Student loan market a brake on US economy

Source: Financial Times

Dysfunction in the US student loan market is holding back the economy and policy makers should act, a senior US regulator has told the Financial Times.

“As with the mortgage market, if it’s true that student loan debt is threatening consumers and the economy, policy makers cannot sit by as passive observers,” said Rohit Chopra, the official responsible for student loans at the Consumer Financial Protection Bureau.

Mr Chopra’s call for action comes at a time when the US Treasury is trying to boost mortgage refinancing and the US Federal Reserve is studying whether it could use direct lending as a way to ease bottlenecks in the financial system. Rising concern about the student loan market could make it the next venue for action to stimulate the economy.

“What we see is not many refinancing opportunities to best allocate price to risk,” said Mr Chopra. “When markets are not appropriately allocating prices and risk, we do not see a well-functioning market. So borrowers may be paying higher rates than what their risk profile justifies.”

Read more: http://liveweb.archive.org/http://www.ft.com/cms/s/0/34f5b484-d5d9-11e1-af40-00144feabdc0.html?ft

bighughdiehl

(390 posts)if reforms are made, that will impinge on the freedumb of corporate america

to have an unlimited army of defacto serfs!

limpyhobbler

(8,244 posts)Just made that up. ![]()

Bail out student debtors to stimulate the economy. Two birds with one stone, dig?

davidpdx

(22,000 posts)I'd be so happy. By the time I'm done with my doctoral degree I'll be near the max limit.

patrice

(47,992 posts)limpyhobbler

(8,244 posts)This is the good government that people want to see.

I hope this results in real policy changes too, and not just study. I think the interest rate regulations will not be enough to make a big change such as what would allow people to buy a house. But a little more protection such as what Senator Brown is reportedly considering, that would be real reform, if I understand it correctly.

patrice

(47,992 posts)its links to the larger economy and housing.

Wow!

I'm looking forward to being even a small part in how that plays out.

![]()

patrice

(47,992 posts)That, in turn, might prevent them from buying a house. “Student debt may be more intertwined with the housing market than we realise and it may prove more important every day to understand that connection,” said Mr Chopra.

limpyhobbler

(8,244 posts)This would be a huge life saver for many people. Right now the banks get a free ride because borrowers have all the obligations of student debt (no escape via bankruptcy) but none of the protections that come with government-backed education loans. This change would restore a small bit of sanity to the system, if indeed those converted loans would be covered by the normal protections.

lovuian

(19,362 posts)there is no reason the banks should be in this

we bailed out the banks now its time they give back

also I agree parents to out second mortgages for college education

they need to be low fixed rate loans ...this would relieve alot of pressure on the economy

dkf

(37,305 posts)Why do people fall into the same trap time and time again?

Are we capable of understanding why it is important to avoid onerous debt burdens?

limpyhobbler

(8,244 posts)which you alluded to. People couldn't have learned from the mortage debacle because it hadn't happened yet. There are close parallels between the two bubbles.

Debt is nothing new in our economic system so I don't think you should be surprised to see it. Blaming the debtors, if that's what you intend, seems a bit misguided to me.

Katashi_itto

(10,175 posts)I worked my way through school, had no family to help me. It was JUST me. I work min wage jobs. Paying for school ANY other way was impossible. When I finished I found I couldnt pay the loans back, even with a business degree. I stayed in school, to avoid paying hoping for a better job now am in the masters program, in a debt race, gambling I have a better job with a Masters vs repaying now and being completely poverty stricken. All while my loan grows inexorably and I am not allowed better terms

dkf

(37,305 posts)Well I hope the extra degrees pay off for you.

Being risk and debt averse your solution probably would not have occurred to me.

Ash_F

(5,861 posts)You may be averse to that I don't know.

University in this country should come at no cost to the individual student.

rrneck

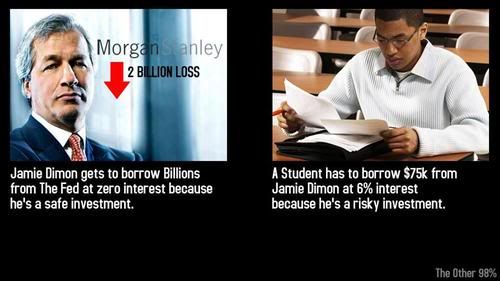

(17,671 posts)the 1% pushing risk down the economic ladder.

Industry demands workets train themselves for a competitive job market. That training is expensive. So expensive it has become impossible to realize a return on one's training investment. It's impossible because the same 1% that demands all that training profits by loaning the money to pay for all that training.

And the judgementalism you just displayed is counterproductive to our political objectives. Questioning the integrity of players in a game rigged by our political enemies makes me wonder who you're rooting for.

Ikonoklast

(23,973 posts)OneTenthofOnePercent

(6,268 posts)probably does, in fact, need more schooling.

snooper2

(30,151 posts)riderinthestorm

(23,272 posts)I have no idea anymore. It used to be however the economy has tanked a lot of formerly high demand careers that were sure things even 5 years ago but no more (civil engineers, architects, teachers, paralegals etc).

Its possible the poster started her degree when the market for her specialty WAS in demand. Now the only way to get hired is to get a masters so you stand even a partial chance of getting your resume looked at (and maybe hired).

snooper2

(30,151 posts)For example, I know of a good paying job in Marketing right now at my company, having a business degree would be a plus. But you should also know what unified commucations and a DS3 are ![]()

riderinthestorm

(23,272 posts)Katashi Itto said they had a business undegrad and headed back to grad school because s/he couldn't find a job with that degree.

You responded about s/he choosing a major that was in "demand".

Clearly for Katashi Itto their business undergrad was not enough in demand (your anecdotal job opening aside). You haven't really answered my post and I'm not sure at all where you are going with your own reply.

snooper2

(30,151 posts)More specific,

Going into financial industry, wanting to start a subway, healthcare industry, Marketing communications?

riderinthestorm

(23,272 posts)Honestly, I don't care that the poster didn't say whether it was finance, marketing, communications or whatever. Its clearly not a liberal arts degree.

The larger point being relating to the thread however is that having an undergrad degree of virtually any type is a pre-requisite for many jobs nowadays, which means substantial student debt. And that even with that undergrad degree, there are something like 50% of new grads who can't find work (http://newsfeed.time.com/2011/05/10/survey-85-of-new-college-grads-moving-back-in-with-mom-and-dad/)

So the poster is going back to school (and getting more debt) in order to increase the likelihood that they may find a job. Its a vicious cycle and is really detrimental to growing our way out of this economy.

Katashi_itto

(10,175 posts)and a Masters in Economics. Eventually towards my PhD in behavioral economics would be my real interest

I would be in even deeper shit, if I wasnt a Vet, getting some help from the VA.

snooper2

(30,151 posts)baby jesus knows we could use some good number crunchers at our company ![]()

shanti

(21,675 posts)ANY degree was fine for an analyst position. my oldest son has a history degree (originally planned to teach, but that didn't pan out) and after 3 years of unemployment, finally got an entry level job with the feds. foot in the door, but he is ecstatic! still, he has 40 grand worth of financial aid debt.

PotatoChip

(3,186 posts)and sincerely hope that your situation will improve.

It sounds as if you are a person of very good character who has plenty to offer, both here on this discussion board, and more importantly, society in general.

I applaud your work ethic, obvious intellect, and willingness to carry on despite adversity. I hope you realize that most of us are not as insensitive as the vocal few who have spoken critically of your choices. It'd be interesting to see what they'd do, given the very same circumstances.

Many years ago, when I was trying to achieve something seemingly unattainable, a wise, older relative of mine once said to me that ... "Crabs in a bucket will always try to pull down the one closest to the top." I think that may apply here. ![]()

Though this may seem like an odd time to say it, since I have not met you before, welcome to DU. I hope to see you around as often as your schedual permits.

Good luck to you.

Katashi_itto

(10,175 posts)magical thyme

(14,881 posts)resource departments, and government statistics?

Not all student loans were taken out for frivolous degrees by people to lazy to work their way through school.

I know of multiple people in the 50+ range whose industries collapsed out from under them. Too old to get hired; too young to retire. So we bought the line about re-training because we didn't have a lot (or any) options left.

We went into allied health care because government statistics claimed ongoing need and demand.

The state university claimed 100% employment for their graduating students. But forgot to mention employment at what.

HR at the local hospital lied to at least 2 of us about the salary range for the jobs we were training for. She increased the starting salary by 20% when she spoke to me, and 2 years later by 25% to another student.

We all worked while in school, but working part time at low wage jobs is not enough to support an individual who is not somehow subsidized, never mind the head of a household. I put in 18 hour days my last 2 years. During clinical training, one classmate was trying to work 7 days/week, with clinical training full time Monday-Friday (plus hours of homework and weekly quizzes for our "free time", he drove a taxi Saturdays and Sundays. After a couple weeks, he realized he couldn't maintain that kind of schedule.

The reality turned out to be somewhat different than what was in the print material and what they had the balls to tell us to our faces.

At our graduation ceremony, faced with the reality of a graduating class where maybe 1/3 had tentative per diem offers for 2 days/week and the rest had no offers or interviews after sending out resumes all over the country, the University rep had the gall to start babbling about "just hanging in there because you should see the numbers in 5 years!"

The taxi driving student quietly mumbled, "But I can't wait 5 years. I need a job NOW."

But go ahead. Throw that 50 year old father and his family out in the street. It's HIS fault for being so stupid as to believe US Guv statistics, representatives from a State University, print material from the State University, HR reps at local hospitals that deliberately lie to students to sucker more into the program.

Throw me and my furfamily out into the street. I don't deserve the home I bought after saving and sacrificing for decades. I'm too stoopid to live.

Just shoot me while you're at it, DKF. Oh...and welcome to ignore. You're another one I'm sick and tired of wondering why you even come to this board. Are you sure you didn't make a left turn when you meant to turn right?

dkf

(37,305 posts)thing.

Kudos to you if you ran the numbers early on and it looked like it should work as planned. This economy should pick up in a bit (hopefully or we are all screwed anyway).

But if you didn't and it was never going to work then what can you expect?

riderinthestorm

(23,272 posts)unfortunately for most, the economy is in a depression and "sure fire" careers 5 years ago aren't there anymore. Whole subsections of our economy collapsed and those careers vanished.

Even STEM majors are having trouble finding jobs. There have been a slew of DU threads about this, even the MSM is running articles on it. For example, for the careers in the following article and DU thread, those people started out on their educational path 10+ years ago. They can't go back and "change" that debt, nor they can they change what has happened to the economy since they started.

Push For Science Majors, But Lots Of Unemployed Ph.D's Already

http://www.democraticunderground.com/1002915559

unapatriciated

(5,390 posts)My son is in the same position. He is disabled (dermatomyositis), in his last semester at the Art Institute in SF for graphic arts (an AA). The reality is he won't be able to find a job because of his disabilities and will have to create some type of free lance work. Unfortunately that won't be enough to pay back his student loan and take care of medical expenses. The school made a lot of promises regarding job placements that they are now reneging on. So his only option is to transfer to a community college and go for a BA.

Egalitarian Thug

(12,448 posts)AndyTiedye

(23,500 posts)riderinthestorm

(23,272 posts)Most countries recognize that an educated populace is an enormous benefit to their future growth.

Nay

(12,051 posts)What happened when banks could loan out tons of money for a house to anyone with a heartbeat? Why, the price of houses shot up. That's what happened with college, too. The money they are charging to go to school is inflated by the willingness of the banks to loan large amts of money to basically penniless students in order to have the sets of loans they need to chop up and sell on to 30 other buyers. THEY DON'T CARE if they'll ever get paid back, because they got their nut already by passing them on via the financial chicanery that brought us the housing bubble and crash.

closeupready

(29,503 posts)nt

lovuian

(19,362 posts)Coolidge and Hoover tried it and all it did is make the 1% richer and the 99% poorer

Roosevelt came in and gave people JOBS ...if these kids have good paying jobs

guess what

they buy things houses cars I pods I phones and they pay taxes

and the economy motors along

but when Capitalism's greed is unchecked and unregulated ...a Depression happens...Economics 101

Debts can't be paid by unemployed and we don't have Debtors Prisons ...because we would have to house and cloth them and feed them all from taxpayers

what happens is Socialism rises up ....Marx said it the WORKER will RISE UP

and we will see Socialism emerge ....

the World's economies will go NO WHERE until the workers have good paying jobs

cbrer

(1,831 posts)We're the only Western Nation that makes students go into often crippling debt to get an education.

Education isn't seen as an investment in our countries future. It's seen as a personal economic tool. How sad.

DeSwiss

(27,137 posts)

- K&R

- K&RAlphaCentauri

(6,460 posts)NickB79

(19,224 posts)I know that if a portion of my wife's student debt was forgiven, we'd have much more money to spend on economically beneficial purchases like home improvements and such.

Or is that just too much sanity and socialism for the GOP to handle?

limpyhobbler

(8,244 posts)But it's not just the gop I'm afraid. It's half the "good guys" too.

Posteritatis

(18,807 posts)bluestateguy

(44,173 posts)You have young people who should be buying their first house but they can't because the student loan payments swallow up such a huge chunk of their monthly income and complicates their ability to save for a down payment. So this crimps the housing recovery in the long-term.

And that's just the people with good jobs. The glut of under and unemployed people that age is obviously obvious.

crimson77

(305 posts)I have my money, enough for a down payment, just sitting there. You couldn't pay me right now to buy a house, especially with property taxes being what they are in Mass. I hate to sound like the cliche northerner but it might be Virginia or North Carolina here I come.

cap

(7,170 posts)I don't think students or educators should turn into substitutes for employer based training. You go to school to develop a base of knowledge and training your mind to think critically and to understand the world enough to participate as an informed citizen.

Rosie the riveter walked into the factories, became managers and the first programmers right off the street, right out of her kitchen. She was trained in the employers way of doing things and she set production records.

I don't believe liberal arts degrees are useless. Some of the best programmers I have met were musicians

Egalitarian Thug

(12,448 posts)It was not too long ago that when an employer desired instruction or a certification for something, they paid for it. This advanced the employee and the company to everyones benefit, and it kept the cost down. Now it is all on the prospective employee and bearing the cost doesn't even guarantee a job.

What could possibly go wrong with that?