back in No 10. Photograph: Linda Nylind for the Guardian

An incoming Labour government will introduce a root and branch budget review to examine every penny of public spending, Ed Balls the shadow chancellor tells the Guardian.

The budget review, expected to report within a year after the next election should Labour find itself back in No 10, is designed to look at the purpose and value of all public spending against the backdrop of some of the toughest long term tax and spending challenges to face the postwar Labour party.

The move – under discussion within the Labour leadership for months – is designed to signal that the party understands the scale of the public spending challenge facing the country.

Balls said: "The public want to know that we are going to be ruthless and disciplined in how we go about public spending. For a Labour government in 2015, it is quite right, and the public I think would expect this, to have a proper zero-based spending review where we say we have to justify every penny and make sure we are spending in the right way."

xchrom

(108,903 posts)LONDON (AP) -- Britain's financial regulator on Friday laid out a 10-point plan to overhaul the handling of a key global interest rate that has been the subject of a scandal involving major banks across multiple countries.

Barclays bank agreed in June to pay a $453 million fine to U.S. and British agencies after admitting it had submitted false information for the London Interbank Offered Rate, or LIBOR, which is used to price trillions of dollars in financial contracts, including mortgages. Other firms are being probed in the scandal, which has undermined public trust in banks and damaged the reputations of British financial regulators.

The new plan proposes that bankers convicted of manipulating the rate face criminal penalties and that a new agency take over management of LIBOR. It also calls for tougher controls on banks involved in the rate's calculation.

"Although the current system is broken, it is not beyond repair," said Martin Wheatley, managing director of the Financial Services Authority, the main regulator, as he announced recommendations from the review of LIBOR ordered by the British government.

xchrom

(108,903 posts)ATHENS, Greece (AP) -- Greece's statistical authority says domestic retail sales dropped eight percent in July compared with a year earlier, highlighting the painful impact of a four-year recession.

The fall was worst in the clothing and footwear sector, where sales were down 18.6 percent compared with July 2011, the authority said in a statement Friday.

July and August are when Greek retailers offer summer sales, which normally boosts turnover.

But according to separate estimates from Greece's national trade confederation, turnover during the two-month sales period dropped 20 percent compared with a year earlier, and a total 36 percent since the summer of 2010.

Greece is surviving on international rescue loans, in return for a punishing austerity program to right its finances. The country's economy is expected to shrink about 7 percent this year.

xchrom

(108,903 posts)BERLIN (AP) -- Germany's Finance Ministry says Berlin and Paris have jointly appealed to the European Union's executive to prepare the introduction of a tax on financial transactions.

The proposal has failed to secure a majority within the 27-nation EU. Germany and France are pressing for its introduction by the legal detour of so-called enhanced cooperation, which would allow a group of at least nine countries to go ahead with it.

The ministry said Friday that Germany's Wolfgang Schaeuble and French counterpart Pierre Moscovici also wrote a letter to their European counterparts urging them to join their appeal to the European Commission.

At a June meeting of finance ministers 10 nations, among them Italy and Spain, backed the proposal. Britain, which has the continent's biggest financial industry, opposes the plan.

mother earth

(6,002 posts)I thank you all!

xchrom

(108,903 posts)

mother earth

(6,002 posts)xchrom

(108,903 posts)

jtuck004

(15,882 posts)"What are you doing, little bird?" he asked.

"The sky is falling, and I am trying to hold it up", said the bird.

"Silly bird, you can't hold up the whole sky by yourself", said the rider.

"One does what one can", said the bird. "One does what one can".

I am reminded of that story when I read quotes such as the one in your sig.

mother earth

(6,002 posts)what "one" can...you do DU proud, my friend.![]()

xchrom

(108,903 posts)NEW YORK (AP) -- U.S. stock futures are down as investors fret over the economy of Spain, which this week announced big spending cuts it hopes will convince potential bailout creditors and investors that it has a rock-solid plan to heal its public finances.

Dow futures are down 49 points to 13,365. The broader S&P 500 futures are down 5 points to 1,436. Nasdaq futures are down 8 points to 2,807.

The positive momentum generated by Thursday's Spanish budget has ground to a halt as investors await more news, including stress test results into 14 banks due after European markets close. The Moody's rating agency is also expected to weigh in on Spain's creditworthiness.

Investors will also be looking at a U.S. report on August consumer spending, due at 8:30 a.m. EDT.

xchrom

(108,903 posts)BERLIN (AP) -- Germany's main opposition party is set to nominate former Finance Minister Peer Steinbrueck, who helped pilot the country through the 2008-9 financial crisis, as Chancellor Angela Merkel's challenger in elections next year.

Officials with the center-left Social Democrats wouldn't immediately confirm reports Friday in several German media outlets that the leadership had decided on Steinbrueck, 65. But the party scheduled an afternoon news conference and former Cabinet colleague Brigitte Zypries wrote on Facebook: "it's true, it's going to be him."

The choice of Steinbrueck - one of three candidates who has been discussed for months as criticism mounted of the party's failure to settle on a challenger - kicks off in earnest the race for the chancellery in parliamentary elections expected this time next year.

Steinbrueck earlier this week presented a plan for "taming financial markets," flagging that as a prominent issue in the party's campaign.

xchrom

(108,903 posts)WASHINGTON (AP) -- The U.S. Postal Service, on the brink of default on a second multibillion-dollar payment it can't afford to pay, is sounding a new cautionary note that having squeezed out all the cost savings within its power, the mail agency's viability now lies almost entirely with Congress.

In an interview, Postmaster General Patrick Donahoe said the mail agency will be forced to miss the $5.6 billion payment due to the Treasury on Sunday, its second default in as many months. Congress has left Washington until after the November elections, without approving a postal fix.

For more than a year, the Postal Service has been seeking legislation that would allow it to eliminate Saturday mail delivery and reduce its $5 billion annual payment for future retiree health benefits. Since the House failed to act, the post office says it's been seeking to reassure anxious customers that service will not be disrupted, even with cash levels running perilously low.

"Absolutely, we would be profitable right now," Donahoe told The Associated Press, when asked whether congressional delays were to blame for much of the postal losses, expected to reach a record $15 billion this year.

otherone

(973 posts):kick:

Demeter

(85,373 posts)Too much happened, too little got done...

Here's a hint of the Weekend to Come:

And here's Aries horrorscope for today:

Try not to get involved in anything that confuses you today -- it's only going to lead to frustration. This isn't a great day for learning new tasks or starting new projects. Your mind won't be able to focus quickly on adapting to new methods or ideas. If you feel that you're unclear about a rule or a law, get clarity immediately! Ask someone in the know what the real deal is, and don't be worried about looking like you don't know what you're doing. Your pride should not enter into things.

On that note, I'm going back to bed...I wish. I'd pull the covers over my head and wait for a better day.

xchrom

(108,903 posts)Tansy_Gold

(17,847 posts)Nope, haven't left yet. Flight doesn't leave for 3 hours so plenty of time to get to the airport. Dogs already know something's up and are starting to stress. . . .

xchrom

(108,903 posts)hopefully you get some good fall foliage viewing in.

xchrom

(108,903 posts)Today, as single farmer can produce as much goods a 100 farmers a half-century or less ago. That freed up labor for manufacturing and the service economy.

However, droids are now replacing humans in both manufacturing and services.

When does it stop?

Every time I go into a grocery store, I see more self-service checkout lanes and fewer manned ones. When RFID checkout comes into vogue, and it will quickly, an entire grocery basket will be scanned at once, and even fewer checkout clerks will be needed.

Read more: http://globaleconomicanalysis.blogspot.com/2012/09/can-fed-fight-droids-and-win-apples.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29&utm_content=Google+Reader#ixzz27leeRWJZ

Egalitarian Thug

(12,448 posts)to meet production demands. We have to adjust our definitions and our thinking to comply with reality. It's not the 19th century anymore and we have to rid ourselves of the notions that arose at that time. They were bad ideas based on popular misconceptions and the desire of the few to extract more from the many a century and a half ago. They are completely absurd today.

xchrom

(108,903 posts)

At first blush, today's personal income and spending news looks like kind of a snooze.

But actually it's not good.

Personal income rose by just 0.1% vs. expectations of a 0.2% rise.

And last month's personal income number rose by only 0.1% vs. original estimates of 0.3%, so that's a downward move of some significance.

Spending held up, rising 0.5%, but that's going to be tough to maintain if earnings keep falling.

Read more: http://www.businessinsider.com/august-personal-income-and-spending-2012-9#ixzz27lg5hU80

xchrom

(108,903 posts)Bank of America will pay Merrill Lynch a settlement of $2.4 billion, AP reports.

The settlement has to do with Bank of America's acquisition of Merrill Lynch.

Read more: http://www.businessinsider.com/bank-of-america-to-pay-merrill-lynch-a-settlement-of-243-billion-2012-9#ixzz27lgeG1L3

Demeter

(85,373 posts)do they mean former shareholders? or are they paying themselves?

The note is exceedingly unclear.

xchrom

(108,903 posts)it's been so long -- i guess i was surprised it hadn't been paid?

where's accounts receivable?

Egalitarian Thug

(12,448 posts)off over who did or did not ice each others crew during the gang war...

xchrom

(108,903 posts)Roland99

(53,342 posts)DOW -0.6%

NASDAQ -0.4% [/font]

Roland99

(53,342 posts)Roland99

(53,342 posts)* US AUG PERSONAL INCOME +0.1 PCT (CONS +0.2 PCT) VS JULY +0.1 PCT (PREV +0.3 PCT)

* US AUG PERSONAL SPENDING +0.5 PCT, LARGEST RISE SINCE FEB 2012 (CONSENSUS +0.5 PCT) VS JULY +0.4 PCT (PREV +0.4 PCT)

* US AUG PERSONAL SAVING RATE 3.7 PCT VS JULY 4.1 PCT

* US AUG REAL CONSUMER SPENDING +0.1 PCT VS JULY +0.4 PCT (PREV +0.4 PCT)

* US AUG OVERALL PCE PRICE INDEX RISE LARGEST SINCE MARCH 2011

* US AUG CORE PCE PRICE INDEX +0.1 PCT (+0.1089; CONS +0.1 PCT) VS JULY +0.1 PCT (PREV 0.0 PCT)

Po_d Mainiac

(4,183 posts)What I find interesting is a month ago (prior to QEI) these would have traded at +/- melt. At yesterdays trade quote, that would equate to a final sale in the $250-$255 range. Also note, this has been a trend and not just a 'cherry picked' auction Re. Pre-1964 coinage.

Note: There is nothing special about the dates, mint marks and or condition of the coins that would add additional numismatic value

Is this a trend? Is the little guy getting fed up (pun intended) with the chairsatans' currency debasement schemes?

xchrom

(108,903 posts)

***SNIP

Roubini says that France is currently on "honeymoon" with French investors who have cut their holdings of PIIGS debt and rotated into French sovereign debt due to a "home bias."

However, according to Roubini, "many problems are brewing in France" at the moment, and there are a few reasons for serious concern if you're holding French bonds.

Roubini gives four, which we summarize here:

Growth is stalling and could go negative next year if austerity is enacted. Unemployment is already rising.

"Hollande was not elected by his base to pursue austerity and reforms, but rather to boost growth and hiring in the public sector," writes Roubini. Talks of austerity is causing unions to become restless and riots could begin among the poor and affected minorities.

Government revenues are around 50% of GDP and economic contraction will increasingly put pressure on the deficit. This will make achieving a balance budget through spending cuts extremely difficult.

Some policy decisions are upsetting the business and financial community. Bernard Arnault left France over talks of a 75% marginal tax rate on the wealthy.

Read more: http://www.businessinsider.com/roubini-social-unrest-brewing-in-france-2012-9#ixzz27liEEknw

***please don't turn out like the austrian minded socialists monsieur hollande.

Demeter

(85,373 posts)THE ONLY THING I'D WANT TO FILL THEM WITH IS CEMENT...(SALUTE TO NJ)

http://www.huffingtonpost.com/robert-kuttner/filling-geithners-small-s_b_1908111.html

Timothy Geithner has said that he'll step down as Treasury Secretary at the end of Obama's first term. Assuming that Mitt Romney keeps self-destructing and Obama wins a second term, who should succeed him?

Just as Obama's choice in 2008 of an economic team led by Larry Summers and Tim Geithner told you a lot about what kind of president he'd be (and not be), Obama will signal a lot in his selection of Geithner's replacement.

In an economic crisis, the treasury secretary (tied with the Fed chairman) becomes the most important domestic public official after the president. Two huge and interconnected issues will face the next secretary: what to do about the still dysfunctional and largely unreformed banking system; and how to deal with the elite clamor for deficit reduction uber alles.

Obama, by rejecting the counsel of officials such as Paul Volcker and Sheila Bair, has already made clear that he is not interested in a drastic reform of the financial system. Dodd-Frank keeps getting nibbled to death by financial industry success in watering down its impact via weakened regulations...

WHAT FOLLOWS IS A LIST OF DEPRESSING AND LUDICROUS CHOICES

Demeter

(85,373 posts)THERE'RE TOO MANY UNEXAMINED ASSUMPTIONS IN THAT HEADLINE

IS EUROPE SAVED? I DON'T THINK SO

WAS THE IMF INTERESTED IN "SAVING" EUROPE? DOUBTFUL

OTHERS MAY OCCUR TO THE SKEPTICAL...

http://www.telegraph.co.uk/finance/financialcrisis/9563849/Bundesbank-castigates-IMF-for-saving-Europe.html

Germany's central bank has launched a blistering attack on the International Monetary Fund, accusing officials of spraying around money like confetti and overstepping their legal mandate.

“The IMF is evolving from a liquidity mechanism into a bank. This is neither in keeping with the legal and institutional role of the IMF or with its ability to handle risks,” said the Bundesbank in its monthly report.

The bank said the Fund was right to help rescue Greece, Ireland and Portugal but said monitoring levels were slipping and there had been a “watering down” of standards. The scale of loans risks “overwhelming the IMF’s institutional structure”.

The unprecedented attack came as the IMF’s chief, Christine Lagarde, called for urgent measures across the world to head off a fresh global slump. While praising the latest emergency measures of central banks in the US, Europe and Japan, she said this was not enough to secure recovery...

CURIOUSER AND CURIOUSER

xchrom

(108,903 posts)Don’t bet the house on a robust revival of the U.S. property market, says the Yale University professor who predicted the bursting of the dot-com and subprime-mortgage bubbles.

There is no “unambiguous” sign of a strong recovery in the market, Robert Shiller and fellow economists Karl Case and Anne Thompson say in a paper published this week by the National Bureau of Economic Research. The study seeks to shed light on the role buyer expectations play in house prices, an angle the authors say has been ignored in analyzing the housing slump.

he results of their work, entitled “What Have They Been Thinking? Home Buyer Behavior in Hot and Cold Markets,” are based on the responses of almost 5,000 recent homebuyers in four cities to regular mail surveys over the past 25 years.

The answers to the latest questionnaire indicate that while perceptions of short-term price direction have turned positive, long-term expectations continue to weaken.

xchrom

(108,903 posts)Japanese and South Korean industrial production fell more than economists estimated last month as slowdowns in China and Europe weighed on exports, building the case for more monetary easing.

Japan’s output fell 1.3 percent from July, the biggest decline in three months, a Trade Ministry report showed in Tokyo today. South Korean production slid 0.7 percent, partly on a strike at Hyundai Motor Co.

An increasing risk that Japan’s economy will shrink this quarter and the failure of central bank loosening to dislodge deflation may increase pressure for officials to ease at either of two meetings next month. Today’s data add to China’s weakest industrial production growth in more than two years in highlighting the failure of policy support to reverse a slowdown across Asia.

“I’m convinced we’ll see a contraction in Japan’s GDP this quarter because consumption, exports and private investment are falling,” said Masamichi Adachi, a senior economist at JPMorgan Securities in Tokyo and a former central bank official. “Prices in Japan are falling because the economy is weak.”

xchrom

(108,903 posts)The Indian government left the target for debt sales in the second half of the fiscal year unchanged after stepping up efforts to pare its budget deficit.

The Finance Ministry plans to raise 2 trillion rupees ($37.7 billion) in the six months ending March, Economic Affairs Secretary Arvind Mayaram told reporters in New Delhi yesterday, retaining the goal given earlier this year. Bond sales in April through September will reach 3.7 trillion rupees following an auction due today, according to central bank data.

India’s budget deficit is the widest among major emerging nations as slower growth hurts tax receipts and subsidies fan spending, imperiling the government’s goal of narrowing the gap to 5.1 percent of gross domestic product from 5.8 percent last year. Officials boosted diesel prices on Sept. 14 to restrain expenditure on compensation for below-cost sales.

“When growth is slowing, it will be very challenging to meet the deficit target and the government will have to resort to extra bond sales later,” said Ashutosh Datar, an economist at IIFL Ltd., a Mumbai-based brokerage. Bond yields may come under pressure if debt supply rises, he said.

xchrom

(108,903 posts)Spanish Prime Minister Mariano Rajoy’s unprecedented raid on a decade-old pension reserve fund to finance increased benefits comes less than a month before before regional elections as his popularity slumps.

As the Cabinet approved a 2013 austerity budget demanded by the European Union, Rajoy’s ministers also agreed to use 3 billion euros ($3.9 billion) from the 67 billion-euro reserve for the first time. It approved a 1 percent rise in pensions for 2013, the same as in 2012, and said retirees may also be compensated for inflation above that rate.

“Politically, they couldn’t do anything else,” Jose Ramon Pin, professor of public administration at IESE business school, said in a telephone interview. “The big problem is the message it sends outside Spain.”

Rajoy, in power since December, faces regional elections in Galicia and the Basque Country on Oct. 21, and in Catalonia on Nov. 25.

xchrom

(108,903 posts)Goldman Sachs Group Inc. (GS) will pay $14.4 million to resolve regulatory claims that a former banker made improper campaign contributions to the treasurer of Massachusetts while seeking underwriting business.

Neil Morrison, who was a vice president in Goldman Sachs’s Boston office, worked for Treasurer Timothy P. Cahill’s unsuccessful gubernatorial campaign from November 2008 to October 2010, sometimes during his office hours, the U.S. Securities and Exchange Commission said in a statement yesterday. That constituted in-kind contributions and broke pay- to-play rules, the SEC said.

The settlement, which includes $4.6 million paid to Massachusetts, is the SEC’s first involving noncash contributions and is the latest since the agency began bolstering oversight of the $3.7 trillion municipal-bond market in 2010. At that time, SEC Enforcement Director Robert Khuzami set up a task force to investigate bid-rigging for municipal- investment contracts. The agency is looking into banks, local governments that don’t disclose their true financial condition, and public officials who hire advisers based on political contributions.

The campaign work by Morrison, 38, disqualified Goldman Sachs from underwriting bonds for Massachusetts and its agencies for two years after the contributions, the SEC said. Nevertheless, the New York-based firm participated in 30 prohibited underwritings, earning more than $7.5 million in improper fees, according to the agency.

DemReadingDU

(16,000 posts)9/28/12 Cyber Attacks on U.S. Banks Expose Computer Vulnerability

Cyber attacks on the biggest U.S. banks, including JPMorgan Chase & Co. (JPM) and Wells Fargo (WFC) & Co., have breached some of the nation’s most advanced computer defenses and exposed the vulnerability of its infrastructure, said cybersecurity specialists tracking the assaults.

The attack, which a U.S. official yesterday said was waged by a still-unidentified group outside the country, flooded bank websites with traffic, rendering them unavailable to consumers and disrupting transactions for hours at a time.

Such a sustained network attack ranks among the worst-case scenarios envisioned by the National Security Agency, according to the U.S. official, who asked not to be identified because he isn’t authorized to speak publicly. The extent of the damage may not be known for weeks or months, said the official, who has access to classified information.

“The nature of this attack is sophisticated enough or large enough that even the largest of the financial institutions would find it difficult to defend against,” Rodney Joffe, senior vice president at Sterling, Virginia-based security firm Neustar Inc. (NSR), said in a phone interview.

While the group is using a method known as distributed denial-of-service, or DDoS, to overwhelm financial-industry websites with traffic from hijacked computers, the attacks have taken control of commercial servers that have much more power, according to the specialists.

“The notable thing is the volume and the scale of the traffic that’s been directed at these sites, and that’s very rare,” Dmitri Alperovitch, co-founder and chief technology officer of Palo Alto, California-based security firm CrowdStrike Inc., said in a phone interview.

more...

http://www.bloomberg.com/news/2012-09-28/cyber-attacks-on-u-s-banks-expose-computer-vulnerability.html

xchrom

(108,903 posts)The French government on Thursday demanded that steel giant ArcelorMitttal restart or sell idled steel furnaces at a plant in France’s blighted industrial north-eastern region, openly declaring itself in “conflict” with the steel maker.

The French government urged ArcelorMittal on Thursday to restart idled blast furnaces at a plant in northeastern France or put them up for sale, declaring itself in a “tug-of-war” with the steel giant over their fate.

President François Hollande held talks with ArcelorMittal’s chief executive after a media report that the firm will shut the furnaces at a plant which became symbolic of France’s industrial decline.

Speaking to angry workers at the plant in the town of Florange, Industry Minister Arnaud Montebourg said Hollande had called on Lakshmi Mittal to invest 150 million euros in the site or sell the furnaces.