Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 9 April 2012

[font size=3]STOCK MARKET WATCH, Monday, 9 April 2012[font color=black][/font]

SMW for 6 April 2012

AT THE CLOSING BELL ON 5 April 2012

[center][font color=red]

Dow Jones 13,060.14 -14.61 (-0.11%)

S&P 500 1,398.08 -0.88 (-0.06%)

[font color=green]Nasdaq 3,080.50 +12.41 (0.40%)

[font color=red]10 Year 2.18% +0.02 (0.93%)

30 Year 3.32% +0.03 (0.91%)

[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Po_d Mainiac

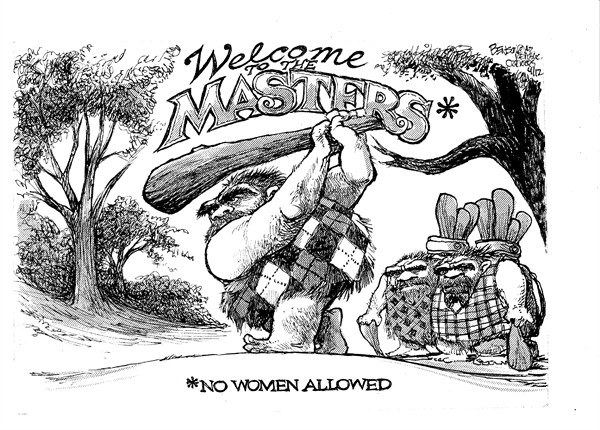

(4,183 posts)always drag their mates around by the hair.

hamerfan

(1,404 posts)How apt.

tclambert

(11,084 posts)I didn't realize Augusta had the motto "Get Rid Of Slimy girlS."

Fuddnik

(8,846 posts)The new CEO of IBM is a woman. The CEO of IBM has always, traditionally, been extended a membership at Augusta.

They're in a bit of a pickle now, and if she decides to push the issue, it could raise quite a stink.

Demeter

(85,373 posts)or it's all just hopium....

InkAddict

(3,387 posts)The foundation says economic abuse, or using finances as a tool of power and control, is just as common as physical abuse. Advocates at CHOICES regularly see the devastating effects. Many clients have no access to bank accounts, and abusers harass them at work until they lose jobs. Huge debt is racked up in their names, while identity theft is common.

“It’s financial abuse, and it’s still a relatively new term as far as domestic violence goes,” said Jesse Jones, the development director at CHOICES. “Not all abuse leaves a bruise. These women can have credit scores and debt that haunt them forever.”

AnneD

(15,774 posts)and the He Man club (no girls allowed).

Frankly, I have always contended that if it were left up to most men, we would still be living in caves and wearing loin cloths.

Case in point, ex furnished his living room in lawn furniture-aluminum fold up lawn chairs and saw no reason to change![]() . He worked full time so money wasn't an issue either.

. He worked full time so money wasn't an issue either.

Po_d Mainiac

(4,183 posts)more grandiose than a G-string?

![]()

AnneD

(15,774 posts)I am a firm believer in the generous application of fabric these days.

I love the way aging affects men's eye site too.![]()

Fuddnik

(8,846 posts)The more you drink, the better I look.

In fact, drink a lot. I'm fixing to put on a bathing suit and jump into the pool!

AnneD

(15,774 posts)I'm coming over to your pool. I figure you've got plenty of vodka.

xchrom

(108,903 posts) ?w=500&h=333

?w=500&h=333Roland99

(53,342 posts)xchrom

(108,903 posts)NEW YORK -- Since October, estimates for first-quarter earnings growth have tumbled while the S&P 500 has surged. With the earnings season starting next week, the outlook is not as sunny as in previous quarters.

Investors will assess whether slower growth is priced into the U.S. stock market, or if the S&P 500's retreat from Monday's four-year high is the start of a larger decline -- if results disappoint.

After the S&P 500's rise of about 30 percent since October, there is concern that buying interest is not strong enough to drive further gains, particularly after soft March U.S. employment figures were released on Friday.

"It seems like we're hitting resistance," said Jack Ablin, chief investment officer of Harris Private Bank in Chicago. "I think the market will grind higher, but it will be at a much slower pace. Earnings and jobs aren't helping."

xchrom

(108,903 posts)NEW YORK/WASHINGTON -- Gary Feeman has been searching for a job for 16 months. He's not ready to give up just yet, but the 60-year-old worries he is running out of options.

Feeman is among the more than 5 million Americans who have been out of work for more than six months and who represent the heart of the crisis in the labor market.

Their plight also poses a warning that U.S. unemployment may not drop back to its pre-recession levels and could be stuck higher than many policymakers expect.

Feeman, from Lancaster County, Pennsylvania, has sent out as many as 100 resumes. But the former maintenance director at a small amusement park in the area, has had only one interview in person. That was in January.

***

Demeter

(85,373 posts)Let's call a spade a dirt-moving implement.

Demeter

(85,373 posts)1. Money and Politics

Our democracy is supposedly rooted in the idea of one person, one vote. But the introduction of big money into politics distorts, and perhaps, destroys that ideal. Unlike most advanced democracies, we have failed to eliminate the destructive impacts of money on politics. The cost of our campaigns are rapidly rising. The Citizens United Supreme Court decision further accelerated this trend so that now there are virtually no limits on how much billionaires can spend on their preferred candidates.

Bankers too are getting into the act. One recent super PAC, “Friends of Traditional Banking” is seeking races where it can “target the industry's enemies and support its friends in Congress.”

Of course the obvious result is that all candidates, regardless of party, spend most of their time begging for money, not legislating. You can’t get elected without kissing the oligarchs’ rings.

2. Voter Disenfranchisement

3. Our Skewed Distribution of Income

4. Tax Breaks for the Super-rich

5. Wall Street Bailouts

6. Deficit Hysteria

7. Crumbling Social and Physical Infrastructure

8. The Failure to Create Jobs

9. The Revolving Door

10. Worshiping the Market Gods

DETAILS AT LINK

Demeter

(85,373 posts)Chinese consumer inflation rebounded slightly in March leaving policy makers less room to ease monetary conditions to prop up the slowing economy economy even though persistent price rises appear largely under control.

The benchmark consumer price index increased 3.6 per cent last month from a year earlier, mostly as a result of higher food and energy prices, according to government figures released on Monday.

Read more >>

http://link.ft.com/r/J0VG55/30SG18/MJTKN/97E6TH/QNMX1V/36/t?a1=2012&a2=4&a3=9

3.6% A MONTH....THAT'S LIKE 43% A YEAR?

Ghost Dog

(16,881 posts)Still high, though.

Demeter

(85,373 posts)On the other hand, I have just as much faith in Chinese statistics as I do in US statistics....that is, nil.

Demeter

(85,373 posts)With the first-quarter reporting season about to kick off, only three of the 10 major sectors in the S&P 500 are expected to post earnings growth

Read more >>

http://link.ft.com/r/2SRI11/L9CD4E/ULCJB/5VD0OQ/DWHH46/82/t?a1=2012&a2=4&a3=9

Demeter

(85,373 posts)Lenders begin testing investor appetite for the trade finance equivalent of collateralised debt obligations in an attempt to boost lending capacity

Read more >>

http://link.ft.com/r/2SRI11/L9CD4E/ULCJB/5VD0OQ/5VFFCJ/82/t?a1=2012&a2=4&a3=9

ANOTHER WHIZ-BANG FINANCIAL INNOVATION FROM THE FAGINS OF LONDON...

Demeter

(85,373 posts)Multi-employer schemes are now just 52 per cent funded, with most of the burden to close $369bn gap likely to fall on SMEs, says Credit Suisse

Read more >>

http://link.ft.com/r/2SRI11/L9CD4E/ULCJB/5VD0OQ/7A332N/82/t?a1=2012&a2=4&a3=9

Demeter

(85,373 posts)As the big banks shrink their balance sheets, start-up ventures are targeting areas such as wealth management and lending to small businesses

Read more >>

http://link.ft.com/r/2SRI11/L9CD4E/ULCJB/5VD0OQ/FKGGX1/82/t?a1=2012&a2=4&a3=9

Demeter

(85,373 posts)Compensation system for victims of tanker pollution will be ‘undermined’ when EU sanctions bar insurers from honouring claims

Read more >>

http://link.ft.com/r/2SRI11/L9CD4E/ULCJB/5VD0OQ/AM117A/82/t?a1=2012&a2=4&a3=9

DemReadingDU

(16,000 posts)Ghost Dog

(16,881 posts)(Bloombug) U.S. equity futures fell and Asian stocks dropped for a fourth day as data on job creation in the world’s biggest economy trailed estimates. The yen strengthened to a one-month high against the dollar and oil declined.

Standard & Poor’s 500 Index futures declined 1 percent as of 12:33 p.m. in London and the MSCI Asia Pacific Index (MXAP) dropped 0.6 percent. The yen rose 0.5 percent against the dollar and the Swiss franc strengthened above the 1.20 ceiling against the euro imposed by the nation’s central bank. Oil fell 1.4 percent in New York and copper declined 1.3 percent.

The Nikkei 225 Stock Average lost 1.6 percent, poised for the lowest close since Feb. 21.

U.S. employers added 120,000 jobs in March, the fewest in five months and less than the median forecast of 205,000 in a Bloomberg survey, a Labor Department report on April 6 showed. European stock markets are shut for holidays, along with Australia, New Zealand, Hong Kong, Thailand and South Africa.

“The job data reduced investors’ optimism,” said Naoki Fujiwara, who helps oversee $6.4 billion at Shinkin Asset Management Co. in Tokyo. “People in the markets are getting more cautious and the mood is growing that the U.S. economy won’t recover so easily.”

/... http://www.bloomberg.com/news/2012-04-09/s-p-500-futures-asian-stocks-decline-as-yen-strengthens.html

Lots of conversations, articles in print, etc. re: the Illustrious French Revolution here (at the moment on the island of Mallorca - full of apparently self-satisfied, but slightly nervous Germans, I might add - ) in Spain.

![]()

Roland99

(53,342 posts)Demeter

(85,373 posts)after consuming most of them themselves...

Demeter

(85,373 posts)...Slowly but surely the courts are recognizing that recording on-duty police is a protected First Amendment activity. But in the meantime, police around the country continue to intimidate and arrest citizens for doing just that. So if you’re an aspiring cop watcher you must be uniquely prepared to deal with hostile cops.

If you choose to record the police you can reduce the risk of terrible legal consequences and video loss by understanding your state’s laws and carefully adhering to the following rules.

Rule #1: Know the Law (Wherever You Are)

Rule #2 Don’t Secretly Record Police

Rule #3: Respond to “Shit Cops Say”

Rule #4: Don’t Share Your Video with Police DUH! POST IT ON YOUTUBE, WORKS, THOUGH

Rule #5: Prepare to be Arrested

Rule #6: Master Your Technology SMART PHONE USER GUIDES

Rule #7: Don’t Point Your Camera Like a Gun

Becoming a Hero

If you’ve recently been arrested or charged with a crime after recording police, contact a lawyer with your state’s ACLU chapter for advice as soon as possible. (Do not publicly upload your video before then.) You may also contact Flex Your Rights via Facebook or Twitter. We’re not a law firm, but we’ll do our best to help you.

If your case is strong, the ACLU might offer to take you on as a litigant. If you accept, your brave stand could forever change the way police treat citizens asserting their First Amendment right to record police. This path is not for fools, and it might disrupt your life. But next time you see police in action, don’t forget that a powerful tool for truth and justice might literally be in your hands.

*****************************************************************

Steve Silverman is the founder & executive director of FlexYourRights.org and co-creator of the films "10 Rules for Dealing with Police" and "BUSTED: The Citizen's Guide to Surviving Police Encounters". This original article appeared in Reason.com.

Demeter

(85,373 posts)...It got $45 billion just in bailout money, and trillions (with a T) in emergency loans from the Federal Reserve—and not only did it not pay taxes last year, it received a tax refund of $1 billion. And yet it's still teetering on the edge of collapse.

Unless we do something soon, we might be heading for yet another people's bailout of America's bank.

Occupy Wall Street has decided to fight back. “This bank is not working, and the people should be deciding how to break up this bank, how it should be democratically run, before it gets either another bailout or is bought out by some other bank,” Nelini Stamp, an Occupy Wall Street participant and organizer, told AlterNet...Back in January, Public Citizen put forth a petition calling for Bank of America to be broken up by regulators, who have the authority to do so under Section 121 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. A group of economists and activist groups signed on to a separate letter to the Treasury Secretary, the Fed and the FDIC, calling for investigation into the country's biggest banks to see if more of them were deserving of dissolution.

And now, Occupy Wall Street has set its sights on B of A.

“Our specific demand is to break up Bank of America because we're done with this too big to fail thing. Bank of America is too big, it has been failing and we want to highlight exactly how it's failing,” Nelini Stamp told AlterNet.

To target the big bank, OWS has a variety of tactics ranging from direct actions to coordinated Move your Money efforts, and as their spring offensive continues, they're ratcheting up the pressure on B of A.

MORE AT LINK

Demeter

(85,373 posts)Americans have had it drilled into them that government is bad, but a new narrative is surfacing. Last Thursday, Roosevelt Institute Senior Fellow Jeff Madrick kicked off the Roosevelt Institute’s new flagship initiative, Rediscovering Government, at an event in New York City, declaring,

“There is no economy without government. There is no America without government. Government doesn’t have a role; it is integral.”In a keynote address, Roosevelt Institute Senior Fellow Joseph Stiglitz also argued that healthy societies have strong governments and that his research has shown that “the reason the invisible hand often was invisible was that it wasn’t there.”

Watch the full video of the opening remarks and keynote below: SEE LINK FOR VIDEO, MORE

Demeter

(85,373 posts)Those who've read much of this blog are aware of the various arguments against the notion that private equity firms are "do-gooders" that we should encourage and even subsidize (through the carried interest provision). On the whole, I believe they are part of a harmful trend towards consolidation of enterprises that weakens links to communities, makes caring for workers seem like too great a cost, and encourages over-leveraging and instability that ultimately is devastating to the economy. Add to that the egregiously inappropriate tax treatment of "carried interest" paid to managers, and you have a wealth-building machine for a small, elite group that does not pay its fair share of the tax burden and whose activities are likely a net social detriment.

Specifically, private equity firms historically have looked for good, stable businesses with decent cash flows, low leverage and decent but not high profits that they can take over, leverage highly (to pay for the acquisition and to provide quick funds to fuel their own ultra-high profit demands), with the cash flow from the ongoing business paying off the debt. The result in these leveraged buyout cases may be that a stable busienss with a profit of 5-6% that spent what was needed on maintenance and new investment, expanding gradually and paying its workers a decent wage and its owners a small but decent profit becomes an overleveraged company that is less stable and has to use more of its cash flow to pay off the debt.

One result of excessive debt is that expenditures for maintenance and investment in new equipment are deferred. and business stalls for the time it takes to pay off the debt. Sometimes that stall is merely a bad time for the business (and often its workers). Liquidity problems can result in proclaimed "efficiency" decisions to fire or lay off hundreds of workers and to reshape benefits like pensions and health care. That's if the company stays in operation. Sometimes the debt service and resultant deferral of investments and change of focus of the business will be fatal. Costly leverage results in bankruptcy or in the business being broken up and sold in pieces, either way with many workers losing jobs (and benefits) and many communities suffering dire consequences. Whatever happens, the equity fund managers gets high fees and "carried interest" profits taxed at inappropriately low tax rates. Romney, for instance, continued to get a "carried interest" cut from Bain Capital's activities in compensation for past work done, long after he retired from doing any work at the firm in 1999. See Romney using ethics exception to limit disclosure of Bain holdings, Washington Post (April 5, 2012).

And of course, private equity firms do not necessarily invest only in domestic companies. They may hold considerable assets offshore--possibly in some of those very companies that represent low-wage, low-benefits, and low-worker-rights havens for US multinationals that end US jobs here in order to hire more cheaply abroad..... Romney, for instance, has holdings in "a high-tech sensor control firm that has moved U.S. manufacturing jobs to China." Id. (noting that these holdings were revealed through SEC filings)....MORE

Demeter

(85,373 posts)In an open letter sent to the Bank's executive board Wednesday, 39 former senior Bank staff endorsed Okonjo-Iweala's candidacy, citing her "deep experience in international and national issues of economic management", which includes four years as the Bank's managing director.

"

She would hit the ground running and get things done from the start," the former officials, who included senior vice presidents, vice presidents, and directors, wrote. "In a word, she would be the outstanding World Bank President the times call for."

In another letter released Thursday, more than 100 economists endorsed Ocampo, arguing that his experience leading the ministries of finance, agriculture and planning, as well as stints as the head of the Economic Commission for Latin America and the Caribbean, the U.N. Commission for Latin America and the Caribbean, and as U.N. under-secretary general for economic and social affairs, made him "the most suitable candidate for World Bank President". The signers included internationally recognized figures, primarily from North America, Latin America, Europe, China, and India, including former Bank officials, ministers of finance and development, and central bank governors, as well as academics.

The endorsements are coming as the Bank's executive board prepares to interview all three candidates early next week and reach a final decision the following week, by the opening of the annual Spring meetings of the Bank and its sister institution, the International Monetary Fund (IMF). The current race is the first since the Bank was created at the Bretton Woods conference in 1944 in which the U.S. candidate has faced a challenge. Under an informal "gentlemen’s agreement" between the U.S. and Europe, a U.S. national has always held the top Bank position, while a European has run the IMF. In recent years, that arrangement has come under sustained attack by developing countries and non-governmental organizations (NGOs) that have complained that it is undemocratic and increasingly outdated, particularly given the growing importance to the world economy - and of the Bank's own financial health - of the emerging economies.

"To maintain a cabal among developed countries, whereby the U.S. appoints the World Bank president and Europe picks the (IMF's) head, seems particularly anachronistic and perplexing today, when the Bank and the Fund are turning to emerging-market countries as a source of funds," wrote Nobel Economics laureate Joseph Stiglitz, who served as the Bank's chief economist and as chair of the Commission of Experts to the U.N. General Assembly on international financial reforms, earlier this week.

Under the existing scheme, the combined shares of the U.S., the Bank's largest single shareholder, Europe, and Japan account for just over half of the votes on the executive board – more than the majority needed to elect Kim if it comes to a vote. The U.S. and Japan, as well as South Korea, have already announced their backing for Kim, and it is widely assumed here that Europe will also support him, if only because the U.S. faithfully backed its candidate for the IMF's managing director, Christine Lagarde, last year.

"I haven't heard anyone is willing to break ranks," said one insider, who also noted that, with its 16 percent share, Washington has the power to veto any other candidate.

Still, the race is being taken seriously by both Okonjo-Iweala and Ocampo, who have been rallying support for their respective candidacies and, unlike Kim, have accepted invitations to discuss and answer questions about their visions of the Bank's future at public forums here next week sponsored by the widely respected Center for Global Development (CGD).

MORE AT LINK

Demeter

(85,373 posts)...1. Disclosure

Citizens United effectively removed the limits that state and federal laws had placed on how much money corporations and other groups can spend to influence elections—but it didn’t dispute the constitutionality of laws that mandate disclosing how that money is spent. In the six months immediately after Citizens United was handed down, 10 states responded by passing laws requiring more transparency—disclosure of how much money outside groups are spending, what they’re spending it on, and so forth. The California Legislature is currently debating the strongest disclosure law to date: It would require that all political ads show the logos of their three largest funders (not PACs, but the originating corporations) on the ads themselves.

2. Clean Elections

In Maine, only 20 percent of candidates accept private campaign contributions. Instead, qualifying candidates (candidates who receive a certain number of $5 contributions from voters) finance their campaigns through the state’s Clean Elections Fund. The results? Lack of wealth doesn’t keep people from running for office; candidates are insulated from the influence of corporate special interests; they spend more time talking to voters and less time fundraising than in other states. The cost? Less than $2 per taxpayer. Similar systems are in use in Arizona, Connecticut, and a number of other states. A federal system has been repeatedly introduced in Congress, including a 2007 bill co-sponsored by then-Senator Barack Obama.

3. Citizen Juries

Since the Progressive Era, citizens’ initiatives have been a way for regular people to propose laws, bypassing elected officials by putting proposals directly to the electorate. But first, deep-pocketed corporate entities with a stake in the outcome have their chance to sway voters; ordinary citizens rarely have the money to counter. To make sure voters have access to unbiased information about what they’re voting on, a creates juries of randomly selected citizens whose job is to learn the issues, study the proposed legislation, and separate fact from fiction. Their findings are then mailed to the homes of registered voters. Citizen juries have also been used, though unofficially, to help voters sift through information in gubernatorial and senate races in Pennsylvania and Minnesota.

4. Recalls

What can citizens do when elected officials stand up for corporations at their expense? In a number of states, they’ve recently turned to recall elections. In the last year, citizens have engineered the recall of Wisconsin officials who passed the anti-union Budget Repair Bill (a recall against Gov. Scott Walker and Lt. Gov. Rebecca Kleefisch is pending); a Michigan state representative who supported a similar bill; and the Arizona state senator who sponsored the draconian anti-immigrant bill SB 1070 (which was written with the help of the private prison industry). Nineteen states currently allow citizen recalls of state officials (Illinois became the latest, in 2010); at least 26 allow recalls of local officials.

Demeter

(85,373 posts)Ghost Dog

(16,881 posts)... The plaintiff in the strip-search case was arrested after a routine traffic stop and jailed for a minor outstanding warrant that may well have been a mistake. Before entering the jail, he was forced to strip, lift his genitals, squat and cough. If that isn’t an assault on human dignity, you might think, what is?

... Every arrest, even for major offenses, is supposed to take place on the basis of suspicion, not proven guilt. Everyone in jail is equally presumed innocent until proven guilty at trial -- or until he or she admits guilt in a plea bargain. To find that all of these people are having their most basic rights violated every day would have been too disruptive to the basic practices of American criminal justice...

/... http://www.bloomberg.com/news/2012-04-08/strip-search-case-reflects-death-of-american-privacy.html

AnneD

(15,774 posts)the fact the courts sided with police on this one further politicizes and polarizes the court. The SCOTUS just like the other branches of the government, have lost the faith of the people. They have lost the moral high ground and now are nothing more than an impediment to democracy in this country.

Demeter

(85,373 posts)Removing the trash would be a good start.

Demeter

(85,373 posts)...Iksil’s influence in the market has spurred some counterparts to dub him Voldemort, after the Harry Potter villain. He works in London in the bank’s chief investment office, which has assembled traders from across Wall Street to its staff of 400 who help oversee $350 billion in investments. While the firm describes the unit’s main task as hedging risks and investing excess cash, four hedge-fund managers and dealers say the trades are big enough to move indexes and resemble proprietary bets, or wagers made with the bank’s own money. The trades, first reported by Bloomberg News April 5, stirred debate among U.S. policy makers over the Easter-holiday weekend as they wrangle over this year’s implementation of the so-called Volcker rule, the portion of the Dodd-Frank Act that sets limits on risk-taking by banks with government backing. The law passed after the collapse of the subprime mortgage market triggered the worst financial crisis since the Great Depression. (INDU)

“I wouldn’t be surprised if the pro-Volcker folks used this as a test case,” said Douglas Landy, a partner at law firm Allen & Overy LLP who is representing Canadian banks in opposing a current draft of the rule.

...Chief Executive Officer Jamie Dimon, 56, sent a 38-page letter to shareholders last week, saying he agrees with the Volcker rule’s intent to eliminate “pure” proprietary trading and ensure market-making won’t jeopardize banks. Still, as with derivatives laws, the rule must be written so that it doesn’t put U.S. banks at an international disadvantage, he said.

“We cannot and should not be in a position where the rule affects U.S. banks outside the United States but not our foreign competition,” he wrote.

Iksil drew attention from market professionals in recent months as trading accelerated in a group of credit-default-swap indexes created before and during the 2008 financial crisis. Until then, transactions had been dwindling as Wall Street banks stopped creating structured debt that the indexes were used to hedge against. Investors use credit-default swaps to shield themselves from losses on corporate debt or to speculate on a firm’s creditworthiness. The trader became such a big client of credit-derivatives dealers that some started calling him Voldemort, the Harry Potter book-series villain so powerful he simply was referred to as “He Who Must Not Be Named,” said one fund manager, who asked not to be identified because his firm does business with JPMorgan. Iksil also has been dubbed the “London whale,” another trader said. Iksil joined JPMorgan in 2005, according to his career- history record with the U.K. Financial Services Authority. He worked at the French investment bank Natixis (KN) from 1999 to 2003, according to data compiled by Bloomberg. Public records showing Iksil’s date of birth couldn’t be located. One person who has done business with Iksil said he’s in his late 30s.

When a group of hedge-fund traders last year bet that a cluster of companies in one of the indexes wouldn’t default before contracts expired in December, Iksil was taking the opposite view, according to four market participants at hedge funds and banks, who spoke on condition of anonymity because they aren’t authorized to discuss the transactions. Iksil’s bet won out, and the hedge funds faced losses of 25 percent, when American Airlines parent AMR Corp. filed for bankruptcy less than a month before the insurance-like swaps matured, the market participants said. The trades were made in so-called tranches of the index, which take concentrated risks on the member companies...

MUCH MORE AT LINK

Demeter

(85,373 posts)Japan and China will seek to coordinate on supporting the International Monetary Fund’s effort to contain Europe’s debt crisis, Japanese Finance Minister Jun Azumi said.

“Rather than make decisions independently, we’ve agreed to consult each other very closely” on financial contributions to the IMF, Azumi told reporters today after meeting with Chinese Finance Minister Xie Xuren in Tokyo.

The finance ministers of Asia’s two largest economies met before the Group of 20 countries gathering later this month in Washington. One topic at the G-20 meeting will be increasing cooperation with the IMF. The Fund needs more resources to shield the global economy from threats of strains on Europe’s financial system, rising oil prices and high unemployment, Managing Director Christine Lagarde said this week...

Demeter

(85,373 posts)Thousands of jobless workers in Washington state will lose their unemployment checks starting later this month when the federal government begins withdrawing emergency benefits because overall state unemployment has dropped below 8.5 percent.

The problem is that the system ignores individual workers’ needs among the roughly 175,000 people collecting unemployment checks...

DemReadingDU

(16,000 posts)4/9/12 Charles Hugh Smith: Ten Minutes After the Titanic Struck the Iceberg

We are like passengers on the Titanic ten minutes after its fatal encounter with the iceberg: the idea that the ship will sink is beyond belief.

As we all know, the "unsinkable" Titanic suffered a glancing collision with an iceberg on the night of April 14, 1912. Ten minutes after the iceberg had opened six of the ship's 16 watertight compartments, it was not at all apparent that the mighty vessel had been fatally wounded, as there was no evidence of damage topside. Indeed, some eyewitnesses reported that passengers playfully scattered the ice left on the foredeck by the encounter.

But some rudimentary calculations soon revealed the truth to the officers: the ship was designed to survive four watertight compartments being compromised, and could likely stay afloat if five were opened to the sea, but not if six compartments were flooded. Water would inevitably spill over into adjacent compartments in a domino-like fashion until the ship sank.

.

.

I think this perfectly describes the present. Our financial system seems "unsinkable," yet the reliance on debt and financialization has already doomed it, whether we are willing to believe it or not.

.

.

The financial system of the United States of America is like the Titanic. Hubris led many to declare it financially unsinkable even as its fundamental design was riddled with fatal flaws and the human pilots in charge ran it straight into the ice field at top speed.

We have some time left before the ultimate fate is visible to all. Ten minutes after the collision, the Titanic's passengers had 2 hours and 30 minutes before the "unsinkable" ship sank. How much time we have left is unknown, but the bow of the ship will be visibly settling into the icy water within a year or two--and perhaps much sooner.

full essay...

http://www.oftwominds.com/blogapril12/Titanic4-12.html

Demeter

(85,373 posts)Amen, and Nearer my God to Thee...

I also wish I knew what a "lifeboat" in this economy looked like...or rather, how to draw people who want to survive together to build a community that will float regardless...thing is, there's so many psychopaths out there, it may take a heightened level of danger to identify and isolate them.

There's only so much one person can do. When the number of people increases linearly, the capability increases exponentially. Two people can do 4 times as much as one, 3 people nine times, etc.

And if the survival candidates show progress, then the undecided start to join up....and soon, you've got a majority, then maybe even 99% (or at least 80%---there may be a psychopath level of 20% nowadays....)

My projects are nearly always bigger than one-person jobs. That's my calling, and when it works, the results are glorious. But getting that team together, that's the killer.

DemReadingDU

(16,000 posts)And won't open their eyes to anything else.

Oh sure, if you can get 2 or 3 or more people, the amount of preparedness increases dramatically. But I have found it is impossible to wake up anybody. Just like the Titantic , no one that I know, believes the economy is sinking.

The crash when it comes, will be epic. Just like the Titantic.

CAPHAVOC

(1,138 posts)AnneD

(15,774 posts)Normalcy Bias.....

http://en.wikipedia.org/wiki/Normalcy_bias

The country is so rife with this. How many canaries need to be at the bottom of the cage before you realize there is a problem.

Demeter

(85,373 posts)Tansy_Gold

(17,847 posts)I'm wondering if there's such a thing as futility bias -- the mindset that there's nothing you can do about it anyway. . . . .

AnneD

(15,774 posts)hopelessness. Or to paraphrase Hotler...I have no hope, I see no future. That is one of the main reasons I am so angry at Obama. He basically stole my hope and gave it away in a compromise-not just once but numerous time. I have been told he was a constitutional scholar, but the only thing I have seen is that he know to get around it. I won't EVEN address his financial illiteracy.

Tansy_Gold

(17,847 posts)I consider hopelessness to be the end of the road, the point of giving up, of not doing anything at all about anything at all.

The kind of futility I'm talking about is the not doing anything active to effect change or improvement or whatever. Along the lines of "Why bother to vote if the other guy is going to win and/or there's no difference between the two?" I don't consider that hopelessness so much as acquiescence to specific circumstances or conditions.

Don't even get me started on the O man's disappoints. ![]()

AnneD

(15,774 posts)to acquiesce to the futility of one's circumstance. To surrender to one's fate.

The Titanic has sunk, the life boats are gone, the water is below freezing, and there is no ship on the horizon. Your screwed no matter how you look at it so you might as well stop swimming.

AKA the "OH SHIT" moment.

bread_and_roses

(6,335 posts)Demeter

(85,373 posts)The big housing policy fight brewing between the Obama administration and the Federal Housing Finance Agency, the regulator that oversees Fannie Mae and Freddie Mac, is over principal forgiveness: lowering the burden of outstanding mortgage debt on homeowners in order to reduce foreclosures and get homeowners out from their underwater mortgages.

Nick Timiraos reports in the Wall Street Journal that the disagreement between the administration and the FHFA’s head, Edward DeMarco, over principal forgiveness is fully out in the open, especially since the Treasury has offered to put up some of the money for the write-downs. What’s interesting is that DeMarco’s argument against principal forgiveness, as explained in a recent speech, is a great argument for another ambitious housing policy — a large scale refinancing of the underwater mortgages backed by Fannie and Freddie:

The fundamental point of a loan modification is to adjust the borrower’s monthly payment to an affordable level. We have seen repeatedly that what matters most in successfully helping borrowers is a meaningful reduction in the monthly payment to an amount that helps stabilize the family’s finances. Indeed, we have found that payment reduction, not loan-to-value, is the key indicator of success in loan modifications.

…

Moreover, this approach recognizes that three out of every four deeply underwater borrowers in Fannie Mae’s and Freddie Mac’s book of business today are current on their loans. These borrowers are demonstrating a continued willingness to meet their mortgage obligations. This should be recognized and encouraged, not dampened with incentives for people to not continue paying. ...

Demeter

(85,373 posts)I guess I'd better answer the call...that's the trouble with holidays, they set one up for disappointment when Reality returns.

Got a committee meeting each night Mon, Tues, Weds....it's that kind of week.

I think recent events have put everybody off innovation, and analysis is being processed now. It's so nice on the Internet, where the news cycle is a couple of days, instead of several decades of hide and seek....

xchrom

(108,903 posts)BEIJING (AP) -- Asian stock markets declined Monday after U.S. hiring slowed in March, raising doubts about the durability of the recovery in the world's No. 1 economy.

Oil prices fell to near $102 a barrel amid hopes international talks this week may help avoid military action over Iran's nuclear program.

Tokyo's Nikkei 225 index lost 1.5 percent to 9,546.26 and China's benchmark Shanghai Composite Index declined 0.9 percent to 2,285.78. Seoul shed 1.6 percent to 1,997.08. Hong Kong, Sydney and Bangkok were closed for holidays.

In Europe, the Frankfurt, Paris and London markets were also closed.

Demeter

(85,373 posts)Demeter

(85,373 posts)TalkingDog

(9,001 posts)Have fun today.

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Hundred points a day loss would get some attention....

xchrom

(108,903 posts)MADRID (AP) -- Spain should consider making richer people pay for their universal health coverage, the country's economy minister said Monday in another reflection of a government scraping and clawing for new sources of revenue.

The ruling party quickly disavowed him, saying the official was only expressing a personal opinion.

The center-right government is desperate for ways to save money or increase revenue as it struggles to achieve deficit-reduction goals. International investors are showing wariness of its ability to do so, shying from buying Spanish debt and pushing up Spain's borrowing costs perilously. This is heightening fears that with sick public finances and other woes like banks overexposed to real estate, Spain could be the next candidate for a bailout, after Greece, Ireland and Portugal.

Economy Minister Luis de Guindos said in a radio interview the co-payment system, such as that which exists in the United States, is no panacea for Spain's financial problems. But he said Spain should mull the idea of making people who earn more than (EURO)100,000 ($130,000) a year pay for state-administered health care that is financed with taxpayer money.

xchrom

(108,903 posts)The government of Mariano Rajoy is preparing to make radical changes in the way Spaniards pay into their health system.

According to sources close to the government, the administration believes that the current system is not economically viable. To defend their argument, government officials say that the public healthcare system is some 20 billion euros in debt. Regions administer healthcare using money suplied by central government.

Ana Mato, the health minister, has commissioned several studies to look at alternatives and help come up with a new financing model. The studies will be presented to all the regional health officials before the end of the month, government sources say.

One of the proposals, say government sources, aims to look at a co-payment plan, whereby Spaniards will pay a nominal fee for medical examinations, doctors’ visits and prescription drugs.

Demeter

(85,373 posts)but of course, we can't have that!

xchrom

(108,903 posts)French President Nicolas Sarkozy once again on Sunday continued to portray Spain as Europe’s problem child, saying that if he is re-elected he will rein in France’s spending to avoid “the same difficulties” that Madrid is facing.

His comments, published in Le Jornal du Dimanche and repeated earlier this weekend during a campaign swing in Saint Raphael, have been received badly by Spanish politicians.

The Socialists have demanded that Prime Minister Mariano Rajoy issue a public complaint against Sarkozy. Elena Valenciano, the Socialist Party number two, said the French leader should not be using Spain as “a bad example” to bolster his campaign.

In remarks to the French newspaper, Sarkozy said that he will “comply scrupulously” with reducing the deficit “because I am convinced that the French don’t want to share Greece’s luck or live through the difficulties occurring in Spain.” For its part, the Rajoy government has not commented on Sarkozy’s comparisons. Elvira Rodríguez, a Popular Party deputy, came out in defense of Sarkozy, saying that the French president was speaking as a candidate and not as a European leader.

Roland99

(53,342 posts)The state also simplified the way it breaks up coverage for its Medicaid recipients by moving to three service regions rather than eight.

"The managed care plans selected stood out among the applications and are committed to improving health outcomes, ensuring access to care, and providing intensive case management services, especially to those individuals with the most complex medical and social conditions," Ohio Medicaid Director John McCarthy said.

Medicaid insurers Molina, Centene, Amerigroup and WellCare, all incumbents in the state, stand to lose business. The change came as surprise, "most expected the large incumbents to be heavily favored to win the new awards,' Wells Fargo analyst Peter Costa said.

Demeter

(85,373 posts)In no particular order, here are 50 things about our economy that blow my mind:

50. The S&P 500 is down 3% from 2000. But a version of the index that holds all 500 companies in equal amounts (rather than skewed by market cap) is up nearly 90%.

49. According to economist Tyler Cowen, "Thirty years ago, college graduates made 40 percent more than high school graduates, but now the gap is about 83 percent."

48. Of all non-farm jobs created since June 2009, 88% have gone to men. "The share of men saying the economy was improving jumped to 41 percent in March, compared with 26 percent of women," reports Bloomberg.

47. A record $6 billion will be spent on the 2012 elections, according to the Center for Responsive Politics. Adjusted for inflation, that's 60% more than the 2000 elections.

46. In 2010, nearly half of Americans lived in a household that received direct government benefits. That's up from 37.7% in 1998.

45. Adjusted for inflation, federal tax revenue was the same in 2009 as it was 1997, even though the U.S. population grew by 37 million during that period.

44. In November 2009, the nationwide unemployment was around 10%. But dig into demographics, and the rates are incredibly skewed. The unemployment rate for young, uneducated African-American males was 48.5%. For Caucasian females over age 45 with a college degree, it was 3.7%.

43. About the same number of people was awarded bachelor's degrees in 2010 as filed for personal bankruptcy (1.6 million).

42. According to The Wall Street Journal, "U.S. refineries are producing more gasoline and diesel than ever. And Americans' gasoline consumption is at an 11-year-low."

41. Americans spend an average of 1.8% of their income on alcohol and tobacco. In the U.K., it's 4.8%.

40. In 2009, 5% of Americans accounted for 50% of all health care costs.

39. As the market was "flat" from 2000 to 2010, S&P 500 companies paid out more than $2 trillion in dividends.

38. The Census Bureau now classifies nearly 1 in 6 Americans as living in poverty.

37. The number of Americans who don't have health insurance: 49.9 million.

36. The share of entitlements like Social Security and Medicare going to the bottom fifth of households (based on income) has fallen from 54% in 1979 to 36% in 2007, according to Binyamin Appelbaum of The New York Times.

35. According to Goldman Sachs' Jim O'Neill, China's growth creates the equivalent of a new Greece every 90 days.

34. With a drop in jobs came a surge in grad-school aspirations. The number of people taking the LSAT (law school entrance) exam surged 20% from 2008 to 2009.

33. From 2007 to 2009, Sheldon Adelson's personal net worth fell by $24 billion. That's about equal to what the federal government spends on agriculture every year. (He's since made most of it back.)

32. The entire town of Pray, Mont., was listed for sale last month. The asking price is $1.4 million (or what Sheldon Adelson lost every 30 minutes in 2008).

31. A full 17 years after college graduation, Yale economist Lisa Kahn found those who began their careers in tough economic times earned less than those who started their careers when the economy was strong.

30. Americans age 60 and older owe $36 billion in student loans.

29. The average vehicle on the road today is 10.8 years old -- an all-time high, and two years older than in 2000.

28. Just five companies, Apple (Nasdaq: AAPL ) , Microsoft (Nasdaq: MSFT ) , Cisco, Google (Nasdaq: GOOG ) , and Pfizer (NYSE: PFE ) , now hold nearly one-quarter of all corporate cash, equal to more than a quarter-trillion dollars.

27. In 2011, the federal government took in $2.3 trillion in tax revenue, and spent the exact same amount on military, Social Security, Medicare, and Medicaid alone.

26. Auto sales in regions where debt accumulation was highest during the bubble years are down some 40% since 2005. In regions where debt accumulation was the lowest, sales are actually up 30%.

25. According to Pew, for every dollar newspapers make in new digital advertising, they've lost $7 from traditional print media.

24. In the S&P 500, 334 companies earned more profit in 2011 than in 2007, when the economy peaked. The median gain is 38%.

23. According to economist Michael Spence, sectors of the economy that have no direct foreign competition added more than 27 million jobs from 1990 to 2008. Those that do added almost none.

22. Capital expenditures among S&P 500 companies set a record in the fourth quarter of 2011.

21. Netflix (Nasdaq: NFLX ) is now responsible for about one-third of all Internet bandwidth.

20. The average salary for a Silicon Valley tech worker surpassed $100,000 in 2011.

19. In 2009 and 2010, 93% of the nation's income growth went to 1% of wage earners, according to economist Emmanuel Saez; 15,600 households captured 37% of all national growth.

18. Growth in health care spending in 2010 was the lowest in half a century.

17. In 2010, President Barack Obama set what looked like an unrealistic goal of doubling U.S. exports by 2015. After growing an average of 16% a year since, the goal is on track to be met ahead of schedule.

16. Good news: 400,000 manufacturing jobs have been added since 2009. Bad news: Manufacturing employment is still down almost 6 million since 2000.

15. Total government employment has shrunk by almost 700,000 since 2009.

14. According to the IMS Institute for Healthcare Informatics, the number of prescription drugs issued fell by 1.1% last year, and doctor visits fell 4.7%.

13. We imported 60.3% of our oil in 2005. In 2010, that figure was 49.2%, and will likely drop further as domestic production rises.

12. For the first time since 1949, the U.S. is now a net exporter of fuel products like gasoline and diesel.

11. The period from March 2009 to March 2012 was one of the strongest three-year market rallies in history -- stronger, in fact, than the 1996-1999 bull market.

10. According to the McKinsey Global Institute, 30% of companies in 2011 had job openings for six months or longer, but couldn't find the right person to hire.

9. Adjusted for inflation, the bursting of the housing bubble destroyed wealth equal to half a 1950s America.

8. At 66.9%, the homeownership rate in America is down considerably from the 2004 peak, but is still above the long-term average of 66%.

7. U.S. apartment vacancies are now at a decade low.

6. A 2008 Swedish study found that unemployed people gradually lose the ability to read.

5. Mike Konczal, a fellow at the Roosevelt Institute, ran the numbers and found that as unemployment goes up, the divorce rate goes down.

4. According to the Airline Quality Rating, 2011 was the best year ever for airline industry performance (lost baggage, on-time departures, etc.).

3. The combined assets of Wal-Mart's (NYSE: WMT ) Walton family is equal to that of the bottom 150 million Americans.

2. As the economy tanked in 2009, the top 25 hedge fund managers collectively earned $25.3 billion. On average, that works out to about $2,000 a minute for each manager.

1. Household debt payments as a percent of income are now the lowest since 1994.

Demeter

(85,373 posts)LOS ANGELES (CBS) — A bill authored by a Southland lawmaker that could potentially allow the federal government to prevent any Americans who owe back taxes from traveling outside the U.S. is one step closer to becoming law. Senate Bill 1813 was introduced back in November by Senator Barbara Boxer (D-Los Angeles) to “reauthorize Federal-aid highway and highway safety construction programs, and for other purposes” . After clearing the Senate on a 74 – 22 vote on March 14, SB 1813 is now headed for a vote in the House of Representatives, where it’s expected to encounter stiffer opposition among the GOP majority.

In addition to authorizing appropriations for federal transportation and infrastructure programs, the “Moving Ahead for Progress in the 21st Century Act” or “MAP-21? includes a provision that would allow for the “revocation or denial” of a passport for anyone with “certain unpaid taxes” or “tax delinquencies”. Section 40304 of the legislation states that any individual who owes more than $50,000 to the Internal Revenue Service may be subject to “action with respect to denial, revocation, or limitation of a passport”. The bill does allow for exceptions in the event of emergency or humanitarian situations or limited return travel to the U.S., or in cases when any tax debt is currently being repaid in a “timely manner” or when collection efforts have been suspended.

However, there does not appear to be any specific language requiring a taxpayer to be charged with tax evasion or any other crime in order to have their passport revoked or limited — only that a notice of lien or levy has been filed by the IRS.

Boxer vowed last week to push House Republicans to pass the bipartisan transportation bill that would keep the Highway Trust Fund from going bankrupt.

“Thousands of businesses are at stake, and eventually we are talking about nearly three million jobs at stake,” she said in a statement. “There are many people on both sides of the aisle in the Senate who want to get our bill, MAP-21, passed into law, and I am going to do everything I can to keep the pressure on the Republican House to do just that.”

NOT CLEAR IF BABS IS BEHIND THE IRS/PASSPORT CONNECTION....THAT'S GOT TO BE PATENTLY UNCONSTITUTIONAL...NOT THAT THE CONSTITUTION MEANS ANYTHING ANY MORE.

Demeter

(85,373 posts)One of the more extreme government abuses of the post-9/11 era targets U.S. citizens re-entering their own country, and it has received far too little attention. With no oversight or legal framework whatsoever, the Department of Homeland Security routinely singles out individuals who are suspected of no crimes, detains them and questions them at the airport, often for hours, when they return to the U.S. after an international trip, and then copies and even seizes their electronic devices (laptops, cameras, cellphones) and other papers (notebooks, journals, credit card receipts), forever storing their contents in government files. No search warrant is needed for any of this. No oversight exists. And there are no apparent constraints on what the U.S. Government can do with regard to whom it decides to target or why.

In an age of international travel — where large numbers of citizens, especially those involved in sensitive journalism and activism, frequently travel outside the country — this power renders the protections of the Fourth Amendment entirely illusory. By virtue of that amendment, if the government wants to search and seize the papers and effects of someone on U.S. soil, it must (with some exceptions) first convince a court that there is probable cause to believe that the objects to be searched relate to criminal activity and a search warrant must be obtained. But now, none of those obstacles — ones at the very heart of the design of the Constitution — hinders the U.S. government: now, they can just wait until you leave the country, and then, at will, search, seize and copy all of your electronic files on your return. That includes your emails, the websites you’ve visited, the online conversations you’ve had, the identities of those with whom you’ve communicated, your cell phone contacts, your credit card receipts, film you’ve taken, drafts of documents you’re writing, and anything else that you store electronically: which, these days, when it comes to privacy, means basically everything of worth.

This government abuse has received some recent attention in the context of WikiLeaks. Over the past couple of years, any American remotely associated with that group — or even those who have advocated on behalf of Bradley Manning — have been detained at the airport and had their laptops, cellphones and cameras seized: sometimes for months, sometimes forever. But this practice usually targets people having nothing to do with WikiLeaks.

A 2011 FOIA request from the ACLU revealed that just in the 18-month period beginning October 1, 2008, more than 6,600 people — roughly half of whom were American citizens — were subjected to electronic device searches at the border by DHS, all without a search warrant. Typifying the target of these invasive searches is Pascal Abidor, a 26-year-old dual French-American citizen and an Islamic Studies Ph.D. student who was traveling from Montreal to New York on an Amtrak train in 2011 when he was stopped at the border, questioned by DHS agents, handcuffed, taken off the train and kept in a holding cell for several hours before being released without charges; those DHS agents seized his laptop and returned it 11 days later when, the ACLU explains, “there was evidence that many of his personal files, including research, photos and chats with his girlfriend, had been searched.” That’s just one case of thousands, all without any oversight, transparency, legal checks, or any demonstration of wrongdoing...

MORE SPECIFICS AT LINK

Fuddnik

(8,846 posts)Decided to drop his daily strips and other political toons to concentrate on his childrens books, after a scary encounter with DHS.

It's fascism already.

Demeter

(85,373 posts)GIVE ME A DUMB HOUSE THAT KNOWS HOW TO KEEP CONFIDENTIALITY

Recently, CIA Director David Petraeus made headlines with a speech given at the summit for In-Q-Tel, the CIA’s venture capital firm. In this talk, Petraeus discussed the emerging “internet of things” and the implications it will have for increased levels of surveillance. Petraeus explained that, because of the rise of gadgets which are connected and controlled by apps, intelligence agencies will no longer need to place spy devices inside your home – you will do it for them.

MY NEIGHBOR IS ALREADY UP IN ARMS ABOUT SMART METERS FOR ELECTRICITY--WITH THE CALIM THAT BY ANALYZING THE POWER DEMANDS, THE ELECTRIC COMPANY CAN FIGURE OUT IF YOU ARE USING A VIBRATOR....CALIFORNIANS, THEY ARE THE YEAST IN THE BREAD OF LIFE...

In conjunction with a recent unveiling of a new low-powered computer chip by ARM, one of the world’s largest chip companies, the fact is virtually every piece of electronic equipment (including appliances) can be controlled via apps and Internet-based systems. It is for this reason that Petraeus stated that the CIA will be able to read these devices via the Internet and even radio waves outside of the home.

Petraeus further stated,

Particularly to their effect on clandestine tradecraft. Items of interest will be located, identified, monitored, and remotely controlled through technologies such as radio-frequency identification, sensor networks, tiny embedded servers, and energy harvesters – all connected to the next-generation internet using abundant, low-cost, and high-power computing.

He also added, “the latter now going to cloud computing, in many areas greater and greater supercomputing, and, ultimately heading to quantum computing.”

Of course, it is well-known that the CIA or any other government agency is admitting to such a level of capability, the truth is that this technology has been available for many years, even tested and perfected long before the first hints were given to the general public. But perhaps just as alarming as Petraeus’ statements is the recent announcement regarding the new models of Samsung televisions currently being rolled out on the market. Indeed, if these new products are not a full blast initiation into the world of George Orwell’s 1984, then they are, at the very least, half way there.

This is because Samsung’s new line of LED HDTV’s will now include built-in, internally wired HD cameras, face tracking and speech recognition capabilities, and twin microphones. In the 2012 8000-series plasmas, the cameras and microphones are built directly into the screen bezel. The 7500 – 8000ES-series TV’s, however, will have the cameras permanently attached to the top of the set. Obviously, the new TV’s, with their ability to access the Internet, will be connected to Samsung’s own software, but the sets will also be compatible with “third party apps” in much the same manner as the appliances mentioned above by Petraeus. These TV’s, via the built-in camera and face recognition software, locate and record the faces of viewers while storing this information within the software for future use. The idea is that the software, after logging the different faces into the program, can then “personalize the experience” for the individual viewers. The TV’s also come equipped with the ability to listen and respond to voice commands. Naturally, the built-in microphones must be active in order to use this feature.

It should also be noted that these features, unlike the add-on accessories that have come with television sets up to this point, cannot be removed simply by unplugging a device by its cord or USB cable. Again, the devices are built-in as part of the system itself. As Gary Merson of HD GURU writes, these new “features” bring with them some important privacy concerns. What concerns us is the integration of both an active camera and microphone. A Samsung representative tells us you can deactivate the voice feature; however this is done via software, not a hard switch like the one you use to turn a room light on or off...

MORE

********************************************************************

Brandon Turbeville is an author out of Mullins, South Carolina. He has a Bachelor's Degree from Francis Marion University and is the author of three books, Codex Alimentarius -- The End of Health Freedom, 7 Real Conspiracies, and Five Sense Solutions. Turbeville has published over one hundred articles dealing with a wide variety of subjects including health, economics, government corruption, and civil liberties. Brandon Turbeville is available for podcast, radio, and TV interviews. Please contact us at activistpost (at) gmail.com.

AnneD

(15,774 posts)for some time now. These early warning alerts to let you know of a tornado will soon be bastardized into a way to monitor you, your conversations, etc. How much longer will it be before the Minority report comes true.

Demeter

(85,373 posts)Ireland's complex proposal for renegotiating its debts today recalls the many years of debt restructuring experienced by Third World countries over the last three decades. Far from giving those countries a fresh start, these negotiations kicked the problem down the road.

So will the debt negotiations in Ireland. Ireland has been brought to its knees by a debt, which originated not with excessive public spending, but a footloose financial sector that gambled with the future of the country. Standing astride Ireland's notorious property bubble is the Anglo Irish bank - which lent money to rich speculators to inflate a property bubble.

When the bubble burst, the Irish government foolishly agreed to guarantee the bank. Economics professor Morgan Kelly said at the time that both Anglo and Irish Nationwide, which was also underwritten, "were purely conduits for property speculation. They fulfil no role in the Irish economy." Anglo is believed to have 15 customers who owe the bank more than €500m each.

Today Anglo Irish, now rebranded as the Irish Bank Resolution Corporation, is a zombie bank - it only exists to repay debts. It will not become a viable bank again and its existence does not benefit the Irish economy. Nonetheless, over €8bn has been paid by the Irish government to Anglo's secret investors, even though many of these bondholders fuelled Ireland's speculative economy.

The bondholders were paid thanks to new 'bail-out' loans. Now Ireland has to 'repay' a series of 'promissory notes' - IOUs which are pumped back into the zombie banks, and effectively removed from circulation. Much needed money is effectively destroyed...MORE

CALLS FOR DEBT JUBILEE

Demeter

(85,373 posts)THIS IS THE REAL DOMINO EFFECT. WE NEED SMARTER SOVEREIGN NATIONS WHO FIGHT BACK THE MULTINATIONAL SHARKS, INSTEAD OF TRYING TO LATCH ON AND SNATCH CRUMBS FROM THEM.

http://www.informationclearinghouse.info/article30991.htm

More than two years ago I began warning readers of the most heinous acts of fraud ever perpetrated by the Western banking crime syndicate, which I dubbed “economic terrorism”. These swindles involved nothing less than the destruction of entire European economies, solely so that the banksters could profit on approximately $100 trillion in bets they had placed on the debts of these economies.

The mechanics of this economic rape have been explained many times in the past. First of all the bankers duped governments and institutions all over the Western world into placing trillions of dollars (and/or euros) in bets that interest rates were about to soar higher – just before they crashed interest rates to the lowest levels in history. This swindle is known as “interest rate swaps”.

The second (and even more destructive) form of fraud perpetrated against these governments didn’t even require their participation – merely their naïve acquiescence. The bankers began placing huge bets (totaling at least $60 trillion) that these nations would default, and then had the audacity to call these bets “insurance” (credit default swaps). Note that such “insurance” had been banned in the U.S. for more than half a century – based upon anti-gambling statutes.

Here is the question which these banksters would never answer: how does a third party placing bets on whether someone’s home would burn down provide any “insurance” to the owner of the home? The answer of course is that it doesn’t. What it did do, however, was to create a $60 trillion motive for “arson”....

Demeter

(85,373 posts)IT'S BEEN TOO WARM...THE TANKS ARE FULL...GOT TO EXPORT TO EUROPE, BREAK THE RUSSIAN BEAR'S HOLD ON FRANCE AND UKRAINE....PLUS

...Temperatures this summer are forecast to be about normal, and much cooler than the last two summers, says David Streit, a meteorologist at Commodity Weather Group expects.

Sultry winters, he said, do not usually develop into sultry summers.

Demeter

(85,373 posts)In a NYT Economic blogpost Jason DeParle ponders the fact that government surveys are not showing much increase in poverty, even though we know there are many people experiencing long periods of unemployment and many forms of government assistance have been cut back. One possible explanation is that people in poverty and extreme poverty are less likely to be covered by the survey.

My colleague, John Schmitt, found clear evidence of a coverage problem in comparing employment rates as shown in the 2000 Census and the overlapping months of the Current Population Survey (CPS). This is a useful check on the accuracy of the CPS, the main survey for measuring both unemployment and poverty, since the Census has near universal reach with a response rate of close to 99 percent. By comparison, the coverage rate for the CPS is close to 88 percent.

Even after applying a Census adjustment formula, Schmitt still found a substantial difference in employment rates, with the CPS showing an overall employment rate that was more than a full percentage point higher than the Census. The difference was largest for groups with the lowest coverage rates. In the case of young African American men, who have a coverage rate of close to two-thirds, the CPS showed an employment rate that was 8 percentage points higher than the Census for the same months of 2000.

These results are consistent with a story where the CPS is missing more people through time and the people who it misses are disproportionately at the bottom of the income ladder. If this is true, then there could be a rise in poverty that is largely missed in the standard surveys.

Demeter

(85,373 posts)Perhaps no law in the past generation has drawn more praise than the drive to “end welfare as we know it,” which joined the late-’90s economic boom to send caseloads plunging, employment rates rising and officials of both parties hailing the virtues of tough love. But the distress of the last four years has added a cautionary postscript: much as overlooked critics of the restrictions once warned, a program that built its reputation when times were good offered little help when jobs disappeared. Despite the worst economy in decades, the cash welfare rolls have barely budged. Faced with flat federal financing and rising need, Arizona is one of 16 states that have cut their welfare caseloads further since the start of the recession — in its case, by half. Even as it turned away the needy, Arizona spent most of its federal welfare dollars on other programs, using permissive rules to plug state budget gaps. The poor people who were dropped from cash assistance here, mostly single mothers, talk with surprising openness about the desperate, and sometimes illegal, ways they make ends meet. They have sold food stamps, sold blood, skipped meals, shoplifted, doubled up with friends, scavenged trash bins for bottles and cans and returned to relationships with violent partners — all with children in tow.

....................

Critics of the stringent system say stories like these vindicate warnings they made in 1996 when President Bill Clinton fulfilled his pledge to “end welfare as we know it”: the revamped law encourages states to withhold aid, especially when the economy turns bad. The old program, Aid to Families with Dependent Children, dates from the New Deal; it gave states unlimited matching funds and offered poor families extensive rights, with few requirements and no time limits. The new program, Temporary Assistance for Needy Families, created time limits and work rules, capped federal spending and allowed states to turn poor families away.

“My take on it was the states would push people off and not let them back on, and that’s just what they did,” said Peter B. Edelman, a law professor at Georgetown University who resigned from the Clinton administration to protest the law. “It’s been even worse than I thought it would be.”

But supporters of the current system often say lower caseloads are evidence of decreased dependency. Many leading Republicans are pushing for similar changes to much larger programs, like Medicaid and food stamps.

............................................................................................

“This is what really bothers me: the people who supported welfare reform, they’re ignoring the problem.”

The welfare program was born amid apocalyptic warnings and was instantly proclaimed a success, at times with a measure of “I told you so” glee from its supporters. Liberal critics had warned that its mix of time limits and work rules would create mass destitution — “children sleeping on the grates,” in the words of Senator Daniel Patrick Moynihan, a New York Democrat who died in 2003. But the economy boomed, employment soared, poverty fell and caseloads plunged. Thirty-two states reduced their caseloads by two-thirds or more, as officials issued press releases and jostled for bragging rights. The tough law played a large role, but so did expansions of child care and tax credits that raised take-home pay. In a twist on poverty politics, poor single mothers, previously chided as “welfare queens,” were celebrated as working-class heroes, with their stories of leaving the welfare rolls cast as uplifting tales of pluck. Flush with federal money, states experimented with programs that offered counseling, clothes and used cars.

But if the rise in employment was larger than predicted, it was also less transformative than it may have seemed. Researchers found that most families that escaped poverty remained “near poor.” And despite widespread hopes that working mothers might serve as role models, studies found few social or educational benefits for their children. (They measured things like children’s aspirations, self-esteem, grades, drug use and arrests.) Nonmarital births continued to rise. But the image of success formed early and stayed frozen in time....The recession that began in 2007 posed a new test to that claim. Even with $5 billion in new federal funds, caseloads rose just 15 percent from the lowest level in two generations. Compared with the 1990s peak, the national welfare rolls are still down by 68 percent. Just one in five poor children now receives cash aid, the lowest level in nearly 50 years. As the downturn wreaked havoc on budgets, some states took new steps to keep the needy away. They shortened time limits, tightened eligibility rules and reduced benefits (to an average of about $350 a month for a family of three). Since 2007, 11 states have cut the rolls by 10 percent or more. They include centers of unemployment like Georgia, Indiana and Rhode Island, as well as Michigan, where the welfare director justified cuts by telling legislators, “We have a fair number of people gaming the system.” Arizona cut benefits by 20 percent and shortened time limits twice — to two years, from five. Many people already found the underlying system more hassle than help, a gantlet of job-search classes where absences can be punished by a complete loss of aid. Some states explicitly pursue a policy of deterrence to make sure people use the program only as a last resort.

Since the states get fixed federal grants, any caseload growth comes at their own expense. By contrast, the federal government pays the entire food stamp bill no matter how many people enroll; states encourage applications, and the rolls have reached record highs.

MUCH MORE AT LINK

DO NOT READ THIS IF YOU ARE DEPRESSED OR SUICIDAL

Demeter

(85,373 posts)Sometime last year computers at the U.S. Social Security Administration were hacked and the identities of millions of Americans were compromised. What, you didn’t hear about that? Nobody did.

The extent of damage is only just now coming to light in the form of millions of false 2011 income tax returns filed in the names of people currently receiving Social Security benefits. That includes a very large number of elderly and disabled people who are ill-equipped to recognize or fight the problem. It’s an impact pervasive enough that the IRS now has a form just to deal with it: Form 14039: Identity Theft Affidavit, December 2011.

The Wall $treet Journal has a story about this problem specific to Puerto Rico, but the Journal fails to mention that this is a national problem — a $30+ billion problem.

The story is going public now because tax season is upon us and there’s no way to keep it under wraps as people file their tax returns only to learn that a return under that name has already been filed with refunds paid electronically into a bank account now closed. The December date on that IRS Form 14039 shows the Treasury has been expecting this for awhile.

MORE...MUST READ!

Demeter

(85,373 posts)Can't wait to see what tomorrow brings....April is the cruelest month

April is the cruelest month, breeding

Lilacs out of the dead land, mixing

Memory and desire, stirring

Dull roots with spring rain.

Winter kept us warm, covering

Earth in forgetful snow, feeding

A little life with dried tubers....

http://eliotswasteland.tripod.com/