RBS will leave Scotland if voters back independence

Source: The Guardian

Royal Bank of Scotland has drawn up plans to shift its head office from Scotland – where it has been based since 1727 – in the event that next week's independence referendum backs a break away from the rest of the UK.

The announcement followed news that Lloyds Bank would also move its head office to England and a warning that mortgage lenders are preparing to restrict lending in the event of a yes vote as concerns deepen over the currency that an independent Scotland would use.

Treasury sources had indicated on Wednesday night that such a move by RBS was likely after the other bailed-out bank with major operations in Scotland, Lloyds Banking Group, revealed it too would set up legal entities in England to protect its credit rating.

The moves by the banks, which received £65bn of taxpayer bailouts in 2008 and 2009, follows a warning by another pillar of the Scottish financial community – Standard Life – that it would shift business to England. BP has also spoken of its concerns.

Read more: http://www.theguardian.com/business/2014/sep/11/rbs-will-leave-scotland-yes-vote

Erich Bloodaxe BSN

(14,733 posts)That's teach em to try and blackmail the Scottish people.

Heh.

brooklynite

(94,513 posts)Scotland doesn't become immediately independent by virtue of the referendum vote. There would need to be a protracted seperation agreement worked out, which would give businesses time to relocate.

Erich Bloodaxe BSN

(14,733 posts)Lenomsky

(340 posts)Hey let them move their head offices we still have Bank of Scotland and Clydesdale Bank.

muriel_volestrangler

(101,311 posts)Royal Bank of Scotland (RBS), Lloyds Banking Group – which includes Halifax, Scottish Widows and Bank of Scotland – Tesco Bank, TSB and Clydesdale Bank all said the risks and uncertainties around separation were behind their decisions.

https://www.pressandjournal.co.uk/fp/news/politics/referendum/342324/salmond-attacked-for-dismissing-bank-plan-to-register-in-england/

freshwest

(53,661 posts)From the link and the comments on it, only 10% of that has been paid and they say the taxpayers in the UK (since those banks are nationalized) will be stuck with the debt.

Scotland does not have a currency plan. They'll will get one, given enough time. Per the comments, separation will take a few years to work out all the details.

Still seems odd that was not taken into account, as the commentors also say that it created the climate for austerity and the source of the debt was Scotland. Whethery they mishandled things, as claimed by some at the link, or greater forces were at work, IDK.

TIA if you know, and you usually do know.

muriel_volestrangler

(101,311 posts)What the government did was put money into RBS (headquartered in Scotland, but had taken over Nat West, a bank in England and Wales, that had a larger turnover), in return for a majority shareholding. So there's an effective price the government paid for the shares, and if the share price ever gets back to that, it could sell them on the open market. But so far, it hasn't got near that price. Independence might affect that price, but the holding would still be an asset of the current UK government, and would have to be part of the dividing up of the government assets and liabilities that independence would force. If independence makes the bank riskier (eg uncertainty about a lender of last resort for it), the share price could go down more.

The other major bank involved, Lloyds, is also complicated; Lloyds was English/Welsh, and the government more or less forced it to merge with 'HBOS', which had been a (pre-crash) merger of Halifax, an English bank, and Bank of Scotland. Again, the government put in money for shares; this bank has faired a but better, and the government has sold back some of the holding without making a major loss on it.

Whose to blame is also, of course, complicated. The Scottish management at RBS did seem particularly ambitious and risk-taking, which meant that bank was particularly hard hit in the collapse. But little has been pointed to as actually illegal - it was more reckless capitalism, with a government (ironically Labour) that didn't bother regulating since it brought in taxable profits.

TexasMommaWithAHat

(3,212 posts)The vote is on separation and separation only, and all the details have to be worked out later.

But think about it: The rest of the U.K. is under no obligation to give in to whatever Scotland wants, and if the Scots vote for independence, I do believe the U.K. is going to start playing hardball.

Once a divorce has been decided upon, the fighting frequently commences. I don't think this is going to be any different.

Lenomsky

(340 posts)Anyway thanks for the info but hey it's bankers I don't believe their threats.

muriel_volestrangler

(101,311 posts)since they have significant operations north and south of the border. Clydesdale surprised me - I thought they had a foreign owner (Australian?) but only operated in Scotland (or do they have something in Northern Ireland - or even Yorkshire Bank?).

Splits into banks that operate mainly in each country, in the event of independence, would seem the sensible solution to me - that way, the regulation and backing in case of disaster can be appropriate and manageable by each government - but what do I know?

TexasMommaWithAHat

(3,212 posts)because of worries over sterling. Scotland wants to keep the pound, which would mean that the U.K. taxpayer continues to back the Scottish government, and that is not going to happen. That's why the banks are leaving.

muriel_volestrangler

(101,311 posts)might make sense - the rUK business (Lloyds, Halifax, Nat West) backed by the Bank of England and the Scottish business (BoS, RBS, Clydesdale) up to the new Scottish government to back - which would be of an appropriate size for the country.

Lenomsky

(340 posts)These banks are being demerged.

I understand Llyods owns a fair percentage and may need to spin off some businesses. I'm unsure if this has been mandated.

TSB now claims to be totally independent and their recent letter stated they would not invest in risky business practices and focus on savings, loans etc for their customer base.

BoS has not yet fully demerged from Halifax as they have an agreement to service each others customers.

It's an about turn from the heady days of huge mergers generating huge profits and we know what happened with that.

I'm shocked with Clydesdale being one of the few banks that didn't throw the dice and lose their shirts as they service only Scotland however share a banking licence with Yorkshire Bank.

FrodosPet

(5,169 posts)...but trust, this would be a bad idea

If they did not move to London - if they somehow magically get nationalized by an unformed government before they had the time to do that - their deposits will shrivel up, and a new nation will be saddled with owning bankrupt banks.

Or I guess they could say "Fuck You! We are nationalizing all the deposits as well too bad so sad you lose you rich assholes" - but that would go REALLY REALLY bad, so I am pretty sure the vast majority of Scots would not support that.

MFrohike

(1,980 posts)Their leaving isn't a threat, it's a gift.

jwirr

(39,215 posts)cp

(6,626 posts)if they pull a crap stunt like that.

Yes Scotland!

CanonRay

(14,101 posts)I wasn't really for the Yes vote, but if the banksters are against it, I've got to re-think my position.

Adrahil

(13,340 posts)Scotland, on its own, isn't much of a financial driver. The economy of Scotland is MASSIVELY integrated with the rest of Britain. Those banks probably have the vast majority of their business interests down south, and it would be damned risky to keep their headquarters in a nation where there is great uncertainty, where the pound won't be the currency, and which is home to a minority of their business.

If the Scots vote for independence, I wish them luck. They certainly should be able to determine their own future. But I think that would be pretty damned foolish

TexasMommaWithAHat

(3,212 posts)And the U.K. is not going to let that happen. That's why the banks are leaving.

This is what the pro-indenpendence group wants:

A divorce, including a split of assets and liabilities, which then allows each partner to go his merry way. However, by requesting that the U.K. allow Scotland to keep the pound, they are essentially asking that the U.K. will back them up in the event they screw up the economy. It's like the ex-wife expecting to keep a credit card with an unlimited credit amount, just in case she needs it.

Not gonna' happen. And the banks are protecting themselves and their depositors by leaving.

Delver Rootnose

(250 posts)...to me. Someone really doesn't want this to happen so they are using economic pressure to stop it. The people of Scotland should then nationalize BP assets in response when they, or if, they get Independence, then ask for help from china.

FrodosPet

(5,169 posts)The Chinese government only wants what's best for the globe. They would never place themselves and their people above the rest of the world.

![]()

yurbud

(39,405 posts)At least not others who don't share a border with them.

So it is in their selfish interests to play nice with others.

As we are seeing the limits of our military power, we would be wise to do likewise.

Divernan

(15,480 posts)Salmond promises a vote for independence will be financially beneficial to Scots - but even in the best case scenario, there will be tremendous disruption for years, and while Scotland may gain more benefit from North Sea oil, that income is variable depending upon many factors. The UK has promised to devolve more powers to the Scottish parliament if there is a NO vote (i.e., independence is rejected).

In any case, after all these years and years of debate upon the subject, it will be great to have the question decided by popular vote, and most interesting to see how a YES vote, if that is the outcome, plays out. I've spent some time in Edinburgh and the Scottish highlands - love the country and wish it the best.

(More from the OP link)

One housing industry insider said there has already been an impact on the housing market, with signs that the market for homes worth more than £600,000 – the top end of the market in Scotland – is drying up. At the same time, commercial property deals were being put on hold until the vote was known – and could be abandoned in the event of a yes vote.

Some potential property buyers have inserted clauses into their offers saying "subject to a no vote", according to the mortgage broker Ray Boulger of John Charcol. He said: "A yes vote will create massive problems in terms of how mortgages are denominated and regulated. We expect it to be much more difficult for Scottish borrowers to get mortgages post a yes vote."

Other bankers are speaking of a pause in lending until the situation is clear. Lenders are refusing to comment publicly for fear of being accused of playing politics. But one said: "Before that poll [the Sunday Times/YouGov poll that showed the yes campaign in the lead] it was interesting but not critical. Now we are watching things very, very closely. It – introduces huge uncertainty and one way of decreasing our exposure and risk would be to reduce the loan-to-value offered to borrowers."

For one example, defense/military bases:

Most controversially, so too is Her Majesty’s Naval Base Clyde at Faslane, home to the UK’s four Vanguard-class submarines – that is, Trident, the four submarines, plus missiles and warheads, that act as the UK’s nuclear deterrent. The recent British Social Attitudes survey showed that opposition to nuclear weapons among Scottish voters outweighs support by 46% to 37% (in England and Wales it is 43% in favour, 36% opposed).

Defence is a big employer in Scotland. According to the quarterly location statistics for April 2014, published by the Ministry of Defence, there were 14,510 MoD personnel based in Scotland, 7.5% of the UK’s total, of whom 10,600 were military (4,210 navy; 3,690 army; 2,700 air force) and 3,910 civilian. The MoD says that by 2020 the number of personnel in Scotland is due to increase to 12,500 (8.8% of the UK total), though overall numbers across the UK are decreasing.

The Clyde naval base at Argyll and Bute – which also includes a large separate high-security nuclear warhead facility at Coulport nearby – is Scotland’s biggest employment site, according to the MoD. Currently around £140m a year is spent on Scotland’s defence estate, which includes Clyde as well as military sites in Leuchars, Kinloss, Lossiemouth, Fort George, Royal Marines Condor near Arbroath, and the Hebrides Range.

http://www.theguardian.com/news/2014/sep/04/scottish-independence-scotland-defence-trident

And re currency:

The future of the currency is of crucial importance. George Osborne, the Conservative chancellor, and spokesmen for the two other main parties have recently said that full currency union would not be acceptable in the wake of a yes vote for independence. The SNP has said that it would be in the interest not only of Scotland but also of the rest of the UK, especially as it would avoid transaction costs on trade. But retaining full currency integration with only one central bank would require Scotland and the rest of the UK to be jointly responsible for debt in both countries. Scotland is too small to bail out the rest of the UK in a crisis, while ministers in the rest of the UK could not be expected to bail out Scotland, if that imposed any burden on their taxpayers.

It seems more likely that Scotland would have to have its own currency, which could be pegged to sterling, and its own central bank as lender of last resort. A separate currency, however, could be damaging to the important Scottish financial sector, which depends on its client base in the rest of the UK for most of its business. With more than 100,000 employees, it is one of the most valued parts of the modern Scottish economy.

http://www.theguardian.com/commentisfree/2014/mar/11/north-sea-oil-independent-scotland-economy-revenue

dixiegrrrrl

(60,010 posts)I wonder how many of the same arguments were used against the idea of Finland refusing to play along with the bankers?

In all seriousness, the more Clegg and Cameron rail against the idea, the more I support it. Anything the banks don't like needs to be looked at.

Esp. telling is that England is promising to Scotland..", we will give you a few more crumbs of perceived power if you don't kick us out entirely"

how veddy veddy generous of The City.

Divernan

(15,480 posts)The UK has devolved the most powers to Scotland, some to Wales and Northern Ireland and none-zero-nada to England. Within England, regional devolution has only extended to London where the Greater London Authority has greater powers than other local authority bodies. Proposals for other Regional Assemblies in England have been indefinitely postponed following the rejection in a 2004 referendum of proposals for the North East.

The situation of devolving different levels of power to different member states (and one city) of the UK would be analgous to devolving different powers to the West Coast, Midwest, Northeast, Deep South and New York City.

https://www.gov.uk/devolution-of-powers-to-scotland-wales-and-northern-ireland

Massacure

(7,521 posts)In a way, we already see this with Medicaid. States are given leeway as to how to administer their programs, and as long as they meet certain guidelines the federal government will step in to assist financially.

Divernan

(15,480 posts)In the UK, the member states do not have equal powers or "leeway".

Ghost Dog

(16,881 posts)from the Guardian article on the potential iScotland - rUK (England) mutual spying conundrum:

Don’t let this vote go the wrong way. I am a Scot living in Norway and I must favour the YES. This is a vote for a break from the Westminster way. A break from inherited power that has been handed through generations. A YES would mean a switch to a government that is in touch with the people it works for and the chance for people to be in touch with the government.

In Norway where the population is less than in Scotland but the country is 5 times the area of Scotland from the rural part where we live I have the feeling that I am close to the government we have. I have first hand experience of my point of view and that of our community actually counting forward and becoming seats in the government.

This directness gives ownership to people and makes them count. Their jobs, their relationships their habits their voice MEAN more to their own country. Its a subtle point that has to be lived to be appreciated. And a YES vote will reveal it. A NO vote will keep this sensation locked into Westminster. And that is what NO fears...

dixiegrrrrl

(60,010 posts)Access to the town Council and even the County commission is very easy, and they have to listen to the voters,

becusae we can and will pop into their office if needs be.

State Gov't is not all that responsive

and certainly the Congress members are not at all responsive, they vote for whoever pays them the most.

Ghost Dog

(16,881 posts)I've chosen to live, these past 26 years, on a small Spanish (Canary) island. We get to organise some very direct democracy sometimes in local elections... But the corruption is deeply ingrained in this culture.

dixiegrrrrl

(60,010 posts)I am very intrigued with how and why you made that Island your home.

Are you from the US originally?

Pls. feel free to PM me if you feel like sharing that info.

If not, I understand.

Ghost Dog

(16,881 posts)at the end of 1987, after having freelance-programmed part of the London Stock Exchange's 'Big Bang', and after meeting a girl from Barcelona...

I kind of 'went native' in Spain - Catalonia & Canary Islands - for quite a while. No, I don't speak (much) Catalan, but I understand a lot of it. I live, think, dream mostly in (Castillian) Spanish now I'm free; but in the last two years I've been learning to work with musicians working here (we're making GREAT music), on the sound recording / human relations / production side, who are internationals. So I'm now using the international English language more.

Writing for DU's been a great language / thought process help over the years, since 2003. Thanks, guys.

My mother's side of the family is from (lowland) Scotland - Mitchell; My immediate family and I lived and worked in the County Clare, Eire, in the early '70s. My brother married an Irish woman and my Niece was born in Edinburgh (my niece and family (her husband is Austrian-American) now live in France and Tokyo).

What I love about Europe is the diversity and the mixing of cultures. This is very creative. I wish the USA could be more that way too... As for freedom for Scotland? Of course. Freedom for the English regions and Wales? also of course. Let London become a post-modern City State. Many, I conjecture, would follow.

... And, hi there! ![]()

dixiegrrrrl

(60,010 posts)Talk about an international family. And such great opportunities for you.

Plus, you have a chance to see/hear more points of view via Europe perspective.

If I were 20 years young...ok, 25 years younger, I might be living outside of the US, for all the obvious reasons.

As it is, the South is a pretty foreign place for someone from the Evergreen State.

DU IS a good melting pot, indeed. ![]()

pampango

(24,692 posts)with the potential benefits.

Often fear of change is a conservative mindset - I like things the way they are. Other times, it can be a liberal attitude - I think change is being orchestrated by conservative forces.

iandhr

(6,852 posts)Other EU nations have there own issues regrading regions that want to break away and form their own countries.

If Scotland wants in Spain will try and block them. They have their own issues with Catalonia.

dixiegrrrrl

(60,010 posts)Losing national identity, having no control over the currency you use, or the markets you are exposed to, having no say in how your military is being used...

not good things, in my book.

Of course, that powers that be, having moved from stealing from a city to stealing from a state to stealing from a country, LOVED the chance to steal from the EU.

EU countries are losing sovereignty very quickly, and are countries in name only. Look at Greece, Italy, and Spain.Their spending is being dictated by the

central Bank, which steps in and imposes that gruesome term, "austerity" following the failure of the countries to carry out conditions of IMF loans.

Which, by the way, is EXACTLY a page from the Mafia handbook...loan money to a business, under onerous rates, then move in and take over the business when the owner cannot pay, run up credit charges for the goods, run the goods out the back door for re-sale, and when the business is finally teetering, torch it for the insurance money.

muriel_volestrangler

(101,311 posts)and the Scottish Green Party is also in favour of the EU, as are the Scottish Socialists. (The EU has no control at all over members' militaries, by the way - Ireland, Austria and Finland are all non-NATO, for instance). Those are the main parties in the Yes campaign.

dixiegrrrrl

(60,010 posts)Thanks for the info. ![]()

Scootaloo

(25,699 posts)Frankly the last thing an independent Scotland needs is to have its assets tapped to bail out Moldavia or whatever, anyway.

pampango

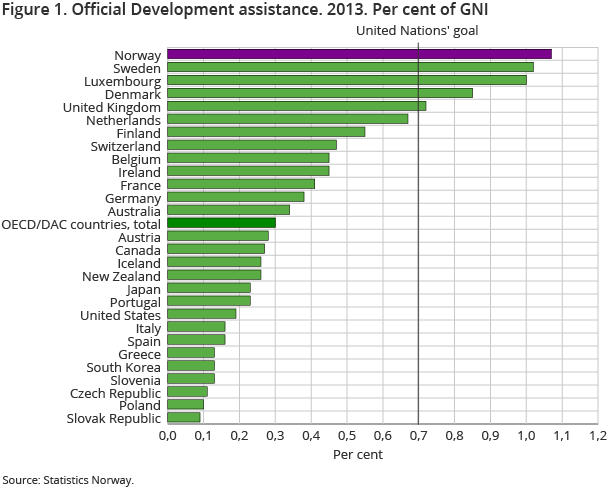

(24,692 posts)citizens of EU countries have because Norway belongs to the European Free Trade Association and the Schengen Agreement. And they don't have the obligations that the French or English or Swedes have towards the Moldovas of the continent.

Of course, Norway is very generous with foreign aid anyway but that is a voluntary thing not something mandated by the EU.

?_encoded=2f66666666666678302f35382f29303136286874646977656c616373&_ts=145f02cff60

?_encoded=2f66666666666678302f35382f29303136286874646977656c616373&_ts=145f02cff60

KamaAina

(78,249 posts)And Spain doesn't have to try and block them. It can do so unilaterally, because the vote has to be unanimous.

mathematic

(1,439 posts)They may take our banks but they'll never take our freedom.

Stargazer09

(2,132 posts)I don't envy the Scots. Short term pain, long term gain, maybe. Lots of uncertainties either way.

toby jo

(1,269 posts)It'll take a lot of work in that sector to reorganize, hope they push their hiney asses to get it done.

Divernan

(15,480 posts)MPs to probe devolution in England, Wales and Northern Ireland

MPs in Westminster are poised to launch an inquiry into devolving more powers to England, Wales and Northern Ireland. The Political and Constitutional Affairs Select Committee will examine extending some of the powers granted to Scotland - in the event of a No vote - to the rest of the UK.

Chair Graham Allen said: "Now is the chance to to discuss devolution. "If it's good enough for Scotland it's good enough for England, Wales and Northern Ireland."

Deputy Prime Minister Nick Clegg said it was inevitable that greater devolution in England, Wales and Northern Ireland would follow if greater powers were handed to the Scottish Parliament if Scotland votes no to independence. Speaking to the Political and Constitutional Reform Committee, chaired by Mr Allen, Mr Clegg predicted that the next Parliament would be "of huge constitutional significance". He told the MPs: "I don't think anyone should imagine that we can embark upon a new chapter of very significant devolution of further powers to Scotland without having a wider debate about how we decentralise power more generally across the United Kingdom."

'Federal '

Mr Clegg predicted a "much wider re-wiring of the governance and constitutional arrangements" across the UK, particularly in England.

hunter

(38,311 posts)If Scotland votes to go their own way it seems likely they'd tell the big bankers to fuck themselves.

justabob

(3,069 posts)I am no expert, but from what little I know about the things is driving this movement, that seems likely to be true.

Divernan

(15,480 posts)It's not simply a matter of letting the banks fail - it's the collapse of a nation's economy.

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/10782671/Independent-Scotland-has-parallels-with-Iceland-warns-SandP.html

Scotland could end up with a banking system much like that of Iceland on the eve of the financial crisis if it votes for independence, according to a warning from one of the world’s leading rating agencies.

Analysts at Standard & Poor’s have said an independent Scotland might lead to the creation of a financial system with eerie parallels to that of Iceland in 2008 when the tiny North Atlantic island was forced to allow all its major banks fail with the loss of billions of pounds of savers and creditors money.

In a report on the implications of independence for Scotland-based banks such as Lloyds Banking Group and Royal Bank of Scotland, S&P said the country was likely to face a situation in which the assets of its lenders were more than 10 times the size of its economy meaning it would be unable to credibly support them if a new crisis struck.

The report focuses on the likely deposit assurance arrangements post-independence and warns that even if Scotland were to join the euro any guarantee to protect the country’s savers would almost certainly fail.

“These arrangements would likely be unfunded, leaving the comparatively very sizeable deposit bases of the largest Scottish banks backed with an implicit guarantee by the Scottish government. We note a possible parallel here with Iceland, where in 2008 the national deposit insurance scheme could not honour claims when the country’s outsized banking system failed,” said S&P.

Divernan

(15,480 posts)(This article pre-dates the announcements from Royal Bank of Scotland and Lloyd's that they would in fact relocate in England in the event of a YES vote.)

S&P points out that while Icelandic banking assets in the run up to the crash peaked at 880pc of GDP, in post-independence Scotland they would equal 1,254pc of GDP. “In our view, the willingness and ability of a future Scottish government to support its banking system is challenging at this point,” said the ratings agency.

Danny Alexander, Chief Financial Secretary to the Treasury, warned in February that if the ‘yes’ vote won Scotland would face an exodus of financial services firms to the rest of the UK. “We’re able to have that scale of financial sector in Scotland because we’re part of the United Kingdom, because we have access to the Bank of England, the deep pockets fiscally of the UK Government as well, which helped to bail out RBS and Bank of Scotland,” said Mr Alexander. He added: “I think it’s very hard to see how major financial institutions could keep their headquarters in an independent Scotland if there was no central bank and no lender of last resort.”

Edinburgh-based insurer Standard Life has already said it could relocated large parts of its business south of the border if Scotland became independent. Lloyds and RBS have both refused to comment on what they would do in the event of independence.

However, S&P said that both banks could likely face pressure to move large parts of their operations out of Scotland, given that the bulk of their customers are outside of Scotland.

hunter

(38,311 posts)There are many rational ways of dealing with bad debt, more than the big bankers imagine.

What we have now is a system where big banks thrive in the bubbles they make and later shed the bad debts they've created upon feckless investors or the taxpayers in general. Or worse, they impose "austerity" upon ordinary people while the uber-wealthy dance and buy up everything at fire sale prices, or just plain loot the economy.

If there is a great disparity of wealth within a nation, as there is in both Scotland and the U.S.A., then something has gone horribly wrong in the economic system.

Orsino

(37,428 posts)sendero

(28,552 posts).. now much the 1% get shaken by any threat to the status quo. From Soros to the banksters, they are predict DOOM, DOOM I SAY, if Scotland would DARE to separate from the UK. Most likely they understand that the government of Scotland wouldn't so readily bail them out again.

God I hope they do it, any price they will have to pay will be worth it.

PaulaFarrell

(1,236 posts)I guess it would be worth it to you.

For myself, I suspect Scotland would become much like Ireland, powerless and doing anything to attract foreign investment. There's not a lot in Scotland to be honest - sheep and mountains mainly. There's the North Sea oil, but that will run out one day.

A Yes vote is a vote for pride over common sense. Say, do you also support secession by states?

sendero

(28,552 posts).. than bound to a corrupt High Street almost as bad as our Wall Street or worse depending on who you ask, a "privatized" health care system (we know how great that will work, for everyone but the patients), and a Tory infested pack of shits running everything.

You are right I have no dog in this hunt. Just like you have no dog in the Middle East, but probably have an opinion of how you would like things to turn out.

Divernan

(15,480 posts)Lenomsky

(340 posts)We are just sick of being governed by Conservatives and the New Tories aka Labour.

No risk no reward and if it hits the fan we can only blame ourselves.

EOM

grasswire

(50,130 posts)A warm welcome to DU! Keep us posted.

Nihil

(13,508 posts)People South of the Border are also sick of this - especially when what had seemed like

a lifeline to liberals turned out to be New Tory Mk2 - but we can also see that your second

point isn't an option either:

> No risk no reward and if it hits the fan we can only blame ourselves.

If it hits the fan, the rest of the UK knows exactly what to expect: we'll be paying for your

"risk" and the "rewards" of the rich bastards leading the rest of you sheep along.

Do you really think that a self-serving twat like Salmond is any different from Cameron or Blair

(except in the matter of scale of what he can screw-up without a successful "Yes" vote)?

You have been here for 5 years or so.

Have you learned nothing about the reality of "Hope and Change" talk from politicians

(and their owners) seeking office during that time?

![]()

I personally don't really care what those south of the border think to be frank .. it's MY vote!

Labour need Scottish seats to govern the UK so tough luck if you guys in the south vote for the Tories AGAIN as we certainly don't. If we get independence then Labour will need to tone down their current policies to be successful in Scotland.

Politicians are politicians yeah I get it .. they are all self serving and I personally have no great love for Salmond nor Sturgeon.

If we are independent we will be responsible for our finances and if we fuck up we'll be paying the tab - why on earth would anybody else be responsible.

Oh and I object to calling me a sheep so F you ![]()

Nihil

(13,508 posts)We can agree to disagree on this but no matter how much rancour this exercise

has stirred up in the rest of the UK, we are highly unlikely to let you drown.

![]()

> Oh and I object to calling me a sheep so F you ![]()

Ah, so the "I personally don't really care what those south of the border think to be frank"

*was* just posturing! ![]()

Best of luck for tomorrow & the future.

![]()

Lenomsky

(340 posts)what you lowlanders think or project. I do object to being called a sheep by a forum member.

You will not need to drag us from the Loch we'll be fine on our own but thanks all the same ![]()

I agree though let's agree to disagree as our future will be know tomorrow.

lululu

(301 posts)I'll hold the door open for them.

I hope the Scots vote for independence.

Ghost Dog

(16,881 posts)some three years ago (we'd been hanging out together some, in a detox clinic on the island of Mallorca (I like islands) - he was in as a (very succesful!) sex addict; me, getting over a relationship that became toxic after 28 years). His reply to the question: Does California really want independence? - "Not as much as Texas does."

NCjack

(10,279 posts)grasswire

(50,130 posts)I wonder what the full story is

amandabeech

(9,893 posts)If they stay in Scotland, they will need huge reserves because they will be using the Pound Sterling but will be unable to draw on the Bank of England, which governs the currency, in the event of a problem.

From further down the article:

The Bank of England governor, Mark Carney, faced intense scrutiny on Wednesday from MPs on the Treasury select committee about the financial implications for an independent Scotland.

He stressed that Threadneedle Street had contingency plans in the face of concerns about capital flight from Scotland and indicated that a Scottish central bank could need at least 25%, and possibly more than 100%, of the nation's GDP in reserves if the first minister, Alex Salmond, decides to use sterling after independence without the support of Westminster.

The precise amount of reserves needed to back an independent Scotland will depended on the size of the banking sector, at least 10 times the size of Scottish GDP.

If Scotland goes independent, it will take years for things to shake out. I wonder how soon after the vote that independence must take effect.

Spider Jerusalem

(21,786 posts)a newly independent Scotland would not be an EU member and would have to negotiate accession to the EU (at the back of the queue, behind Iceland and others); no longer being in the EU means that major banks with international clients (like RBS/Lloyds) would be effectively shut out of the European financial services market, or would incur much higher taxes on cross-border transactions than if they were in an EU country (hence the move to London).

amandabeech

(9,893 posts)Scotland would be out of the EU for years. Some writers have stated that some other EU countries with active separatist movements, like Spain, might not vote for Scotland's accession under any circumstances in order to discourage its own separatists. In Spain's case, that would be the Catalans and perhaps the Basque.

RBS now says that it will redomicile in England. I'm not sure what Lloyd's is doing.

Wanting to get out from under never-ending Thatcherism is completely understandable, as is the desire leave a union with an oppressor state, but there are very serious drawbacks to a complete separation from the UK.

geek tragedy

(68,868 posts)with no record of self-governance, one would expect any international company that could afford to flee to do just that, especially financial institutions which are dependent on access to central banks

blkmusclmachine

(16,149 posts)Adrahil

(13,340 posts)consider re-locating.

And independent Scotland is looking at a tough financial future. And if my company were HQ'd there, I consider a move to England. Just sayin'.

ChairmanAgnostic

(28,017 posts)But mine is a minority view, I am sure.

NASA and some defense manufacturers would very likely leave.

I suspect that the banks' threats are actually hollow. Their income depends on the business they do in Scotland. Do they really think that leaving doesn't mean that someone else will fill the void? Of course someone will. There are plenty of financial institutions that would love a wide open field for financial opportunity, especially with an educated base like Scotland.

As for Texas, I could easily see a crucifix maker, bible publishers, and the Flat Earth Society relocating there. Maybe even the Ayn Rand Society.

Adrahil

(13,340 posts)Most of those banks do the majority of their business in the south, and more importantly they do their business in the Pound Sterling.

And relocation doesn't mean they would renounce their Scottish business interests. But an independent Scotland would be facing a lot of uncertainty? Could they remain in the EU? What will they use as a currency? What kind of cross-boarder arrangements could be made with England? What will be the country's financial base in the coming years.

It's not that these things challenges can't be met, but with an iffy economy, where would you rather be? In a more or less secure financial environment, or in an environment fraught with uncertainty?

As for Texas.... I'm not saying if it would be a good thing, or a bad thing. But I do think a seceding Texas would see a lot of capital flight.

Nye Bevan

(25,406 posts)Would it be better if they kept these plans secret?

fbc

(1,668 posts)and he's almost always right

candelista

(1,986 posts)And Scotland will have to prove its "worthiness" to new investors. Just saying.

quadrature

(2,049 posts)FrodosPet

(5,169 posts)Why are there conditions for entry to the euro area?

The process of building Europe is one of progressive integration. The single market for goods, services, capital and labour, launched in 1986, was a major step in this direction. Economic and Monetary Union and the euro take economic integration even further, and to join the euro area Member States must fulfil certain economic and legal conditions.

Adopting the single currency is a crucial step in a Member State's economy. Its exchange rate is irrevocably fixed and monetary policy is transferred to the hands of the European Central Bank, which conducts it independently for the entire euro area. The economic entry conditions are designed to ensure that a Member State's economy is sufficiently prepared for adoption of the single currency and can integrate smoothly into the monetary regime of the euro area without risk of disruption for the Member State or the euro area as a whole. In short, the economic entry criteria are intended to ensure economic convergence – they are known as the 'convergence criteria' (or 'Maastricht criteria') and were agreed by the EU Member States in 1991 as part of the preparations for introduction of the euro.

In addition to meeting the economic convergence criteria, a euro-area candidate country must make changes to national laws and rules, notably governing its national central bank and other monetary issues, in order to make them compatible with the Treaty. In particular, national central banks must be independent, such that the monetary policy decided by the European Central Bank is also independent.

The Member States which were the first to adopt the euro in 1999 had to meet all these conditions. The same entry criteria apply to all countries which have since adopted the euro and all those that will in the future.

~ snip ~

muriel_volestrangler

(101,311 posts)The idea is that the EU wants new members to stabilise their currency, and move to joining the euro at a stable rate.

The Yes campaign doesn't want to use the Euro - since Greece and other countries (especially Ireland, on which the SNP wanted to model the Scottish economy) showed the downsides of being a small Euro country in difficult times, it stopped looking attractive. But even if it did, as the link FrodosPet gives above says, the EU wants the countries to have an independent national central bank, which the Yes campaign's currency union with rUK would not be, before merging.

If Scotland didn't want to be in the EU at all, it could use the Euro like the Vatican - but that would guarantee all the banks moved their headquarters into England, where most of their work, denominated in sterling, is. And most of Scotland's exports would be to rUK, so they'd give themselves exchange costs and inconveniences.

Nye Bevan

(25,406 posts)Mail will be more expensive is another one. And as Paul Krugman points out, keeping the pound without having control over interest rates risks Scotland becoming "Spain without the sunshine".

Historic NY

(37,449 posts)quadrature

(2,049 posts)go back, Scots people, go back.

what will you do for a currency?

liberalhistorian

(20,818 posts)I can't seem to find a date anywhere in any articles, they just keep saying "next week" or "this week" or "coming vote", etc. Very annoying.

Emotionally, I'm all for the Scottish Independence movement and understand where they're coming from and why they're so unhappy with the U.K. and England especially. And Cameron cracks me up when he begs them not to break up a "very beneficial 307-year-old union". Yeah, and exactly how much "choice" did Scotland have in "joining" that "union"? About as much as Ireland, probably. And it was amazing to see him and his staff heckled and hassled at appearances, to the point where they were, in one case, afraid for themselves.

HOWEVER. Rationally and intellectually, I know that it would be a disaster for Scotland in so many ways and, therefore, for the nations around it. So, as emotionally satisfying as it would be to see the independence vote prevail, I have to say that I hope, for Scotland's and Europe's long-term sake, it does not.

IDemo

(16,926 posts)liberalhistorian

(20,818 posts)thanks. Going to be very interesting to see what happens.

muriel_volestrangler

(101,311 posts)http://www.educationscotland.gov.uk/scotlandshistory/unioncrownsparliaments/unionofparliaments/

http://www.bbc.co.uk/history/british/empire_seapower/acts_of_union_01.shtml

They did have a choice; but whether Scottish politicians did it for their nation, rather than their own pockets, is disputable.